Summary:

- In the 2010s, Intel failed to invest in keeping its leadership position.

- The current transition, while difficult, is returning Intel to relevance.

- Foundry is not just about competing with TSMC; it is first about rebuilding Intel’s manufacturing ability.

- Intel is betting all on 18A; if it fails, all bets are off.

- My current valuation puts Intel at $30 and makes me assign the stock a Strong Buy.

Editor’s note: Seeking Alpha is proud to welcome The Investing Fool as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

JHVEPhoto

Introduction

In this article, I will tell a fairly simplified and short story of Intel’s (NASDAQ:INTC) past, present and future. This story on its own should justify my bullish stance on the company, but I will also flesh out some of the more important parts, like, their plans for Foundry, how they will pay for those plans, and their all-in bet on 18A. Finally, I’ll do a valuation on Intel using my own take on a discounted cashflow model, and point out some of the many risks.

When I research a company, I write myself a quick article, justifying my valuation of it, I find this focuses my thoughts and allows me to see holes in my models. This is the first time I have fleshed out one of those articles and posted it, and already the extra work I put into it has been hugely helpful in ironing out my thesis. It’s my hope that any feedback and discussion that this article can generate will provide even greater assistance.

The Story

Let me set out a brief history of Intel, in which hopefully we will see the trajectory for the future.

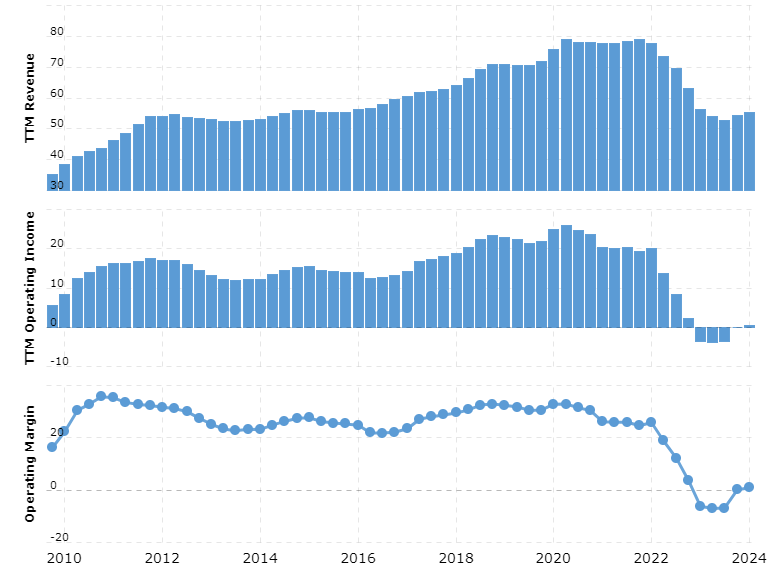

Intel makes chips; every 2 to 3 years, they improve the process that they use to make chips – this is called a node. Sometime in the mid-2010s, they began to have trouble with their next node. Strangely, this didn’t hurt them financially; you see, it takes years and lots of money to research, create and ramp up a process. Intel found themselves in a position where they were still increasing revenue on older chips made on a more and more outdated process, without spending enough money on new ones. This led to continuingly good revenues with increasingly good margins, at the cost of the future.

This short-term success came to a head in and around 2018-2021 with the removal of two CEOs and ended with Pat Gelsinger being installed in 2021. He implemented a goal of creating five nodes in four years, to get them back on track, a goal that by all accounts is hitting its milestones. The problem is that Intel’s chips became outdated as the last leading node got older. Worse, this new goal of getting them back to relevance costs money. So while revenues continued to fall and indeed plummet, costs needed to increase to keep the future on track – in other words, falling revenue and collapsing margins.

marcotrends.net

Unsurprisingly, the market has taken this poorly, but I argue that these failures are due to decisions made up to a decade ago. We need to ask ourselves what decisions are they making now, and how they will impact the future.

They talked about five nodes in four years, bringing them back to process leadership. My story and later my model will only give them credit for process relevance. Basically, they say they will be great again, but I am only giving them credit for being ‘OK’. While this won’t return them to the market dominance they once held with near 40% margins, it should allow them to regrow revenue from here and improve margins to around 20% levels.

