Summary:

- Intel’s recent 30% dip presents a golden buying opportunity due to its promising turnaround program aiming to improve AI exposure.

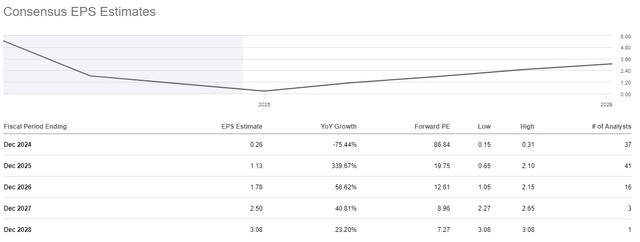

- Wall Street analysts are optimistic about Intel’s turnaround, with EPS expected to rebound significantly in 2025 and beyond, driven by AI advancements.

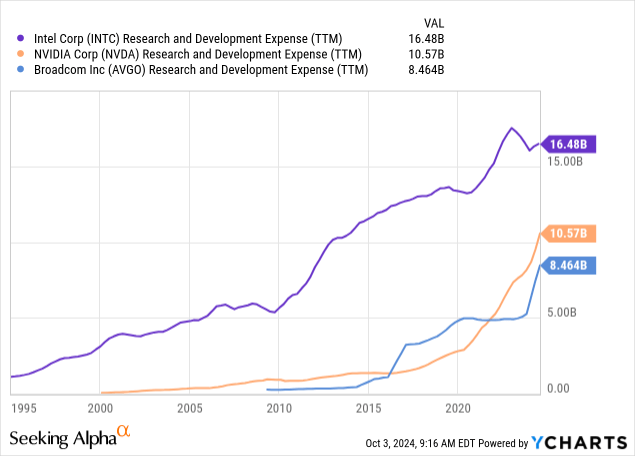

- Intel’s robust R&D budget, custom AI chips, and governmental support under the CHIPS Act position it well against competitors like Nvidia and AMD.

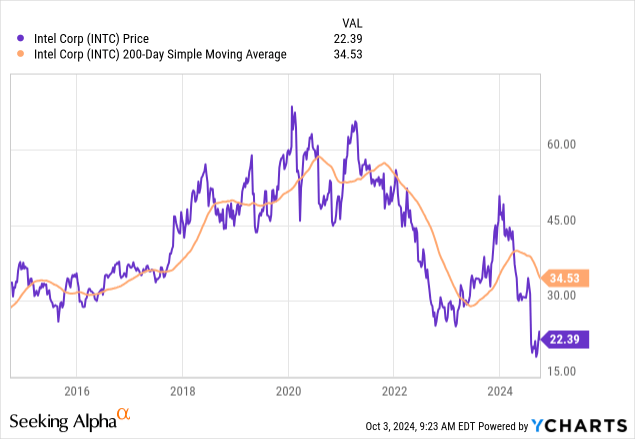

- Despite risks like high volatility, leveraged balance sheet, and potential recession, the technical setup suggests a bullish reversal, making Intel a compelling buy.

JHVEPhoto/iStock Editorial via Getty Images

My thesis

Some might say that my previous bullish Intel (NASDAQ:INTC) (NEOE:INTC:CA) call failed as the stock dipped by 30% since July 5. I cannot agree here, since the recent dip provides a golden buying opportunity, in my opinion. The stock is significantly undervalued, which my intrinsic value calculation suggests.

The company continues pursuing its turnaround plan, which is supported by multi-billion governmental support under the CHIPS Act. Intel’s R&D spending is significantly higher compared to NVIDIA (NVDA) and Broadcom (AVGO), which are considered to be the major AI darlings. These R&D investments appear to be efficient as the company continues rolling out new high-performance computing processors and accelerators. The AWS partnership to develop custom AI chips also looks quite promising, as this partner is by far leading in terms of market share in cloud infrastructure. I think that with all these positives, Intel’s stock is still a Strong Buy.

