Summary:

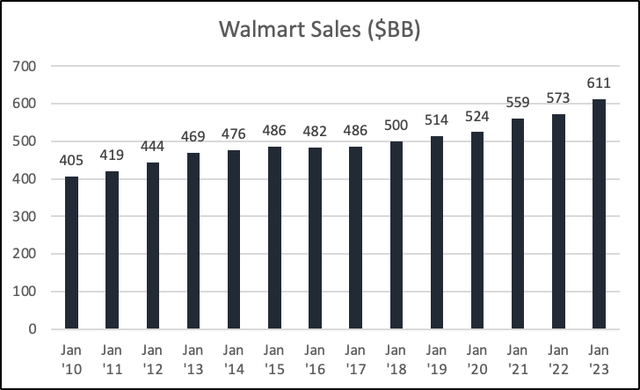

- Walmart is the largest retailer in the US with $600 billion in annual sales and a global footprint of +10,000 stores.

- I believe the recent sell-off is over with, offering investors the chance to buy a high-quality company at an attractive price.

- I expect Walmart to gain more market share in the near term as consumers tighten their belts and focus on buying low-cost groceries.

- My valuation indicates a price target of ~$166 by the end of FY2024, making this a buy.

bgwalker

Investment Thesis

On July 2, 1962, Walmart (NYSE:WMT) opened its first store in Rogers, Arkansas. Today, Walmart is the biggest retailer in the United States, with over $600 billion in annual sales and a store footprint of more than 10,000 stores globally. I believe the recent stock drop post-earnings provides long-term investors with an opportunity to buy a high-quality company at a fair price. My “BUY” rating arises from Walmart’s scale, stability, stellar management team, and attractive valuation.

1. Scale & Stability

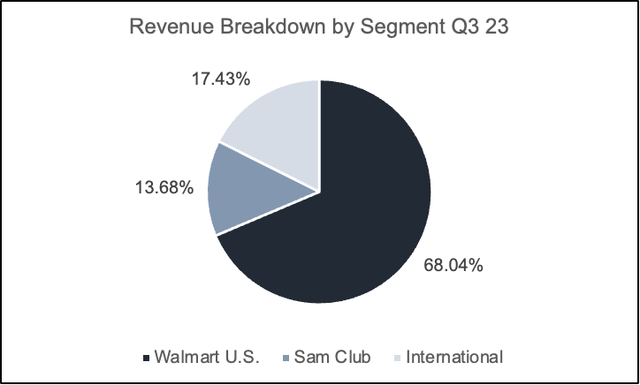

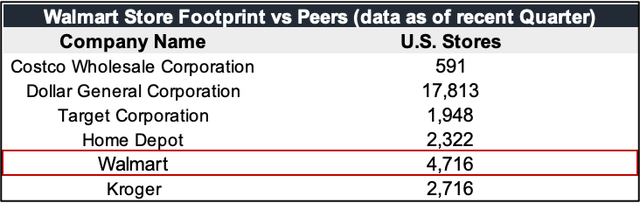

Walmart Inc. is the largest retailer in North America, with a leading market share of 47% within the retail sector and a 6.4% share in e-commerce retail, second behind Amazon. Walmart has 4,716 locations domestically, more than twice that of its competitor Target (TGT). In the international segment, WMT had 5,318 stores. In total, the company has a store footprint of 10,034. Revenue is derived from three segments: Walmart U.S., Sam Club, and International.

created by the author

Walmart has a simple business model that has worked for decades: leverage its scale to buy goods at a low cost and resell them at a lower price than peers to attract customers. This strategy has propelled WMT to be a favorite among consumers. I don’t believe a new retail company can just come and replicate WMT’s scale; it is impossible to do. I only see two companies that can cause a problem for WMT: Costco and Amazon. Other than that, I believe WMT will continue to enjoy its leading market share.

Author

As I said in my thesis, I believe WMT is a stable business because it benefits from recurring revenue and has a high retention rate. According to Statista, Walmart has a 93% awareness rate and a 60% loyalty rate. The combination of the two and the steady revenue over the years, as shown below, prove that. I also expect Walmart to gain more market share in the near term as consumers tighten their belts and focus on buying low-cost groceries.

Author

2. Management

One can’t invest in a company without looking at management and how they are compensated. The CEO (C. Douglas McMillon) has been with the company for over 30 years. He owns more than 1.7 million shares worth roughly $270 million. In 2023, his total compensation was $25.3 million; of that, $19 million was in stock awards. Mr. McMillion has been the CEO since 2014. Under his leadership, revenue has grown at an average rate of 2.85% and EPS by 2.68%.

The CFO (John David Rainey) joined the company in May 2022. He was appointed Executive Vice President and Chief Financial Officer of Walmart Inc., effective June 6, 2022. He is relatively new to the company, so he doesn’t have a significant stake (167,735 shares); in 2023, his total compensation was ~$40 million; of that, $32.6 million was in stock.

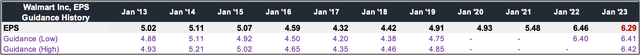

My two cents is that, so far, management has focused on shareholder return, returning more than $15 billion to shareholders in 2023 in the form of dividends and buybacks. I don’t believe this will change, given that WMT is now a mature business with few areas left to expand into. Additionally, the management team has consistently delivered on its guidance, only missing in 2023 due to economic headwinds.

