Intel Vs. TSMC: ‘Defense’ Buy Of The Decade

Summary:

- Intel Corporation has experienced a selloff after announcing a significant loss in its foundry business, leading to investor disappointment.

- The company aims to become a prominent defense contractor for the U.S. and its allies, which aligns with current geopolitical tensions.

- Intel’s transformation includes plans to achieve profitability by 2030 and improve operating margins through its foundry initiative.

Paul Souders/DigitalVision via Getty Images

Thesis Summary

Intel Corporation (NASDAQ:INTC) has seen a substantial selloff in the last few days after announcing a significant loss in its foundry business.

The company laid out its plans moving forward, and investors are not impressed. Bernstein even commented that there’s “nothing to get excited about until 2030.”

Yet, as investors, we must be forward-looking, and Intel is exciting to me as we look at 2030 and much beyond that.

In my opinion, Intel is now embarking in a campaign to become one of the most prominent “defense contractors” for the U.S. and its allies, and the timing couldn’t be better, as Janet Yellen is on her way to China to express “concerns” over their trading practices.

I’m adding some INTC stock here, hoping for the best but also expecting the worst

Intel’s Transformation

The last time I covered Intel, it didn’t even have a foundry business yet, though talks of it were beginning to emerge.

I rated the stock a buy then, based on its appealing valuation and concerns over Taiwan. While the stock has returned a decent 13%, it has lagged the S&P 500 (SP500) and has significantly underperformed other chip companies.

Though concerns over Taiwan have died down in the past few months, there is still an escalating trade war with China, and we are now beginning to see the extent of Intel’s foundry initiative.

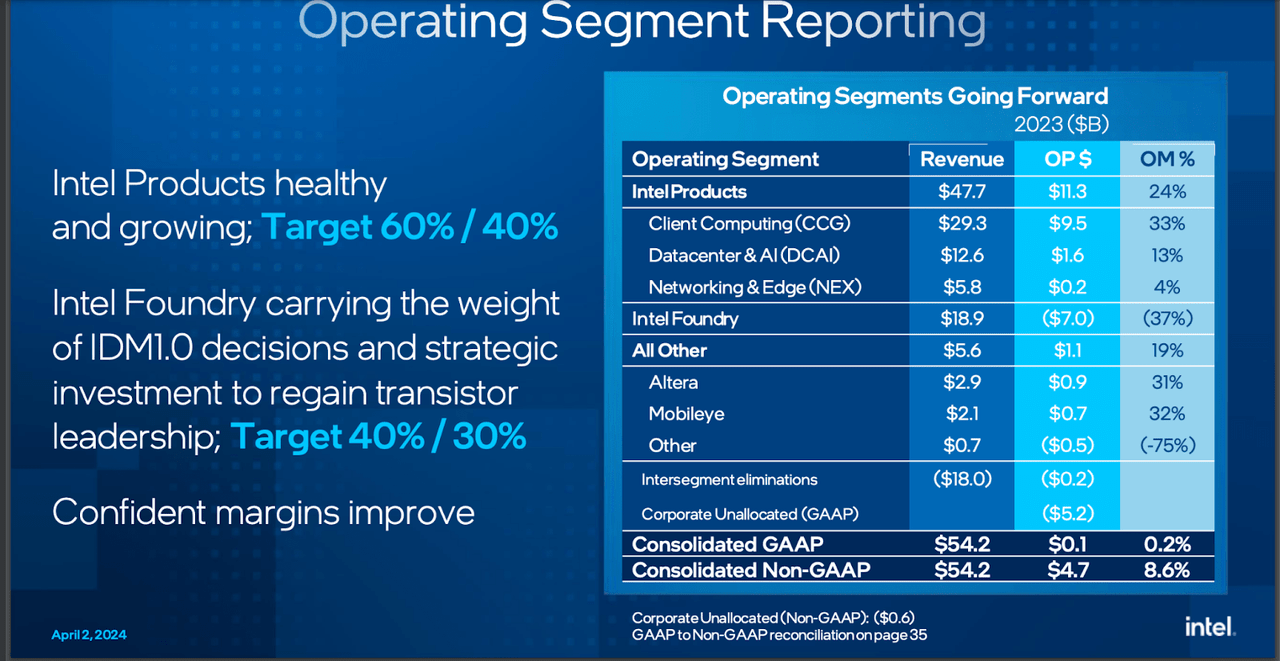

Most notably, investors have been quick to point out the $7B loss.

