Summary:

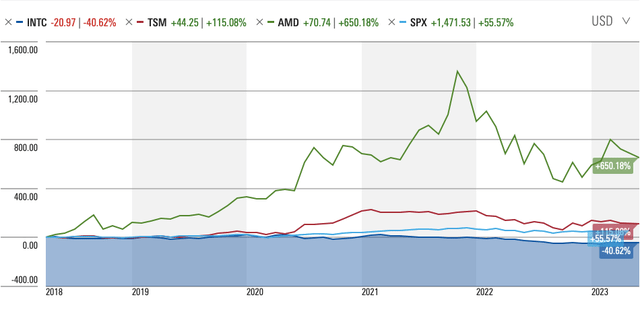

- Intel Corporation’s share price is down 40% over the last 5 years, while peers and the market are deep into positive territory.

- The company has returned more cash to shareholders than it generated in free cash flow over the last five years.

- Intel management has overseen an expansion in assets, R&D and capital investments, and depreciation, driving profitability down.

- These policies are unsustainable and bad for returns and ultimately, Intel shareholders.

JHVEPhoto

Intel Corporation (NASDAQ:INTC) is a name that for decades was associated with excellence. However, Intel has fallen behind its peers, most notably the Taiwan Semiconductor Manufacturing Company Limited (TSM), and it has even found itself forced into a partnership with this erstwhile rival. As we shall see in this analysis, Intel management has made two enormous mistakes that will ensure that returns continue to decline: management continues a cash return policy at odds with the firm’s clear need for cash; and, management has overseen an increase in spending on R&D and capital investments, as well as depreciation, that has driven returns on invested capital (ROIC) down. Intel is not a healthy business, and investors should expect things to get worse.

A Stock Market Laggard

In the last five years, Intel’s share price has plunged more than 40%, while the S&P 500 (SP500) has returned nearly 56%, and the company’s main rivals, the Taiwan Semiconductor Manufacturing Company and Advanced Micro Devices, Inc. (AMD), have returned over 115% and 650%, respectively.

Intel’s Cash Policy is Unsustainable and at Odds with Intel’s Needs

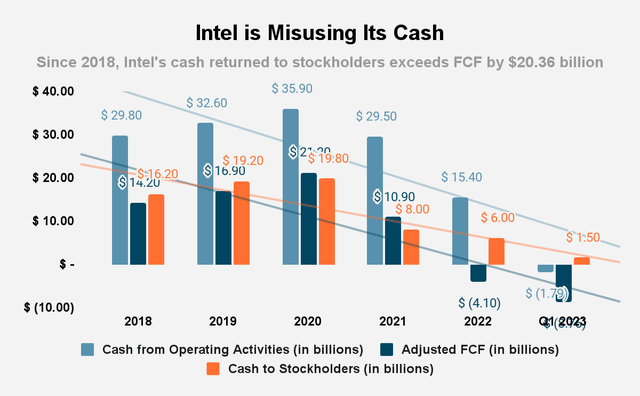

Intel’s core business is in trouble. Operating cash has fallen from $29.8 billion in 2018 to $15.4 billion in 2022. In 1Q23, the firm generated -$1.79 billion compared to $5.9 billion in 1Q22. Since 2020, operating cash has been in decline. Adjusted free cash flow (FCF) has fallen from $14.2 billion in 2018 to -$4.1 billion in 2022. In 1Q23, adjusted FCF fell to -$8.76 billion, compared to $5.55 billion in 1Q22. In that period, the firm has generated $50.34 billion in adjusted FCF, some 39% of its market cap.

Conventional wisdom holds that management should return cash to shareholders if it cannot find suitable investments. This is especially true for declining businesses, which, by their nature, are better off giving shareholders their cash back through dividends and share repurchases; those shareholders can find better places to invest those funds. That is true. However, under Intel chief executive officer (CEO) Pat Gelsinger, there has been a clear attempt to rebuild the business. In other words, Intel needs all the cash it can get. Yet, management has chosen to continue to issue dividends and to conduct share repurchases. Cash returned to stockholders has declined from $16.2 billion in 2018 to $6 billion in 2022. In 1Q23, that was $1.5 billion, the same figure as in the same period the year prior.

Here, we have a tension between the need to allow shareholders to invest cash in alternative bets, and the firm’s need to hoard as much cash as it can, to grow the business. Not only that, but since 2018, the firm has returned $70.7 billion to shareholders. That is $20.36 billion more than it generated in FCF! That is a clearly unsustainable policy, and eventually, Gelsinger will likely be forced to eliminate dividends completely.

