Summary:

- PENN Entertainment disappointed investors with earnings missing expectations for Q4 and a surprisingly rocky start with losses for the new ESPN BET app.

- PENN has recently found itself locking horns with HG Vora, a New York hedge fund that owns an 18.5% economic interest in the company.

- After Q4 earnings, this is likely to escalate.

- ESPN BET has had a rough start, but share price performance from countries like Ireland and Australia shows that sports betting is a great long-term business.

- Despite its well-publicized problems, PENN trades under book value and looks sufficiently priced to compensate investors for their risk.

David Baileys

PENN Entertainment, Inc. (NASDAQ:PENN) took another beating after the company’s Q4 earnings report missed expectations. For long-suffering investors in the stock, it was another disappointment- with the cash flow from the company’s profitable casino assets overwhelmed yet again by losses in speculative business ventures and acquisitions. PENN bet big on ESPN BET, and while the company saw a ton of downloads and bet activity, their profits weren’t quite as expected, and the state-by-state rollout of the app has been rocky. PENN has problems. Importantly for us, these problems are very much priced into the stock. The million-dollar question – are investors getting enough compensation for the risk of investing in PENN at current prices? I’d argue yes, but let’s get into why.

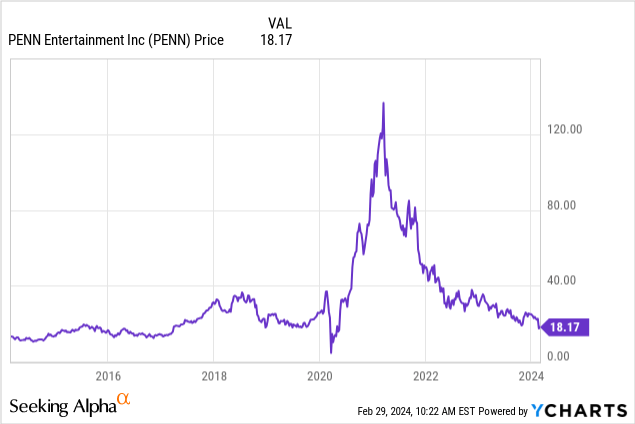

It’s said that a picture is worth a thousand words, and I find this to be doubly true when looking at long-term stock graphs. In the 2010s, PENN was a regional casino company with a low valuation. They then decided to get into the sports betting business and ended up partnering with Dave Portnoy/Barstool Sports, causing a huge boom in the share price that was largely driven by retail traders. Now, PENN is back to being valued like a regional casino company again, with the added caveat that investors from the boom are stuck tons of money and many of them just want to be done with the stock.

ESPN BET Update: Can PENN Capitalize on Legal Sports Betting?

- Rocky rollout. Things were looking up for PENN in August when the company announced that they were partnering with ESPN to create a new sports betting app called ESPN BET. I thought PENN stock represented a great value for $25 then, with the potential for a 5x or more return over the coming five years. The process of getting the app live state by state has been rocky, though. I’ve been frustrated by the pace. Setbacks such as Connecticut (ESPN’s home state) awarding its betting license to Fanatics Sportsbook while DraftKings Inc. (DKNG) and FanDuel have the tribal licenses locked up mean that Connecticut’s ~3.6 million largely affluent residents are off the table for PENN. PENN did manage to secure a license for New York (population ~19.6 million), which was a necessary step. New York can drive a hard bargain and is taking 51% of the revenue from sports betting operators. They’re opening in North Carolina as well (population ~10.6 million). But I’m disappointed that they’re not fighting harder to get in states like Maine or Vermont. Canada is another big market that PENN is in, but they don’t seem to be monetizing it very well, despite having paid $2 billion for Score Media. News also broke last month that Dave Portnoy is now partnering with DraftKings again. If true, he got a great deal on his noncompete, and it makes PENN look bad.

