Summary:

- Intel is set to report Q3 earnings on October 31, 2024, with low expectations due to a continual restructuring effort.

- Intel’s potential sale of Altera or Mobileye could raise billions of dollars for the chipmaker, aiding its restructuring and boosting investor confidence in its transformation.

- Despite low EPS estimates and a distressed valuation, Intel shares could revalue significantly if restructuring progresses and Gaudi 3 AI accelerators gain traction.

- Risks include continued cash bleeding, failure to catch up in AI accelerators to AMD and Nvidia, and lack of concrete plans for selling standalone businesses, which could disappoint investors.

hapabapa

Intel (NASDAQ:INTC) is set to report earnings for its third fiscal quarter on October 31, 2024 and investors and analysts alike don’t seem to expect much from the chipmaker. This is because Intel effectively threw in the towel in the last quarter and said that it will focus once again on a major restructuring that is expected to yield up to $10B in cost cuts and which is expected to come at the cost of growth.

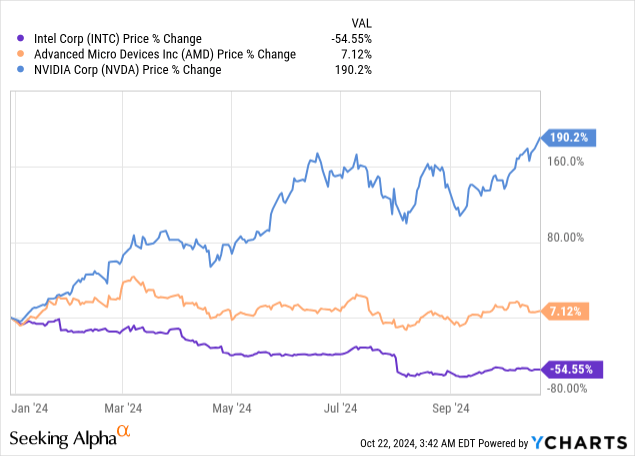

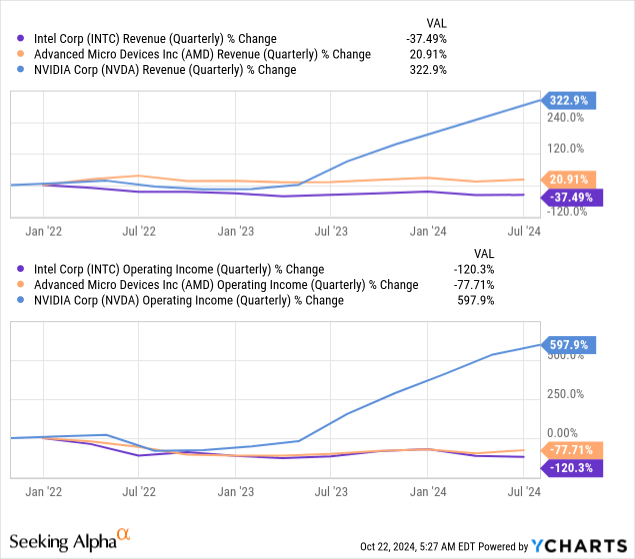

In addition, Intel has been taking major criticism after it fell behind AMD (AMD) and Nvidia (NVDA) in terms of launching its own AI accelerators. I believe earnings estimates are very low ahead of the Q3 earnings report card, which should make it easy for the chipmaker to beat expectations. Further, Intel has the opportunity to lay out a strategic vision for the company and potentially announce the sale of Altera, or potentially even Mobileye. With shares being as beaten down as they are right now, I can’t help but like Intel as a turnaround play and believe a revival could be coming much sooner than investors think.

Previous rating

I rated shares of chipmaker Intel a strong buy after the company announced a new restructuring (which was part of its second quarter earnings report) and then after the company was rumored to be a potential acquisition target of Qualcomm: Back In Play After Buyout Rumors. Intel was recently also rumored to consider selling Altera, its FPGA company, which would make a lot of sense strategically. Since the estimate trend is extremely negative ahead of the Q3 release, I believe investors don’t want to make the mistake an underestimate Intel’s recovery potential: a quick sale (even of a minority position) in Altera could raise billions of dollars for Intel which could be used to aid the company’s restructuring and potentially accelerate the scaling of Gaudi 3 AI accelerator shipments.

