Summary:

- Investor interest in quantum computing has soared after Google’s Willow announcement. Although Google has made stellar progress, I continue to believe in little-known IonQ’s long-term potential.

- Up 170% since my investment, IonQ has had a stellar 2024 so far, with the company continuing to make technological progress ahead of schedule.

- Although it might take years for a versatile quantum computer to be built, IonQ has recognized the importance of monetizing its technology as is.

- I believe the quantum computing market is still at an infant stage and has substantial room for growth, leaving sufficient room for not one but many players to win.

- I believe Google Willow and IonQ can co-exist in the long run given the unique characteristics of the qubit technologies used by the two companies.

adventtr

I fell in love with IonQ, Inc. (NYSE:IONQ) last year but only turned bullish on IONQ stock in February this year when I thought the market sell-off was overdone. When I invested in IonQ in February at an average cost of around $11, I was attracted to the company’s focus on industry applications of quantum computing through partnerships and the continued improvements to the trapped ion technology used by the company.

With IonQ stock rising more than 170% since my investment, I could not have been happier with how things have turned out. Alphabet, Inc. (GOOG) has also made stellar progress with its quantum computing efforts, evidenced by Google’s Willow making headlines earlier this week for solving a complex computation that would take today’s supercomputers more than ten septillion years in under five minutes. Amid rejuvenated enthusiasm toward quantum computing, IonQ stock has lost 16% in the last 5 trading sessions as Google has taken center stage.

After a closer evaluation of IonQ’s commercialization progress, technological developments, and recent partnerships, I remain bullish on the long-term outlook for the company.

IonQ’s Focus On Commercialization Is Yielding Results

Quantum computing has been limited to theory until recently, and I am encouraged by how IonQ is focused on the practical applications of quantum computing. Although it might take years for a versatile quantum computer to be built, IonQ has recognized the importance of monetizing its technology as is. Confirming this stance during the Q3 earnings call, IonQ CEO Peter Chapman said:

In the quantum world, there are two camps or schools of thought on this topic. One camp believes, you need near perfection before value can be unlocked. If they are correct, sadly, Quantum is still a long way off. The naysayers belong to this camp, but their numbers are dwindling every day. The other camp, which IonQ and others belong to, believe today’s early noisy quantum computers can provide value even before they are perfected. If we are right, it gives us a significant advantage by generating early meaningful cash collection as we work towards perfection.

IonQ, following this strategy, has already made progress in building a commercial product portfolio.

Today, IonQ generates revenue from a few sources.

- Designing specialized quantum computing hardware.

- Providing access to quantum-computing-as-a-service.

- Consulting services related to co-developing algorithms on quantum computing systems.

The company, as seen above, generates revenue both from hardware sales and consulting services. In Q3, both these segments contributed almost equally to total revenue.

Below are some of the recent deals and developments that highlight IonQ’s unwavering focus on commercializing its quantum computing technology before perfecting it.

- Securing a $54.5 million contract with the United States Air Force Research Lab for developing and delivering hardware for scaling and networking quantum systems.

- Receiving a $5.7 million award from the Applied Research Laboratory for Intelligence and Security to design a networked system for blind quantum computing.

- Extending its system access contract with AWS, making its technology available through cloud services.

- Unveiling its first quantum computer in Europe a few days ago, which is now online and available for use.

With a long-term view of IonQ’s prospects, I believe the company’s early success in commercialization paves the way to secure long-term contracts with existing customers, gain more visibility through proven practical expertise, and enjoy long-lasting customer stickiness. These factors may help IonQ enjoy competitive advantages in the long run.

IonQ And Google Willow Can Co-Exist

Google Willow’s stellar progress has given rise to doubts about IonQ’s ability to compete with the tech giant. Although these fears are not entirely unfounded, I believe the quantum computing market is still at an infant stage and has substantial room for growth, leaving sufficient room for not one but many players to win. According to Fortune Business Insights, the global quantum computing market was valued at $885 million at the end of 2023 and will grow at a stellar CAGR of 35% through 2032 to $13 billion. Even by 2032, the quantum computing industry will still be at a very early stage given that fully versatile quantum computers are not expected to be available for many years.

