Summary:

- Intel has been undergoing a massive transformation since 2021 with IDM 2.0, but so far, it has created more problems than benefits.

- The deprioritized core business has been losing its competitive strength and experiencing macroeconomic weakness.

- In addition, foundry projects seem to be far in the future, and as porojects get delayed, earnings from them become less relevant for today’s valuation.

- The stock appears cheap at first glance, but there is no short-term catalyst for upside, leading to my “Hold” rating.

SweetBunFactory

Investment Thesis

Intel (NASDAQ:INTC) has been undergoing a massive transformation since 2021 when the company announced IDM [Integrated Device Manufacturing] 2.0. Although these plans were impressive, so far, it has caused more problems than benefits for the company.

With a shifted focus and macroeconomic pressures, the core business has started to struggle. In addition, new projects have taken more time and cost significantly more money than anticipated. The promised earnings from these new ventures are still further in the future.

The stock appears cheap, but I believe the market is justified in pricing it this way. I do not see any strong short-term catalyst for the stock price to increase, which is why I am assigning a “Hold” rating to the stock.

This article will review the core business, new ventures, developments since IDM 2.0 was announced, and the valuation of the stock.

Intel Before IDM 2.0

Intel announced IDM 2.0 in 2021. This initiative introduced Intel’s aims to revitalize its manufacturing capabilities and expand its market presence in the semiconductor industry. It includes investing in manufacturing facilities, allowing the company to manufacture its own designs, as well as products of external customers through Intel Foundry Services.

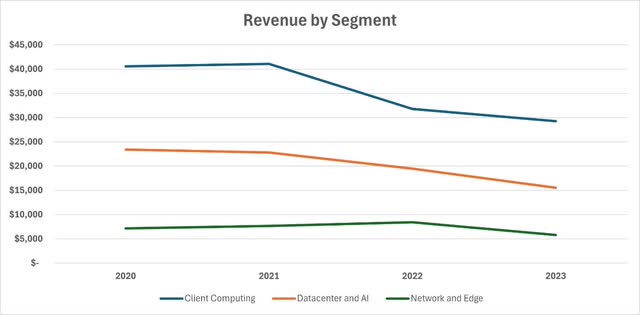

However, despite heavy investments in this area, it remains far from being Intel’s core business. Intel has historically been a designer of chips and processors for the PC market under Client Computing Group [CCG]. These products are primarily demanded by data centers.

The second largest segment is Data Center and AI [DCAI]. The company sells various processors, field-programmable gate arrays, and other solutions for networking, storage, and computing under this segment. These products are demanded, unsurprisingly, by data centers.

The third largest business is Networking and Edge [NEX], which focuses on solutions for Internet of Things, edge computing, and networking. Products in this segment include 5G infrastructure solutions, network processors, and ethernet products.

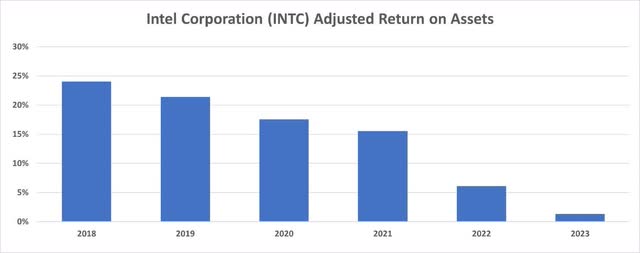

Mainly with these businesses, Intel successfully defended its competitive advantage, generating an adjusted ROA of above 15% since 2010, with the exception of three years.

S&P Capital IQ

Intel After IDM 2.0

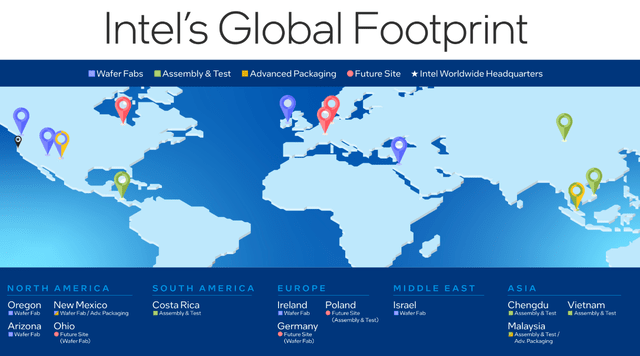

With IDM 2.0, the company significantly ramped up its investments in its global manufacturing capacity. Currently, Intel is undertaking projects worldwide in places like Arizona, Ireland, Israel, Poland, and Malaysia.

