Summary:

- As we head into 2024, investors are on the lookout for which company will be the next big name in AI.

- Business adoption of AI is expected to be bigger than consumer applications, making the B2B market more promising in 2024.

- Don’t just look at Nvidia’s CUDA; Intel’s strong footing in desktops and laptops is something investors can’t ignore.

- Although tiny at the moment, Intel’s foundry business is a strategic asset that helps to strengthen its ecosystem.

- Intel is well-positioned to capitalize on the AI boom, with its ecosystem integration and competitive position in the market.

SweetBunFactory

The AI Investment Surge of 2023

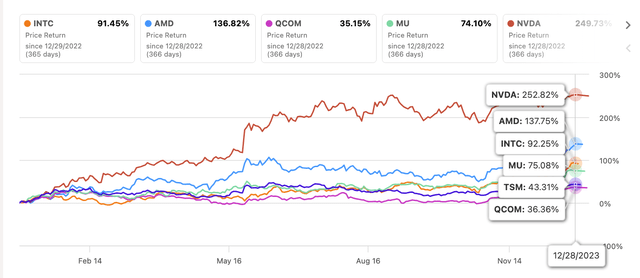

2023 is marked by a significant investment surge in AI, offering promising long-term opportunities in areas from chip manufacturing to end-user devices. This trend has notably boosted tech industry stocks. However, this investment boom also poses challenges in identifying long-term winners, as many stocks might already reflect their AI growth potential somewhat. Investing in this rapidly evolving field requires careful analysis and a strategic approach.

Investment Thesis

Back in September, we published a buy rating on Intel (NASDAQ:INTC). We believed that its foundry business and its integrated model would give the company a long-term competitive edge. Given that the foundry business accounts for a very small fraction of Intel’s overall sales, it seems that investors have overlooked the business’s importance in building the company’s ecosystem moat.

In this article, we want to go into more detail about why, in our opinion, Intel is well-positioned for the near to mid-term in terms of ecosystem health in this essay.

Yes, the whole semiconductor industry stands to benefit from the AI boom ahead. But we believe Intel in particular is poised to be one of the biggest winners.

The B2B Market’s Dominance in AI

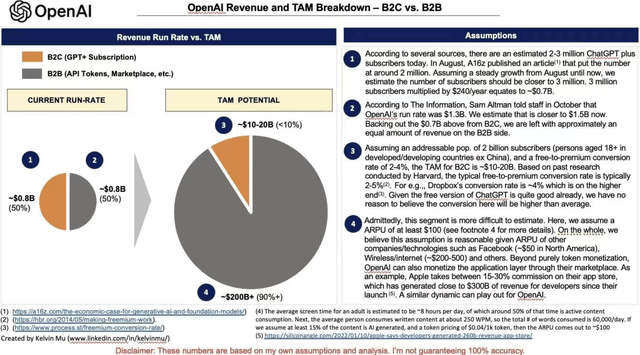

First, let’s think about which specific areas stand to benefit most from AI in the coming year. I came across an interesting addressable market analysis recently from someone named Kelvin Mu. The key takeaway is his market size estimates based on OpenAI’s token usage.

By looking at how enterprise customers are charged for OpenAI tokens, Mu concluded the long-term total addressable market (“TAM”) for business uses of AI could be 10x bigger than consumer applications. That’s a huge potential market as companies integrate AI into their operations and products.

Investors are welcome to dig into Mu’s full assumptions, which I’ve included in the attached picture. The details aren’t critical for our discussion. The key point is that business adoption of AI looks far greater than consumer use cases like chatbots.

While Mu’s market size estimates may still be rough, his B2B focus aligns with what we’re observing so far – At this stage, ChatGPT seems most valuable for content creators and enterprise use cases.

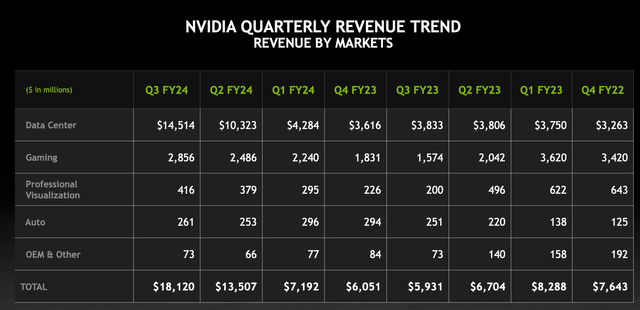

The B2B opportunity is also evident in Nvidia’s recent financials. In Q3 2023, their data center revenue grew 278% and now makes up almost 5x their still-strong gaming chip business, which grew 81%.