Due to the years of work, it takes to create, or fail to create a new node, Intel was struck down by decisions and circumstances in years past. The market kept Intel’s stock price high for a long time before realizing the situation. It is my working assumption that Pat Gelsinger and Intel have made decisions that will put them back on the correct path by prioritizing regaining the technology lead that they lost. And once again, I think the market is failing by not anticipating Intel’s future due to its current poor results.

18A or bust

Five nodes in four years is a bit of a misnomer – Intel 3 is an iteration on 4 and the same can be said with 18A and 20A. So really, it is 3 nodes, Intel 7 (done and ramped), Intel 3 (done and ramping), and Intel 18A (expected to be done and start ramping in late 2025/2026). And even then, Intel 7 and Intel 3, still seem to be minor pieces of Intel’s master plan, so it is all about 18A. Now, as I already said, my model doesn’t require leadership from 18A, but just near-leading edge – good in some areas, and weak in others. It merely needs to be a viable option for customers, something that Intel chips have been failing at over the last 5 years.

I won’t claim to be an expert in microprocessors, but from everything I read, they seem to be on track for a return to relevance. 18A will be one of the first nodes to use a gate-all-around design, and the first to integrate power on the back of processors. It is this back-side power that the industry seems to be the most excited about, and could potentially give Intel an edge.

Intel

My main theme is Intel was bad, and they made decisions 3 years ago that will hopefully return them to good. This mainly revolves around 18A working, being roughly on time, and being a moderately good seller. On the one hand, it is not a lot to ask, but on the other, with Intel’s recent history, perhaps it is a lot to ask.

Why am I so confident that Intel will succeed? Well, I am not really, I am just edging towards the belief that they will succeed. I am basing this on them being on track with all their developing milestones in the last few years. In fact, they are slightly ahead of schedule. They have even recently released a PDK for the 18A process, which is like a how-to book for making chips on 18A -this is a great indication that on the Intel Foundry side, the process is on track. Now, it is just a question of Intel’s design.

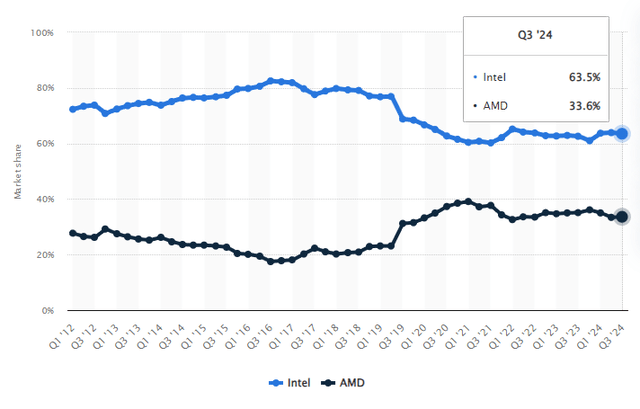

Intel’s market share has been hurt in the last decade. It has fallen from 80% to 60%, but 60 is not 0. Large industry players like Dell (DELL), Lenovo (OTCPK:LNVGY) (OTCPK:LNVGF) and HP (HPQ) still do billions of dollars of business with Intel. If they’ve not dropped them yet, it is not hard to foresee that a large uptake in orders if their Panther Lake chip built on the 18A node is half as good as they hope.

Intel and AMD x86 market share (Statista.com)

My thinking is that Intel is priced like 18A has a low chance of success, and I am modelling for a medium to good chance. Finding these mismatches is one of the goals of my investing strategy. I do accept that it is very uncomfortable to have the fate of a company riding on the success or failure of a single thing, and it must be accepted that my entire story unravels if 18A fails.