Intel 10K

We should also mention why Intel is doing this, and not just what it’s doing. Currently, the largest semiconductor foundry in the world is Taiwan Semiconductor (TSM). In Q4 2023, TSMC generated 61% of worldwide semiconductor foundry revenue. This is very impressive, and incredibly tough to beat.

Intel knows this. It does not aim to surpass TSMC’s revenue. Instead, it aims to be the second-largest foundry in the world, which would mean becoming the largest one in the Western Hemisphere.

If Intel achieves this, the results could be substantial. The US – and possibly its European allies – might choose to outsource their semiconductor manufacturing to an American and established technology company. Although TSMC currently seems like the best option, Intel’s foundry presence could change this. At least, that is the vision.

However, Intel’s focus on IDM 2.0, combined with macroeconomic pressures, has resulted in a significant decline in earnings and profitability. We will talk about this in the following sections.

S&P Capital IQ

The Core Businesses Deteriorates

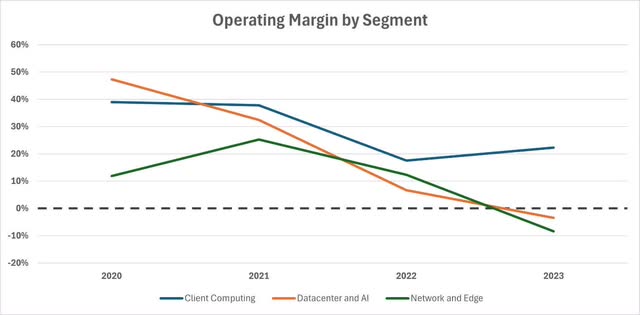

Intel still relies on its core businesses for profits. The foundry business is not yet profitable. However, these core businesses have been struggling since the pandemic. There are two main reasons for this.

Firstly, the company is facing macroeconomic pressures. As a result of weaker commercial and consumer demand, PC shipments declined by 14% in 2023. As the largest end market, this affected demand significantly for Intel. Although computer sales now seem to be recovering, this has not shown up in Intel’s financials yet.

Additionally, as core businesses were deprioritized to focus better on IDM 2.0, Intel started losing its competitive advantage. The semiconductor industry requires constant innovation, and consumers have shown that they prioritize better performance, especially in computers. The initial reaction to Apple’s M series is a clear example. CEO Pat Gelsinger has admitted that Intel has been underinvesting in its core businesses, leading to this deterioration. The initial reaction to Apple’s M series is a clear example. CEO Pat Gelsinger has admitted that Intel has been underinvesting in its core businesses, leading to this deterioration.

Below are charts showing the decline in revenue and operating margin in core businesses.

S&P Capital IQ

S&P Capital IQ

The Foundry Business Took A Lot More Than Expected

I think the vision to be the world’s second-largest and the Western Hemisphere’s largest semiconductor foundry is impressive. Once Intel builds this business, it could see huge demand from the West and generate substantial earnings.

However, building this business takes a long time and a lot of investments. While the plans were exciting when first announced in 2021, investors have since recognized that these promised cash earnings are further in the future, making them less relevant to today’s valuations and more uncertain.

Although the CHIPS Act was a catalyst for the completion of some of Intel’s projects, there have been funding delays, which have caused some projects to be delayed as well. Each year a project is delayed means delayed earnings from these facilities.

Problems with these projects are not limited to delays. With high inflation, construction costs are rising significantly. For example, each of the fabrication plants in Arizona was initially projected to cost about $10 billion. But a year later, Intel had to make a deal with Brookfield Asset Management to cover additional costs, totaling closer to $30 billion.

Another problem is staffing. The US semiconductor industry is struggling to find enough qualified personnel, which means Intel needs to invest in finding and training staff as well.

