Summary:

- iQIYI’s fourth quarter numbers were fine with 3% revenue growth, operating margin growth and 11% year-over-year growth in net subscribers.

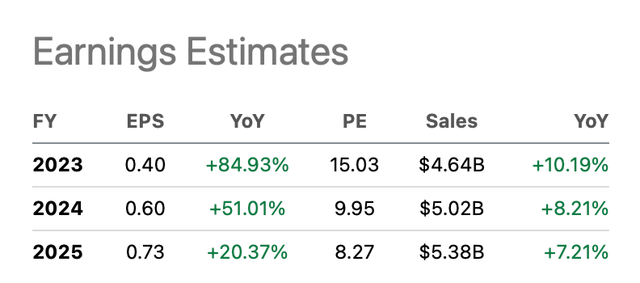

- Analysts are positive and expect solid earnings per share growth for the next few years. The 2025 forward P/E ratio is only 8.3.

- Still, dark clouds hang over iQIYI as the CCP implements their Common Prosperity policy.

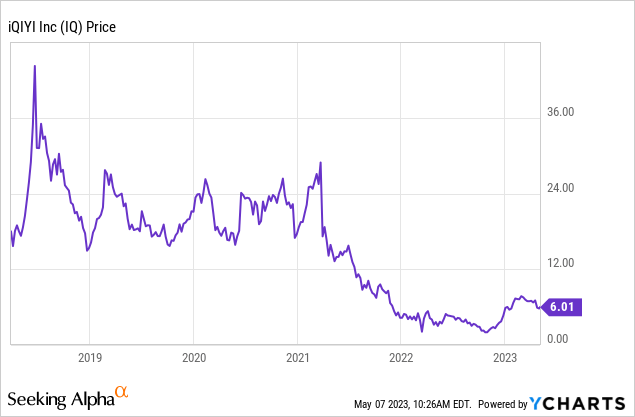

- The stock already showed strong volatility and peaked at $40 but plunged to $2, so it is suitable for investors who can tolerate this intense volatility.

- iQIYI is worth buying because the outlook is excellent, the company has become profitable and the stock’s valuation is very attractive.

Spencer Platt

Introduction

iQIYI (NASDAQ:IQ) has had a wild ride since its IPO where the stock peaked at $40 with declines to $2. It is therefore suitable for investors who can tolerate high volatility in my view.

The stock fell hard due to a sudden slowdown in revenue growth, but earnings also lagged. My investment in Alibaba (BABA) has taken a major hit ever since Common Prosperity made their introduction. I decided to sell Alibaba due to the lack of clarity surrounding its future. I also sold Alibaba because the SEC threatened to remove Chinese shares from the Nasdaq, and this risk applies to iQIYI as well.

Sales and earnings expectations are strong, and the sharp price decline makes the stock’s valuation favorable. Despite the significant risks, I give iQIYI a buy rating for investors who can tolerate these risks.

Fourth Quarter and Full Year Earnings

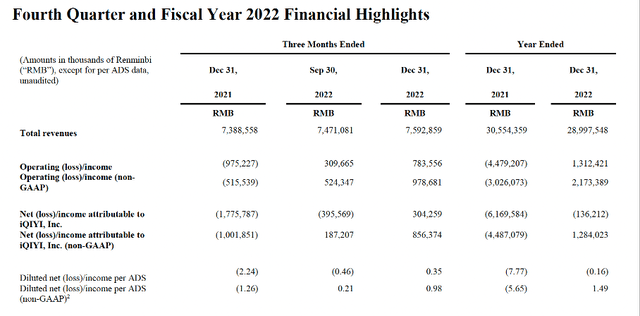

Fourth quarter 2023 earnings (iQIYI investor relations )

In the fourth quarter of 2022, revenues increased 3% year-on-year to $1.1 billion. iQIYI was profitable and the margin on operating income was 10%, compared with a loss in the same quarter last year. This resulted in positive non-GAAP net income of $124 million.

The fourth quarter was a good quarter because for the full year 2022, revenues were down 5% and operating margin was also low at 5%.

iQIYI recorded more than 10 million net subscribers in the fourth quarter. The average daily number of total subscribers was 112 million, compared to 101 million for the same period in 2021. Another good point is that average monthly revenue per membership increased to RMB14.17, compared with RMB13.9 for the third quarter in 2022.

