Summary:

- Alphabet’s stock has underperformed the magnificent seven YTD due to increased competition and fear of losing market share.

- Despite missing cloud revenue estimates in the recent quarter, GOOG still posted stronger growth than its peers.

- I believe the company will come out stronger on the other end given its leading position and strong leadership.

- My $152 price target is based on 23.00x of my FY2024 EPS estimate of $6.61.

Justin Sullivan

Investment Thesis

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) needs no introduction. The company is the main beneficiary of the shift to the digital world. The firm experienced a nasty sell-off post-earnings due to a missing cloud revenue estimate by ~$200 million. Although the stock has rebounded since then, it seems as if investors are still worried Alphabet might underperform in the future. I believe otherwise, and I will explain why. I have a price target of $152 by the end of FY2024.

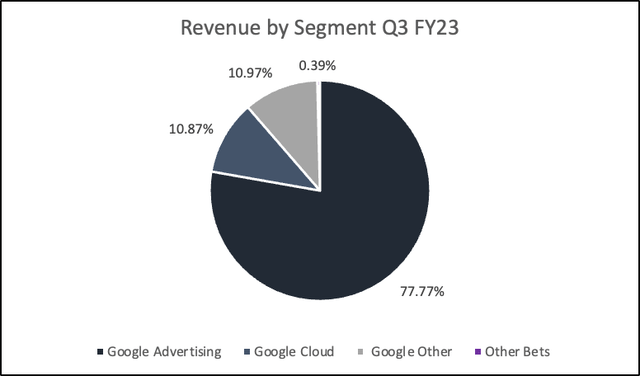

If we look at GOOG’s revenue sources, most of it stems from advertising, which is made out of the Google search engine, YouTube, and Google network.

Google’s search engine has a 91% market share and good long-term prospects, such as continued smartphone penetration and partnerships with top-selling smartphones. Additionally, most phones have Google’s search engine as a default option, and some never bother to change it because it is smooth and effective. The digital advertising industry is still substantial; according to Statista, it is expected to grow by 7.2% from 2023 to 2028.

YouTube is the same story. I don’t see any other platform competing with it. I expect the company to benefit from the long-term tailwind of many kids and young teenagers wanting to become YouTubers and the rise of “side gigs” because the platform offers the chance to work from anywhere in the world and earn a good chunk of money. I have noticed this with my young brother, who is 14 years of age; he barely watches TV because YouTube has it all. Plus, the smartphone user base is still expanding and is projected to reach 5.13 billion in 2028, up from 4.74 billion in 2022.

Additionally, GOOG treats its creators better than most platforms. It splits revenue with creators 50/50. This has led to increased productivity and a larger user base. YouTube generates almost as much revenue as Netflix. The only thing preventing online platforms from fully taking over TV cable is sports, and YouTube’s recent deal with the NFL will further increase user retention and attract a new customer base.

Now, let us take a dive into Google’s cloud services, the segment that caused the stock to drop by roughly 9% post-Q3 earnings. Google Cloud reported earnings of $8.4 billion, and the market expected $8.6 billion. Regardless of missing expectations, the segment still posted 22% growth YoY, compared to AWS 12% and Azure 19%. Additionally, AWS sales also missed estimates ($150 million) in AMZN’s latest quarter.

Personally, I believe the street’s estimates might have been too high for Google Cloud, especially in a world with 5.25% interest rates; businesses would rather keep a cash reserve than invest in the cloud, or perhaps the company has reached a point where 30-40% growth is over, or at least until economic conditions get better. Over the past four years, Google’s cloud segment has grown at an annual rate of 46%, which is more than Amazon’s “AWS” 33% and Microsoft’s “Azure” 23%.

Additionally, GOOG’s board of directors has deep industry knowledge and experience, with an average tenure of 13.7 years, with its co-founders still a part of it and holding a significant stake in the company. CEO Sundar Pichai holds more than $240 million worth of GOOG shares and options.

Both Larry and Sergey have been able to steer the business in the right direction and adapt to new trends, such as acquiring YouTube and Android. Developing Gmail, Google Maps (the most downloaded app), and Google Cloud. I believe they will do the same thing with AI and machine learning.

