Summary:

- Intel announced the retirement of CEO Pat Gelsinger as the company continues to face big challenges.

- The massive investment in the foundry segment has not delivered the promised results.

- The new management at the Company will likely reduce the investment pace for the foundry business or split this business.

- The next Intel management would need to be AI-focused in order to deliver a successful turnaround and compete with Nvidia and AMD for this lucrative segment.

- INTC stock is cheap, but investors should wait for the next management to lay out their strategy.

JHVEPhoto/iStock Editorial via Getty Images

Intel (NASDAQ:INTC) stock has seen a massive correction of over 50% this year. I mentioned earlier that Intel’s foundry strategy will be a massive headwind for the stock. Despite the massive subsidies by several governments, Intel would have found it very difficult to compete with market leader TSMC (TSM) in the foundry business. On the other hand, investments in the foundry business reduced the management focus on AI. Intel is now a big laggard in AI chip development, falling far behind Nvidia (NVDA) and AMD (AMD). In a prior article before the earnings, it was mentioned that Intel will face a tough challenge if it misses expectations again.

The next Intel management would need to be laser-focused on building a strong AI chip pipeline. It is also likely that the next CEO could have some AI expertise. The skills and strategy of the top management make a massive difference in this industry. Over the last few years, we have seen AMD’s Lisa Su build a very sound strategy in the core business and is now focusing on the AI segment to drive future growth.

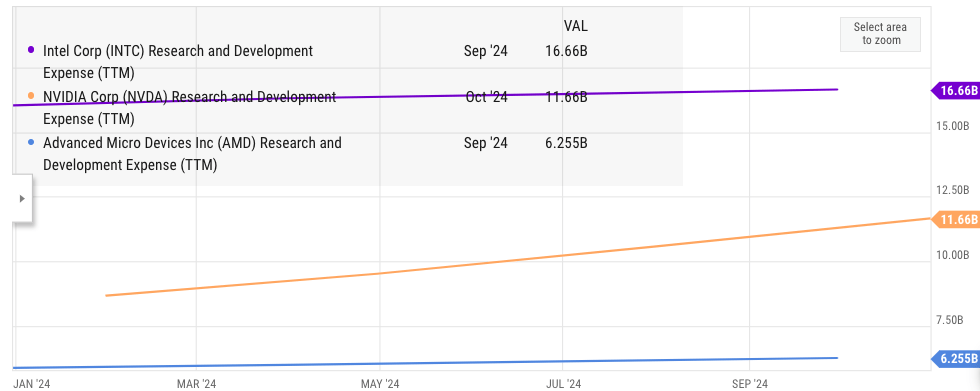

Intel has enough resources to compete with Nvidia and AMD in the AI segment. Intel’s trailing twelve-month R&D expense was $17 billion, compared to $12 billion for Nvidia and $6 billion for AMD. Intel needs to get a better bang for the buck. The recent restructuring should help Intel focus more on AI development and right-size the company. I continue to maintain a Sell rating for the stock. However, a clear vision by the next CEO could turn the ship around and improve the rating for the stock.

Another change in management

Intel has announced another change in the CEO. To some extent, this was inevitable as competitors raced ahead in AI chip development while Intel lagged behind. I believe the foundry strategy of Intel was a big mistake and have mentioned it in my earlier thesis on the company. Recently, some other analysts have also made similar observations. The foundry business has a very long investment period, and Intel does not have this much time. Regular changes in government can also lead to changes in policies, which reduce the attraction of subsidies.

If Intel had not invested heavily in the foundry segment, it could have more resources to invest in the AI chip development. Hopefully, this could have given a better product pipeline. We have already seen in the past few quarters how AMD has shifted its focus to AI chips. This has put the company in a good position to compete with Nvidia and grab some of the juicy margins and market share for AI chips.

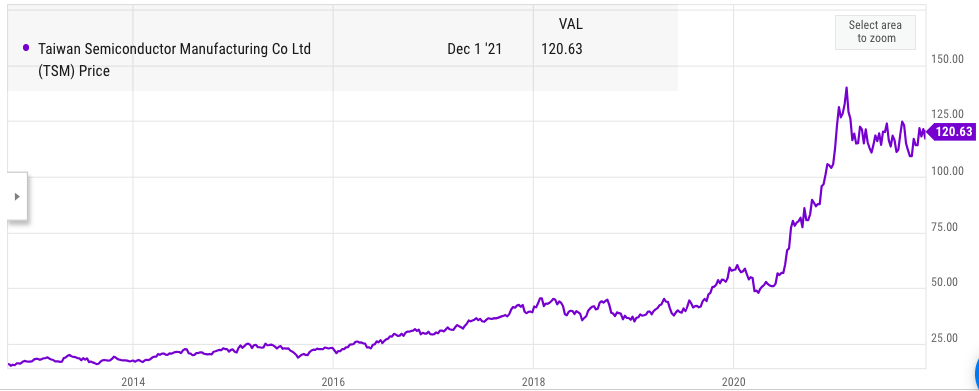

TSM stock movement in 2020 and 2021 (YCharts)

In late 2020 and early 2021, TSM stock had a massive bull run, which could have influenced the previous Intel CEO when he announced the foundry business for Intel. However, the foundry business takes a long time to develop. It is highly likely that the next management might reduce the foundry investment to focus on AI or split the business.

