Summary:

- Intel’s stock experienced extreme volatility, plummeting nearly 40% before rebounding 21%, only to drop again after disappointing earnings and cost-cutting measures.

- Despite the volatility, Intel’s price to book ratio is at a 30-year low, presenting a compelling value compared to competitors like AMD, QCOM, and TSM.

- Chart analysis suggests strong potential for upside, with a significant price gap to fill, indicating a possible 29.83% increase from current levels.

- While risks remain, Intel’s current valuation and industry leadership in CPUs support maintaining a “buy” rating, expecting stabilization and gradual recovery.

hapabapa

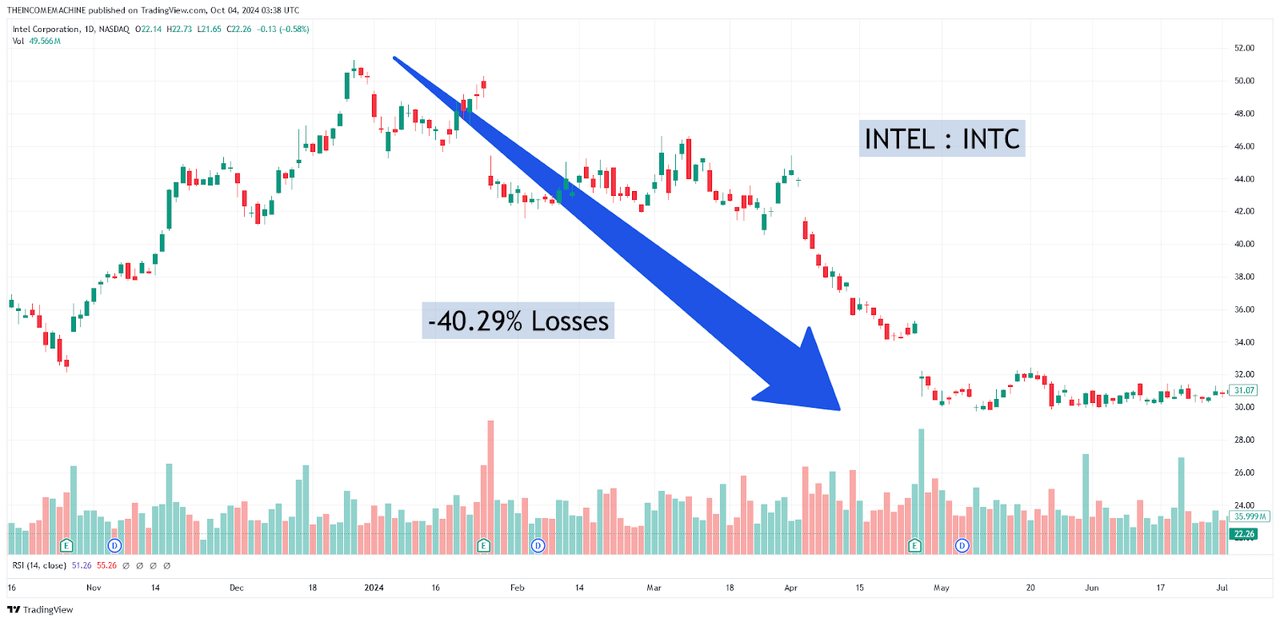

When I last covered Intel Corporation (NASDAQ:INTC) on May 14th, 2024 with “Intel: Steep Descent Creates Buying Opportunity”, the stock itself was trading with what can only be described as incredibly abnormal activity. Specifically, INTC shares were caught within an extremely tight trading range (which was roughly $1.50 wide) and this price formation followed a “steep descent” of nearly -40.29% that had been seen in a period of less than five months:

Intel Stock: Substantial Declines in Early 2024 (Income Generator via Trading View)

Fortunately, share prices eventually broke out of this sideways trading range with forceful moves to the topside and rallies into the $37.16 level recorded on July 17th resulted in gains of over 21.35%:

Intel Stock: Gains Following Sideways Range Breakout (Income Generator via Trading View)

