Summary:

- Intel experienced a significant sell-off after a disappointing financial performance as the firm attempts to separate the fab & fabless businesses.

- Management pulled forward production of Lunar Lake and A20 in order to take on market share while putting pressure on margins due to outsourcing wafers.

- Despite some positive signs, the future remains uncertain for Intel as it navigates a potential turnaround strategy.

JHVEPhoto/iStock Editorial via Getty Images

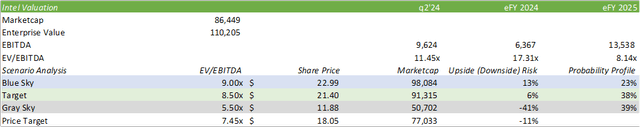

Intel (NASDAQ:INTC) experienced one of the worst sell-offs after posting q2’24 results that management noted as disappointing. Intel’s declining financial performance has led to a major restructuring that involves drastic cost-cutting measures as the firm continues their decoupling of the fab & fabless businesses. At this point in the cycle, the question remains, is Intel now a turnaround strategy or will the firm’s downward trajectory remain in motion? For those that follow my research, I have remained an adamant bear on INTC stock since initially reporting on the company here on Seeking Alpha at the end of January 2024; however, the verbiage in the earnings report is now making me think otherwise. The ultimate question is whether Intel will be successful in a major turnaround, or will Intel’s appeal fall into value-trap territory? Despite the more realistic outlook, I remain bearish with INTC shares and maintain my SELL rating with a price target of $18.05/share at 7.45x eFY25 EV/EBITDA. I believe INTC will be a “show me” story, meaning that any positive sign towards operational improvement, achieving their milestones in their products roadmap, and building out Intel Foundry Services (“IFS”) customer book will result in positive risk for shares.

Be sure to review my previous work on Intel here:

Intel’s Turnaround Is A Long Shot That May Not Pan Out

Intel’s Stock Is Stuck In A Value Trap

Intel Operations

Patrick Gelsinger has been fighting tooth and nail to turn Intel back into a leading chip designer ever since returning as CEO in 2021. His major venture has been to separate out the two major businesses, products and foundry services, which I believe has become a more daunting task than anyone anticipated. From my perspective, unless the two lines of business are completely decoupled, I do not anticipate IFS to reach the level of contracted production of advanced chips as I believe management had initially set out for. My rationale behind this statement is that Intel is playing catch up in their design business and that the thought of IP slippage is at top of mind. This is purely my theory, and whether it holds will be determined by future business.

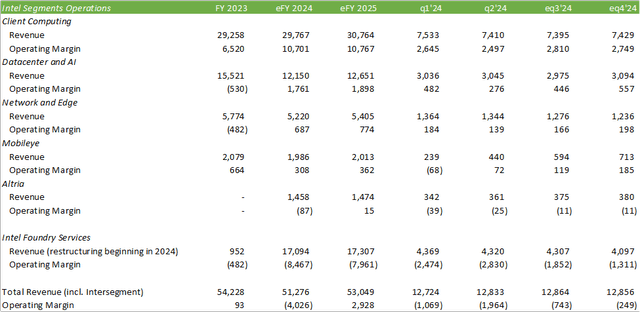

The big headline in the q2’24 earnings release was the 15% cut to headcount and the drive to reduce operating expenses to $20b for eFY24 and even further down to $17.5b in eFY25. In addition to this, management is driving down capital investments by 20% to net between $11-13b in eFY24 and $12-14b in eFY25. I have reason to believe that management is beginning to realize that acting as the outsourced foundry of choice isn’t as appealing to competing chip designers, as capital deployed to their foundry business will not be as pre-emptive and more reactionary to new business. This cautious approach can potentially be a double-edged sword in which Intel is making the attempt to draw in new business to their foundry services while becoming more hesitant on making capital investments to make their foundry business an appealing option when compared to Taiwan Semiconductor (TSM). Given the more realistic expectations that IFS may not be as grandiose as initially discussed, I believe management will refocus spending in the segment from hyper-growth, tech-like spending to a more disciplined approach. This factor may lead to significant improvements to operating margins and may in turn pull forward profitability on the back of lower revenue expectations.

To the contrary, IFS revenue may be modestly challenged for the duration of eFY24. As of q2’24, the majority of foundry customers are focused on advanced packaging. Q3’24 is forecast to remain relatively lackluster, as 85% of wafer volumes are expected to be pre-EUV nodes with uncompetitive cost structures with market-based pricing. This dynamic will likely shift over time as management remains adamant about transitioning to EUV lithography for pattern etching.

In addition to this, management pulled forward the ramp-up of their Intel 4, Intel 3, and Intel 20A to production in q3’24. The downside risk to this was that the firm heavily depended on external wafers to ramp up AI PC products and will continue to do so over the next several quarters. Due to wafer costs, this will continue to pressure gross margins on the back of potentially stronger revenue as the PCs are shipped. Management did note that the next phase, Panther Lake, will be internally sourced on 18A and will likely result in an improved cost structure when compared to its predecessor, Lunar Lake. Given the current state of the macroeconomy, this may not be as detrimental as one may expect, given the budgetary constraints between consumers and enterprises. From a macroeconomic perspective, this may not necessarily be to Intel’s detriment, as business activity in certain industries appears to be slowing down.