So, the business market currently looks more promising than consumer applications as we head into 2024, based on today’s vantage point. Chatbots like ChatGPT aren’t yet creating tremendous value for average consumers. But AI is already empowering businesses to work smarter and drive efficiencies. As we evaluate investment options, we should focus on companies well-positioned to capitalize on AI in enterprise settings. The B2B market is where the real money will be made.

For investors right now, companies enabling enterprise AI adoption look like safer bets than those focused on fickle consumer use cases. Nvidia’s data center growth shows where the money is being made today. As AI expands further into business settings, companies like Intel enable B2B applications through their chips, and foundry businesses seem poised to benefit.

The B2B market may not be as sexy as imagining AI chatbots in every home. But for investors, it represents a bigger and more realistic opportunity in the near term. We should focus our analysis on the companies empowering business usage of AI today and in 2024.

Valuation

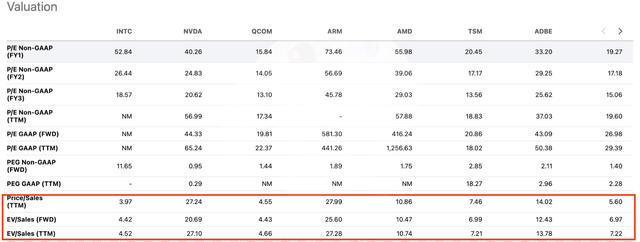

When looking at valuations for the major players in AI/semiconductors, traditional P/E analysis isn’t too useful right now. These companies are investing heavily to establish long-term competitive edges, so short-term profitability isn’t the focus.

Instead, let’s look at metrics like P/S and EV/S ratios. By these measures, Intel trades at a discount compared to other software providers like Adobe with premium valuations, as well as other chip designers and manufacturers.

We think that the market is concerned about Intel’s competitive position and moat versus rivals like Nvidia (NVDA) and AMD (AMD). That skepticism is baked into Intel’s lower valuation multiples.

So, if Intel can capitalize on the AI boom in 2024 and improve profitability as we expect, a substantial valuation upside is possible. If they gain an edge in AI chips and foundry services, they could re-rate closer to peers.

Nvidia and AMD won’t give up their leadership without a fight. But if Intel executes well, its valuation has a lot more room to run than the hot multiples awarded to Nvidia and high-flying software vendors.

Intel’s Competitive Position and Ecosystem Integration

Before crowning Nvidia the undisputed AI chip leader, let’s reconsider Intel’s competitive position. Investors see Nvidia’s advanced GPUs and CUDA developer ecosystem as strong competitive moats. But Intel’s platform dominance shouldn’t be underestimated.

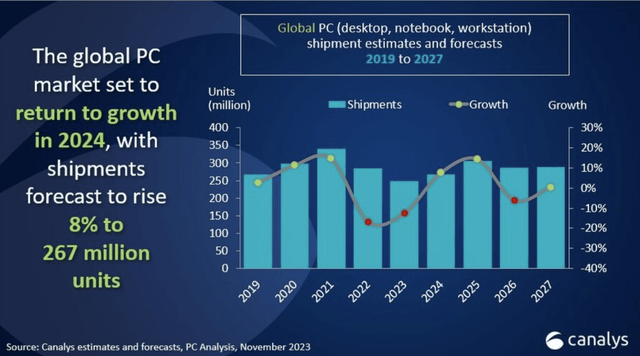

In our view, enterprise PC upgrades will drive the initial AI computing boom in 2024, more so than consumer purchases, as Canalys predicted AI PC should driver the PC market to grow by 8% in 2024.

According to the latest Canalys forecasts, worldwide PC shipments are on the verge of recovery following seven consecutive quarters of decline. The market is expected to return to growth of 5% in Q4 2023, boosted by a strong holiday season and an improving macroeconomic environment. Looking ahead, full-year 2024 shipments are forecast to hit 267 million units, landing 8% higher than in 2023, helped by tailwinds including the Windows refresh cycle and emergence of AI-capable and Arm-based devices.