Foundry

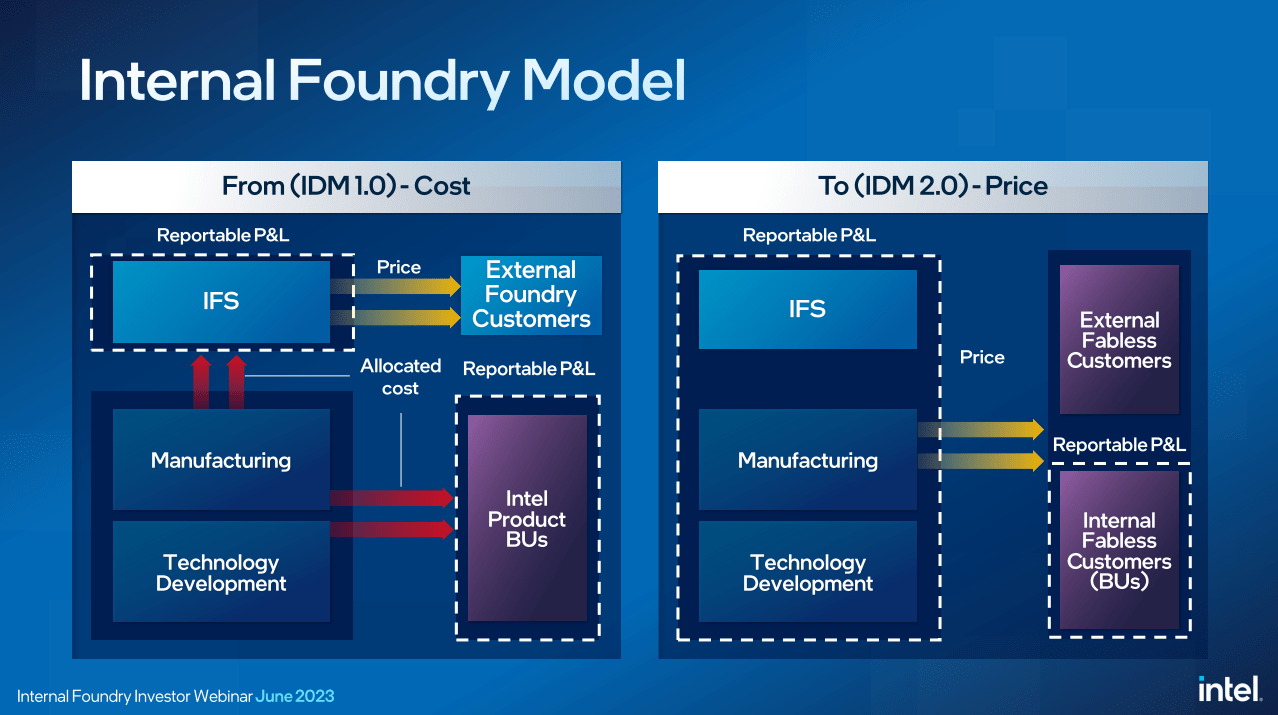

The next big change Intel is initiating is internally splitting the company. One part to design the chips, and one part to make them (Foundry) – they call this plan IDM 2.0. In this section, I will focus on the Foundry part. Intel is touting it as good for efficiency and a potential source of extra revenue via outside customers.

Intel

On efficiency, in their Internal Foundry Model webinar, CFO David Zinsner highlighted many situations where an inter-managed design and foundry led to massive waste. One that stands out is test runs. The design side would request test runs and samples, basically pausing profit-making chip manufacturing and running experimental chip designs instead. Of course, these tests are necessary, but Intel was running 2-3 the number as was the industry standard and was doing so with little thought for efficiency and cost. Simply by separating the segments’ accounting and thereby introducing accountability, it is hoped they can save $8-$10 billion by 2025.

As for the hope for increased revenue from outside customers, I believe it is a bit misunderstood. In my opinion, they are not going all out to compete with TSMC, but they are going all out to update their foundry to produce 18A chips. Next, they are separating foundry, for efficiency reasons. Only then, are they thinking of getting outside customers. Don’t get me wrong, outside customers are great for many reasons.

-

They can be used to generate extra revenue by making use of excess capacity.

-

They can outbid Intel products, thereby increasing margins.

-

Having multiple outside companies work on your node, has the potential to improve the quality and efficiency of the processes.

