Summary:

- Intel Corporation stock excitement is unwarranted, as the company has missed out on the AI GPU chip surge and will only benefit from fringe AI opportunities.

- Intel’s Q3 results are expected to barely top guidance, with revenues down 12% YoY, while Nvidia’s revenues are soaring.

- The foundry customer prepayment remains void of any actual details, including a definite agreement.

- Intel stock is very expensive at 20x aggressive ’24 EPS targets.

Leon Neal

The stock market has gotten excited over some positive commentary coming from Intel Corporation (NASDAQ:INTC), yet the chip giant really hasn’t reported anything spectacular warranting higher stock prices. In fact, Intel appears to have missed the AI GPU chip surge and will only benefit from fringe AI opportunities. My investment thesis remains ultra Bearish on the stock, even after breaking out above a double top around $37.

Source: Finviz

Limited Rebound

Intel has gotten a minor boost with the company back to reporting results above midpoint guidance. Back on August 31, CEO Pat Gelsinger stated the chip giant’s Q3 results would be above guidance.

Back with Q2 ’23 earnings, Intel guided to Q3 revenues in a range of $12.9 to $13.9 billion after reporting $12.95 billion in revenues for the quarter. Analyst consensus estimates sit at $13.5 billion, suggesting predictions for Intel to barely top the guidance midpoint.

The issue here is that numbers are partly rebounding due to the PC inventory correction ending. Intel is still expected to report revenues down 12% YoY.

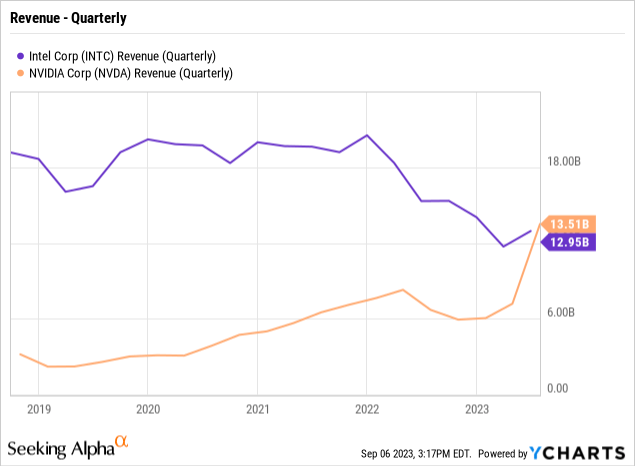

The chip company was reporting peak Q3 revenues above $19 billion, so an investor shouldn’t celebrate revenues back above $13 billion. The crazy part is that Nvidia Corporation (NVDA) just reported quarterly revenues nearly catching Intel at $13.0 billion, while the company guided to revenues soaring to $16.0 billion in their October quarter.

The point here is that the company topping reduced estimates isn’t impressive at all. Intel is falling behind in the AI race and has limited options to compete with Nvidia while Advanced Micro Devices (AMD) has the MI300 GPU chip hitting the market any month now as a competitive threat to Nvidia.

Intel doesn’t have a competitive AI GPU chip to compete with the Nvidia H100 chip. Intel does provide the Xeon CPUs utilized alongside the H100 GPUs in generative AI. In essence, Intel is stuck to using AI accelerators, such as the Gaudi 2, to work with the advanced GPUs from Nvidia competing with AMD’s GPUs utilizing internal accelerators.