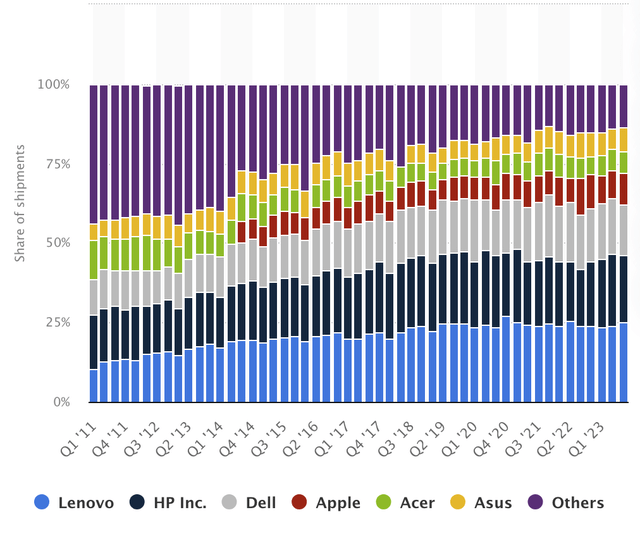

Intel still holds a 61% market share in overall computers as of Q4 2023 per Statista, well above AMD’s 35%. Looking just at laptops, Intel’s lead grows to 69% versus AMD’s 22%.

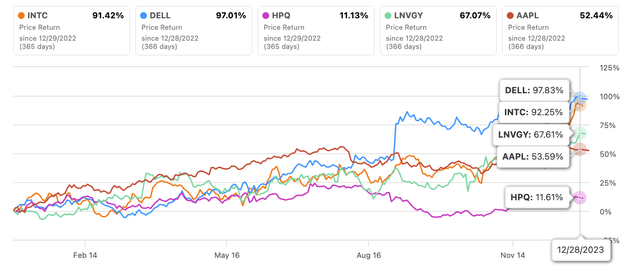

Through long-standing partnerships with major OEMs like Dell (DELL), HP (HPQ), Lenovo, and Acer, Intel has cultivated a massive installed base. As the attached Statista chart shows, those OEMs hold stable global market shares year after year.

Personal computer (PC) vendor shipment share worldwide from 2011 to 2023, by quarter (Statista)

The result is that Intel gets to work with one of the largest developer communities around through those entrenched OEM partnerships. While Nvidia forged its developer base with CUDA, Intel collaborates with countless enterprise developers by powering the majority of business laptops and desktops.

In other words, while Nvidia’s moat is impressive, let’s not crown them the undisputed AI winner yet. Intel’s enduring relationships and massive installed base give them their wide moat and built-in developer community. For the coming wave of enterprise AI computing upgrades, Intel remains firmly entrenched. Their competitive position is stronger than many investors acknowledge.

Examples of Collaboration Within Ecosystem

Let’s look at how the collaboration between Dell and Intel makes it hard to displace Intel’s market share, even with advanced competing technologies.

When working with Intel, Dell typically optimizes its hardware design to take full advantage of Intel’s CPU capabilities. This includes:

– Ensuring compatibility and performance tuning of the motherboard, memory, and other components with Intel chips to maximize CPU performance.

– Developing effective cooling solutions to handle the heat output of Intel CPUs.

– Optimizing power delivery to keep Intel CPUs stable under different workloads.

– Updating firmware and BIOS to support the latest Intel processor features.

On the software side, Microsoft (MSFT) works closely with Intel to optimize Windows and other technologies:

– Tuning Windows to fully leverage Intel CPU capabilities like multi-threading and virtualization.

– Building drivers tightly integrated with Intel hardware for increased system stability and performance.

– Enabling security features like Intel SGX on Windows.

– Collaborating on cloud and AI optimizations using Intel processors.

This tight co-engineering between Intel, Dell, and Microsoft creates a strong ecosystem effect. Competing CPUs can’t match that level of cross-layer optimization between Intel, major OEMs like Dell, and Microsoft’s software stack. The collaboration makes Intel’s market position stickier than it may appear to investors only looking at chip performance specs.

Competitive landscape: Intel, NVIDIA and AMD

Intel is working to develop more competitive GPUs to take on Nvidia and AMD in AI acceleration. Though Nvidia still leads in raw performance, their prices remain high. Not every company needs bleeding-edge power for AI workloads.

We believe the inference market will be much larger than training advanced models. Many applications are about efficiently automating redundant tasks, not pushing the limits of computing power.

AMD is a strong rival, but Intel’s incumbency gives them sticking power if they can deliver sufficient performance improvements over time. For many customers, the high costs of re-optimizing hardware and software with AMD make staying with Intel the pragmatic choice.