INTC stock analysis

The stock has lost 55% of its value YTD, and it makes investors nervous and bears happy. The dip explained by the unstable financial performance in 2024 with revenue growth and EPS dynamic demonstrating massive volatility, which resulted in several negative earnings surprises this year.

But such an instability is explained by a positive reason, in my opinion. I think so because Intel is aggressively pursuing its IDM 2.0 strategy, which aims to regain leadership in transistor performance and power efficiency by 2025. The company’s ambitious “five nodes in four years” (5N4Y) program is a testament to its commitment to technological advancement. This initiative is expected to enhance Intel’s competitive edge in the semiconductor industry, particularly in the high-performance computing and AI sectors.

Seeking Alpha

Wall Street analysts appear to be quite optimistic about Intel’s ability to complete its turnaround successfully. In the above table we see that the EPS is expected to demonstrate massive rebound in 2025 with an aggressive growth for the years beyond.

We all know that the AI revolution is a big tailwind for the semiconductor industry. While the market perceives Nvidia and Broadcom to be the major AI winners, let us also not forget about Intel. By the way, Intel’s R&D budget is comparable to the combined innovation spending of these two AI darlings. Therefore, I think that Intel invests a lot to ensure it finds its place in the AI era.

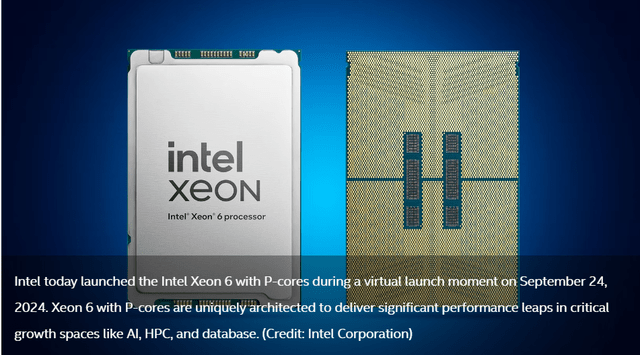

intel.com

The recently expanded collaboration with AWS to develop custom AI chips underscores Intel’s strategic focus on AI and cloud computing. The introduction of the Intel Core Ultra, featuring advanced AI acceleration capabilities, positions Intel to capture a substantial share of the AI market across various applications, from data centers to edge computing. Apart from Intel Core Ultra, Intel also recently unveiled a few more promising products. These are called Intel Xeon 6 Processor and Gaudi 3 AI Accelerator, designed for high-density workloads.

We should also remember that Intel receives robust governmental support under the CHIPS Act, unlike Nvidia and AMD. The company already received billions under the Act, which will help in Intel’s initiatives to establish state-of-the-art semiconductor facilities in Europe and the U.S. Having its own cutting-edge manufacturing sites is something that will give Intel competitive advantage compared to rivals, as Nvidia and AMD outsource their manufacturing to the Taiwan Semiconductor Manufacturing Company (TSM). This is especially crucial considering vast geopolitical risks due to complex relationships between Taiwan and China.

As for the last part, the above chart looks very bullish on the technical setup. INTC price is much below its 200-day simple moving average, a rare move that could lead to a reversal. This is a huge dissimilarity, which means the stock might be in oversold, which is an opportunity for anyone expecting a bullish uptrend. Historically, this type of divergence from the moving average is a sign that the stock is about to rebound, so it is a promising setup for investors trying to ride the uptrend.

Intrinsic value calculation

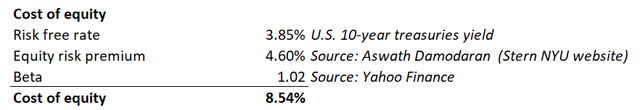

Due to Intel’s growth prospects, the discounted cash flow (DCF) model will help to determine the intrinsic value. The capital asset pricing model will help me to figure out the discount rate by figuring out Intel’s cost of equity. The below working reflects the calculation of the discount rate for INTC’s DCF.