INTC Segment Reporting (Investor slides)

Despite this loss, Intel hopes to achieve a 40%-30% operating margin in this segment eventually.

Intel Foundry is going to drive considerable earnings growth for Intel over time. 2024 is the trough for foundry operating losses. We’ve committed to being the number 2 foundry by the end of the decade. And between now and then, we’ll hit breakeven operating margin about midway through that and then driving operating margin improvement through the period.

Source: CEO Pat Gelsinger, New Segment Reporting Webinar.

While $7 billion is a substantial loss, we should see a reversal start in 2025, and the company expects to be profitable by 2030.

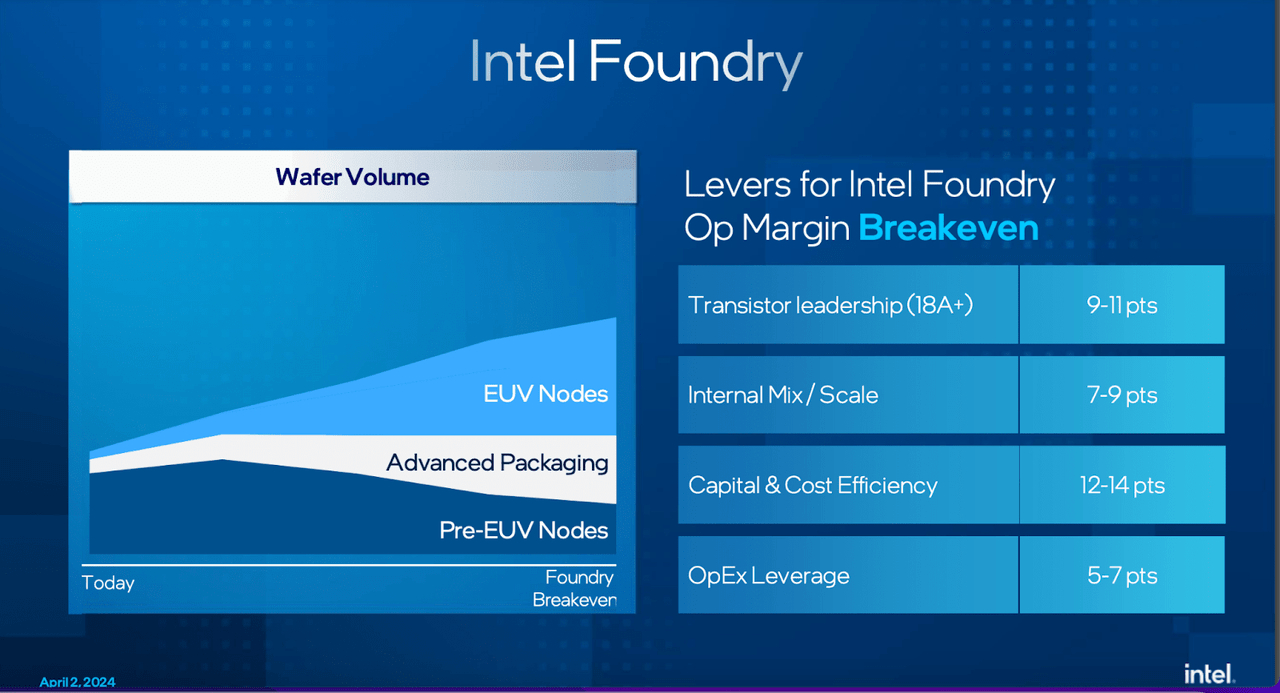

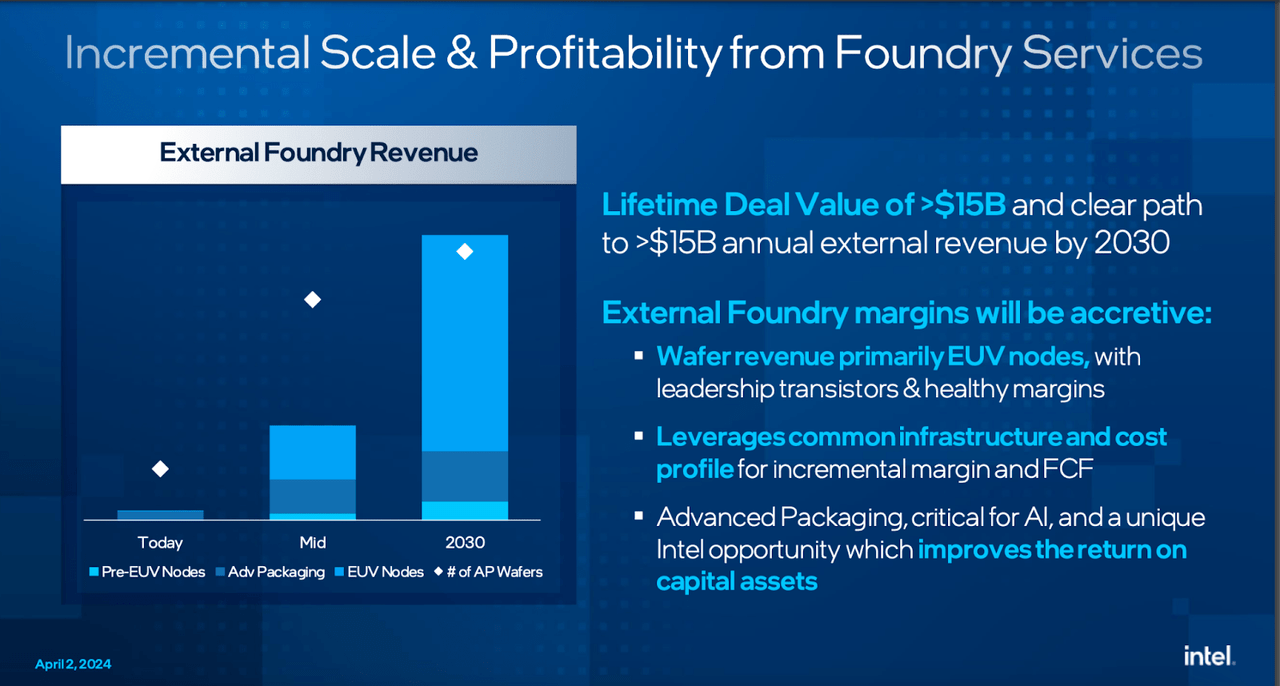

We can get a little more insight into Intel’s roadmap by looking at the slides they provided.

Intel Foundry (Investor slides) Scale and Profitability (Investor slides)

Intel expects revenues from the increased EUV nodes. Through advanced packaging, which is a key component for AI, the company expects to increase its ROA and also achieve higher free cash flow, or FCF.

The new business and vision comes complete with a new CFO for the Foundry segment:

As we move from breakeven to our 2030 target, the buckets don’t change, but we do get the added benefit of incremental efficiencies that drive capital avoidance today but take time to show up in the P&L. To help drive this process, we hired Lorenzo Flores as CFO of Intel Foundry. As many of you know, Lorenzo was the CFO of Xilinx, and more recently, he was Vice Chair of Kioxia. This page lays out the priorities Lorenzo has as he comes aboard, and I’m excited to have him join.

Source: CEO Pat Gelsinger, New Segment Reporting Webinar.

Lorenzo Flores will no doubt have his work cut out for him.