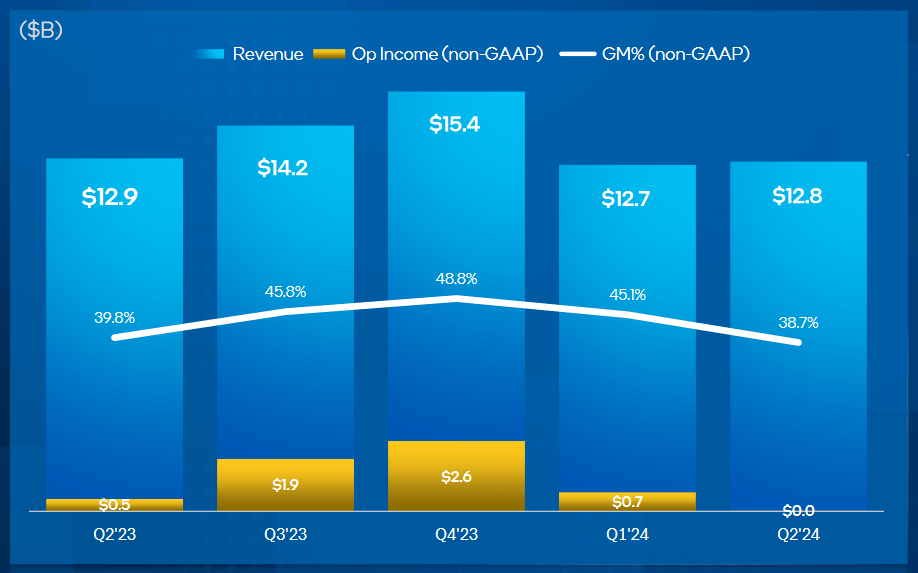

In many cases, this type of stabilization at lower price levels will often mark the end of the story. However, in Intel’s case, the wild ride was far from over, and this would become clear with the market response to the company’s next earnings release. For the second quarter period, Intel reported per-share adjusted earnings of just $0.02, which was far below consensus expectations of $0.10 per share. Revenues for the quarter also fell short of the $12.94 billion consensus estimates (coming in at $12.83 billion). For the net income figures, the company recorded a loss of $1.61 billion (a loss of $0.38 per share).

Intel: Q2 2024 Earnings Performances (Intel Q2 2024 Earnings Presentation)

