Summary:

- Intel stock remains a hold despite being at multi-year lows due to poor earnings, weak guidance, and management struggles.

- Intel’s long-term performance is dismal, with the stock down 42% over the last decade, indicating chronic underperformance.

- A new CEO, preferably an outsider, could potentially drive significant corporate culture reform and improve Intel’s competitive position.

- Until Intel demonstrates consistent, better-than-expected earnings and innovation, INTC stock could remain range-bound between $20-$30.

hapabapa

I wrote about Intel Corporation (NASDAQ:INTC) several months ago, downgrading it to a hold. I also concluded that Intel could be a value trap and that it may be better to look for buying opportunities in Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation (NVDA), and other competing chip stocks. Several months have passed since I posted my cautious Intel article, and Intel’s stock has cratered by roughly 33%.

Intel reported another poor earnings announcement, underwhelming the estimates and further amplifying its slipping position among the global chip giants capitalizing on AI. Intel’s management continues to struggle to execute at an acceptable level, and Intel could continue giving up market share to its more agile and flexible competitors.

Intel remains in a challenging position. There is no clear indication that Intel’s situation is improving fundamentally, and the upside potential may be limited despite its stock being around multi-year lows. Therefore, Intel could remain dead money until a true turnaround can be achieved, which may require substantial time and opportunity costs. Therefore, Intel’s stock is a hold even at these profoundly depressed levels.

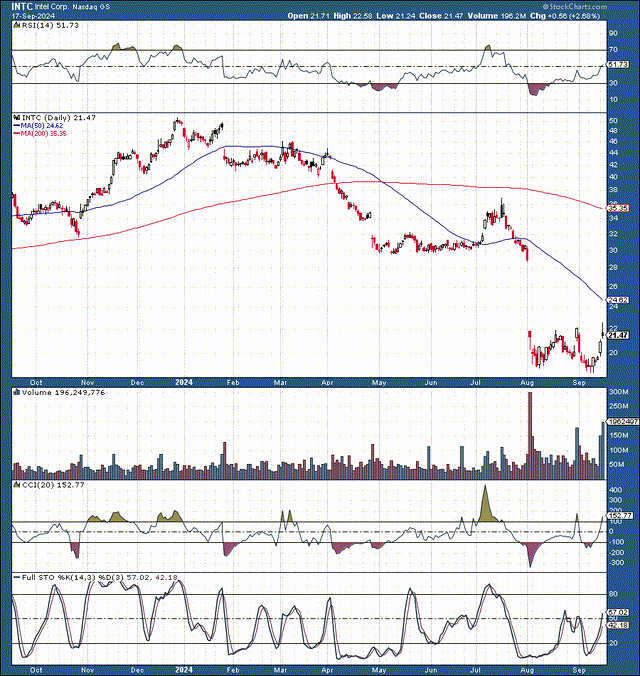

Technically Speaking – Intel is Improving

Technically, we can view Intel from a short-term perspective or form an intermediate and long-term viewpoint. From a near-term perspective, Intel became highly oversold recently, and it looks like Intel may be forming a double bottom around the $18-$20 support point. There is also a relatively high probability that Intel will close the gap at around $30 if the news flow changes to a more positive tone soon.

However, if we take a longer-term viewpoint, Intel’s stock has not gone anywhere for years. It is down by roughly 42% over the last decade, which is a horrible performance relative to just about anything. Therefore, despite being oversold and trading around multi-year lows, Intel’s intermediate and longer-term upside potential may be relatively muted.

Another Terrible Earnings Announcement

If Intel cannot effectively capitalize on the AI revolution, it will be in big trouble. We’ve seen Nvidia, AMD, and other industry-leading chip stocks doing extremely well because of innovation and the increased AI-related demand from enterprises and the consumer segment.

Unfortunately for Intel, while Nvidia, AMD, and others have been doing the leading, Intel continues to lag, which is apparent in its earnings and is a prime reason why its stock remains depressed.

Intel missed top and bottom-line consensus estimates when it reported in early August. Intel provided non-GAAP EPS of just $0.02, missing by 8 cents. Moreover, Intel produced $12.83B in revenues, about a 1% decrease YoY, and a miss of about $150 relative to its consensus estimate.

While the earnings miss was bad, Intel’s guidance was awful, further underscoring its weakening market position. Intel provided Q3 revenue guidance of $12.5-13.5B, well below its $14.39B consensus estimate. Intel also anticipates losing 3 cents in Q3 on an adjusted basis vs. the consensus estimate for a 30-cent gain.

In addition to announcing poor earnings and guidance, Intel will cut about 15% of its 110,000 global workforce. While layoffs may appear like solid efficiency-increasing tactics, it may be more accurate that the layoffs represent Intel’s shrinking market share, which is ultimately negative for Intel.

Missing top and bottom line estimates and providing poor guidance during the lucrative AI expansion phase is an embarrassment for Intel, especially considering that many of its competitors and industry leaders continue surpassing analysts’ estimates, providing substantially better than expected results. But not Intel.

Why Intel’s Management Has To Go

First, let’s look at Intel’s stock track record:

- YTD: minus 57%.

- 1-Year: minus 44%.

- 5-Year: minus 59%.

- 10-Year: minus 42%.

Intel’s stock is down considerably regardless of the time frame we view it on. Therefore, Intel is continuously underperforming, which is ultimately the fault of its management team. Leadership is crucial in any company, but because of the competitive nature of the ultra-high-tech industry, top-quality management is especially critical.