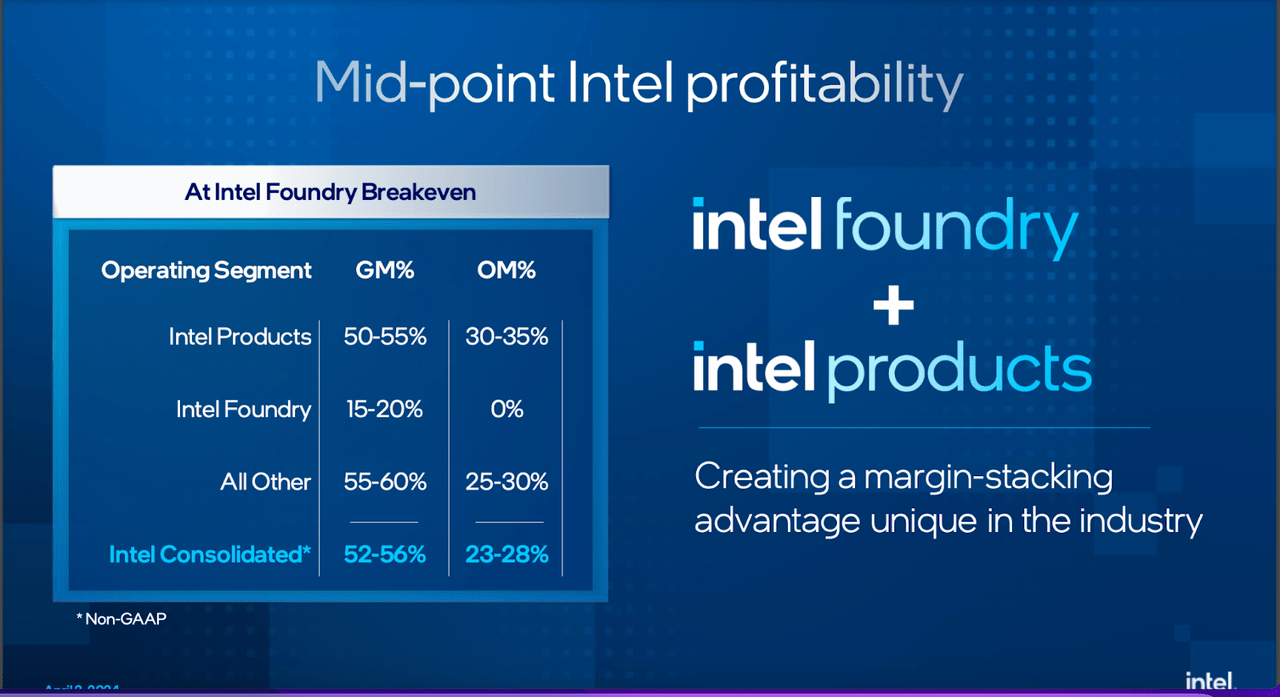

Intel Profitability (Investor slides)

Intel has laid out some very precise targets for its profitability; now, the new CFO will have to deliver.

Overall, Intel hopes to achieve operating margins of 52%- 56% and 23%- 38% from its consolidated business.

Can Intel Pull It Off?

That’s the real question here. Following the recent selloff, Intel would be an attractive investment at that level of profitability, but that’s a big if.

In terms of margins, we can assess Intel’s potential profitability based on historical record, as well as the margins achieved by one of its main competitors in foundry, Taiwan Semiconductor aka TSMC (TSM)

