Summary:

- Intel continues to confirm that the company is on track for not only Intel 4 but an entire future line-up through 2025.

- Intel’s continued progress could see an unexpected benefit as its key competitor were experiencing delays.

- With industry headwinds expected to ease, the overall environment is shaping up to be a favorable one for Intel in the latter half of 2023.

Justin Sullivan

Introduction

In my previous article, “Intel (NASDAQ:INTC) is a buy ahead of Intel 4 release,” I had a buy rating on Intel as the company continued to show promising progress in its turnaround effort. To catch up and outcompete its key competitors, Intel planned massive fabrication and design upgrades. Although the company has not proven that the aggressive timeline will be feasible, Intel continued to provide investors with an update, which has led me to have a buy rating in my previous article due to the progress and its implications. Today, as Intel nears reaching the first step of its aggressive roadmap, I am reinstating a buy rating on Intel for two major reasons. First, Intel continues to show confidence in the company’s ability to keep up with the aggressive roadmap expected to start unfolding in the second half of 2023. This will not only allow Intel to be more competitive, but it is also likely that the market will award the company with higher valuation multiples due to Intel addressing doubts surrounding the company’s ability to achieve many aggressive goals set the company. Further, the semiconductor market is starting to see a sign of recovery, which will create a positive tailwind for Intel as the company starts to release new products. Therefore, I am maintaining my bullish thesis on Intel.

Intel’s Roadmap

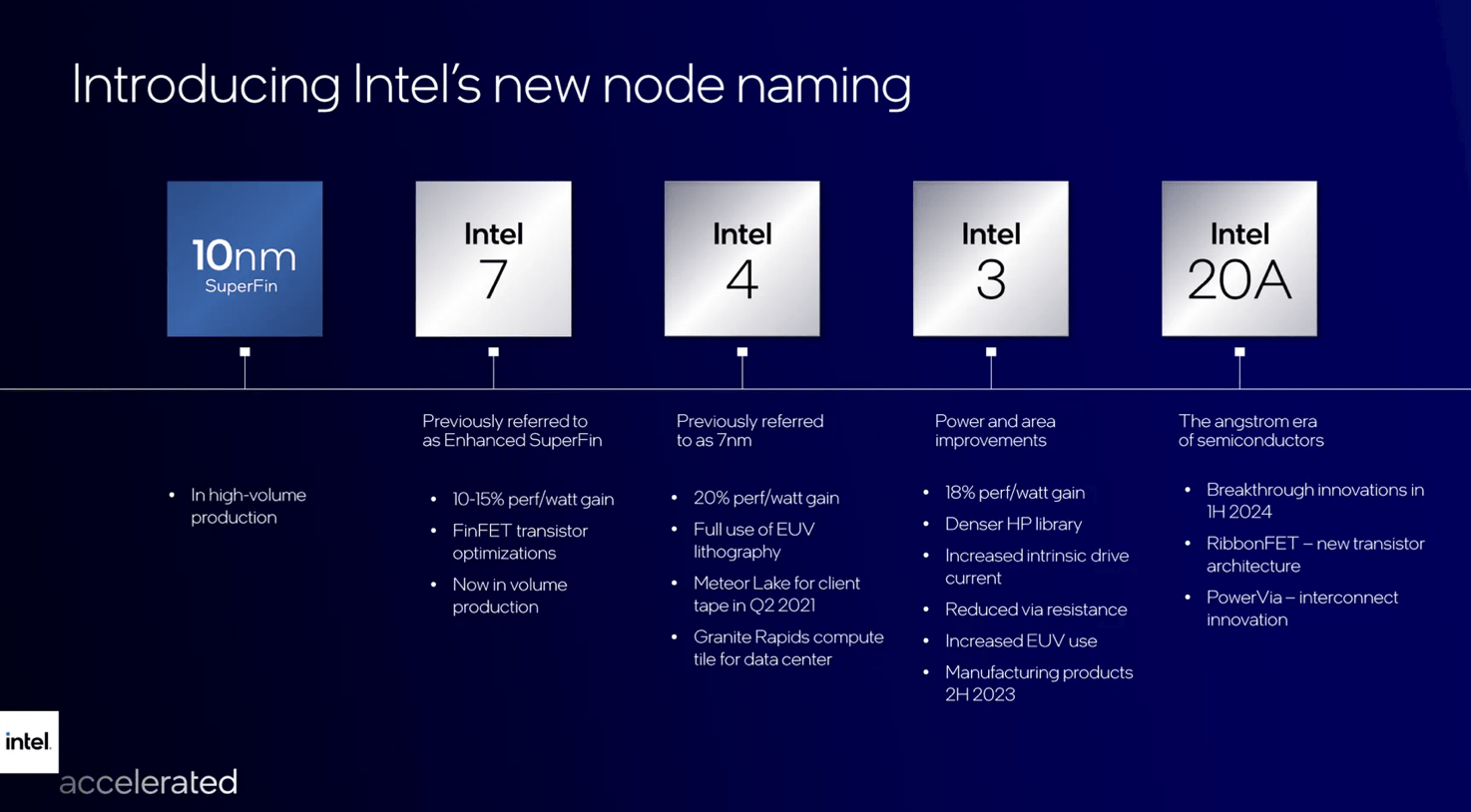

To start with a quick refresher, Intel, in 2021, has released a roadmap to regain semiconductor leadership by 2025. The company’s plan was to release new process nodes every year, which was met with many doubts. The fabrication market was and is dominated by TSMC (TSM), and with no signs of slowing investment from TSMC, it seemed nearly impossible to achieve such an aggressive goal. Further, AMD (AMD), at the time, was starting to eat away at Intel’s market share using the most advanced TSMC fabrication technology. Thus, it was paramount for Intel to instantiate confidence in the market by proving that the company was capable of achieving the proposed roadmap.