Recently, Pat Gelsinger said, “We now have about a dozen customers that are actively engaged with us … “ when talking about their external Foundry. And they are suggesting they will have $15 billion in revenue from outside customers in 2030, which compares to about $1 billion in 2023, on $54 billion in total revenue.

I see Foundry as a sensible reorganization to improve how Intel is run. Sure, it has the potential of becoming a competitor to Samsung and eventually TSMC, but that is years off and not the main goal. It is a nice option, though.

Another benefit is, if Intel does fail, it would be easier to sell off Foundry as a separate entity and run Intel as a fabless design company. Or indeed vice versa. As I am writing this article, there are reports of just that potentially happening.

Updating their outdated fabs is going to cost a fortune, for the sake of keeping my story simple, let’s say it will cost $100 billion. But a lot of countries outside Taiwan, particularly the US and the EU, really want to have leading-edge chip manufacturing within their borders, so to facilitate that they are willing to help pay for it. The US has already committed $8.5 billion with more expected from the EU, my working assumption is $10-$15 billion total from world governments, more if you count the value of low-interest loans. While it will take years to get this money in the long run, Intel is getting $100 billion in assets and only paying $85-$90 billion. Unless Intel completely messes up, which history has shown it could do, this should be a good deal for them.

Then it is not just governments that I foresee helping Intel out, other companies also want a competitor to TSMC, take a made-up company XYZ, they currently have 100% of their leading-edge chips running through Taiwan. Even if Intel only manage to make a chip 90% as good as TSMC at 110% the price, I can see company XYZ buying a small percentage of their chips from Intel, firstly to help build up a competitor to TSMC and secondly for diversification in case of any future supply shocks.

Fixing their manufacturing problems is shockingly expensive and may indeed prove to be too much for them to manage, but they do have support, I don’t want to say too big or too important to fail because they are not. But a lot of powerful interests do want Intel to succeed here.

Show me the money

In the previous part I touched on where they might get some money, but they will still need a boatload over the next few years to turn this ship around, especially given that they have been bleeding money for the last couple of years and will probably continue to for the next 12 months. Especially given the severance packages that must be paid out for laying off 15% of their workforce.

I’m going to talk about the next 18 months because my base model assumes after those 18 months Intel should decrease its capex spend to a more standard level and should be able to fund that from their increased revenues being brought in by their latest 18A chips. These chips failing or being overly delayed is the main failure point I see in Intel going forward. All numbers from here are just my personal guesswork, I don’t trust them fully, so you certainly shouldn’t.

How much money do they need to spend over the next 18 months, looking at their latest quarterly report, we take the midrange of their expected capex for 2024 and 2025 removing the amount already spent in 2024, we get $35 billion. So how are they paying for that?

-

They are expecting $4.8 to $8.8 billion from government incentives

-

If you adjust for depreciation and share-based comp, I am modelling Intel will generate $20 billion in the next 18 months

-

Cash and short-term equivalents are $29 billion, but of course, you want to keep a lot of that for emergencies. Let’s say they can use $14 billion

-

Increasing debt. Currently, their debt has ballooned to $48 billion. Thankfully, a lot of that is at favorable interest rates, but that will continue to worsen as rates stay higher for longer. So there may not be too much room to increase debt. Let’s say they can raise $10 billion more.

-

Selling assets. They have already sold off partial stakes in Mobileye and IMS, and have indicated their intention to do the same for Altera. This should both raise money and refocus Intel. I see them raising $2 billion from this, but with the potential of raising $10-$15 billion more if they sell the remaining stakes.

-

Profit sharing deals, this is a strange one that I don’t claim to fully understand, but they have raised money from Apollo asset management by selling off future revenue of certain fabrication plants. These deals have messed up Intel’s balance sheets because the liability of the lost future revenue is not being accounted for. It is my sense that if Intel does succeed from here, these deals will end up being very expensive. I do see it as a worrying sign that they could not raise the money in a more standard way. But like I said, I do not fully understand the implications of the deal. Either way, they plan to raise $4 to $5 billion more this way.

