Summary:

- We’re upgrading Intel Corporation to a hold as we believe low expectations could make the stock an in line performer rather than an underperformer in the near term.

- While our investment thesis of A.I. server cannibalizing computer server volumes is correct, A.I. server penetration rate remains low, and the negative thesis will take longer to play out.

- We now think the stock will perform in line with the market due to the moderating share loss to AMD, PC TAM recovery, and process node roadmap execution.

- We believe Intel has some leverage in its financial model to drive gross margin and earnings upside; thus, we are recalibrating our rating on the stock.

- We don’t think Intel deserves a sell rating, but we continue to prefer names like Nvidia and Advanced Micro Devices.

FinkAvenue/iStock Editorial via Getty Images

We’re upgrading Intel Corporation (NASDAQ:INTC) to a hold from a sell. We think our previous sell rating on the stock driven by our expectations of A.I. server cannibalizing compute server volumes and negatively impacting INTC’s data center business is correct, but will take longer to play out as the A.I. server penetration rate remains low in the near term. Hence, we no longer believe INTC deserves a sell rating, as we now see the company being more of an in-line performer rather than an underperformer in the near term. However, we continue to prefer other names at the moment.

We downgraded INTC to a sell in June based on our belief that the A.I. boom would hurt CPUs; we think cloud customers’ wallet-share shift to A.I. acceleration rather than compute will present significant challenges to INTC’s data center business in 2024. Research from DigiTimes outlines the situation in more depth:

“With traditional cloud spending of enterprises and consumers continuing to be undermined by the hiking interest rate in mature markets and subsiding cloud service demand in the post-pandemic era, datacenter establishment of cloud service providers has also been decelerating, leading to CSPs shifting parts of their general server budget to higher-price AI servers to cater to the growing popularity of generative AIs.”

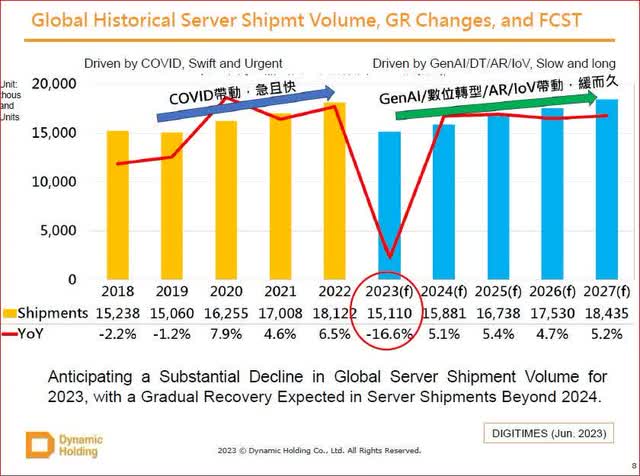

It’s a matter of when rather than if our negative thesis will play out; the 2023 server total addressable market (“TAM”) is expected to drop 17% Y/Y from 18.1M to 15.1M, while A.I. server TAM is estimated to be up materially by +38% Y/Y to 563K units. While the A.I. server unit volume is small in comparison to server units, it will still have a unit decline impact on INTC, Micron (MU), Broadcom (AVGO), and Marvell (MRVL) as the A.I. server ASP is 10-15x that of a compute server. Hence, we expect to see unit growth for Nvidia (NVDA) and see unit decline for others due to the A.I. boom. The A.I. server spend will have a negative impact to compute server because the server capex is not going up in the near term.

The following graph outlines global historical server shipment volumes and forecasts.

We are upgrading INTC to a hold rather than buy because the overall unit TAM for server in 2023 is still bad, and looking into 2024, server TAM is estimated to grow only 5% Y/Y which will not be good for INTC. Our hold rating is based on our belief that INTC has some leverage in its financial model, coupled with low expectations that’ll help drive earnings upside and gross margins. The stock is up roughly 8% since our downgrade to sell in June, outperforming the S&P 500 (SP500) slightly. Since our early August note, the stock is down 5%, underperforming the S&P 500 by around 3%. We now think the stock will perform in line with the market due to the following: first, moderating share loss to Advanced Micro Devices (AMD) in PC and server markets; two, PC TAM recovery; and three, process node roadmap execution of five nodes in four years.