The Verge

[Source]

Intel’s Continued Progress

As the release of Intel 4 is expected in the second half of 2023, Intel continued to confirm its progress in the conference held on March 29th, 2023. In this conference, Intel looked beyond Intel 4 to Intel 3, Intel 20A, and Intel 18A. Regarding Intel 3, Sierra Forest and Granite Rapids, the company said that they “will ship Sierra Forest to customers in the first half of 2024 with Granite Rapids following shortly after,” and the “first customer for Sierra Forest has already received [the] silicon.” Further, “the first units of Granite Rapids…is healthy” showing that the company is hitting “all major engineering milestones.” Looking beyond Intel 3 to Intel 18A, the company showed confidence by saying that they are “firmly on pace to deliver…Clearwater Forest [, Intel 18A,] in 2025.” Finally, regarding Intel 4, the company did confirm that the “fifth-gen Xeon…will ship in Q4 of this year.”

I believe the renewed update on progress in 2023 to have many important implications. Not only did Intel continuously confirm that the company was on track throughout 2022, the company again, in 2023, confirmed that all the aggressive milestone seen in the roadmap was on-track. With such a consistent progress report, I believe it is reasonable to assume that the company’s roadmap will start to reach fruition in 2023 casting away many doubts.

Fruition

What do I mean by Intel reaching fruition starting later this year?

The first is fairly obvious. As I have said before, I believe the successful launch of Intel 4 will instantiate confidence among investors that Intel can actually reach its aggressive roadmap, but beyond a psychological factor, Intel chips will be far more competitive in the market. Going back to my previous article, I have already said that Intel 4 will pack two times more density, 40% power reduction, and 21.5% performance gain. Today, on top of the expected improved performance, Intel has another factor that may give the company an edge.

In late 2022, TSMC confirmed the 3nm chip mass production delay. Then, in early 2023, the situation became better for Intel as Apple (AAPL) procured TSMC’s entire production of an initial 3nm for its iPhone 15 and new Mac models in the second half of 2023. This leaves Intel’s key competitors like AMD to wait until 2024 for TSMC’s N3E mass production to take advantage of the newest fabrication technologies. Therefore, the delay will give Intel time to not only release Intel 4 later in 2023, but the delay may give enough time for Intel to bring out Intel 3, putting the company in a much more competitive situation than previously estimated. Therefore, I believe the continuous update reaffirming that Intel is on schedule is paramount as it could be crucial in Intel’s journey to catch up to its competitors.

Semiconductor Market

Beyond Intel-specific updates, the company is also expected to benefit from the entire semiconductor market as it is expecting to start to see a recovery in the coming quarters. Although Intel has not released its 2023Q1 earnings, the market sentiment could be forecasted by looking at other companies in the industry.

After about a year of continuous decline in the memory chip market, Micron (MU), in their earnings report, said that the company is “close to a transition to sequential revenue growth in [the] quarterly results” allowing the company to “anticipate a return to normalized growth and profitability.” Because the memory chip market cycle and the overall logic chip cycle move closely together, Micron’s upbeat views could mean that Intel, too, will see headwinds ease as tailwinds start to form.

Intel, although it was not said in the earnings call, did give some color on what the company is seeing during the Media & Telecom Conference. During the conference, CFO Dave Zinsner said that the industry will “largely [pass] in the first half of the year” since the declining “demand [has] generally stabilized.”

Therefore, considering both Intel and Micron’s view of the coming semiconductor market, I believe that Intel will start to see headwinds ease as tailwinds start to form.

Risk to Thesis

The biggest risk to my bullish thesis will likely be the potential for a delay in any of Intel’s future process nodes. A major delay will crater investors’ confidence in the company’s management team while allowing competitors to increase the competitive gap making it harder for Intel to ever catch up. With the global semiconductor industry tied to not only economic but national security interests, a single major delay could have a significant blow to Intel’s future competitiveness.

Summary

Intel has been aggressive in all aspects in the past few years. Everything from announcing an aggressive plan to executing such a roadmap, and the company may finally start to see fruition starting in the latter half of 2023 with Intel 4. All of the company’s future process node plans are on track with continuous confidence and updates on Intel 4 being on schedule. Further, as potential competitors are experiencing delays due to TSMC, Intel may have a more favorable environment than expected, especially as the entire industry headwinds are expected to ease in the coming months. Therefore, I continue to believe Intel is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.