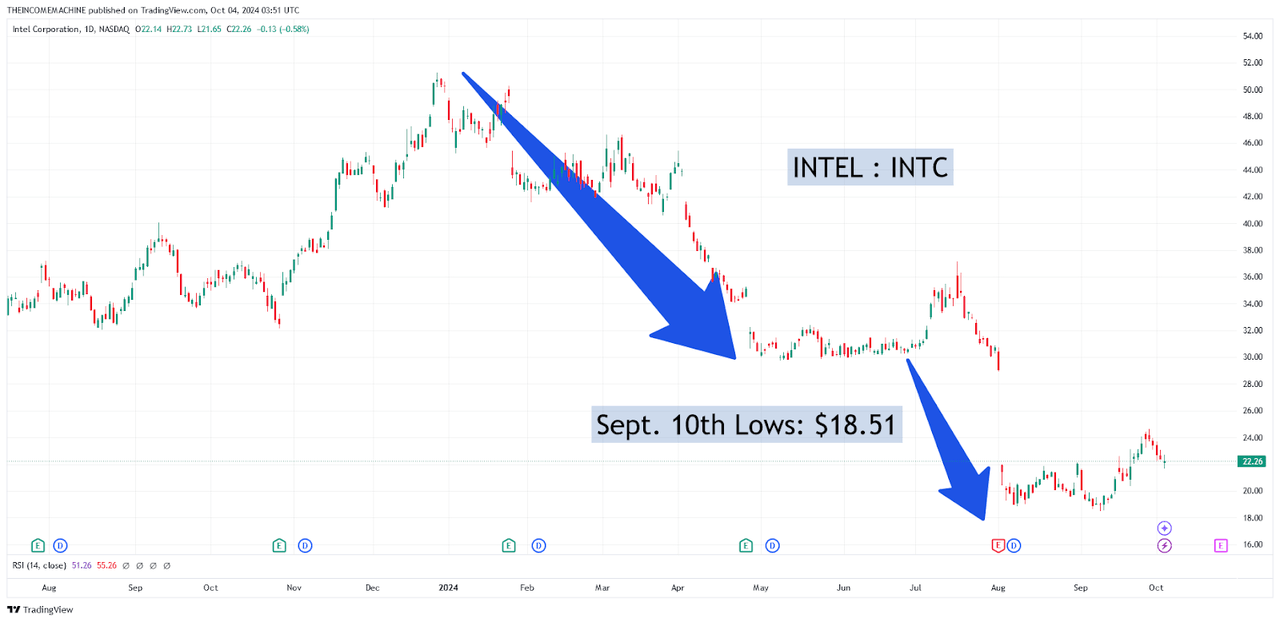

On the positive side, the Client Computing segment generated revenues of $7.41 billion (indicating annualized growth rates of 9% and coming close to meeting expectations of $7.42 billion). However, the most impactful headlines may have been the announcements to lay off more than 15% of Intel’s workforce and to suspend the stock’s attractive dividend in Q4 2024. Unfortunately, these aggressive plans to cut costs by $10 billion and reduce capital expenditures by more than 20% for the full-year period were not received well by the market. In response, the stock quickly dropped to new lows below $20.50 and eventually fell to $18.51 before stabilizing on September 10th:

Intel Stock: Post-Earnings Market Reaction Sell-Off (Income Generator via Trading View)

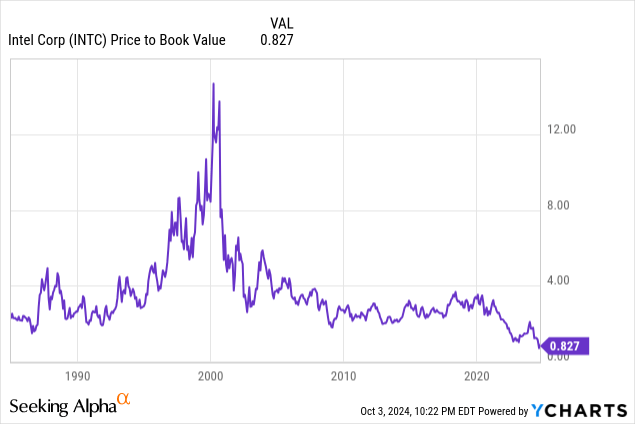

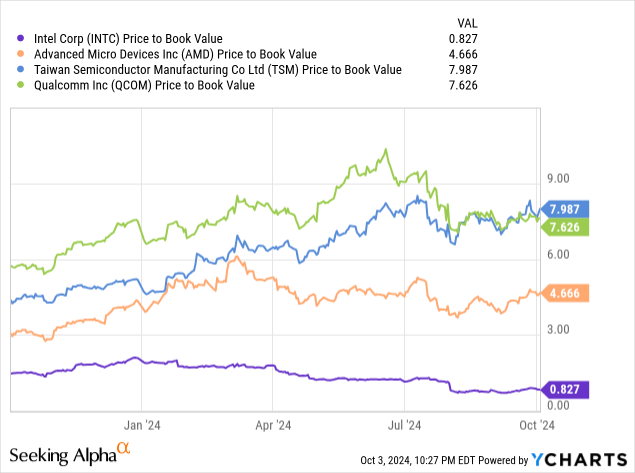

When these types of surprisingly volatile price moves are witnessed (especially when dealing with a company that is as well-established and widely respected as Intel), it can become quite easy to make panicked decisions that ultimately significant financial losses. However, when we look at this stock from the perspective of its price to book ratio, the picture starts to look a bit more favorable. With these severe declines in share prices, INTC is now trading with a price to book value of 0.827x (which is the lowest valuation we have seen at any time during the last three decades):

Intel Stock: Price to Book Value – Long-Term (YCharts)

Furthermore, the stock’s comparative valuation also presents key positives for investors because there are somewhat excessive divergences when we assess Intel’s price to book ratio alongside key industry competitors like Advanced Micro Devices, Inc. (AMD), Qualcomm, Inc. (QCOM), and Taiwan Semiconductor Manufacturing Company (TSM). In the chart below, we can see that both Qualcomm and Taiwan Semiconductor are both trading with price to book valuations well above 7x and AMD’s price to book ratio is currently seen above 4.6x.

