Summary:

- iQIYI, Inc.’s profitability is starting to show.

- The total addressable market is enormous, and the company has a lot of room for growth.

- High-quality programming is increasing subscriber count, while advertising is seeing a re-emergence, which will benefit the company.

- Even with the very conservative estimates, the company is a buy.

demaerre

Investment Thesis

I wanted to take a look at iQIYI, Inc. (NASDAQ:IQ) to see if it would be a good time to start a position before it reports earnings close to the end of this month. The company is poised to come out of the hole and start to be profitable going forward and it seems like a turning point is upon us. The past financials were not looking the best; however, these have improved recently, therefore I initiated my coverage of the company with a buy rating and have opened a small position. There are risks associated with the company so please do your due diligence before committing your capital.

Comments on the outlook

Streaming

The company is known as the “Netflix of China”. It has been producing high-quality content for a while and has become the leading streaming platform in terms of long-form content like Netflix, Inc. (NFLX). It is hard to be a streaming business, and many similar companies are burning cash and not making any profits besides Netflix. IQ has been net income positive on a GAAP basis for the last two quarters now and the management is looking to maintain that momentum going forward citing Mr. Yu Gong:

“Our original content strategy continued to deliver top-notch titles, which in turn brought the strongest second-quarter performance in our history in terms of key metrics, such as total revenues, profits, free cash flow, and average daily subscribers.” Mr. Yu Gong also mentioned that the company is investing in many new technologies to better prepare IQ for future growth like Generative AI.

If the company can manage to produce high-quality content that got it to become profitable recently, I believe it will see its profits grow massively, and coupled with the revolution of AI, the company will be running more efficiently, thus more profitably going forward. Currently, the company has around 110m paying subscribers, which is a lot, however, the size of China and surrounding regions where IQ is available, is much bigger so the total addressable market is enormous. Netflix has around 247 million paying subscribers globally, and it is facing a lot of stiff competition. If IQ can grow its subscriber base consistently, the growth could be tremendous in my opinion.

Advertising Revenue

The advertising side of the business has seen massive growth over the last while, with the latest quarter showing a very healthy growth of around 25% y/y to $206m. There is a nice recovery afoot for the advertising side of the business as the performance ad revenue doubled in Q2 to reach a historical high, while still seeing acceleration in growth. The company is employing AI to enhance ad creation and improve ROI, and it seems to be working out for them as that is phenomenal growth.

The company saw an increase in ad revenues coming from their highly rated dramas, as more and more advertisers are signing annual contracts, so if the company can succeed in attracting a high subscriber base, the advertisers will continue to flock to the platform and average revenue per members or ARM will continue to improve over time.

Advertising works in streaming platforms, although as much as I hate seeing ads coming back and turning my on-demand platforms into cable once again, it’s been very profitable for many streaming platforms to offer ad-tier subscription services and IQ will not pass up this opportunity.

Analysts Estimates

So, with such high growth that the company achieved from the two main revenue generators, I was very surprised to see that analysts’ estimates for the revenues are rather lackluster. The company managed to achieve 17% revenue growth and the management appears quite optimistic for the future, especially in terms of advertising recovery. In my opinion, the company will see low-double-digit growth for the next couple of years if I’m being conservative, so I don’t agree with the analysts’ estimates. The company is the Netflix of China, with high-quality production content that can retain and attract high-quality subscribers. This, coupled with further advancements in AI that help tailor the content to be more efficient, is why I could see the company retaining its profitability going forward.

Briefly on Financials

As of Q2 ’23, the company had around $840m in cash and equivalents against around $1.6B in long-term debt. So how worrisome is this debt? Well, if we look at the company’s operating income and 6 months ended June interest expense, we get an interest coverage ratio of around 2.6. This means that EBIT can cover annual interest expense on debt 2.6 times over, which according to many analysts is healthy. I prefer to be more conservative and usually look for companies that can cover interest expenses at least 5 times over. This way I feel much safer when a company has a bad year or two and the coverage ratio dips below 5 but if it was at 2 already then, the debt is not manageable and there isn’t much wiggle room.

The company’s current ratio has not been particularly great over the last couple of years, and it has not improved in the latest quarter either. The company has a lot of short-term loans and deferred revenue, which makes sense given the business is subscription-based. So, I wouldn’t think this is very worrisome. The company is paying off the debt slowly so that should improve the ratio slightly over time. Netflix’s current ratio as of September ’23 stood just over 1.3 so it’s not too far apart but if Netflix can do it, so can IQ, therefore I will add a bit more margin of safety to my intrinsic value calculation.