While issues at Intel weren’t new, things began worsening in 2017. Unfortunately, Intel’s delays with Cannon Lake were only the beginning. Instead of 2022, Intel’s 7nm server CPUs arrived in 2023. More recently, Intel has suspended plans to build new plants. Therefore, there is substantial uncertainty surrounding Intel’s stock, and a considerable reason for the problems at Intel seems to be its management.

Is It Time To Consider A New CEO?

Pat Gelsinger has been Intel’s CEO since early 2021. While the market was positive about Intel’s CEO change, it’s been nothing but a downside for Intel’s stock. Intel’s stock peaked at around $68 in the weeks after the new CEO decision was announced. Now, the stock is around $21, representing about a 70% decline during the 3+ year reign of the current CEO.

Meanwhile, earnings haven’t kept up with expectations, Intel continues lagging innovation-wise, and it continues losing market share to AMD, Nvidia, and other competitors. Therefore, despite the high hopes for Pat Gelsinger, Intel may need a CEO replacement. Sentiment is poor at Intel, and one of its significant problems may be that it is with an in-house CEO.

This problem of poorly managed tech and industrial giants is not a new phenomenon. We’ve seen many cases, including General Electric Company (GE) and others, of companies that badly require corporate culture reform going with in-house CEOs.

In 2017, GE went with John Flannery (an in-house CEO), who didn’t achieve many significant changes. The company’s image did not change dramatically until GE brought on Lawrence Culp, an outside CEO who proved capable of turning around the troubled industrial giant.

Of course, every case is unique, and Pat Gelsinger has many excellent achievements. He has been at the helm of Intel for over three years. This dynamic suggests he wasn’t selected as the “fall guy,” but the board and investors had high hopes.

However, Intel continues falling behind during one of the most advantageous periods for the tech industry. At the end of the day, the buck stops with the CEO, and if Pat Gelsinger can’t right the ship at Intel, it may be time for a new CEO.

In Recent Intel News

Separating The Foundry Program – Intel plans to separate its Foundry business, which could benefit the company by “clearer separation and independence from the rest of Intel” and the possibility of raising outside funding the CEO said. While this may be a constructive move for Intel, the execution and the costs and benefits associated with the move appear murky, in my view.

The AWS Partnership – Intel’s partnership with Amazon.com, Inc. (AMZN) seems like solid news. The two companies recently unveiled a multibillion-dollar framework, which could become the basis for a long-term relationship between the two companies. Also, other companies may follow Amazon’s format, joining Intel in close long-term working relationships. However, we must consider Intel’s poor execution and the possibility of continued competition and better execution from Intel’s competitors.

The $3B CHIPS Funding – Intel’s stock rebounded on Monday after it was announced the company would receive up to $3B in direct funding under the CHIPS and Science Act for the Secure Enclave program. This dynamic illustrates that Intel remains a favored government contractor. However, while the government-induced sales are a positive catalyst, Intel still faces considerable issues with execution and other factors that continue to weigh on its profitability.

The Bottom Line – Earnings Uncertainty

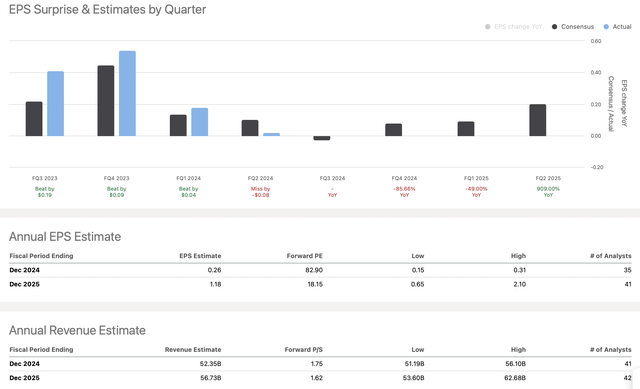

Earnings vs. estimates (SeekingAlpha.com)

The bottom line is that there is substantial uncertainty surrounding Intel’s future earnings. The worse-than-expected results and worse-than-anticipated guidance do not reassure investors and suggest Intel could continue underperforming, potentially missing future EPS and sales forecasts.

While 2025’s consensus EPS estimate is $1.18, the estimate range is very wide ($0.65 – $2.10). This dynamic implies that Intel could earn below $1 in EPS next year, which means it could trade above 20 times forward earnings here, which is not necessarily cheap.

Perhaps more importantly, the poor performance suggests that the upside may be limited. While Intel may climb marginally higher in the near term, there is little to offer hope for a sustainable move higher based on previous performance, management, execution, and other factors.

Until Intel can demonstrate that it is ready and able to perform a comprehensive turnaround, it remains a hold with limited intermediate and long-term upside potential. It could remain range-bound around the $20-$30 zone until substantial improvements materialize.

What Will Make INTC Stock A Buy

Intel stock has suffered due to various issues. However, we can have an increasing probability of a lasting turnaround once we see several quarters of better-than-expected and improving earnings. Also, a new CEO (especially an outside CEO) would be a welcomed change, as an outside CEO could influence more significant change, leading to positive corporate culture reform, less bureaucracy, better execution, increased efficiency, improved sentiment, and other constructive factors. Intel must start leading and innovating again. It must become highly competitive in its segment, taking advantage of the growth and profitability potential in AI and other growing sectors. In my view, transitioning to his bullish dynamic would make Intel’s shares a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!