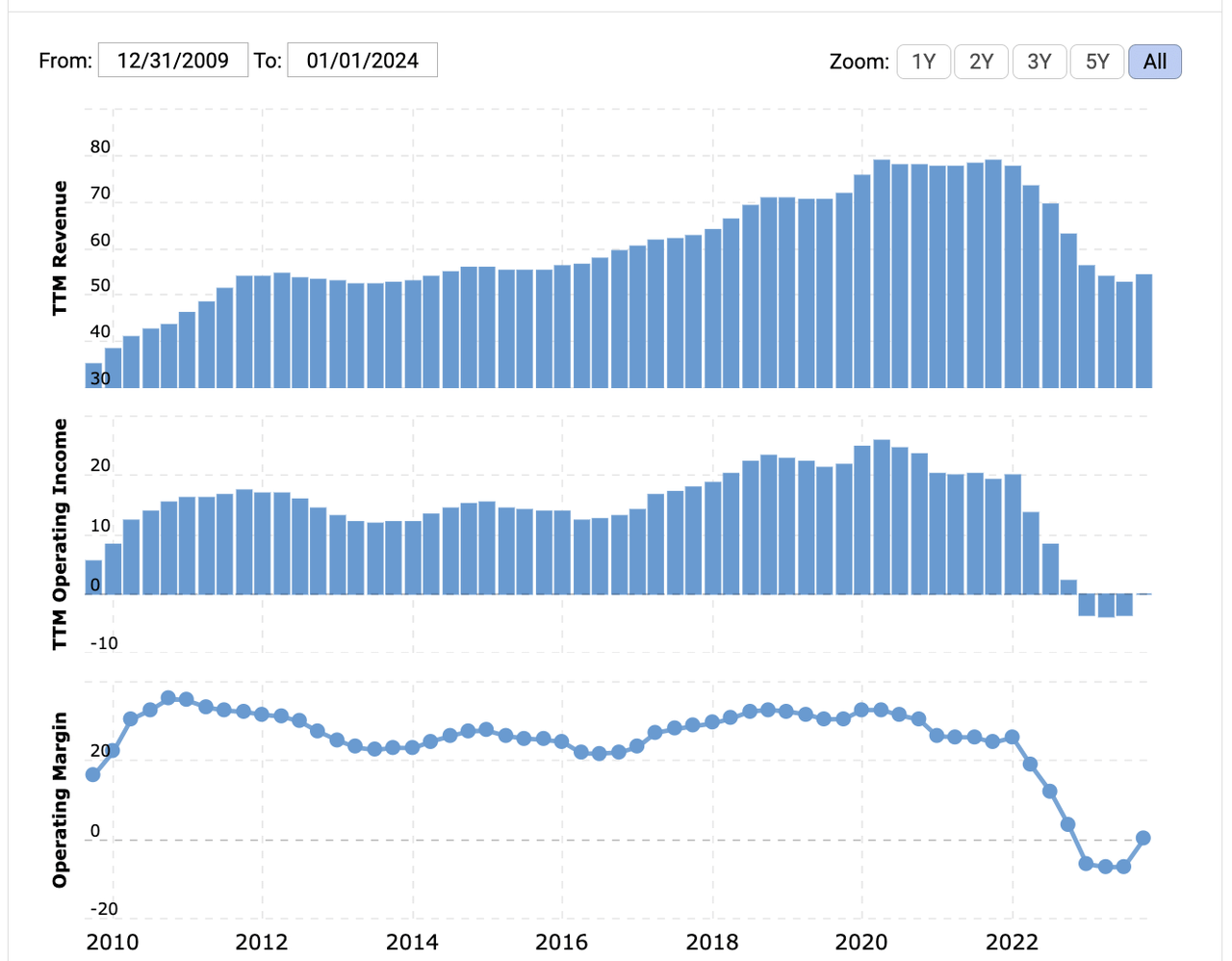

Intel’s margins began to decline after 2020, when competitors started to take its market share.

Before that, Intel’s margins, which would be equivalent to today’s “Intel Products,” achieved a range of between 30%-35%.

Therefore, Intel’s objective is to regain the margins it had before. To do so, it will certainly have to step up its innovation to keep up with Advanced Micro Devices (AMD) and Nvidia Corporation (NVDA). However, one could even argue that Intel could even surpass these previous margins given the advancements in AI and the increased demand for semiconductors and related products.

Now, as far as the Foundry goes, Intel’s midterm objective is to achieve breakeven, but its long-term target for Operating Margins is 25%-30%.