Intel is set to focus on strategic alternatives and potentially sell Altera

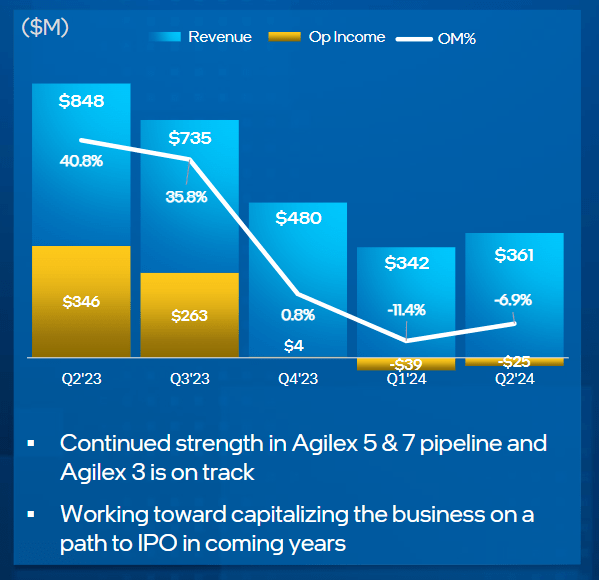

Based on rumors, Intel is arguably interested in finding a strategic solution for its subsidiary chipmaker Altera Corporation, which could raise billions of dollars for the chipmaker. Intel is, according to CNBC, looking to find at least a minority investor for Altera which produces programmable logic devices that are used in cloud and edge computing. Intel acquired Altera in FY 2015 and created Altera as a stand-alone entity at the beginning of this year. Altera therefore reports its results separately from Intel’s other businesses.

Altera generated $361M in revenue in the second quarter, representing a total consolidated revenue share of 2.8%. In the trailing twelve months period, Altera generated $1.9B in revenues and $203M in operating income, so the business has been profitable, except in the last two quarters.

Intel

Altera and Mobileye, which develops autonomous driving technology, are obviously candidates for either a sale of either a minority or majority stake. Intel paid $16.7B for Altera in FY 2015 and could be seeking a similar price for a full sale.

Selling non-core assets would be a great strategy for Intel to address shareholder criticism about how poorly the chipmaker has been managed, especially in its Data Center business. Intel just last month launched the Xeon 6 processors with Performance-cores and Gaudi 3 AI accelerators which will help Intel get a foot in the door in the market for generative AI solutions. This could be a strong lever for an acceleration of Intel’s AI accelerator shipments in the fourth quarter. Nvidia has been dominating this market for years and both AMD and Intel have made moves here: AMD launched the Instinct MI300X in order to compete with Nvidia’s H100 and Intel is going all-in on the Data Center market opportunity with its Gaudi 3 AI accelerator.

A potential sale of either Altera, or Mobileye, could help the chipmaker refocus its attention on the Data Center market opportunity. An acceleration of Gaudi 3 shipments together with strategic solutions could fundamentally improve investors’ perception of Intel as a growth play… which suffered greatly lately.

With Intel falling way back behind its other chip-making rivals, Intel will be under growing pressure to present a more drastic solution to its growth problems. In this regard, I expect Intel to make some kind of strategic announcement at the end of the month when earnings are due.

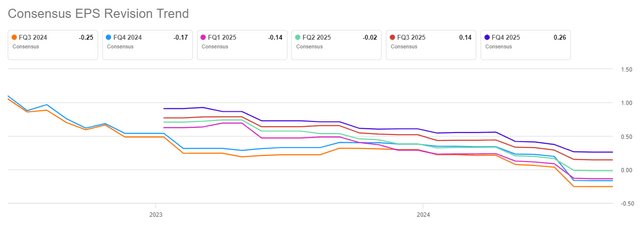

Intel’s estimate trend ahead of Q3

Ahead of the third-quarter earnings release, Intel is still suffering from the shock report of the second quarter, which told investors that a $10B restructuring was necessary to get the chipmaker back on the right track. In the last ninety days, analysts revised their EPS estimates downward 33 times compared to 0 EPS estimate upward revisions. In other words, analysts (and likely investors) could not be more bearish for the upcoming earnings release on October 31, 2024. This also means that Intel will have very low EPS expectations to beat and has a good chance of doing so even if the company is making only slow progress on its cost restructuring.