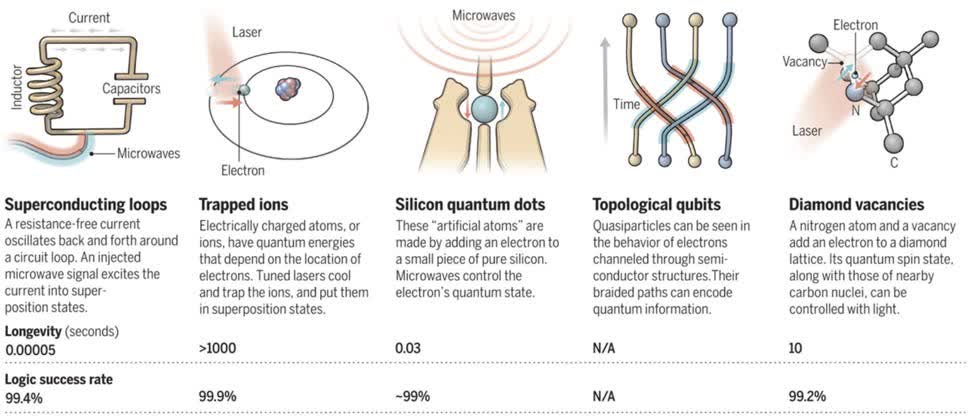

In addition to this, I believe Google Willow and IonQ can co-exist in the long run given the unique characteristics of the qubit technologies used by the two companies. To recap from my previous article, below are some of the most commonly used qubit technologies. Google is using superconducting qubits while IonQ is using trapped ion technology.

Forbes

I believe IonQ is on the right track to carving out a niche in sectors where the trapped ion technology will perform better than superconducting qubits. For example, the long coherence times of trapped ions make them excellent for applications requiring extremely precise measurements. This makes it easier for IonQ to target industries such as aerospace, defense, and even geological surveying. Another example is that trapped ion systems excel at simulating quantum systems, which could be useful for drug discovery, materials engineering, and chemical reaction modeling.

IonQ’s recent acquisition of Qubitekk, on the other hand, positions it well for developing quantum communication systems. Trapped ion qubits are well-suited for quantum networking, an area where IonQ has the potential to dominate in the long run.

We can already see that IonQ is focused on leveraging the strengths of the trapped ion technology through partnerships with market leaders in sectors that are likely to benefit from the unique characteristics of trapped ion.

In addition to this, recent research has shown the potential for trapped ion qubits to operate at room temperature, which is a breakthrough development. A research paper published by the Department of Physics at the University of Oxford on December 6 revealed that trapped ion technology, as previously thought, can function well at room temperature. In comparison, Google Willow has to be stored under extremely cold temperatures. This could lead to the development of portable quantum devices, benefiting industries such as field research, on-site diagnostics, and mobile computing.

Technological Developments

IonQ is ahead of its technology roadmap and the company delivered Forte’s AQ35 12 months earlier than expected. This is a trend that we have seen over the years as IonQ achieved all of its previous algorithmic qubit targets earlier than planned.

The company also demonstrated ion-to-ion entanglement, which is the second of four milestones required to develop photonic interconnects. Achieving photonic interconnects will substantially improve the scalability of IonQ’s quantum systems, paving the way for an acceleration in monetization.

IonQ also achieved high gate fidelities by surpassing 99.9% two-qubit gate fidelity on its barium platform, which leads to lower error rates. High gate fidelities will increase the reliability of quantum algorithms while lowering costs, eventually resulting in improved appeal for quantum computing technology for commercial use.

Risks To Monitor

Although I am bullish on IonQ’s long-term prospects, I believe the strong market run this year has made the company expensive. Investing at elevated valuation multiples may lead to short-term disappointments for investors. In addition, I am monitoring competitive risks closely, especially the risk posed by tech giants such as Google and International Business Machines Corporation (IBM).

Takeaway

Investor interest in quantum computing has soared after Google’s Willow announcement. While acknowledging Google’s tremendous feat, I continue to believe in IonQ’s long-term potential to carve out a niche in this fast-growing market, delivering handsome returns to investors. Quantum computing does not have to be a zero-sum game, and I don’t think it will be. IonQ is doing the right thing by focusing on the commercialization of its existing technology ahead of developing a fully versatile quantum computer. Despite stretched valuation levels, I continue to remain bullish on IONQ stock with a long-term perspective.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IONQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.