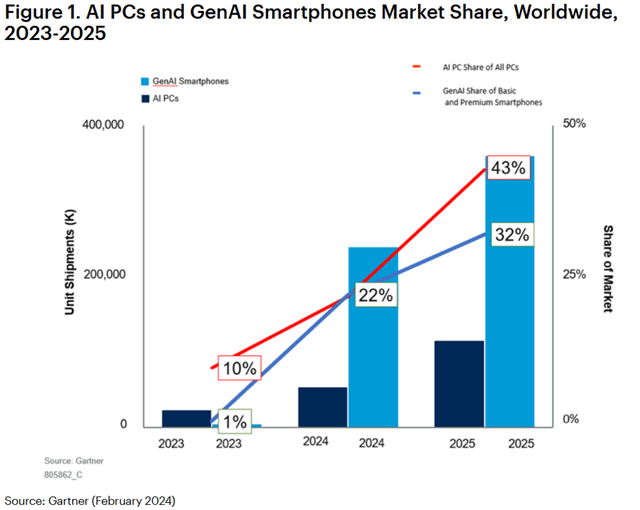

Management, along with research firms like Gartner, anticipate AI PCs to take on considerable market share of devices shipped over the next two years, potentially reaching in the range of 50-60% of total PCs shipped in 2025. Gartner’s estimate for 2022 is in the ballpark of 22%, or 54.5mm AI PCs.

Given this factor, Intel will have a significant proportion of the market, with the expectation of shipping 40mm AI PCs by the end of 2024. Management anticipates shipping 60mm AI PCs in 2025 alone, for cumulative shipments reaching 100mm units by the end of 2025. This initial ramp-up will likely be with Lunar Lake as Panther Lake is expected to start ramping in 2h25 with production volumes hitting the market in eFY26. Given these factors, I anticipate the duration of eFY24 to remain uneventful in the AI PC space in terms of margin accretion, with eFY26 being a major pivotal year.

Total revenue for q3’24 is expected to decline in the range of -5 – -12% as the firm faces a challenging market environment given that CPU and networking inventory destocking continues. There have been some positive notes in the networking arena as end-customer demand begins to pick up, as seen in Arista Networks’ (ANET) recent results. Management at Hewlett Packard Enterprise (HPE) and Dell Technologies (DELL) have each suggested that general compute servers have reached their trough and are entering the next refresh cycle. These all can be positive signs that Intel may realize a return to growth in each respective segment in the coming quarters as excess inventories roll off.

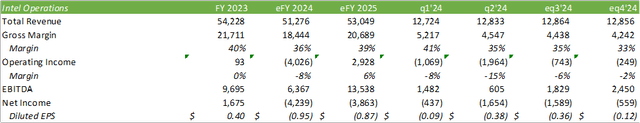

Given these factors, I anticipate Intel to return to growth in eFY25 as the firm undergoes its transformation. Working on guided operating expense, I anticipate the firm to turn an operating profit in eFY25, with the operating expense reduction to near $17.5b. Despite the improvements in operations, I anticipate Intel to generate a net loss in eFY25 following eFY24’s lackluster performance as a result of the challenging market and restructuring costs. Though I anticipate Intel will have a strong recovery in the coming years, I believe that the firm will have to work through this restructuring, catch up on chip design, and ready their foundry business before margin accretion will be realized.

Valuation & Shareholder Value

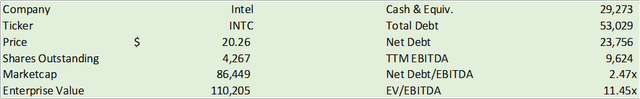

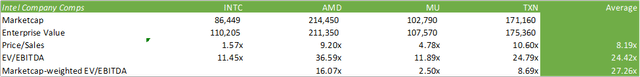

INTC shares currently trade at 11.45x TTM EV/EBITDA, a significant premium to their historical trading range. To the contrary, INTC shares trade at a significant discount to its semiconductor peers. Given the painful recovery Intel will be undergoing over the course of the next year or two, I believe INTC shares will remain below-market value until signs of growth reemerge.

Despite the more realistic outlook management has for the business, I remain cautious with INTC shares as the firm will undergo more pain before realizing signs of growth reemergence. Given the micro & macro headwinds ahead for the firm, I reiterate my SELL rating for INTC with a price target of $18.05/share at 7.45x eFY25 EV/EBITDA.

Given the recent derisking to the momentum trade, INTC shares may sell off beyond my price target. I would not take this as a directive to purchase into the sell-off, as further macroeconomic decay could further burden Intel’s operations. Despite the post-earnings selling, I believe INTC shares will continue to trend down to my price target, with the possibility of buyers attempting to average into a position. My long-term strategy for Intel going into eFY25 and beyond will be a wait-and-see approach. Intel will need to provide more evidence that the firm is pulling in customers to their IFS business and that the products’ side is making headway towards 18A production.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.