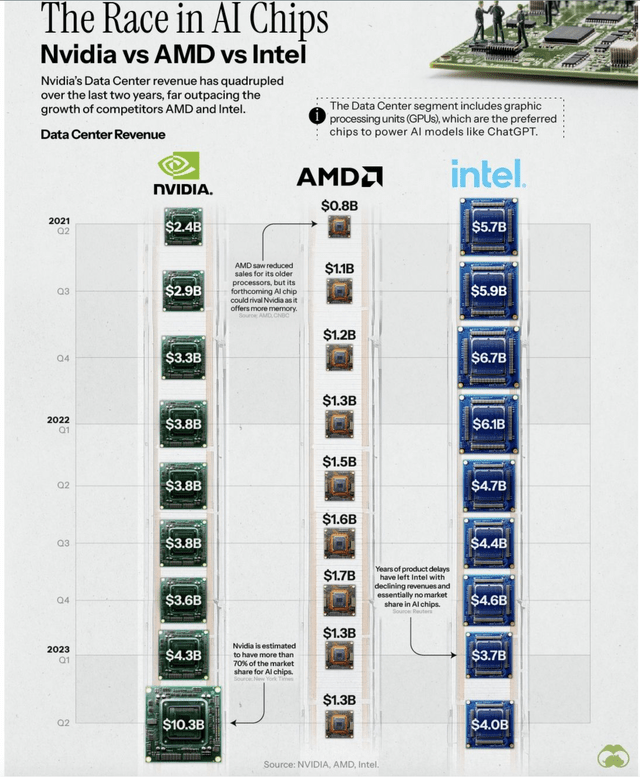

Ultimately, the AI chip race will be focused on the Data Center revenues in light of the market capex shift to spending on GPUs. The numbers still include traditional CPU sales from AMD and Intel, but the majority of the growth going forward will be due to AI demand.

Intel has already seen Data Center sales slip from a peak of $6.7 billion back in Q4’21 to a low of $3.7 billion in Q1’23. Based on updated guidance, the chip company will likely see some stability in Data Center revenue going forward, but Nvidia has already guided to topping $12 billion in the current quarter.

Foundry Prepayment Nonsense

The Intel Foundry business, or IFS, remains another area where bulls see a big upside from the chip giant, but bears have plenty of questions. Intel CEO Pat Gelsinger recently suggested the chip company signed up a major foundry player with a prepayment for the 18A process.

Intel forecasts the 18A process technology being the point in 2025 when the chip company catches up to the process technology of TSMC (TSM). Unfortunately, management didn’t provide any additional context of the size of the prepayment, though the amount was suggested as enough to help the company move forward with the Arizona fab construction.

The statement is odd as the original promoted customers were Nvidia and Qualcomm (QCOM). At the Citi conference a few days later, CFO David Zinsner confirmed the customer as a “whale” and one of the original customers with the following statement (emphasis added):

By the end of the year, this will be a whale, by the end of the year on 18A. And so one of these particular customers was pushing us to move a bit quicker. And yet we’re not all lined up in terms of the definitive agreement and all that stuff. And so the request was to — what ultimately the request was driving was an acceleration of our Arizona build-out, which, of course, requires capital but also we needed to see a little bit of commitment from the customer to make sure that they were really serious about the demand. So that is kind of, I call it, a show of good faith and to support us in terms of accelerating Arizona, put up what Pat said was a meaningful prepayment. You could call it a down payment, too, I guess you could — just is right. And so we’re going to get good going on accelerating Arizona to get that out. 18A really isn’t in production for foundry customers probably until the 2025 time frame. So it would have to be out a few years before we actually see the revenue from it.

The odd part is that the CFO actually says Intel doesn’t have a definite agreement. Without a definite agreement, one has to wonder about the prepayment details.

The data lines up that Nvidia is the “whale” customer looking to work with Intel potentially due to a lack of capacity at TSMC. The partnership with the Xeon CPUs utilized with H100 GPUs suggests a possible working agreement on this front utilizing advanced packaging from Intel in the future. Investors should likely read into the inability of Intel to produce a competitive AI GPU chip by 2025 making Nvidia willing to work with a non-competitor foundry service in capacity is in short supply at the primary foundry.

As long discussed, the IFS business faces major headwinds with the likes of Apple (AAPL), AMD, and Qualcomm likely uninterested in IFS due to competitive threats. Nvidia might be working with Intel in a negative tradeoff of getting a major foundry customer with lower margins while missing out of on the GPUs sold by Nvidia with a forecast for 70%+ gross margins in the current quarter.

Above the double top at $38, Intel trades at over 21x 2024 EPS targets of $1.80. The chip company will have to boost EPS by nearly 200% to reach this target next year after only $0.63 this year, while any foundry deal is likely to pressure prices and margins in order to sign a major “whale” to an unproven foundry platform with the former chip giant.

The bearish thesis is that Intel will struggle to produce the predicted EPS growth in the next few years due to a lack of a true AI GPU chip to compete with Nvidia and AMD. The company is likely to continue losing Data Center revenues during this period and the quarterly level of $4 billion leaves a lot of revenues at risk.

Takeaway

The key investor takeaway is that Intel has bounced off decade lows following a disastrous period where revenues collapsed and competitors are now reporting record revenues. The former chip giant is starting to post improving numbers, but the business is nowhere close to returning to its former glory. The company appears to have missed the AI chip race and any hype over a major foundry customer still appears misplaced considering the current data center revenues are at risk.

Investors should remain Bearish on the Intel stock, with the recent bounce already factoring in the small improvements in the business and not accurately factoring in the AI risk to data center revenues.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.