Summary:

- Intel is in talks with Qualcomm for a potential merger and Apollo for a potential $5 billion investment, boosting shareholder value if deals proceed.

- A multi-billion-dollar partnership with Amazon AWS for custom AI chips could catalyze Intel’s transition to EUV technology and attract more hyperscaler clients.

- If Intel is broken up, individual segments like client and foundry services could unlock significant value, potentially raising Intel’s total equity value to $722 billion.

real444/E+ via Getty Images

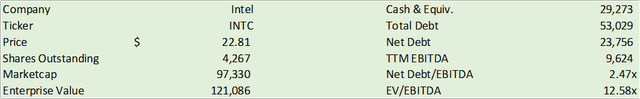

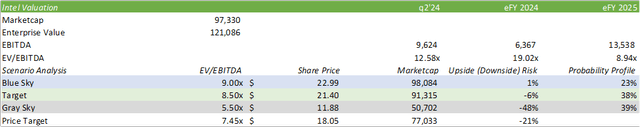

Intel Corporation (NASDAQ:INTC) has been making headlines in recent weeks with the possibility of a carve-out deal with QUALCOMM Incorporated (QCOM), a potential $5b investment by Apollo Global Management, Inc. (APO), and a multi-billion-dollar deal with Amazon.com, Inc. (AMZN) AWS. With the news beginning with Qualcomm’s interest in Intel’s PC business turning into rumors of a complete merger, Intel shareholders may be in a position to realize improved share value if a deal goes through. In this report, I will walk through the investment case for Intel and a sum-of-the-parts analysis that may provide more insight into Intel’s potential value if broken up. Given that these are rumors with no definitive agreement in place, I will be upgrading INTC shares to a HOLD rating; however, I will be maintaining my price target of $18.05/share at 7.45x eFY25 EV/EBITDA given the possibility of these talks falling through.

Investment Opportunity For Intel

There has been a lot of talk on the Street relating to the future of Intel over the course of a couple of weeks. The headlines all share a similar, yet divergent theme: how can Intel be salvaged. I believe the first headline of this was the rumor of QUALCOMM Incorporated (QCOM) approaching Intel with interest in their PC business. Reuters has more recently reported that the deal may involve the entirety of Intel as opposed to a single segment. In addition to Qualcomm’s interest, Apollo Global Management, Inc. (APO) has proposed investing up to $5b into Intel to help the struggling chip designer/manufacturer as it undergoes financial straits. This follows a previous $11b investment to acquire a 49% equity interest in a joint venture entity related to Intel’s Fab 34.

As it relates to Intel’s financial challenges in q2’24, the JV with Apollo may have added a certain degree of pressure to Intel’s operational performance as it relates to the AI PC ramp. In the quarter, management decided to accelerate the transition from Intel 4 to Intel 3 wafers at their high-volume facility in Ireland, adding pressure to margins as a result of higher wafer costs. Perhaps margins will normalize after this pull-forward; however, added pressure to perform in a timely manner may keep Intel in a position of constant catch-up.

Intel and Amazon.com, Inc. (AMZN) AWS announced a co-investment in custom chip designs under a multi-year, multi-billion-dollar deal with designing and producing products and wafers for AWS. These chips will be designed to cater to the performance demands of AI applications and will be produced on Intel 18A. The partnership will also include Intel’s custom Xeon 6 chips on Intel 3.

Though this isn’t necessarily the first deal between Intel and AWS, this deal may pave the way for other hyperscalers to have their custom AI chips co-developed and manufactured through Intel. Microsoft Corporation’s (MSFT) Maia 100 will be manufactured on Taiwan Semiconductor Manufacturing Company Limited’s (TSM) CoWoS technology, so they’re likely off the table. Alphabet Inc. (GOOG) (GOOGL) could potentially be in the running for outsourcing their manufacturing to Intel.

The risk to Intel entrenching operations into the hyperscaler space is that margins may not perform as hyperscalers are known for their discount purchases. Though this deal may not result in a much-needed turnaround for Intel, it may act as a catalyst for positive momentum. In Intel’s q2’24 earnings call, management noted that the firm will defer further investments in the foundry until the business receives advanced chip orders. My thoughts on this is that the deal with AWS may act as the catalyst for Intel to move from inaction to action in migrating their fabs to EUV technology. In terms of what comes first, the chicken or the egg, the chicken approached Intel to develop the egg. Now that Intel will be moving forward with filling their foundry business with the equipment necessary to manufacture these high-powered chips, Intel may be moving into a position of acquiring additional business.