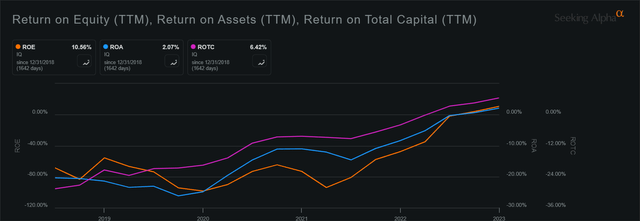

In terms of profitability and efficiency, we can see that these have improved dramatically over the last while and are in the positive territory, which looks like a turnaround to me that is going to hold up because of the management’s focus on high-quality content and subscriber retention. These are the reasons the company finally became profitable in my opinion. The metrics aren’t very impressive yet, however, it does seem like it is the beginning of an uptrend and only time will tell if the company succeeded.

Profitability and Efficiency improving (Seeking Alpha)

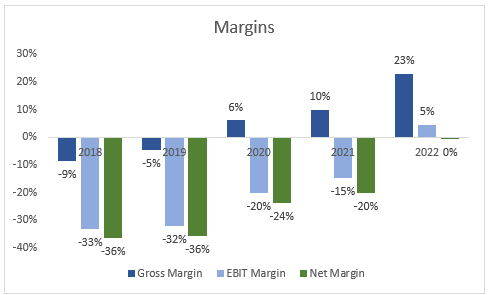

In terms of GAAP margins, historically these have been horrible, to say the least, however, we can clearly see massive improvements over the years, and as of Q2 ’23, gross, operating, and net margins were 27%, 9%, and 6%, respectively, which is quite an impressive improvement.

IQ Margins (Author)

Overall, there is a clear turnaround in the company’s profitability and I would like to see this continuing over the next couple of years, however, it is still too early to tell if it will be sustainable. I believe that the period of unprofitability has passed and now the company will be profitable going forward.

Valuation

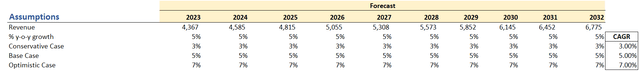

I said that I don’t believe the company’s revenues are going to grow as slowly as the analysts are saying, however, to be on the conservative side of things I decided to go with similar growth rates. This way I will get an extra margin of cushion. Below are my assumptions for the three cases.

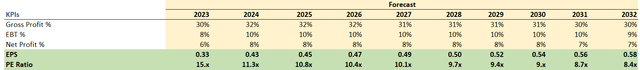

In terms of margins and EPS, I decided to lowball estimates compared to the analysts as well for even more cushion. Below are my estimates.

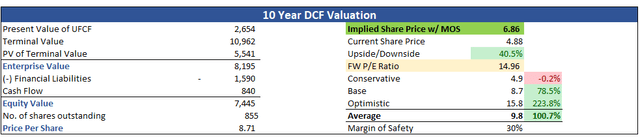

For the DCF analysis, I went with the company’s weighted average cost of capital or the WACC of around 7% as my discount rate and 2.5% for the terminal growth rate. On top of these estimates, I went ahead and added another 30% margin of safety to give me that sleep-well-at-night feeling that I need with all my investments. With that said, IQ’s intrinsic value is $6.86 a share, implying that the company is trading at a 40.5% discount to its fair value.

Risks

The opening up of China may present a slight slowdown in subscriber count since fewer people are going to stay at home all day and watch internet shows. So far, the re-opening has been rather slow, which is good for the company, however, there will be a time when people decide to hang out with their friends and family in the restaurants rather than facing a screen.

Since it is a Chinese company, there are going to be those whole political risks, where the Chinese government is very unpredictable, and the tensions between China and the US are still the talk of the town. Many investors tend to avoid Chinese names because of it and the company may never reach its full potential.

There is also around 11% short interest on the company, which not only supports my thesis on the dislike of Chinese names but also there could be something that I don’t know that will bring down the stock further. On the other hand, we could see another rally as short sellers start to cover their positions, but that fad seems to have subsided about a year ago when many companies saw their share price increase due to GME/AMC fiasco.

Closing Comments

It seems that it is not a bad time to start a position here as it looks like the company is seeing a turnaround and is becoming profitable. I have opened up a small position recently and will see how it develops over the next couple of years, but I believe that the risk/reward is very attractive here, and if the share price comes down after the earnings while the long thesis is still intact, I will most likely develop the position fully and give it a few years before selling it.

The risks are something to think about, however, I believe that the worst has been priced in already and I am putting my trust in the management of the company to reward the company’s shareholders in the long run.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.