Summary:

- Intel Corporation stock has rebounded significantly and investors are betting on a sizable recovery in 2024.

- Q4 earnings will determine if the rally can continue, with guidance being a key factor.

- Analysts have raised expectations for Intel due to strong Q3 results and a respectable guide, but the bar is still relatively low.

- What we are looking for from Intel on revenues and margins, as well as cash.

hapabapa

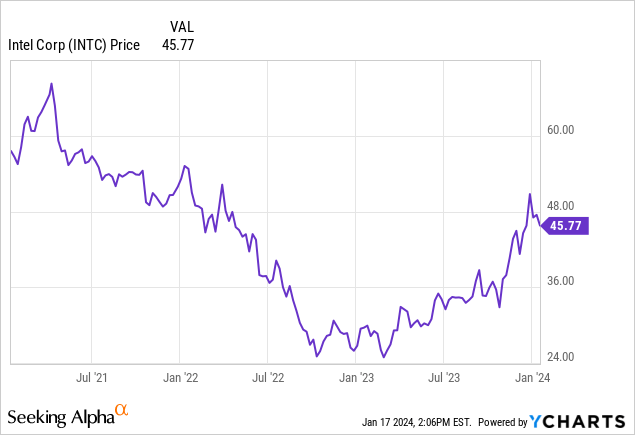

Intel Corporation (NASDAQ:INTC) stock certainly has turned around after being in a position where its technology was seemingly behind the curve of many competitors. The stock has had an amazing run just quarters after reporting its largest loss in history. We traded this one, as we saw shares a buy when they were in the $20s. The question now is whether this rally can continue following Q4 earnings. In our estimation, while the actual print matters, it’s going to come down to guidance to set the tone for 2024. The momentum will face a critical test when earnings are reported (scheduled 1/25 after hours). In this column, we discuss our expectations for the report.

Macro backdrop

First, we believe that the chip cycle troughed in 2023, and for Intel, that was in the early spring of 2023. Intel got nailed but focused on innovating and expense control. It came with some painful news, like a dividend cut, but this is what had to be done during times of losses. Intel has rebounded significantly as better days are ahead.

This rebound and chart formation is strong, but to keep it going we will need a strong report and guidance. That said, we still have other preferred chip stocks which we have discussed at our investing group, but Intel does still have a good long-term future. Sentiment has improved in the stock, and investors are betting on a sizable recovery. There have been developments like the spinning off of the Programmable Solutions Group. Intel is sharpening its focus on its core CPU business, and focus on AI initiatives. The AI market will continue to grow markedly, and Intel is fighting for its piece of the pie. We have the Gaudi machine learning processor, a goal for 5 nodes in 4 years, the release or Meteor Lake CPUs, Arrow Lake, and Intel 4 production, all of which we have discussed or have been discussed by colleagues on Seeking Alpha.

Through 2023, the company focused on preserving capital and re-expanding margins after several painful quarters. So, with that, let’s turn to our broader expectations for Q4. Back in Q3, we saw results that exceeded the high end of management’s guidance. For Q4, we believe you will see Intel continuing to control what it can control while advancing strategic priorities, several of which were aforementioned, while controlling costs through its cost savings plans. We will look for updates on investments being made as well.

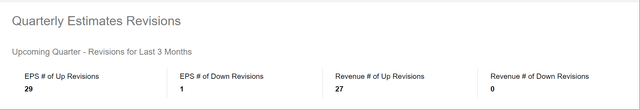

We think the bar is overall set relatively low, despite momentum in Intel’s favor. However, analysts have been upping their expectations, so the bar has been slowly raised. Analysts have ramped up thanks to a strong Q3 and a very respectable guide for Q4.

Back in Q3, the company beat estimates on the top and bottom lines and handily did so. While better than expected, the comps with Q3 2022 showed results were still down, but it was nothing like the tough comps seen in H1 2023. In Q3, there were large PC gains, though Intel’s revenue was down 8% from a year ago. Intel reported $14.2 billion in revenue with adjusted gross margins hitting 45.8%, pretty much flat from a year ago. Net income was up year-over-year, rising 14% from last year’s earnings. Outstanding performance really.

For Q4, we think we see further performance stabilization relative to a year ago. Once again, we are laser-focused on the progress with margins. While we expect margins to be down from a year ago, we think margins will improve from Q2, by several hundred basis points. We are looking for revenue of $15.0-$15.6 billion, significantly higher than the midpoint of management’s guide. We are also looking for 46.6-47.0% adjusted margins, which would be further margin expansion sequentially. On the EPS front, we expect earnings of $0.45-$0.48 per share in the quarter as well.

If we hit these metrics, we would return to year-over-year growth. Of course, Q4 2022 was in the heart of some of the toughest quarters for Intel in recent memory, but seeing the growth would be welcomed. Our midpoint is $15.3 billion in revenue, which would be a $1.3 billion, or 9.3% increase from Q4 2022. Adjusted gross margin is expected to expand from last year’s 43.8%, and we are slightly more bullish than the guide and consensus on both pricing and cost controls. Q3 saw a strong margin bump, and we think that happens in Q4 as well. Earnings of course will be up dramatically from last year’s $0.10 in EPS. The other key metric we are looking for is what happens with cash. The company had been burning cash badly. In Q3, cash from operations was strong. Intel generated $5.8 billion in cash from operations and paid dividends of just $0.5 billion. We see $6.5-$7.0 in cash from operations.

Now, our expectations are more bullish than the guide, but we think Intel even with a strong guide after Q3 is under-promising to over-deliver. If the report is strong, that is likely to give shares a bump, even after the rally, but it is really going to come down to the guide. Make no mistake, the Q1 guide should show dramatic improvement from the horrible Q1 2023. But investors will look for sustained momentum in revenues and earnings for the year. Also, updates on development and timelines for Intel’s aggressive planning will be scrutinized. We think that the Intel Corporation rally will take a big breather if there are perceived delays, but long term, the future remains bright. It is all about execution now.

Your voice matters

So, what kind of guidance do you think we will need to take shares meaningfully higher? Are we expecting too much on revenues or margins? Do you agree with an under-promise and over-deliver type quarter being in the cards, or is the bar actually set high? What else can drive Intel shares higher? Let the community know below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Welcome 2024! Pay yourself dividends with outsized returns and income

Get more with our playbook to advance your savings and retirement timeline by embracing a blended trading and investing approach at our one-stop shop.

Our prices are rising in 2024, but take 10% off NOW with our New Year Special

We invite you to try us out, with a money back guarantee if you are not satisfied (you will be). There’s also a light version of BAD BEAT, on sale for 55 cents a day with great benefits too. Come take the next step! Start WINNING