DT Invest

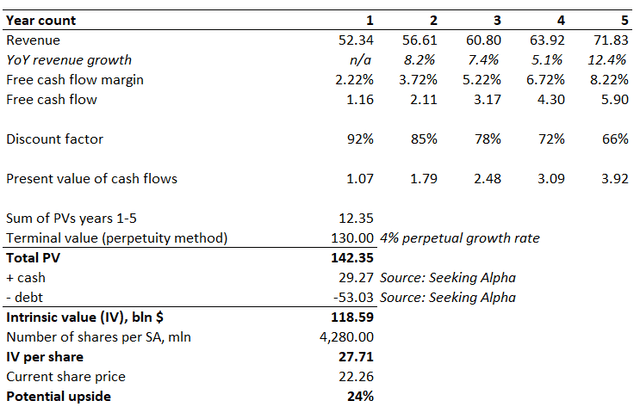

According to the CAPM, Intel’s cost of equity is 8.54%. A DCF model also needs revenue and free cash flow assumptions. Consensus estimates are the ones that are usually priced in by the market, so I use consensus for my years 1-5 horizon. Taking a TTM levered FCF margin will not work for INTC because it is negative. At the same time, Wall Street analysts expect the EPS to demonstrate strong growth over the next five years.

Therefore, my FCF margin assumption for year one will be INTC’s historical average of 2.22%. Due to the expected aggressive EPS growth, I incorporate a 1.5 percentage points yearly FCF improvement. A 4% perpetual growth rate is two times higher than historical inflation levels but looks fair given Intel’s prospects in AI and data centers. I also consider the net debt position when finalizing my DCF calculations.

DT Invest

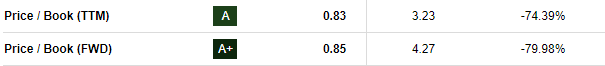

As a result, INTC’s intrinsic value per share is close to $28, and there is a solid 24% potential upside. Another factor that is strong evidence of undervaluation, is Intel’s Price-to-Book ratios. Intel’s current market value is around 15% lower than the book value, which does not make much sense.

Seeking Alpha

This implies that the market is valuing the company at less than the net worth of its tangible assets, which seems illogical.

What can go wrong with my thesis?

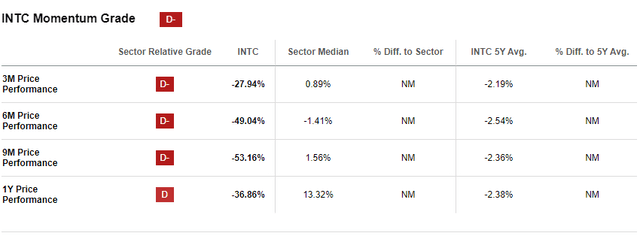

We see that the stock is extremely vulnerable to sharp selloffs. Losing 30% of its value indicates massive volatility, and there is the risk that the stock might deep even further if new unfavorable headlines pop-up. Such a problem for investors is also explained by the extremely weak momentum, suggested by SA Quant Momentum rating. Therefore, it might take a while before we see a pivot in the market’s sentiment.

Seeking Alpha

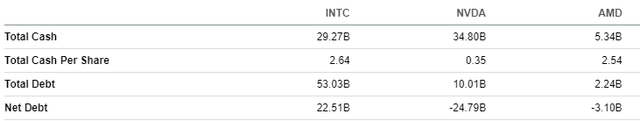

Intel has a massively leveraged balance sheet, relative to NVDA and AMD, that could be an issue for the company. Excessive levels of debt hamper profitability and limit any organization’s wiggle room in where to invest its capital. The balance sheet perspective is NVDA and AMD out-compete INTC.

Seeking Alpha

The semiconductor space is always dynamic and has an extreme reliance on the economy as a whole. Some analysts believe the US will see a deep recession this year or in 2025, and the recession will inevitably slow down overall spending in the economy, including semiconductors. Furthermore, a potential recession could also see investors sell assets that are risky, such as stocks, and reinvest in fixed-income instruments. This, too, will not serve my thesis well.

Summary

Intel’s firm exposure to thriving AI and data center domains together with its compelling 24% upside potential makes it a Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.