Summary:

- It’s safe to say that Intel has already lost the AI GPU race, but Intel’s AI opportunity through CPU advancements is also under threat amid intensifying competition.

- With Nvidia offering its own CPU superchip, it subdues the revenue growth prospects for Intel.

- Nexus Research does not believe Intel stock is worth buying at 42x next year’s earnings.

wellesenterprises/iStock Editorial via Getty Images

With the AI revolution already in full swing, investors are looking towards the chipmakers to be the earliest winners of AI as businesses demand more computing power for running their AI workloads. It is clear now that Nvidia (NVDA) is by far the leader in powering AI workloads through its advanced GPUs. Though that does not mean that Intel (NASDAQ:INTC) can’t benefit from this AI revolution, as its chips are proving useful in running AI workloads too. Intel’s main product offering for data centers remains its CPUs, for which the company hopes there will be increased demand in the context of AI use cases. However, the tech giant faces immense competition, and Intel is not as strongly positioned to conquer the AI opportunity as executives would like investors to believe. Nexus Research assigns a ‘hold’ rating to Intel stock.

Recently there has been a lot of optimism around Intel being able to make a comeback through capitalizing on the AI revolution. While every Intel segment should eventually benefit from generative AI, the ‘Data Center and AI’ [DCAI] segment is seen as the most immediate beneficiary, while the tech giant also strives to monetize the booming demand for AI chips through its ‘Intel Foundry Service’.

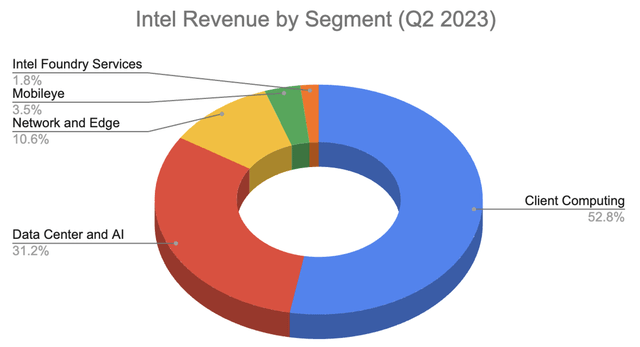

Whether the ‘Intel Foundry Service’, which made up only 1.8% of total revenue last quarter, is able to optimally benefit from the AI revolution can only be determined in a few years, as the tech giant builds out its fabs with 18A nodes. However, the ongoing AI revolution immediately impacts (for better or worse) the performance of the DCAI segment, which made up 31.2% of total revenue last quarter.

In Q2 2023, DCAI revenue was down 15% year-over-year. Although it was up 8% sequentially as it benefitted from AI-driven demand for its chips, particularly the 4th generation of its Intel Xeon CPU, as CEO Pat Gelsinger proclaimed on the last earnings call:

“We also saw great progress with 4th Gen AI acceleration capabilities, and we now estimate more than 25% of Xeon data center shipments are targeted for AI workloads.”

While the Xeon was not specifically built for AI workloads, the chip still carries AI capabilities that enable Intel to participate in the AI boom. While the use of Xeon CPUs in AI workloads is encouraging for Intel, AI computing is mainly driven by GPUs. On the Q2 2023 earnings call, the CEO highlighted the increased demand that Intel is witnessing for its Gaudi GPUs:

“The surging demand for AI products and services is expanding the pipeline of business engagements for our accelerator products, which includes our Gaudi Flex and Max product lines. Our pipeline of opportunities through 2024 is rapidly increasing and is now over $1 billion and continuing to expand with Gaudi driving the lion’s share. The value of our AI products is demonstrated by the public instances of Gaudi at AWS and the new commitments to our Gaudi product line from leading AI companies such as Hugging Face and Stability AI”

The use of Gaudi GPUs at some of the most well-publicized AI companies is certainly encouraging. But despite the CEO’s enthusiasm, investors must question to what extent Intel can really benefit from the AI revolution through its GPUs. The pipeline of over $1 billion in revenue for 2024 signals AI-driven growth prospects for Intel, but it is still only a peripheral beneficiary of AI. For context, Nvidia’s data center segment generated over $10 billion last quarter, dwarfing the $4 billion in revenue generated by Intel’s DCAI segment .

CEO Pat Gelsinger did acknowledge the shift in cloud customers’ capex towards AI-specific solutions, but his outlook for Intel’s future in the AI revolution seemed a little too sanguine:

“We do see that big cloud customers, in particular, have put a lot of energy into building out their high-end AI training environments. And that is putting more of their budgets focused or prioritized into the AI portion of their build-out.

That said, we do think this is a near term, right, surge that we expect will balance over time. We see AI as a workload, not as a market, right, which will affect every aspect of the business, whether it’s client, whether it’s edge, whether it’s standard data center, on-premise enterprise or cloud. We’re also seeing that Gen 4 Xeon, and we’ll be enhancing that in the future road map has significant AI capabilities. And as you heard in the prepared remarks, we expect about 25% today and growing of our Gen 4 is being driven by AI use cases.

And obviously, we’re going to be participating more in the accelerator portion of the market with our Gaudi, Flex and MAX product lines. Particularly, Gaudi is gaining a lot of momentum. In my formal remarks, we said we now have over $1 billion of pipeline, 6x in the last quarter. So, we’re going to participate in the accelerator portion of it. We’re seeing real opportunity for the CPU as that workload balances over time between CPU and accelerator.”