Intel Stock: Comparative Price to Book Value (YCharts)

When we take these extremely low valuations into consideration and combine this information with the fact that Intel still leads the industry for central processing units (CPUs) that are used in servers and personal computers, I think it becomes much harder to justify the extent to which share prices have fallen over the last two months. Clearly, Intel has valuable assets tied to its manufacturing processes and with price-book valuation metrics falling to these depths I think it would be difficult to express a valid bearish outlook for this stock at current levels.

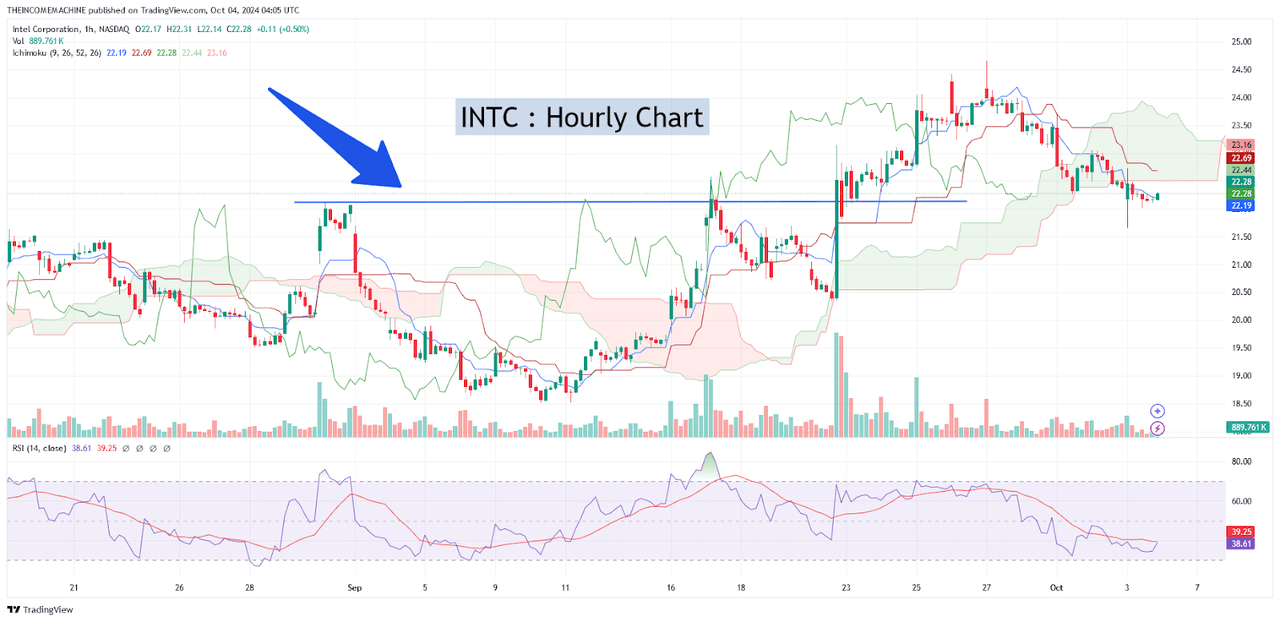

Intel Stock: Hourly Resistance Level Broken (Income Generator via Trading View)

When looking for signs of a potential upside reversal, I typically prefer to view charts on the lower time frames because there is greater detail present in individual price structures. In the chart above, we can see that share prices have shown evidence of broad stabilization after falling to the $18.51 level and the recent break above the $22.10 historical level suggests that momentum can continue to build to the topside. Recent pullbacks from price highs near $24.66 have allowed indicator readings in the relative strength index to move closer to oversold territory, and this suggests that further downside could be limited at this stage.