Investment Case For Intel

Referring back to the initial portion of this report, Intel may be moving into the position of either being broken up or engaging in a merger with Qualcomm. This could mean that Qualcomm acquires the PC & server business and Apollo acquires the foundry segment, or Qualcomm merges with the entirety of Intel. Given Qualcomm’s asset-light business, I have reason to believe that the firm will likely prefer to remain fabless, though this may be the opportune time for the firm to vertically integrate the operation of design to manufacturing.

Assuming Qualcomm seeks an acquisition of the PC business alone, this will leave server, networking, foundry, Mobileye, and Arista as other components to either remain under the Intel umbrella or be sought by other suitors. Given Qualcomm’s mobility segment, Mobileye may be an appealing acquisition as well.

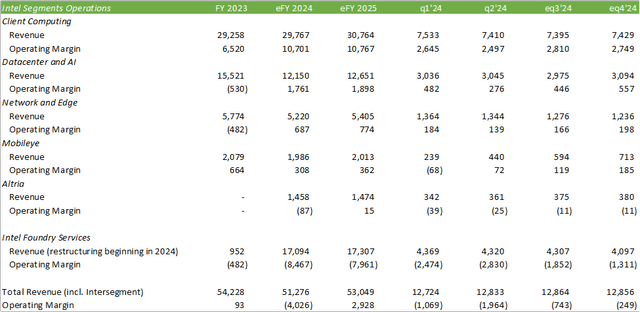

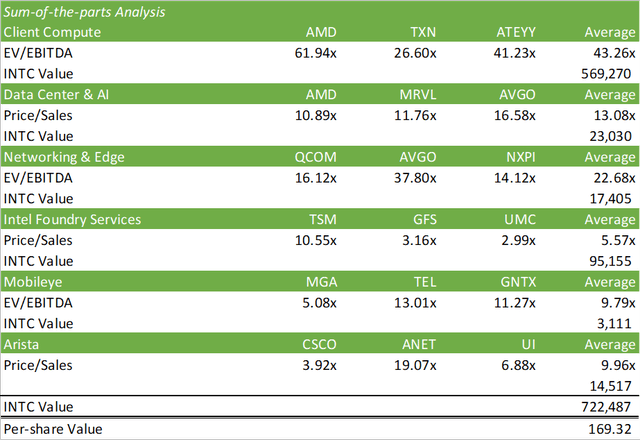

Sum-of-the-parts Analysis

Using a SOTP analysis to value the individual segments for Intel will not be a one-for-one valuation as individual components must be estimated in order to reach a conclusion. Given that the segments do not have TTM figures as a result of the restructuring, I will be using forward estimates for each individual segment to value each component at eFY24 results. In addition to this, not all segments produce a positive operating income, leading me to use price/sales for certain segments. Depreciation & amortization are also estimated on a segment basis based on the weight of each segment as it relates to total revenue generation. Given that foundry services are more capital-intensive than other segments, D&A will be significantly more heavily weighted for this segment when compared to others.

Averaging out each segment’s closest competitors’ valuation multiples and applying them to Intel’s respective segment, we can come up with a general value for each individual component of Intel. Looking at the numbers, each value appears to be inflated relative to Intel’s current market cap of $96.5b. In all honesty, these figures threw me off given that each component has the ability to provide significantly more value as a standalone company as opposed to the conglomerate. In terms of individual market caps and valuations, these figures work out.

Whether they’re parsed out at this value is another question. For all intents and purposes, it may be time for Intel to be broken up to unlock its full potential.

Risks Related To Intel

Bull Case

Intel is beginning to gain the attention of potential suitors that may either wish to acquire a component of the business or merge the business in their entirety. This could unlock significant value for the chipmaker as the firm has struggled to keep up with the competition in terms of design and has fallen behind financially. If each component is individually spun off or sold in a Reverse-Morris Trust, shareholders may be in a position to realize significant gains as a result. A complete merger may come at a lower valuation relative to INTC’s current valuation plus a premium.

Bear Case

If no deal occurs, Intel will be left to operate business as usual. The firm has made clear with Intel 3 that operations are playing catch-up, resulting in margin compression in order to capture market share in the AI PC space. The AWS deal appears promising; however, deals with hyperscalers are known to price infrastructure at a significant discount when compared to deals with enterprises. This may result in continued margin pressure for the chipmaker.

Valuation & Shareholder Value

Assuming no deal goes through, and Intel continues business as usual, I will maintain my SELL rating with the internal price target of $18.05/share at 7.45x eFY25 EV/EBITDA. This valuation is based on my financial forecast above and the INTC share’s historical trading multiple.

If a deal does occur, I believe INTC shares will have the ability to realize significant value given each individual component’s comparable value. Given this factor, I will be upgrading INTC shares to a HOLD rating with the potential of a total equity value of $722b, or $169 on a per-share basis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.