Summary:

- 2Q22 expected slowdown in subscribers has no structural impact to IQ long-term fundamentals.

- Despite a potential sequential subscriber decline in 2Q23, I expect a rebound in subscriber and ad revenue due to a strong content season and a rise in advertiser interest.

- I maintain optimism about IQ future prospects given the focus on maintaining profit margins, controlling content costs, and the recovery of high-growth verticals in the advertising industry.

Spencer Platt

Overview

I reiterate my buy rating for iQiyi (NASDAQ:IQ). The online video industry in China has a secular trend in its favor because of rising disposable income and improved consumption habits, as well as a diversified business model that includes membership fees, online advertising, content distribution, and other revenue streams made possible by fully realizing the potential of its IP content. IQ’s original content, which includes a wide range of variety shows and drama series, is its main competitive advantage. This is due to the company’s innovative culture, which centers on the merging of technology and creativity, and the efficient work of its management team in recognizing shifts in consumer taste. I believe the reversion in share price is an opportunity to size up any existing position as I believe IQ is heading to a strong summer season ahead with a backlog of blockbuster dramas. Importantly, my thesis of sustainable profitable growth is playing out with gross and EBIT margin sustaining at the same level as 4Q22.

Subscriber growth

I believe that the potential sequential subscriber decline in 2Q23 (as guided by management) is a major reason for the large drop in share price since the 4Q22 earnings report. I can see why shareholders would be concerned as it appeared that rivals like Tencent were slowing the growth of IQ. I think it’s important to step back and take in the big picture. The guided subscriber count for 2Q23 suggests a sequential decline, but it would still be an increase from 2Q22 and the highest 2Q subscriber count in IQ’s history. The sequential drop is due to the fact that in 1Q23 there was an increase in subscribers as a result of the hit content The KnockOut. IQ experienced churn because many of its subscribers joined solely to watch a single show or event and then cancelled their subscriptions when that show or event concluded. However, the important metric here is the slight increase in average revenue per membership [ARM] in 1Q23, which shows that a sizable fraction of users have signed up to be annual paying members. In my opinion, this qualitative factor is beneficial to ARM levels in the long run, and it helps to mitigate the negative effects of a higher subscriber mix of short-term paying users.

From June 2023 onward, IQ will enter a strong content season with a plentiful supply of content, which should propel a rebound in subscriber and ad revenue, and thus accelerate the growth of IQ’s subscriber base. Story of Kunning Palace and Destined are two of these shows that are based on well-known novel intellectual property and have a large fanbase. The latter is available only on iQiyi and, 41 hours after its debut, has already climbed to position #10,000 on the platform’s popularity index. In my opinion, this is where IQ and its team’s innovative spirit really shines.

Margin

Recall my previous updates that achieving sustainable profitable growth is a key part of IQ equity story. I think management got it, and they’ve done a fantastic job of carrying it out. Profit margins have been maintained throughout this run of excellent content and the promising summer season ahead. The same applies to increase in subscribers as well (subscribers growth is no longer driven by promotions but quality content). Management is set on only modestly increasing content costs despite a growing list of pipeline projects. With rising subscription demand and well-contained content production costs, I anticipate IQ’s margins to continue expanding on the back of this.

In addition, I anticipate a rise in margin thanks to a rise in ad revenue (ads have a high margin profile). Advertiser interest has been on the rise since April, and management expects it to continue rising until the 2H23. This recovery will be led by the fast-moving consumer goods, retail, travel, entertainment, and healthcare industries. I believe that the high-growth verticals, such as e-commerce, will re-enter the advertising scene, allocating more budget to digital advertising, which is good for IQ, as we continue to recover from and progress through this weak macro environment. This gives me optimism that growth in the recovery will quicken in the coming quarters.

Valuation

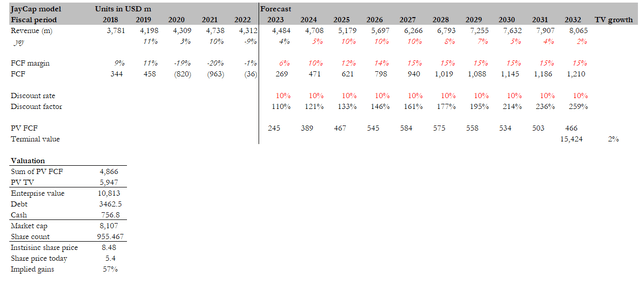

My model has been updated to better reflect consensus near-term expectations (FY23 revenue) and to allow for the earlier realization of positive FCF, which consensus are expecting to hit ~10% by FY24. I believe the valuation remains attractive now that the sustainable profitable growth thesis is playing out nicely (driving earlier realization of equity value due to time value of FCF).

Author’s estimates

Risks

There is the concern about incremental competition from Tencent Video and Youku, as both platforms launched popular dramas in 2Q23. I believe competition will never go away, but this is not a zero sum game. An individual could subscribe to multiple platforms just like how I subscribe for Netflix, Disney+, and Prime. So long as IQ can continue to produce quality content, subscribers should come along naturally.

Conclusion

I remain optimistic about IQ future prospects. The sequential subscriber decline in 2Q23 should be viewed in the context of overall growth, as it would still represent an increase from the previous year and the highest 2Q subscriber count in IQ’s history. The increase in average revenue per membership indicates a significant number of annual paying members, which bodes well for long-term revenue stability. With a strong lineup of upcoming content, including highly anticipated shows like Story of Kunning Palace and Destined, I expect IQ’s subscriber and ad revenue to rebound. The management’s focus on maintaining profit margins and controlling content costs further supports sustainable profitable growth. Additionally, the rise in advertiser interest and the recovery of high-growth verticals in the advertising industry contribute to the positive outlook. I maintain my buy rating for IQ.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.