Three capital increases have been made to reduce debt, so financial prospects are bright as well. This has made the company’s financials much stronger, and iQIYI is now generating positive earnings. About 16 analysts are positive about its prospects and expect solid revenue and earnings growth. Earnings per share are expected to grow in double digits, bringing the PE ratio to just 8.3 by 2025. If growth actually materializes, this is very promising.

iQIYI’s earnings estimates (IQ ticker page on Seeking Alpha)

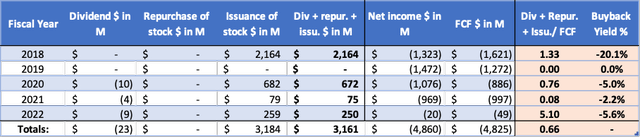

Share Issuances

Neither dividends nor share repurchases are offered by iQIYI. It has grown through the issuance of stock. More than 20% of its shares were issued in 2018, greatly diluting the interests of equity investors. The share price peaked to $40, but quickly plummeted to $15 in December 2018. Equity issuance, in my view, is a negative concept because it can cause the share price to fall. However, this is not always the case. A good example is Tesla (TSLA). Tesla issued shares to finance the expansion of their production sites. Over time, these production sites became profitable, favoring investors. In contrast, iQIYI’s revenue growth lagged and the company had to issue shares to raise capital.

Since the company’s losses are decreasing, there is no longer a need to issue new shares at this time. The previous financial outlook was dismal, but significant progress has been made since then.

iQIYI’s cashflow highlights (Annual reports and analyst’ own calculations)

Valuation

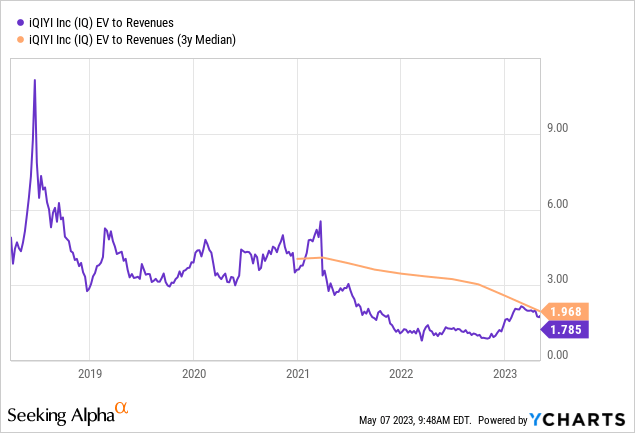

The stock’s valuation is difficult to map due to the lack of earnings and positive free cash flows. Therefore, I map its valuation using the enterprise value-to-revenue ratio. This ratio also incorporates the amount of debt and cash.

We see that this ratio has made wild fluctuations. The Enterprise Value to Revenue ratio is currently 1.8, but it was lower in 2022. So what is a fair valuation? That is hard to determine. For example, I expect that the EV/Revenue ratio will never reach 4 (Alphabet’s (GOOGL)(GOOG) EV/Revenue ratio) because iQIYI’s gross margin is much lower. Its gross margin is only 29%, while Alphabet’s is 55%. I think an EV to Revenue ratio of 2 is a fair valuation of the stock. Looking at forward earnings, we see an attractive forward 2025 PE ratio of only 8.3. iQIYI is therefore undervalued in my view.

Conclusion

iQIYI had a wild ride since its IPO, but has been on the right track lately. Its fourth quarter numbers were fine with 3% revenue growth, operating margin growth and 11% year-over-year growth in net subscribers. With the funding round, iQIYI’s balance sheet looks very good and the company is now on a profitable path. Analysts are positive and expect solid earnings per share growth for the next few years. The 2025 forward PE ratio is only 8.3. Still, dark clouds hang over iQIYI as the CCP implements their Common Prosperity policy. iQIYI shares could potentially be delisted from the Nasdaq. This could cause high volatility and perhaps strong declines in its stock price if investors had to sell the shares en masse on the Nasdaq. The stock already showed strong volatility and peaked at $40 but plunged to $2, so it is only suitable for investors who can tolerate this intense volatility. iQIYI’s growth was made possible in part by issuing shares, but now that the company is profitable, that should no longer be necessary. As a result, the financial picture looks a lot better now. Looking at the stock’s valuation, we also see attractiveness with an enterprise value-to-revenue ratio that is historically low. iQIYI is worth buying because the outlook is excellent, the company has become profitable and the share valuation is very attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.