Summary:

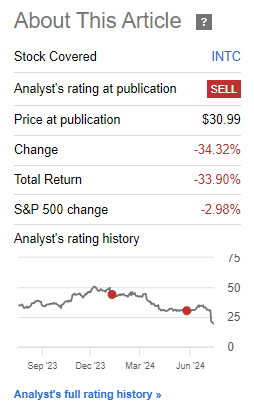

- After an active return of almost +31% on my previous ‘Sell’ view on Intel, I am maintaining my bearish stance post Q2 FY24 results:

- Intel investors face a potential long term FCF bleed, as the company is not expected to be FCF-positive for the next 4 years.

- I believe investors should skip management’s turnaround and transformation pitch and instead focus on evaluating the results.

- Notwithstanding the recent guidance shockers, I believe proactive and transparent communication is lacking since the company did not issue a timely profit warning to inform of a drastic EPS downgrade.

- Valuations seem to bake in a bit of an undeserved semi + AI-theme in my view as the stock still trades above its long-term average multiple. The technicals suggest a multi-year lag vs the S&P500 going ahead.

Intel CEO Patrick Gelsinger Alex Wong/Getty Images News

Performance Assessment

As familiar readers would know, I always start my follow-up updates with a performance assessment. Sometimes, I get things very wrong. But that is not the case here with Intel (NASDAQ:INTC). My ‘Sell’ view has played out rather well, generating an active return of +30.92% so far vs the S&P500 (SPY) (SPX):

Performance since Author’s Last Article on Intel (Seeking Alpha, Author’s Last Article on Intel)

Thesis after Q2 FY24

Intel delivered a shocker in its Q2 FY24 results. The company seems to be making desperate moves to save costs as it strives to catch up with competitors from a lagging position in the technology curve.

In my previous articles, I have discussed Intel’s technological issues at greater length, mentioning how Taiwan Semiconductor Manufacturing Company (TSM) (OTC:TSMWF) remains ahead, and how players such as Arm Holdings (ARM), AMD (AMD) and NVIDIA (NVDA) are gaining share.

This time, I’m focusing more on the implications of what investors in Intel can expect from a FCF return perspective and why management’s narrative ought to be ignored:

- Intel investors could face a long term FCF bleed

- Skip management’s pitch and look at the results

- Valuations are not compelling for knife-catch buys

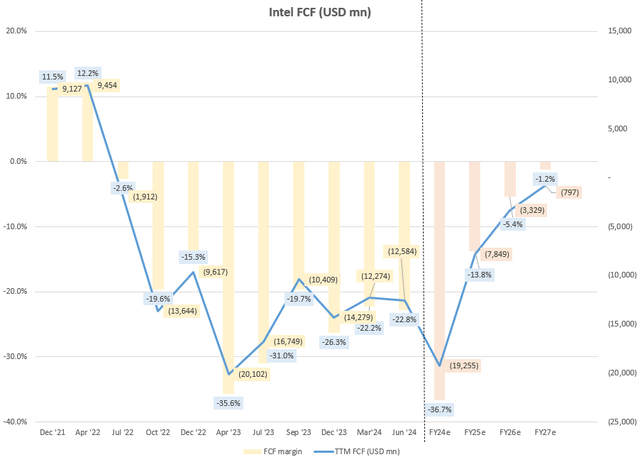

Intel investors face a long term FCF bleed

As Intel invests in its Foundry, the company’s FCFs have been bleeding for the last 9 consecutive quarters. The FCF margins (which I’ve computed using TTM FCF/TTM Revenues) are deeply negative at 22.8% as of the latest quarter.

Looking at the outlook, consensus estimates data from Capital IQ point toward the market’s expectations of negative FCFs for at least the next 4 years:

Intel FCF (USD mn) (Company Filings, Author’s Analysis)

FY24 in particular is expected to lead to a big FCF burn of $19 billion, implying a -36.7% FCF margin. Now, I am very skeptical that Intel’s investments would prove fruitful wherein they catch up in the technology curve. Considering this, coupled with the fact that I think the value of a company is equal to the present value of its future cash flows, I believe the current FCF outlook for Intel is a strong deterrent for investing in the stock.