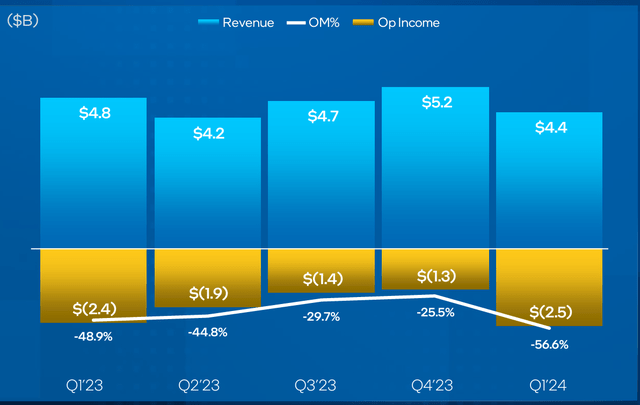

As a result, we still cannot say with confidence when this foundry business will be built and become profitable. As seen below, it is still burning cash. Its operating income and operating margin were actually worse in Q1 2024, compared to the same quarter a year ago.

Intel 10K

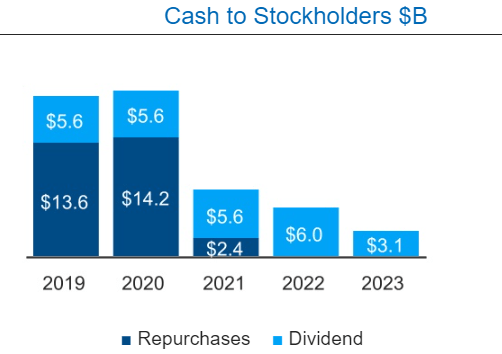

Furthermore, Intel seems to have decided not to return as much value to shareholders directly, in order to invest in this business. Although the dividend remains, Intel significantly reduced its share buybacks in 2021 and completely stopped buying shares in 2022. Although these investments may become profitable in the future, shareholders could have received more value out of the company in the short term.

Intel 10K

Insights From The Earnings Call

Intel held its earnings call on the 25th of April. The company slightly missed revenue and beat EPS estimates. The positive performance was driven by the core business. Its revenue was up year-over-year, but down quarter-over-quarter.

The biggest news was that the foundry business losses continued to increase. The company hasn’t shown much progress in artificial intelligence and foundry. Additionally, the revenue guidance disappointed analysts. Intel expects revenue to be between $12.5 billion and $13.5 billion in the second quarter, below the analyst estimate of $13.61 billion.

That said, management expects the revenue growth momentum to continue into 2025, driven by the enterprise refresh cycle, growing demand for AI PCs, and data center recovery. Additionally, management still mentions that the foundry market will be a $240 billion market by 2030, but it is not certain how much share of this market they can gain.

Looks Cheap, But No Reason For Investor Sentiment To Change

For a company aiming to become the second-largest foundry in the world, I believe it makes sense to look at the price-to-book multiple to understand what the market expects.

Currently, the stock trades at the lower end of the historical P/B range. In fact, the company is priced slightly above its adjusted book value. Based on historical values, the stock appears cheap.

S&P Capital IQ

Although it looks cheap at first glance, I believe that the company itself caused this value destruction, and the destruction is real. The company does not return as much value to shareholders and promises earnings far in the future, which are uncertain. Now, the market expects the foundry projects to materialize. Repeatedly, the company fails to provide updates showing progress.

That is why, although the foundry business might generate earnings by 2030, I think the stock lacks the short-term catalyst to be a buying opportunity.

Conclusion

Back in 2021, Intel presented an impressive vision, but each year, investors are seeing that these targets are not easy to achieve. Projects are delayed and turned out to be more expensive than initially expected.

On the other hand, the company has been struggling to maintain its competitive advantage in its core business. If it cannot recover and regain market share, this could cause a permanent loss of enterprise value.

Although the price-to-book multiple may indicate that the stock is cheaper than how the market has historically priced it, I believe there are valid reasons for its inexpensiveness, and I cannot see any short-term catalyst. That is why I am assigning a “Hold” rating to the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.