Note: As I’m getting this article ready for publication, GOOG unveiled the launch of its large language model (“LLM”) called Gemini, the AI language model that the company hopes will challenge OpenAI’s ChatGPT. It includes a suite of three different sizes:

- Gemini Ultra is the largest and most capable model for highly complex tasks.

- Gemini Pro is the best model for scaling across a wide range of tasks.

- Gemini Nano is the most efficient model for on-device tasks.

What can it do? Well, Gemini can generalize and seamlessly understand, operate across, and combine different types of information, including text, code, audio, image, and video. It can be used in data centers and on mobile phones. Gemini Pro will first be available on “Bard” on December 13th across 170 countries.

I believe the release of Gemini is definitely a big deal, not just for GOOG but for the whole industry; GOOG can also integrate its LLM to be used on its various applications and software, such as Google Chrome, search, YouTube, ads, and more. This would also enable better cost management, as a JPM analyst said.

Valuation

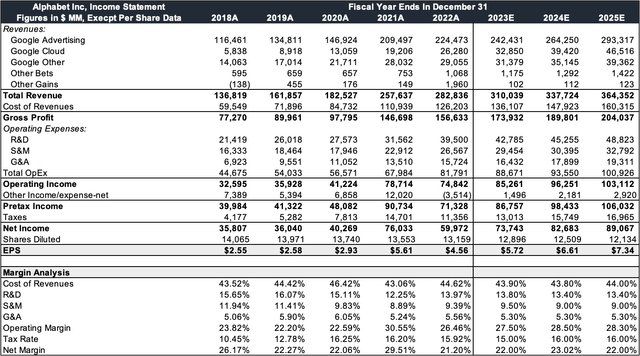

My price target is based on 23.00x of FY2024 EPS of $6.61. I assumed revenue to compound at an average rate of 9% from FY2022-FY2025, underpinned by a 9% growth rate in advertising, 11% in Google Cloud, 21% in Google Other, and 10% in Other bets. My revenue assumptions are driven by price increases, continued market penetration, and market growth.

I expect shares outstanding to decline by 2.67% annually over the same period, driven by aggressive buybacks. GOOG is expected to spend roughly $60 billion annually on share repurchases. For expenses, I derived my assumption from historical figures, given that they haven’t changed in a major way over the past few years.

As I’m writing this, the stock is sitting at $135. GOOG is trading at a forward P/E of 24.11x the FY23 consensus of $5.74 and 20.76x the FY2024 consensus of $6.67. On a trailing free cash flow basis, the stock yields over 5.09% relative to its enterprise value.

Investment Risks

In 2017, 2018, and 2019, the European Commission imposed fines on Google of $2.7 billion, $5.1 billion, and $1.7 billion for infringing European competition law. GOOG is also facing domestic cases, mostly antitrust investigations and lawsuits, with one filed in late January 2023 by the U.S. Justice Department.

New laws that restrict data collection could also hurt the company. Google thrives because of its data; the more data they have, the more advertisers they can attract. ChatGPT also poses a threat, but with the recent launch of Gemini, which further improves “Bard,” I believe the company finally has a fighting chance.

GOOG competes with conglomerates such as Microsoft (MSFT), Amazon.com (AMZN), and Apple (AAPL) in every aspect of its business, including advertising, cloud computing, products, and more. GOOG is a very attractive company, but it does have risks.

Takeaway

All in all, Alphabet is a dominant business with leading positions across different sectors. Over the past year, the stock hasn’t performed as well as its peers because of increased competition and the fear of losing market share. But I believe the company will come out stronger on the other end, given its strong cash flow generation and leadership.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a qualified financial advisor or investing professional. My content and analysis are based on my opinion and are intended to be used and must be used for educational purposes only. No content or analysis constitutes or should be understood as constituting a recommendation to enter into any securities transactions or to engage in any investment strategy. It is very important to do your own analysis before making any investment based on your own personal circumstances. Readers should always seek the advice of a qualified professional before making any investment decision. Past performance is not indicative of future performance. A reader should not make personal financial or investment decisions based solely upon this analysis.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.