A good example is Google cutting jobs in advertising by using AI for efficiency gains. That doesn’t require the utmost GPU performance – it’s about reasonably priced chips doing cost-saving inference at scale.

As long as Intel avoids major missteps, its ecosystem integrations with OEM partners and developers will retain customers satisfied with iterative gains. Nvidia leads in bleeding-edge AI power, but Intel’s broad inference offerings can still thrive while improving gradually.

For investors, Intel’s strategy is not about reclaiming performance leadership across the board. It’s about leveraging their legacy position to own the larger opportunity in cost-efficient inference at the enterprise scale. Intel will cede the cutting edge to Nvidia but can still succeed in more pragmatic AI adoption.

The Shift in AI Demand

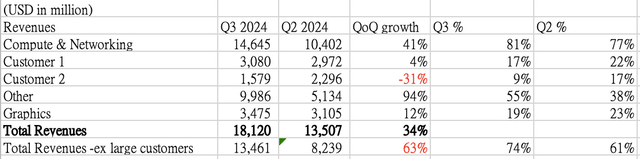

In addition, looking at Nvidia’s recent financials, we see signs of slowing momentum even as overall revenue grows. Their largest data center customers seem to be plateauing quarter-over-quarter. One top 2 customer purchased 31% less in Q3 than in Q2.

This suggests Nvidia’s largest buyers may be seeking more diversity or have finished building out capacity for advanced LLM training. As AI expands into efficiency-focused enterprise use cases like Google’s job cuts, cutting-edge power becomes less critical.

For 2024, we believe the most immediate AI benefits will come from pragmatic boosts to business productivity, not pushing the limits of computing. The rise of edge devices for data privacy will also push more inference away from the cloud.

End customers are unlikely to ditch Intel’s optimized ecosystem just to gain incremental performance from Nvidia. Intel remains well-positioned for the less demanding inference boom.

Foundry and Ecosystem

Investors have miscalculated Intel’s foundry plan. Some investors even believe that Intel ought to divest itself of the foundry division. To begin with, chip production and advanced packaging are highly lucrative industries.

Further, Intel’s expanding foundry business contributes to its competitive moat by increasing collaboration with customers. With new process tech launching in 2024 and advanced 3D packaging, Intel’s mature nodes become more attractive for certain buyers.

By opening up its manufacturing capacity, Intel is strengthening partnerships across the ecosystem. This foundry strategy seems likely to pay dividends in 2024.

Investors may underestimate Intel’s resilience. But between the ecosystem stickiness, their foundry gambit, and tailwinds for enterprise efficiency over cutting-edge power, Intel looks poised for a turnaround. The AI trend offers them new opportunities despite Nvidia’s leadership position.

Risk

There is certainly a risk that Intel will fall behind in both chip design and manufacturing technology, as some skeptics argue. We don’t discount that possibility, as Intel may have lost some focus over the years.

However, weighing the risks against potential rewards, we currently prefer to bet on the stability of Intel’s ecosystem over betting on the continued dominance of advanced products that can become outdated or face disruptive competition.

Advanced technology alone does not guarantee success – execution and ecosystem matter just as much. Nvidia’s bleeding-edge GPU performance could still be matched or surpassed down the road. However, Intel’s co-optimization with major OEMs and software partners creates high switching costs that help maintain their market share.

We will keep monitoring the technology risks Intel faces. But their entrenched position provides resilience even if their next-gen products are merely competitive, not market-leading. Perfect execution is not required for Intel to benefit from AI’s rising tide.

Conclusion

We initiated coverage of Intel with a Buy rating, as we were bullish on their integrated strategy.

Early AI adoption seems focused on reducing enterprise costs rather than driving revenue growth. This gives us more visibility ahead and we believe it makes the B2B market the most profitable AI segment right now.

Intel’s ecosystem strengths should help them compete with Nvidia and AMD in 2024 as inference workloads and edge devices gain share over advanced training. This expanding market needs balanced price, performance, and compatibility more than sheer computing power.

Intel’s leading desktop and laptop market share positions them well to ride the B2B AI wave in 2024. Their growing foundry business can also expand Intel’s ecosystem as they deploy 3D packaging and new process tech.

Given Intel’s solid execution and focus on the most profitable AI opportunities, we maintain our Buy rating. The risk of technology missteps remains, but Intel’s pragmatic AI approach targets the bigger market in cost-saving business applications.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.