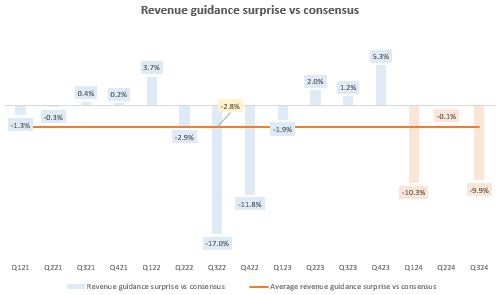

Skip management’s pitch and look at the results

Intel’s management has been pitching a major transformation story for the company. However, the company has consistently fell short of expectations. In my last article, I had shared data on the company’s beat vs miss track record. Whilst the company missed again in Q2 FY24 on both revenues (1.14% miss and EBITDA margins (204bps miss), I draw your attention to the even more concerning guidance disappointments:

Revenue Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

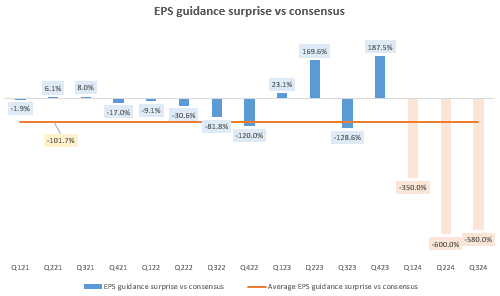

Revenue guidance for Q3 FY24 came in almost 10% below consensus expectations. This amounts to 2 ~10% disappointments in the last 3 quarters. Still, this is nothing compared to the recent history of EPS guidance shockers:

EPS Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

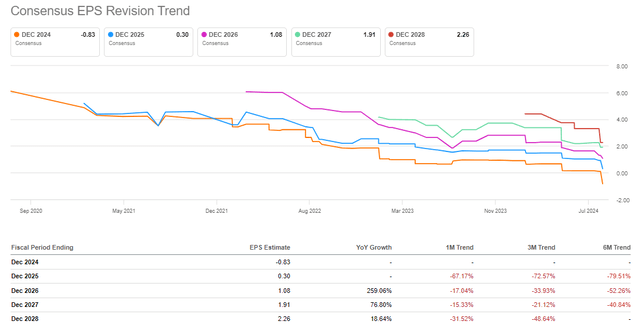

The market was taken aback by the fact that Intel is on-track to post EPS losses this year, as reflected by the steep consensus EPS downgrades:

Intel Consensus EPS Revisions (Seeking Alpha)

Now, bad results may be forgivable. However, I believe poor communication is not. Although Intel gave a revenue guidance update before Q2 FY24 results (indicating the lower-end of the $12.5-13.5 billion range. Actual was $12.8 billion), management also indicated that full-year EPS is still expected to grow in 2024 vs 2023.

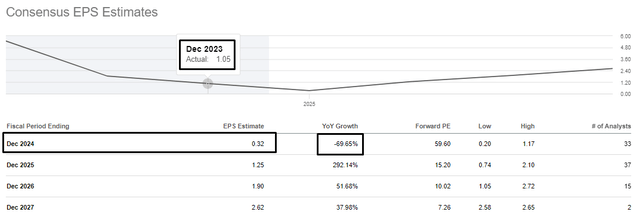

Yet, that is no longer the case now, as indicated by the consensus EPS numbers.

Intel Consensus EPS (Seeking Alpha)

No profit warning was announced by the company to restate expectations from positive EPS growth to a 70% EPS decline in FY24. Such gross lack of proactive communication and transparency seems to have been the tipping point for some disgruntled investors who have sued the company for allegedly concealing key issues. This just adds fuel to the fire, stoking the woes of Intel.

Valuations are not compelling for knife-catch buys

Given the disappointing lack of transparency, poor execution and the prospects of funding Intel’s foundry technology investments for multiple years, despite a perceived low chance of success in it catching up in the technology curve, I believe Intel is a stock to stay away from no matter how cheap it may seem.

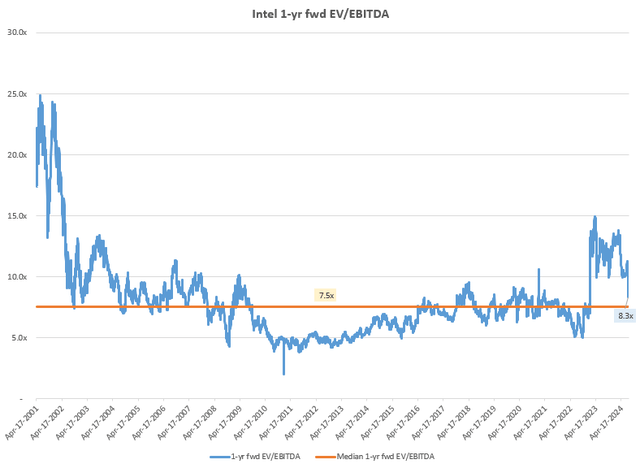

Nevertheless, I notice that at 8.3x, the stock still trades at a 16% 1-yr fwd EV/EBITDA premium to its longer term average of 7.5x:

Intel 1-yr fwd EV/EBITDA (Capital IQ, Author’s Analysis)

This premium may be attributed to the broader bullishness in the semiconductor market, as the sector enjoys high demand from new AI applications. Still, I think for the consistently underperforming Intel who is losing share vs competitors, the premium is not deserved. Hence, even if valuations were a key consideration, it doesn’t look attractive for investment in my view.

