Summary:

- Intel Corporation stock has declined by over 40% and is severely oversold, making it a potential buy opportunity.

- However, Intel’s earnings have underwhelmed and its management’s performance is a major concern.

- Analysts have mixed feelings about Intel’s future, suggesting it is a risky investment even at current levels.

- Intel must improve performance before losing more lucrative market share in enterprise business, AI, and other segments.

JHVEPhoto

I‘ve been bullish on Intel Corporation (NASDAQ:INTC) stock as a turnaround story, mentioning how a favorable AI scenario may unfold for the chip giant. I even recently bought some Intel shares at around the $35 level, as the stock appeared cheap, given its improved sales and profitability growth outlook.

Unfortunately, Intel produced another lackluster quarter and offered weak guidance, sending its stock sharply lower again. This poses the question: what should we do next with Intel?

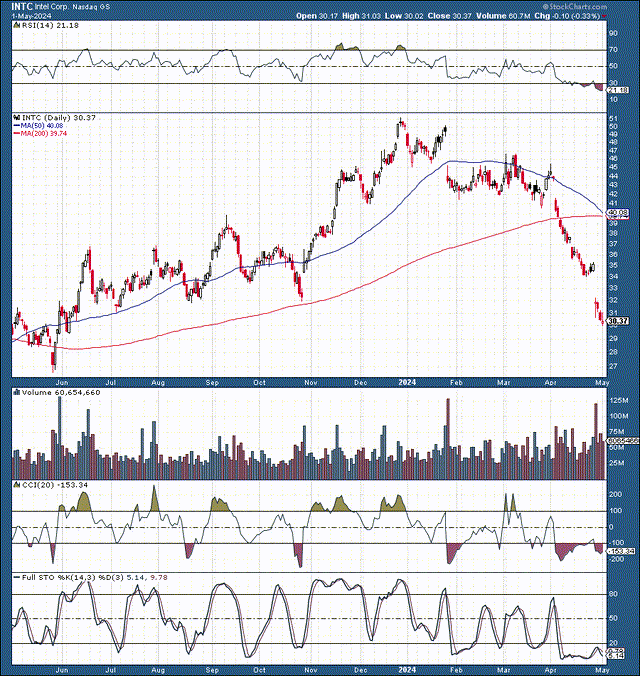

Intel 1-Year Chart

Intel shares tumbled by about 14% since we discussed it recently, bringing its total decline to over 40% from its top late last year. Intel is now the stock I am most conflicted about in my portfolio.

From a technical standpoint, Intel is severely oversold, as its RSI approaches the 20 levels. Therefore, the market may be overreacting, making Intel a good buy here.

Still, part of me wants to take the loss and move on because this may be a lengthy turnaround story. “Is Intel worth the opportunity cost?” It is a question I often hear. On the other hand, Intel is so badly beaten down and underrated that it may be a worthy contrarian buy-and-hold now.

While I’ve decided to keep my Intel stock for now, I’ve downgraded it from a Buy to a Hold, as Intel’s AI prospects are cloudy here, especially given the recent earnings and guidance announcement.

Intel’s Earnings Underwhelm

Intel’s most glaring issue is its management, which directly impacts the company’s financial performance. The company’s inability to execute on the foundry/AI side has left many analysts puzzled and questioning management’s strategy.

This recurring pattern of management underdelivering is a significant concern. After all, Intel used to dominate the chip industry but is now struggling to remain relevant. This turnaround may take longer than expected, and Intel’s CEO Pat Gelsinger, who is already in his fourth year at the helm of the struggling chip giant, has a challenging job ahead. Despite generating $12.7B in revenues and 18 cents in adjusted EPS, the company’s performance is a major obstacle for shareholders here.

For Q2, Intel guided to revenues of $12.5-13.5B, well below the $13.61B consensus analysts expected. The EPS guidance was also below estimates. Intel has “Intel-specific” problems, and this dynamic may keep a lid on Intel’s stock price as we proceed. Some analysts dropped their 12-month price targets on Intel from $40-45 to the mid $30s, also suggesting the upside may be limited in the near term for Intel.

What Wall Street Analysts Think

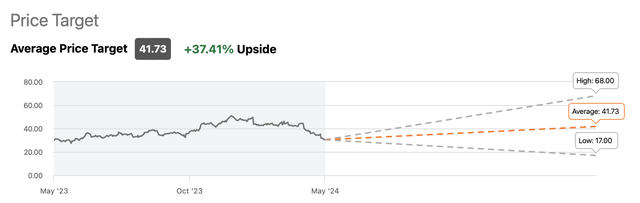

Price targets (seekingalpha.com)

The analyst community remains fixated on a price target of around $42. This is about 37% above Intel’s current price, and the average price target may come down to around $35-38 soon. While this price range is still well above Intel’s current price, please note the extensive $17-68 price target range. This dynamic suggests that analysts, as a community, have mixed feelings about where Intel may be in a year, making it an increased risk investment, even at current depressed levels.

When Will Intel’s Earnings Take Off?

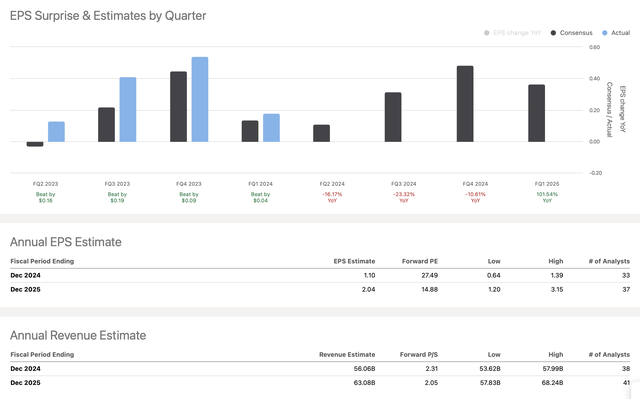

We’ve been waiting for Intel’s earnings to take off for a while, but I’ve yet to witness any concrete results. While we see some outperformance in recent quarters, estimates are for three consecutive quarterly YoY declines, as Intel’s earnings are projected to stagnate.

EPS vs. estimates (seekingalpha.com)

The consensus forecast is only for about $1.10 in EPS for this year, and now it’s questionable if Intel can achieve such lofty EPS growth next year. It’s now possible that Intel’s growth could underwhelm, enabling Intel to earn just $1.50 or less in EPS next year. Also, the market hopes for double-digit revenue growth in future years. However, the market may be disappointed if Intel continues to execute poorly, especially regarding its enterprise business/AI expansion.

The Bottom Line: Intel May Be A Value Trap

We’ve seen many earnings announcements, and AI is fully expanding. Yet, Intel continues to underwhelm. It seems like Intel’s management is fine, with Advanced Micro Devices (AMD) and Nvidia (NVDA) continuing to lead in the CPU/GPU and other crucial growth segments. Intel is not making the AI/enterprise progress I expected, and it could continue lagging its competition, resulting in more limited upside for its stock price.

There’s a reason why Intel has underperformed in the market and, especially, its more nimble and higher growth competition, like AMD and Nvidia. Intel will likely continue underperforming as we advance. While I am still long Intel stock, I am considering reducing or liquidating my position due to insufficient concrete catalysts to propel the share price substantially higher, in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!