The following outlines our rating history on INTC.

Valuation

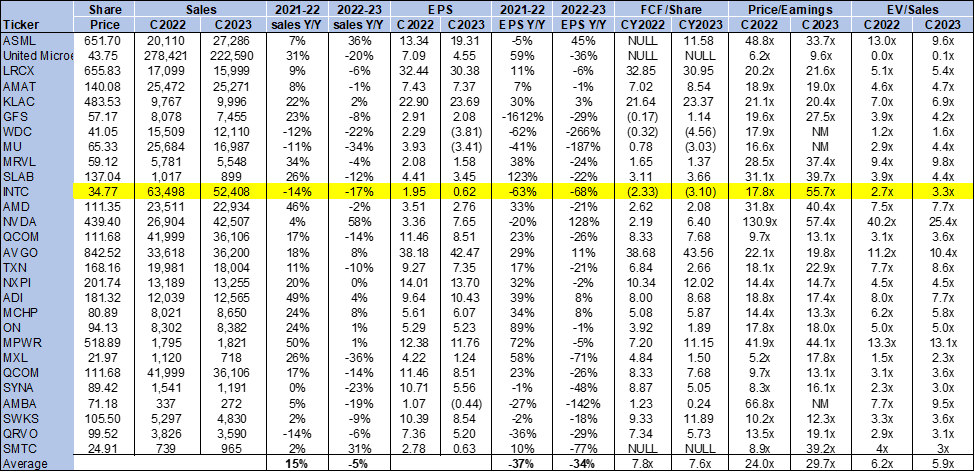

INTC is trading well above the peer group average. On a P/E basis, the stock is trading at 55.7x C2023 EPS $0.62 compared to the peer group average of 29.7x. The stock is trading at 3.3x EV/C2023 sales versus the peer group average of 5.9x. We think INTC doesn’t deserve a sell at these levels but also don’t believe the stock is immune to the impact of A.I. servers cannibalizing compute server capex. We recommend investors stay on the sidelines for the near term.

The following chart outlines INTC’s valuation against the peer group.

TSP

Word on Wall Street

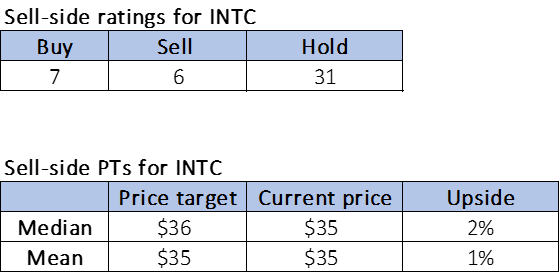

Wall Street is overwhelmingly bearish on the stock. Of the 44 analysts covering the stock, seven are buy-rated, 31 are hold-rated, and the remaining are sell rated. The stock is currently priced at $35 per share. The median sell-side price target is $36, while the mean is $35, with a potential 1-2% upside.

The following charts outline INTC’s sell-side ratings and price targets.

TSP

What to do with the stock

We’re upgrading Intel Corporation to a hold, as we think the stock will be an in-line performer in the near term. Our investment thesis regarding cloud customers shifting more wallet share to A.I. over traditional compute investments in a limited cloud capex environment remains at play and will negatively impact INTC’s data center business. Still, we think this thesis will take time to materialize and harm INTC; in the meantime, we think INTC’s financial model and lower expectations will enable the company to see earnings upside. While we no longer think Intel Corporation deserves a sell rating this early, we continue to see other names better positioned in the A.I. boom.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2-week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2-week free trial, so we hope to see you in our group soon.