Technicals flash warning signs of long term lag vs S&P500

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

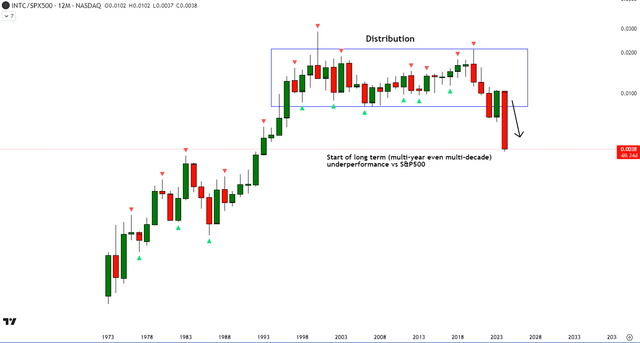

Relative Read of INTC vs SPX500

INTC vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative yearly chart (every candle represents 1 year) of Intel vs the S&P500, I notice a Wyckoff distribution pattern that is playing out with the first breakout of the range triggered via the 38% fall in the stock post Q2 FY24 results. I believe this spells a rather gloomy outlook for the stock over the next few years and even decades (since this technical read is based on the yearly chart; a decade is represented in only 10 candles).

Key Risks and Monitorables

I do believe Intel is making the right and necessary moves for the company in cutting costs and restructuring to extend the financial bandwidth for funding their aspirations to catch up in the foundry technology curve. However, I fear that these corrective actions may be too late. Even if Intel’s management is making the best decision to restructure the company, the company still has to dig itself out of a deep financial hole as it invests to hopefully emerge as a technology competitor let alone leader once again. A key thing to monitor for my thesis would be to track Intel’s product progress coupled with the quarterly financial results.

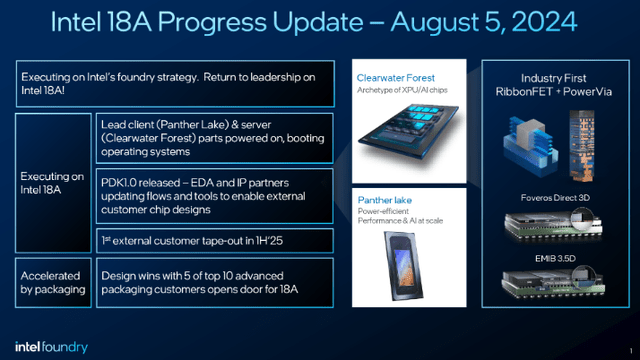

On the product progress side, Intel’s 18A is a key semiconductor chip that the company is relying on to regain foundry process leadership vs TSMC. Recently, Intel shared that this chip is out of the development phase and has started to boot operating systems, which is a key milestone:

Intel 18A Progress Update (Intel, AnandTech)

Intel expects the 18A’s final stage design and manufacturing with an external client to commence in H1 FY25. This is the next key milestone to track. It is noteworthy that this timeline has been delayed a bit, since previous expectations were that the 18A would be ready for manufacturing in H2 FY24.

Takeaway & Positioning

My earlier bearish view on Intel has been playing out well, generating an active return of almost 31% vs the S&P500. After Q2 FY24 results, I am continuing with my ‘Sell’ stance on the stock.

I believe long term investors in Intel need to reconcile with potentially having their investment be dead money for at least the next 4 years, as FCF is expected to continue declining. Intel delivered guidance shockers on revenue and even more on EPS in Q2 FY24. I believe there ought to have been more proactive and transparent communication to inform the market of huge (from FY24 EPS growth expectations to a ~70% EPS decline scenario in FY24) revised expectations via a profit warning prior to the Q2 FY24 results release.

I also don’t find valuations compelling and technically, relative to the S&P500, it looks like INTC is likely to underperform the S&P500 for multiple years and potentially more than a decade in my opinion.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.