- NFL Trouble. Another under-emphasized aspect of ESPN BET’s performance was the way the second half of the NFL season and how the NFL playoffs went. Sportsbook managers in Vegas, offshore, and on the big apps repeatedly made decisions to allow large imbalances of bets on popular teams rather than move the line. This normally works in the book’s favor, but it didn’t this year. For example, I know a sportsbook manager who had a massive imbalance on the Chiefs for the Super Bowl. The computer models all had San Francisco at -3 or so, implying that San Francisco was around 60% to win the game. They moved the line against the Chiefs, charged customers double commission, and they still all piled in on the Chiefs. San Francisco probably should have won the game, but bad decisions in overtime cost them the game, and sportsbooks from coast to coast had to pay out hundreds of millions of dollars to bettors whose thought process was that “Travis Kelce is the man and no one can stop him.” Adding insult to injury, key prop bets around the Chiefs and Taylor Swift hit, denting profit margins. With March Madness coming up, my guess is that a lot of the money that customers made on the NFL is going to end up back in the book’s pockets. College basketball is interesting from this perspective as well because the books routinely shade lines on popular teams, and the public bets big on them anyway. This doesn’t work well in the long run for people punting their money.

- The current market for sports betting is not zero-sum. If big states like Texas and California (see the buzz on Texas billionaire and former Dallas Mavs owner Mark Cuban’s ambitions) legalize sports betting and PENN can take market share, it’s not hard to justify assumptions that ESPN BET could be a billion-dollar annual business. There’s a lot that can go wrong with PENN, but at the current stock price, there’s also a lot that can go right. For example, gambling stocks have been the best performers over time in the Australian market. Ireland-based Flutter Entertainment plc (FLUT) has returned roughly 16x for investors since listing in 2009. Flutter is the parent company of FanDuel. If PENN can get out of its own way, there is tons of long-term potential here.

What’s PENN Worth?

I find PENN interesting because it’s again valued like a regional casino company. The market is essentially assigning a negative value to the sportsbook operation. But when you go look at the balance sheet and income statements, things don’t look so dire. For example, PENN’s book value is $21.48 per share – the stock is now trading under book. PENN passes all the classic liquidity tests (current assets>current liabilities, assets>liabilities, etc.). The company’s debt load is relatively heavy, raising the cost of potential mismanagement. S&P Global put PENN on a negative credit rating watch after the most recent earnings report. However, the underlying operating cash flow is still there from the casino portfolio. If sports betting works for them, that creates a ton of optionality. It might not need to come to that, though.

Activists are agitating for change. New York hedge fund HG Vora is seeking board seats and owns roughly 18.5% of the company. HG Vora has accused PENN of constraining the number of board seats and disenfranchising shareholders. This is an interesting angle – there’s EBITDA to be had and big investors in the company don’t like the management. This could play out one of several ways. A proxy fight might ensue where HG Vora seeks to replace the management of the company. They own about 18.5% of the economic interest in the company so they generally would only need to win a minority of the remaining shareholders. IF PENN goes lower, Vora might be able to even buy more stock. Also, due to its small size, private equity could easily buy out PENN and recapitalize it, unlocking the operating cash flows tied down by the company’s debt load.

If the bear case on PENN is that the underlying company is profitable, but the management is terrible, then those same factors should make the company appealing to activists and private equity. I don’t know what they would try to buy PENN for, but with analyst earnings estimates showing that PENN should come close to breaking even this year and turning a profit next year, I’d expect any takeover to happen at a nice premium to the current price, perhaps for $30-plus.

Bottom Line

Investors have a way to win small in PENN stock with the company trading for below book value and subject to activist pressure. They also have a way to win big if the trajectory of sports betting stocks over time in the US follows the success seen in markets like Ireland and Australia. PENN is dirt cheap and there’s a lot that can go wrong with the company’s large debt load, but there’s also a lot that can go right for them. I don’t see a need to double down here, but for the above reasons I continue to believe that PENN stock is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PENN, FLUT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.