Summary:

- Intel has renewed government support behind the company, which could provide it billions in capital.

- The company has the benefit of being able to focus on new nodes rather than ramping up capacity like other manufacturers.

- The company’s financial picture has remained reasonably strong for a transitioning portfolio and a struggling economy.

- 2023 is an incredibly important year for the company, we expect things to pan out, however, whether that happens remains to be seen.

JasonDoiy

Intel (NASDAQ:INTC) has been pummeled by the market for years. The company’s market capitalization has continued to be devastated, dropping to less than $120 billion, with a single-digit P/E and a dividend yield of more than 5%. As we’ll see throughout this article, Intel’s drop in valuation and unique strengths make it a valuable long-term investment.

Intel’s Unique Standing

Intel has an incredibly unique standing. There are 3 companies globally that are expected to have cutting-edge foundry capacity by the middle of this decade. The first is TSMC (TSM). The second is Samsung (OTCPK:SSNLF). The last is Intel. Each is spending $10s of billions in capital spending to attempt to maintain that positioning.

However, Intel has one more unique trait. It’s the only one of the 3 companies headquartered in the good ol’ US of A. The largest economy in the world and a country that, under President Biden, has renewed its focus on making itself a powerhouse in the chip and semiconductor industry. The bill has $52.7 billion in semiconductor incentives, and Intel should see $10-15 billion of that.

The bill has announced $100s of billions of manufacturing announcements from companies (including the Big 3 above) that have announced plans to move manufacturing to the United States. However, as a U.S. company, we expect Intel to continue to see strong government interest and support, helping it long term.

Intel’s 3Q Performance

Financially, Intel has to handle the short term before it can outperform in the long term.

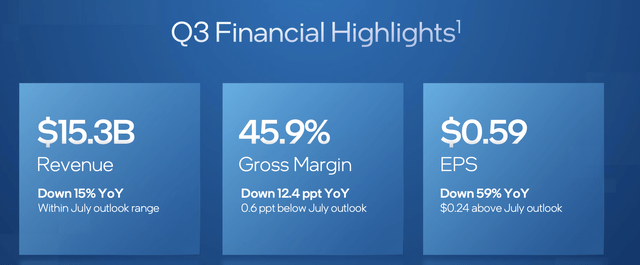

Intel Investor Presentation (Intel 3Q Highlights)

The company’s 3Q results saw 45.9% gross margins, a significant decline YoY as revenue declined to $15.3 billion. The company’s EPS was above guidance, with its P/E sitting at roughly 13, but the outlook is for the company’s gross margin and EPS along with revenue to all decline into the end of the year. That’s expected as the market continues to struggle.

Still, there’s something to be said about the company remaining profitable during a major capital-intensive transition and trading at a reasonable valuation based on trough earnings.

Intel’s Industry Outlook

The company is in a volatile industry, although it did get a sizable boost from COVID-19, that’s now declining.

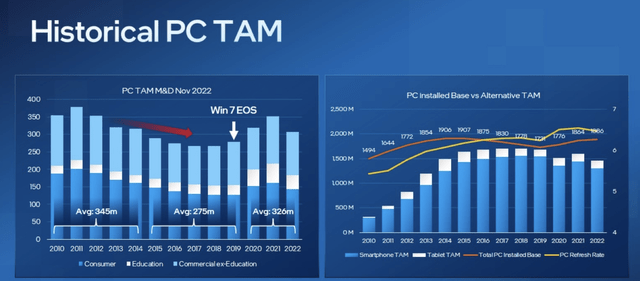

Intel Investor Presentation (Intel Industry Outlook)

The company’s forecast for 2023 TAM is roughly 285 million units or a 5% decline from 2022, although in line with pre-COVID-19 numbers. The company’s new forecast for long-term TAM is on the scale of 300 million units annually, which we feel is slightly optimistic, but definitely reasonable given continued growth in access to technology.

The key takeaway here is that (at least) from Intel’s point of view, their expectation is that the permanent decline of the PC market has stopped.

Intel’s Time to Shine or Fail

Intel is rapidly modernizing its business, and the company is in an industry where demand is substantial. Demand for computing resources can be expected to continue growing dramatically. For those looking to invest in Intel, the thing worth paying attention to is that it’s currently Intel’s time to shine or fail.

We expect the company will manage to shine. The company is finally revamping its business and spending the $10s of billions where required. The company appears to be on track for Intel 4, although there are rumors of delays. The latest rumors are that the company will launch Intel 4 mobile CPUs but do a refresh of Intel 7 for the desktop CPUs.

Intel has moved to the Apple (AAPL) model of hybrid architecture with efficiency and performance cores, something that AMD (AMD) hasn’t done, and it’s a big gamble for the company. It also introduces complexity. The company might feel that Meteor Lake Desktop CPUs simply aren’t worth the staggering amount of effort required. That combines with the fact that Intel 4 is the first EUV node.

As node values become more and more meaningless (nothing on Intel 4 is actually 4 nm), it becomes tougher to tell CPUs apart. Using various components, various commentators attempt to draw an equivalence, and that’s what Intel is doing with its Intel 4 naming versus N3 from TSMC at 3 nm. Intel needs to get Meteor Lake out the door to have a shot at catching up with 20A.

Whether or not that happens remains to be seen, but with strong governmental support and a revamped business, we’re excited for 2023.

Thesis Risk

The largest risk to our thesis is what we just discussed above, Intel’s execution. The company could wow investors and deliver solid processors with N4 and lower nodes, or it could hit the same issue it did with its 10 nm mode, where years of delay combine with struggles to just barely stay competitive in the industry.

The next 1-2 years will be telling, however, history shows worried investors would be justified.

Conclusion

Intel is a company under transformation. Despite the risks associated with that, we’re making it our top investment recommendation for 2023 for several reasons. The first is that the company has increased long-term implicit government support due to a desire to move semiconductor manufacturing back to the USA.

The second is that the company has numerous markets where it can enter and achieve vertical efficiencies being the only remaining fab company to work on Desktop CPUs. The company’s success in 2023 depends on whether it can launch its Intel 4 Meteor Lake CPUs as expected, and rumors continue to float around. However, we’re optimistic the company will achieve its goals.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.