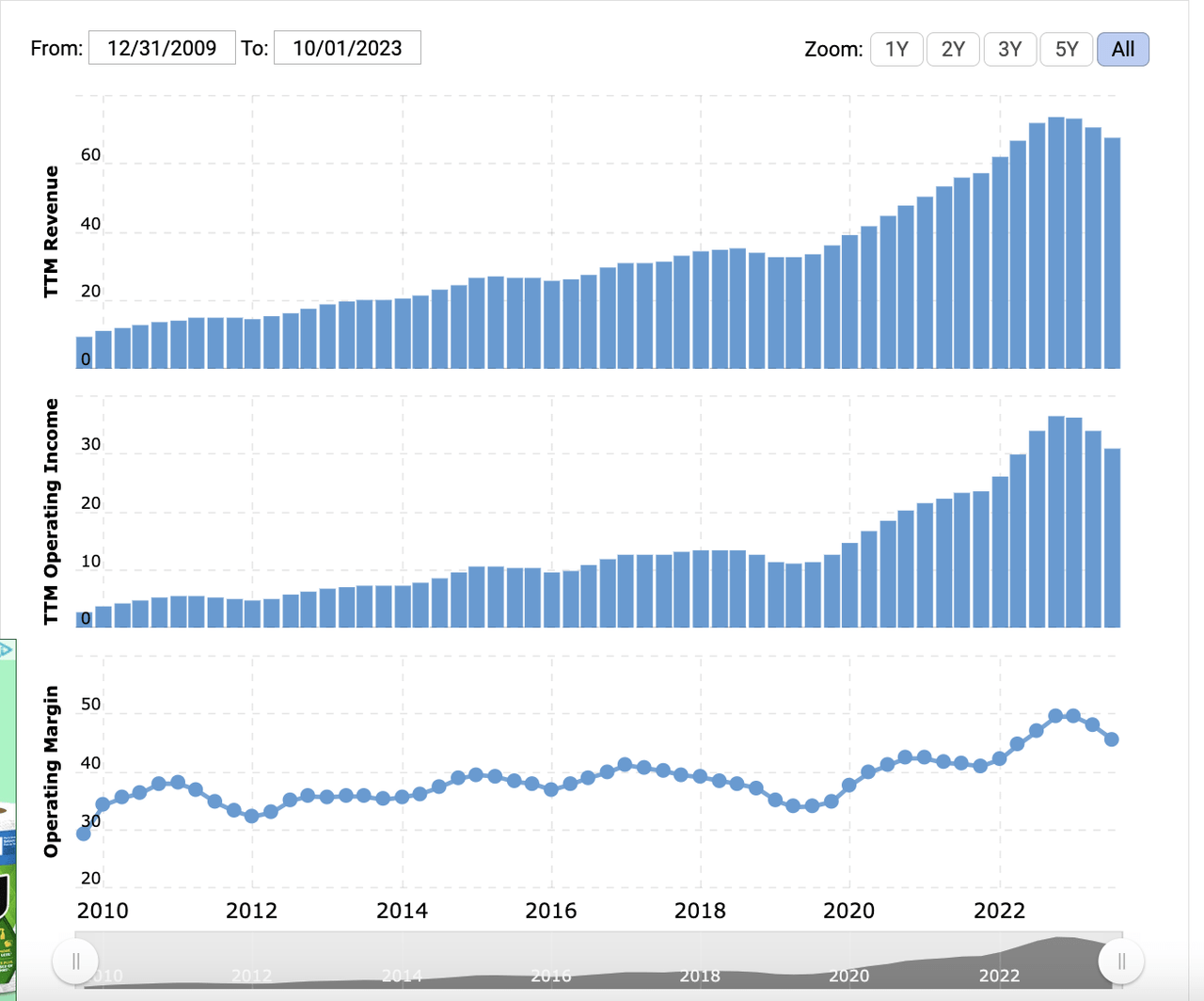

This would be in line with what TSMC achieved from 2010 to 2020. In fact, since then, TSMC’s operating margin has expanded to as high as 50%.

Now, TSMC does have some competitive advantages when it comes to keeping a lid on costs, but I do think that a 30% margin for Intel is possible if this is the new norm.

INTC Vs. TSMC

Now that Intel is fully committed to the foundry business, it’s worth comparing it to its main competitor in the space, TSM, to see which one of them offers better value:

|

INTC |

TSM |

|

|

P/E GAAP (FWD) |

68,41 |

25,58 |

|

PEG Non-GAAP (FWD) |

1,17 |

1,04 |

|

Price/Sales (TTM) |

3,07 |

8,97 |

|

Price to Book (TTM) |

1,59 |

5,60 |

|

Price/Cash Flow (TTM) |

14,74 |

15,61 |

|

Dividend Yield (FWD) |

1,26% |

1,60% |

Data Source: Seeking Alpha.

As we can see in this table, INTC actually seems quite expensive when we look at a metric like FWD P/E, trading well above TSM. However, the valuations seem more equal if we compare forward PEG, where INTC trades at 1,1 and TSMC at 1,04. However, judging INTC based on earnings during this transition may not be the best.

What I find most appealing for INTC in terms of valuation, is the margin of safety provided by its strong cash flow and low Price/Book value.

At 1.54 P/B, this strongly limits the potential downside for INTC in my opinion. The company has a strong balance sheet, and trades close to its book value.

On the other hand, INTC trades at under 15x cash flow, which is even lower than TSM. This is something many investors may be overlooking now.

A Whole New War

When it comes to investing in Intel, or Intel vs. TSM, the issue runs much deeper than cash flow and valuation.

Though it may still be early days, there is significant geopolitical tension between China and its allies, and the U.S. and its allies.

While I am optimistic that all-out conflict can be avoided, a trade war is already ongoing, and it’s going to continue escalating.

Janet Yellen recently was in China, seemingly trying to urge the country not to export as much.

In addition to this, last week, the U.S. urged South Korea to curb its chip exports to China.

Technology has revolutionized the way we live, and it will inevitably change the nature of war, which will no longer be won on the battlefield, but in R&D labs.

Intel is beginning a long (and painful) journey to becoming a key defense contractor. The chipmaker has already received an $8 billion investment by the Biden administration, as well as being eligible for substantial tax exemptions in the future.

I’d be hard-pressed to find a company with such strong support from the U.S. government that hasn’t done well.

I’ve been bullish on many defense sector names in the last year, and I am now adding Intel to that list.

Risks

As far as I see, the risk here for Intel is that somehow the geopolitical tensions between the East and the West reach a positive conclusion.

It’s also possible that in a few years the current chip cycle will once again turn bearish, and Intel may find itself with excess production capacity. However, many people would agree that the evolution of AI has kicked off a secular bull market in semiconductors.

Takeaway

All in all, I like Intel Corporation stock at this price. It offers a substantial margin of safety, and the upside could be significant if the company can achieve the objectives it has laid out. While 2030 sounds like the distant future, the markets will start pricing things much sooner.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This stock is part of my End Of The World Portfolio.

A portfolio of highly diversified, secure and reliable companies that will do well in ANY environment.

Join the Pragmatic Investor today to get full access to the portfolio and more.

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video