Author

What Caused The Pullback?

On November 16, 2023, Walmart reported Q3-FY2024 earnings. The company beat top-line estimates by $895 million and bottom-line estimates by $0.01, yet the stock closed the trading day down by 6.8%. Even though WMT raised its full-year sales growth guidance to 5% to 5.5% from 4% to 4.5% and its full-year EPS guidance range to $6.40 to $6.48, analysts expected better. Management also made a few cautious comments about the outlook for the holidays. The CFO had this to say:

“Sales during November have turned higher as unseasonal weather abated and we kicked-off holiday events. So sales have been somewhat uneven and this gives us reason to think slightly more cautiously about the consumer versus 90 days ago.”

I believe the combination of such comments, EPS revision, and WMT stock trading at an all-time high a day before earnings might have caused the ~7% decline. I think Q4 results are priced in unless the company notices other trends, which might lead to consumers spending less in the future.

3. Attractive Valuation

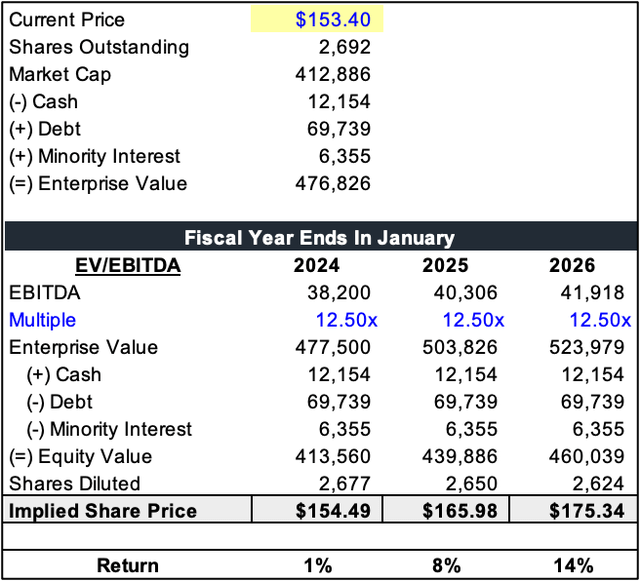

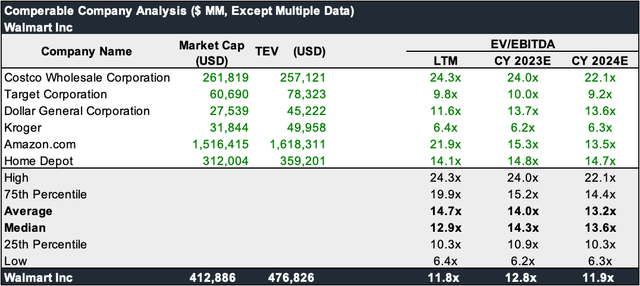

As I’m writing this, the stock is sitting at $153.4. WMT is trading at a forward P/E of 24.05x the FY23 consensus of $6.47 and 21.92x the FY2024 consensus of $7.11. On a trailing free cash flow basis, the stock yields over 2.64% relative to its enterprise value. I estimate revenue to compound at an annual rate of 4.17%, driven by growth in e-commerce, Walmart+, and pricing.

I believe margin enhancement is a strong possibility as advertising, e-commerce, and automation initiatives are progressing and starting to bear fruit. With that said, I expect COGS and SG&A margins to deleverage by 25 bps and 20 bps in FY2024, 20 bps and 10 bps in FY25, and 5 bps in FY26, yielding an EBIT margin of 3.80%, 4.1%, and 4.20%, respectively.

Author

The multiple used (12.50x) aligns with the company’s FWD multiple, but is a discount to competitors. Using the assumptions above, I arrived at an implied share price of ~$166, translating into an 8.2% return for the price of this writing. Usually, I don’t consider an 8.2% return in 14 months a buy, but given WMT’s stability, safety, and dominant market position, I think I can make an exception.

Author

Key Risks

My biggest concern when it comes to Walmart is competition. Amazon already poses a threat to WMT on the e-commerce side, but with their acquisition of Whole Foods in 2017, competition has ticked up to physical stores.

Customers prefer to shop at Walmart because they buy goods at a low price. Although tightening consumer spending can serve as a tailwind, too much inflation can eat into the company’s bottom line by increasing costs.

Conclusion

The bottom line here is that WMT’s business model of leveraging its scale to buy goods at a price below market and resell them for cheap has allowed it to become the leading retailer in North America. I like management’s focus on shareholder returns; even while the company is trading 8.2% below my price target, it is still assigned a buy due to its stability and defensive nature.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a qualified financial advisor or investing professional. My content and analysis are based on my opinion and are intended to be used and must be used for educational purposes only. No content or analysis constitutes or should be understood as constituting a recommendation to enter into any securities transactions or to engage in any investment strategy. It is very important to do your own analysis before making any investment based on your own personal circumstances. Readers should always seek the advice of a qualified professional before making any investment decision. Past performance is not indicative of future performance. A reader should not make personal financial or investment decisions based solely upon this analysis.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.