Firstly, the perception that demand for CPUs relative to GPUs will balance out over time is debatable. In the era of AI, GPUs will be the preferred silicon for computing, which is why Nvidia is witnessing such jaw-dropping demand for its AI chips. This is not to say that CPUs will not be required at all, but GPUs are likely to be in higher demand among data center customers in the era of AI. CPUs are the bread and butter of Intel DCAI segment, which means the AI revolution indeed poses a risk to this segment’s growth prospects.

And even if we see a substantial rise in demand for CPUs again after a few quarters, Intel faces intense competition here, and not just from AMD (AMD). Nvidia also offers its own CPU, the Nvidia Grace CPU, which is already sampling with customers. This CPU, which was originally introduced in 2021, is aimed at “the computing requirements for the world’s most advanced applications – including natural language processing, recommender systems and AI supercomputing”.

So Nvidia had been preparing for the AI revolution not just through GPU superiority, but also though CPU advancements. Now while Intel is witnessing strong demand for its Gen 4 Xeon after realizing its AI capabilities, the tech giant was certainly not as prepared for AI revolution as Nvidia.

Intel is looking to make advancements in the AI capabilities of its chips, but it’s going to be an uphill battle. It’s safe to say that Intel has already lost the AI GPU race, with Nvidia fulfilling the lion’s share of data center demand. But Intel’s AI opportunity through CPU advancements is also under threat amid intensifying competition.

We mentioned earlier the Nvidia Grace CPU aimed at AI supercomputing. But Nvidia has gone a step further and introduced the Grace Hopper Superchip, combining its Grace CPU with its Hopper-based GPU to offer one dynamically powerful chip to run complex AI workloads.

This superchip offers seamless integration between the CPU and GPU, and essentially strives to close the entry-point for Intel’s CPUs to be used in data centers alongside Nvidia’s GPUs. This significantly steepens the uphill battle for Intel. Over the next several quarters we will gain insights into how successfully Nvidia is able to sell this CPU-GPU superchip to data center customers, relative to demand for Intel’s CPUs. Though given Nvidia’s leadership in AI innovation, it does undermine demand for Intel’s chips going forward.

Now all hope is not lost for Intel, as cloud service providers will indeed try to subdue vendor lock-in as much as possible, and hence try to diversify the range of GPUs they offer to their customers. So, Intel should still witness some growth in demand for its AI-oriented CPUs and GPUs. But investors should certainly tame their expectation for Intel’s DCAI growth prospects, given how far behind Intel is and the intensifying competition.

While Intel is clearly not the big winner in the data center AI opportunity, CEO Pat Gelsinger has been emphasizing that Intel will strive to capitalize on the AI chips boom through its foundry business. And there are indeed reasons to be optimistic on this front. Intel has secured first access to ASML’s next edition lithography machine, TWINSCAN EXE:5200, which is expected to be available to Intel in 2025, before TSMC (TSM) and Samsung (OTCPK:SSNLF). Furthermore, the tech giant recently also announced that it had received a large prepayment order for its 18A node foundry, which is currently under construction in Arizona.

After years of relying on TSMC, chip designers are indeed seeking to diversify towards using multiple foundries for the manufacturing of their chips. This creates an opportunity for Intel to prove it can be a leading foundry service provider. Though it will ultimately depend on how well Intel can execute on its foundry strategy in 2025, following years of manufacturing setbacks tarnishing its reputation. The ‘Intel Foundry Service’ currently makes up less than 2% of its total revenue, but nonetheless is dragging down Intel’s profitability amid heavy capex to build its foundries. The operating margin for the ‘Intel Foundry Service’ stood at -61.64% last quarter.

Shifting back to the DCAI segment, Intel will inevitably have to engage in heavy capex here as well if it truly wants to produce high-quality AI chips that can compete with Nvidia’s silicon. But Intel’s DCAI segment is already loss-making, with an operating margin of -4.02% last quarter. And the pressure on profitability is further aggravated by the fact that Intel is unlikely to enjoy the same level of pricing power for its chips as Nvidia. So while Nvidia finances its own R&D through massive streams of sales revenue to continuously innovate new industry-leading AI chips, Intel’s profitability will witness immense pressure for the foreseeable future as it invests in R&D to play catch up, while witnessing much lower revenue numbers than Nvidia.

And the problem is that even after engaging in capex to produce its own suite of AI-centric chips, the return on investment may be unexciting, as it is unlikely to witness the same level of sales revenue as Nvidia. Data centers are already building out their AI infrastructure through spending heavily on Nvidia’s GPUs, which means the window for Intel (as well as AMD) is becoming tighter and tighter, subduing the future revenue and profit growth prospects for Intel’s DCAI.

Intel is expected to turn profitable next year, and according to data from Nasdaq, the stock is trading at almost 42x next year’s earnings. That is expensive considering the steep uphill battle Intel faces.

While certain investors are bullish about Intel’s AI growth prospects through its foundry service, this segment will not be generating any meaningful income growth over the next several quarters while it builds out its foundries. At the same time, the earnings growth prospects for its DCAI segment are subdued by the intensifying competition. Therefore, Nexus Research does not believe Intel stock is worth buying at 42x next year’s earnings. Nexus Research assigns a ‘hold’ rating to Intel stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.