Source: Intel Corp. Proxy Statements, 2018-2022

In the trailing twelve months, Intel has -$18.86 billion in FCF, giving us an FCF yield (FCF/enterprise value) of -12.19%. This tells us a lot about Intel’s economics, putting into light the enormous investments the firm is having to make into the business.

In a way, it is difficult to assess what Intel is trying to do. If the cash return policy was an admission of the secular decline of the business, it is certainly a noble thing, but Intel is not preparing to close its doors, it is, instead investing aggressively in the business. That investment suggests that the core business needs the cash that Intel is returning to shareholders. The responsibility of management to return cash to shareholders if there are better opportunities, is at odds with the demands of the firm. In the end, the firm will suffer and be forced to raise more capital, at higher costs, and shareholders will face cuts in share repurchases and dividends. At that point, it will be clear that there is no point in returning cash you need to shareholders, and then turning around to raise debt-financing to support a struggling business. You cannot pursue two goals at the same time.

The Wrong Side of the Capital Cycle

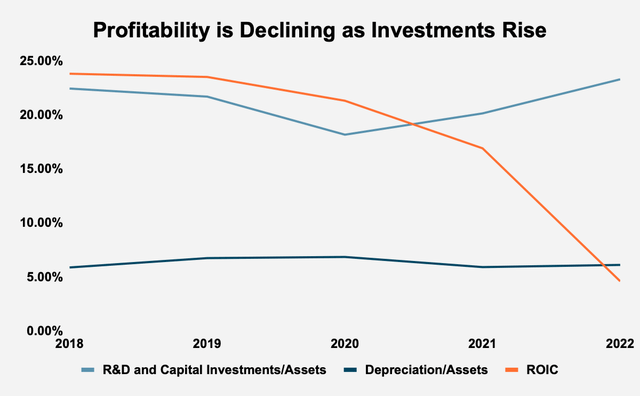

There are few things that are axiomatically true in finance. One of those things is that there is an inverse relationship between asset growth and future returns. That phenomenon, known as the asset growth effect, is very hard to resist. In the last five years, Intel has grown assets from $127.96 billion in 2018 to $182 billion in 2022, compounding at 7.3% a year. The reason that future returns decline is because managers tend to overestimate future FCF and the growth opportunities they are facing. The result is that firms raise too much capital, and invest excessively in exploiting those growth opportunities, putting money into R&D and capital investments. However, over time, those investments do not pay off, and the expected profitability does not materialize, driving down returns.

Naturally, Intel has invested in R&D and made capital investments in its bid to compete with TSMC and build a profitable business. R&D and capital investments have grown from $28.7 billion in 2018 to $42.4 billion in 2022. R&D and capital investments as a share of total assets has risen from 22.43% in 2018 to 23.28% in 2022. Meanwhile, depreciation as a share of total assets has risen from 5.88% to 6.11% in 2022. The turning point is 2020, when, at the peak of adjusted FCF in the last five years, the firm decided to pour money into the business. Gelsinger would argue that these investments are necessary to build a new Intel, but the consequences have been clear. ROIC have declined sharply from 23.8% in 2018 to 4.6% in 2022. In 1Q23, ROIC has further declined to -2.2%. Asset growth has been followed by declining returns.

Source: Intel Corp. Filings and Author Calculations

We should also note that Intel has also increased long-term debt from $25 billion in 2018 to $$37.68 billion in 2022, in line with our observation that firms tend to raise too much capital in pursuit of ultimately unprofitable opportunities.

Valuation

Intel has a price-earnings (P/E) multiple of -0.02, and a forward P/E of 15.04, compared to a P/E multiple of 23.68. As we have seen, Intel has been forced to ramp up its investments into its business, raising R&D and capital investments and depreciation, while increasing its debt load. The firm’s FCF yield is a better indication of the attractiveness of the business, and at -12.19%, tells us that Intel’s stock price will fall. Intel’s gross profitability, which scales gross profits by total assets, declined from 0.34 in 2018 to 0.14 in 2022, well below the 0.33 threshold for attractiveness. Intel is simply not an attractive business to invest in.

Conclusion

The anticipated Intel Corporation revival under Gelsinger has simply not materialized. The company has fallen to the gravitational force of the asset growth effect, with returns plunging as investments rise. Not only has the business misallocated funds to investments that are not paying off, but, Intel’s cash return policy is at odds with the firm’s need for more cash. The Intel core business desperately needs the cash management is sending to shareholders, and by doing so, Intel likely will eventually be forced to cut dividends, and kill repurchases, in order to support the business operations. it makes no sense to spend more in cash returns than Intel generates in FCF, and to do so when the business is trying to grow. Intel Corporation’s priorities are contradictory and self-defeating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.