Putting that all together, they should have access to about $55 – $73 billion which should cover the $35 billion I predict they need, but will start to struggle if their turnaround gets any more delayed or if costs overrun significantly. The real question is: Can they right the ship and produce a competitive chip? If they can, I believe they can find the money to survive the next 18 months; if not, all bets are off.

My valuation

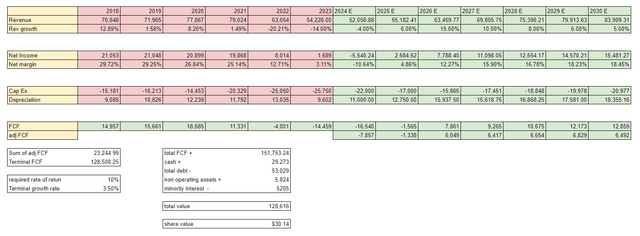

Future estimates and FCF valuation (Author)

Let me walk through my valuation of Intel, but as I do, remember the future numbers I am basing this on, are made up by me to fit my story, and are very arguable, as indeed is the method I am using, so take everything with a large grain of salt.

Revenues have plummeted in recent years, going from $79 billion in 2021 to my projection of $52 billion in 2024. I am estimating a slight turnaround in 2025 on the back of sales of Intel 7 and Intel 3 chips, just outpacing the continuing fall of older chips. The real game changer will be in 2026 as Intel 18A begins to hit scale, I am projecting increased revenue growth starting in 2026 and continuing for years before I model out a more lackadaisical growth rate.

Margins have also collapsed as they try to rebuild, this will get even worse in 2024, mostly due to the one-off cost of severance. On top of that, Intel 7 and 3 chips are still not entirely made in-house so they have pretty bad margins, this will improve as time goes on, on top of which 18A’s margins will help in 2026 and continue to help more as it is optimized. So I am giving them credit for a large improvement in 2026 due to cost savings and better margin on newer chips, and then I am gradually improving it to slightly under 20%.

For Capex, I am predicting a slowdown in the coming years before settling into a steady level of 25% of revenue. Depreciation will be bumpy in the medium term given all the turmoil, but I am setting it at a terminal level in line with the terminal revenue growth of 3.5%.

Net income – Capex + Depreciation gives me my Free Cash Flow, I use net income, so stock-based comp isn’t removed. Discounting and adding up all the future cash flows give me a value of $152 billion. Add to that their cash pile and take away their ever-increasing debt, plus or minus a bit of housekeeping, that gets me a value of $129 billion and a share price of $30.

While my targets may seem ambitious, there is still plenty of room for outperformance, on revenue growth and margins, to get there they would need

-

18A being a leading-edge node

-

Foundry gaining significant outside customers

-

Intel’s achieving and maintaining a leaner business after cost-cutting

- Continuing to develop leading nodes, 14A

All four are stated goals of Intel but given their past decade it is hard to give them credit for achieving it all. However, if I adjust my model for the best case, I can get to as high as $80 to $100 share price. Not my base case, but it does show that there is room for an upside surprise.

Risks

Hopefully, the main risk is clear, the 18A process underperforming. In theory, Intel could transition to fabless manufacturing, but if they have just spent $100 billion on equipment and fail to produce competitive chips, it is hard to see them surviving. Intel has been rightly described as all in on 18A.

From reading this, you’d be right to assume that I think Intel’s current path is the right one, but it is long and difficult. I am concerned that they may not have the fortitude to stay on it, particularly with the fall in stock price putting pressure on the board to do something. I could foresee the board changing the CEO or forcing him to drastically alter his plans. Recently, we have had a board member reportedly quit over their revival plan. I see this as a massive risk, they don’t have any time left to pivot.

Ultimately, Intel may just be too old and bloated to reinvent itself, they could very well succeed with 18A only to find themselves in a similar problem in 5 years when the inherent issues inside Intel lead to the same mistakes again.

Then, as with all my analysis, a large risk is that my story is just wrong.

Conclusion

Intel’s stock has been falling for 3 years now. It’s my opinion that this was the market realizing, too late, that large mistakes were made in the previous decade. I am currently investing in Intel not because I believe it will return to a position of dominance but because I believe it has a high chance of returning to relevance, while the market continues to price Intel for failure.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.