Skills and strategy of next CEO

Intel has enough resources to turn the ship around. However, it would require excellent management and the right strategy for the company. The R&D expense of Intel is significantly higher than both Nvidia and AMD. Intel would need to reduce some of the lower-margin products and focus more on its AI business. The previous management announced a massive restructuring, which should help in right-sizing the company.

R&D expense of Intel, Nvidia and AMD (YCharts)

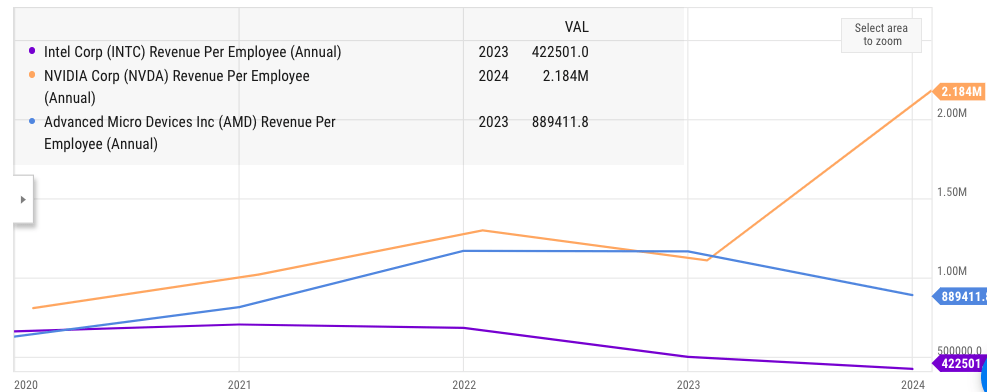

As shown in the above chart, Intel’s R&D expense is almost equal to the combined R&D expense of Nvidia and AMD. On the other hand, Intel’s revenue per employee is significantly lower than Nvidia and AMD. Intel’s revenue per employee is close to $400,000 compared to $900,000 for AMD and $2.1 million for Nvidia. Back in 2020, AMD’s revenue per employee was lower than Intel. This shows the massive change which took place in Intel over the last few years.

Revenue per employee of Intel, Nvidia and AMD (YCharts)

It seems highly likely that the next CEO of Intel will have at least some AI skills and will be focusing on this segment. The only way to improve the stock trajectory of Intel is to deliver strong AI chips which can compete head-on with Nvidia and AMD.

Maintain a Sell rating

My previous Sell rating on Intel was spot on. Many analysts argued earlier that the decline in Intel stock made it a value buy. However, I maintained the Sell rating due to Intel’s foundry strategy and poor execution in the AI segment. Intel stock has suffered close to 50% correction this year, while S&P500 has surged by over 20%. Since the last management took over in early 2021, Intel stock has declined by close to two-third. This shows that the foundry strategy is not working for the company. It is very likely that the next management will make some significant changes in the foundry business by splitting it off or divesting it.

It is also highly likely that the next management will have a very high focus on building a good product pipeline for AI chips. The importance of top management cannot be overstated. We have seen AMD stock rise by 50X since CEO Lisa Su took over the company a decade back. With the right CEO and management, Intel could also deliver excellent returns. Investors should close watch the skills and strategy of the next management to gauge the potential of Intel stock in the next few years. While I maintain a Sell rating, a clear AI-driven vision by the next CEO could lead to an upgrade in the rating.

Intel’s earnings trajectory

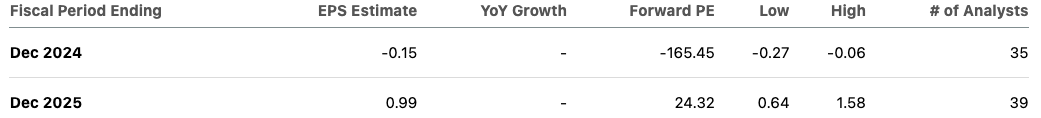

The next management could divest or split the foundry business and also improve the margins by increasing the layoffs. Intel still looks very bloated, and one of the first tasks for the next management would be to make it leaner and nimble to compete effectively. The EPS estimate for next year is $0.99 which gives the company a forward PE ratio of 24.32.

EPS estimates of Intel for the next fiscal year (Seeking Alpha)

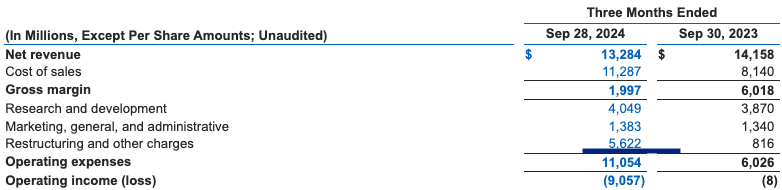

Massive restructuring expense led to a dip in operating income (Company Filings)

The most important factor for investors is what skills and strategy the next management will have. Intel has enough resources to compete, but it requires very good management to navigate the AI era.

Investor Takeaway

Intel has announced the retirement of its CEO. During his tenure, Intel stock dipped by over two-third, while other chip stocks have surged on the AI boom. The foundry business requires massive investment over a long period, which Intel does not have. It is highly likely that the next Intel management will make changes in the foundry business and will be focusing more on building AI chip pipeline.

My previous Sell rating was spot on as the stock declined by 52% YTD. I am maintaining the Sell rating, and I am in a wait-and-watch mode for the next management to announce its strategy. It is very likely that the next management will be more AI-focused, which should help the company improve the market share in this important segment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.