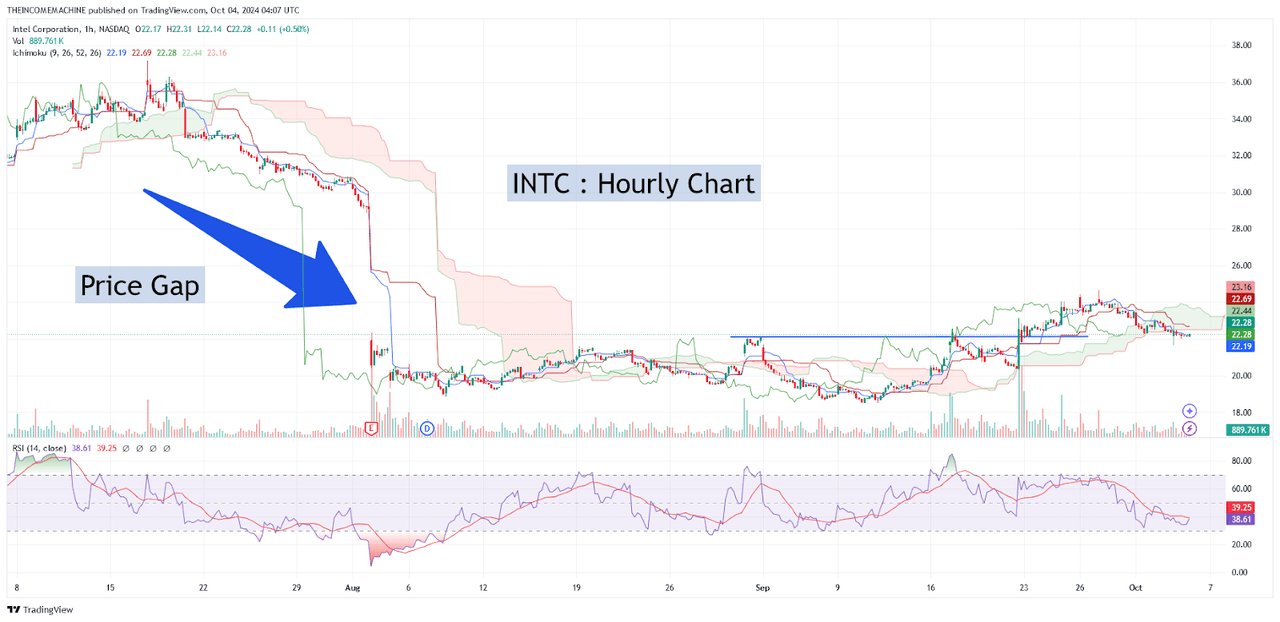

Intel Stock: Post-Earnings Price Gaps Remains Unfilled (Income Generator via Trading View)

In addition to this, we can see that there is still a very significant price gap that remains visible on the hourly price charts. Overall, this is encouraging because we would normally expect these types of vacant price structures to be filled, and move share prices back into these gapping regions, and this implies strong potential for a fair amount of price movement in the upward direction. Specifically, INTC’s price gap began near the $28.90 level, and this would mean share prices would still need to travel higher by nearly 29.83% before this gap region would be filled completely. From a risk-reward standpoint that is based on near-term support zones, this would suggest $3.75 in potential downside versus $6.64 in potential upside. Of course, this is still less favorable than my ideal risk-reward ratio of 3:1, but these measurements suggest that the potential for bullish price movements still significantly outweighs the potential for near-term decline in share prices.

Of course, dealing with a stock that has encountered such a substantial surge in downside price volatility does carry a certain element of unforeseen risk. Intel’s current Q3 2024 guidance figures show expectations for net losses of $0.03 in adjusted EPS and revenues that fall within a $12.5-13.5 billion range. Unfortunately, this marks a stark contrast with the consensus estimates of $0.31 in per-share adjusted earnings and revenues of $14.35 billion that marked prior expectations. Additionally, it is now clear that income-minded investors can no longer rely on the stock’s attractive dividend payout to create added incentives for the patience that might be required for Intel to cut costs and further solidify the company’s operational efficiency. But when we consider the fact that the stock is currently trading at price to book valuations that have not been witness at any point during the last 30 years, it would be difficult for me to justify or explain a potential “sell” rating for this stock. As long as INTC is able to maintain a foothold above prior support levels near $18.51 per share, the stock still has potential to fill its recent price gap and send share prices back toward the upper $20s. Obviously, this is not a stock that should be expected to generate sizable returns in a short period of time, and there are still uncertainties that remain while the company moves forward with its cost-cutting and restructuring initiatives. On balance, however, the potential for upside seems to outweigh the risk of decline, and this is why I will maintain my “buy” rating for INTC at current price levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.