Summary:

- IonQ must consistently exceed expectations and achieve triple-digit revenue growth in 2025 to maintain investor confidence, which is a challenging and risky proposition.

- Despite holding significant cash and no debt, IonQ’s valuation is steep, requiring flawless execution to justify its current market cap.

- IonQ’s high cash burn rate, spending $2 for every $1 of revenue, raises concerns about its sustainability and financial health.

- IonQ’s current financial trajectory and valuation make it a risky investment, demanding caution from investors.

adventtr

Investment Thesis

IonQ (NYSE:IONQ) has caught investors’ imagination. Presently, with the stock roaring higher, I recognize that I’ve missed the boat. At its core, I struggle to reconcile myself to recommend paying more than 450x 2028 non-GAAP operating profits to Deep Value Returns members.

Yes, the business is clearly the leading quantum computing player. But if I’ve seen this movie enough times, where a business seems to be the next big thing, only for a while later to look like little more than a mirage.

At the end of the day, the business has to produce more than a story. It will have to produce some sort of sustainable profits, and perhaps when I see something beyond a cash incinerator, I’ll happily revisit this story, even at a higher valuation than now.

Rapid Recap

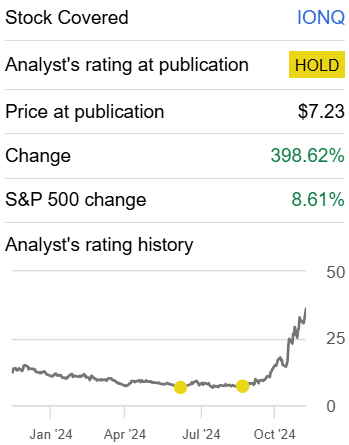

Back in September, I said,

IonQ is a contentious stock. Proponents of this business describe quantum computing as the next big wave, and that taking a position early makes sense.

While more suspicious investors, myself included, make the case that expectations are too high.

Author’s work on IONQ

Since I said that expectations were too high, the stock went on to rapidly move higher. A lot higher. And now, having clearly missed the boat, I’m sticking to the sidelines.

IonQ’s Near-Term Prospects

IonQ is a quantum computing company that specializes in developing and commercializing quantum computing applications.

Its value proposition lies in harnessing quantum technology to solve previously impossible problems, offering transformative solutions in industries like biopharmaceuticals and engineering simulations.

By partnering with organizations like AstraZeneca (AZN) and Ansys (ANSS), IonQ demonstrates its ability to leverage quantum computing for practical applications, reducing product development timelines.

Moving on, as noted on the earnings call, IonQ has consistently exceeded revenue expectations, reflecting its strong execution and customer demand. Partnerships with major organizations such as its $54.5 million deal with the U.S. Air Force Research Lab reflect its ability to secure high-value opportunities.

IonQ’s application-driven strategy, including collaborations in drug discovery and engineering, positions it for sustained growth. Essentially, this is a futuristic story stock.

With that in mind, let’s now discuss its fundamentals.

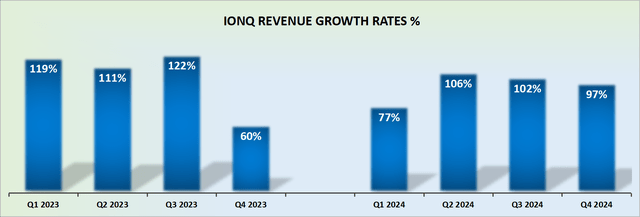

2025 Revenue Growth Rates Need to Double

For Q3 2024, IonQ delivered $12.4 million in revenues. Therefore, when management guides for about $9.1 million at the midpoint of its guidance, investors are straight away looking beyond that, and think that IonQ should deliver about $12 million in revenues in Q4 2024.

And that starts to become a tricky game. Why? Because you practically need IonQ to blow out expectations each and every quarter, simply to keep investors content. And that’s a really tough game.

And for you to have confidence in this sort of setup, either you need to have tremendous self-confidence or you need to be a bit more risk-seeking than me. Either way, I find it too challenging a game.

On top of that, there are implicit expectations that IonQ must deliver triple-digit revenue growth rates in 2025, simply to maintain investors’ bullishness. And that’s a challenge when expectations are already so stretched.

IONQ Stock Valuation — +450x 2028 Non-GAAP Operating Profits

There’s one thing that I do like about IonQ. And that’s the fact that it holds a lot of cash on its balance sheet and no debt. More specifically, with about 5% of its market cap as cash, and no debt, this business has ample flexibility to invest in its future prospects.

But the crux of my issue is this. Let’s assume that IonQ grows next year by 100%. And that the year after that, it also grows by 100%. And the year after that, it grows by 100% yet again, while delivering 5% non-GAAP operating margins.

This would mean that in 2028, it will deliver about $17 million of non-GAAP operating profits. That’s a fantastic outcome and presumes flawless execution On that point, this would mean that investors today are asked to pay more than 450x 3 year forward non-GAAP operating profits. That’s too punchy for me.

Further Risk Factors

IonQ just delivered slightly over $31 million in revenues. To grow these revenues, IonQ burnt through approximately $84 million of free cash flow. And the year isn’t even over yet. This means that realistically, IonQ is going to burn through $100 million of free cash flow this year, to grow its revenues by around $45 million.

In other words, for every $1 of revenues, the business burns through $2 of free cash flow. That’s not a business that I find myself overly comfortable recommending.

Furthermore, IonQ competes with companies like Rigetti Computing (RGTI), which also focuses on quantum computing technologies. Both firms are racing to secure market share in an emerging industry with significant government and commercial spending.

On top of that, in the next 3 years, it’s more than likely that other new peers may also come to the surface. Will investors still be willing to support more than 450x forward 2028 non-GAAP operating profits for this stock when there are several other peers in this sector?

The Bottom Line

Paying more than 450x forward 2028 non-GAAP operating profits prices me out of IonQ.

While I appreciate the groundbreaking potential of quantum computing and IonQ’s industry-leading position, I find the valuation too aggressive.

Even with flawless execution, the current premium assumes an almost utopian growth scenario, which I am not prepared to underwrite. I’ll happily revisit IonQ once it demonstrates a clearer path to sustainable profitability or when the valuation becomes more grounded.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.