Intel’s valuation

Intel is trading significantly below valuations of other chipmaker’s which is not surprising considering that Intel pretty much missed the boat on launching its own viable Data Center server chips, reduced (and then suspended) its dividend and embarked on a new restructuring program worth $10B. However, a sale of Altera (and potentially Mobileye) could help the company raise much needed cash and instill new confidence in investors that Intel is going to become a more streamlined and focused chipmaker going forward.

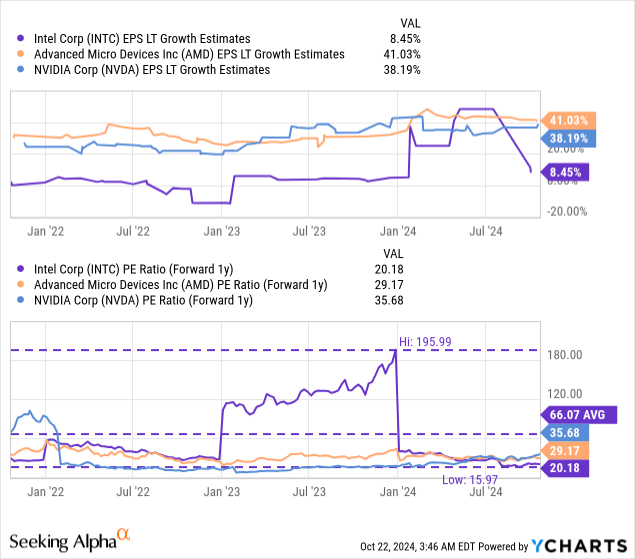

Intel is currently valued at a price-to-earnings ratio of 20.2X, which is way below (70%) the 3-year average P/E ratio of 66.1X. AMD and Nvidia trade for 29.2X and 35.7X forward earnings (based off of FY 2025 estimates). Nvidia especially is crushing it in the AI GPU market right now, and I believe that Nvidia’s revenue potential related to Blackwell is still massively undervalued. I discussed here why I thought that consensus estimates for Nvidia for next year could underestimate the firm’s real top line potential by $50B (or more). Interestingly, AMD also stands to profit from a Blackwell GPU shortage and even Intel could be on track to see higher Gaudi 3 sales given elevated market demand for accelerators.

Intel, on the other hand, does not have such high upside in its top line (or its estimates), but clearly shares trade at a distressed valuation multiplier. In my August work on Intel, I argued that the chipmaker could trade at a forward P/E ratio of 30X if it streamlined its business and managed to position its Gaudi 3 AI accelerators as a viable alternative to AMD’s MI300X accelerator.

If Intel were to revalue to a 30X fair value P/E ratio, assuming that its restructuring progresses, revenue growth resumes, Gaudi 3 shipments accelerate and Intel can sell (a portion of) Altera, shares of the chipmaker could have a fair value in the neighborhood of $34/share… which is my twelve-month target. My longer-term price target for Intel (5-year time horizon) is still $64-65/share, which is where Intel traded at the beginning of the year. I believe Intel could return to this price/valuation level if the company successfully restructures its core business and sells non-core operations.

Risks with Intel

Intel is pretty much in a restructuring setup, and the chipmaker’s shares will remain risky before and after the Q3 earnings release. If the company continues to bleed cash and reports another major loss, without a clear path back to profitability, investors are going to punish Intel for disappointing even the lowest expectations. Further, if Intel fails to catch up to at least AMD, which is itself lagging behind Nvidia, in terms of its AI accelerator sales, then shares could experience new selling pressure. Lastly, if Intel does not come up with a strategic solution and concrete plans to sell off some of its stand-alone businesses, I believe investors may lose hope of a successful turnaround.

Final thoughts

Intel’s recovery could be much smoother than investors think right now, and the reason for this is that Intel has the opportunity to sell one of its two stand-alone businesses, Altera or Mobileye, to other chip-making companies. This would accomplish a number of things: 1) A sale of Altera or Mobileye could result in billions of dollars in cash infusions which could accelerate Intel’s restructuring, 2) It would tell investors that Intel is shrinking to its core operations, and 3) Help the chipmaker accelerate its transformation in the Data Center business… which is where Intel is lagging the most, but also has the most potential, in my opinion. Intel recently debuted its Xeon 6 processors and Gaudi 3 accelerators which should add a nice shipment boost in the fourth quarter and I will be looking to hearing some positive comments about the launch from Intel’s management as well at the end of the month.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.