Summary:

- iQIYI is trading at multiyear lows, with significant investments in AI and R&D expected to drive user growth and net sales.

- Baidu’s control and support, including increased user traffic, bolster IQ’s potential for future growth and profitability.

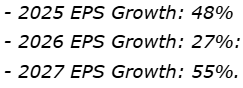

- Despite recent profitability and reduced debt, IQ remains undervalued compared to peers, with a promising EPS growth forecast for 2025-2027.

- Risks include potential declines in advertising revenue, content production challenges, and regulatory impacts on data privacy and international investments.

PM Images

iQIYI, Inc. (NASDAQ:IQ) represents one of the largest streaming video platforms in China, and currently trades at multiyear lows. With a growing platform of users and most employees dedicated to research and development, IQ also revealed extensive use of artificial technologies to offer better video content as well as to enhance search capabilities. IQ does trade significantly undervalued as compared to other companies developing artificial technologies all over the world. In addition, there is the fact that Baidu, Inc. (BIDU), the largest search engine in China, signed agreements to provide user traffic to IQ. In sum, there are many reasons to believe that the stock could trade at better price marks in the future.

IQ

With operations in China, IQ offers video content online. In 2023, the company owned a total of 40k titles and a large number of diversified video content including drama series, variety shows, films, and others.

In the last quarterly report, the company noted that it has one of the largest subscribing member bases among all internet streaming services in mainland China. The company successfully developed diversified monetization models including membership services and online advertising services.

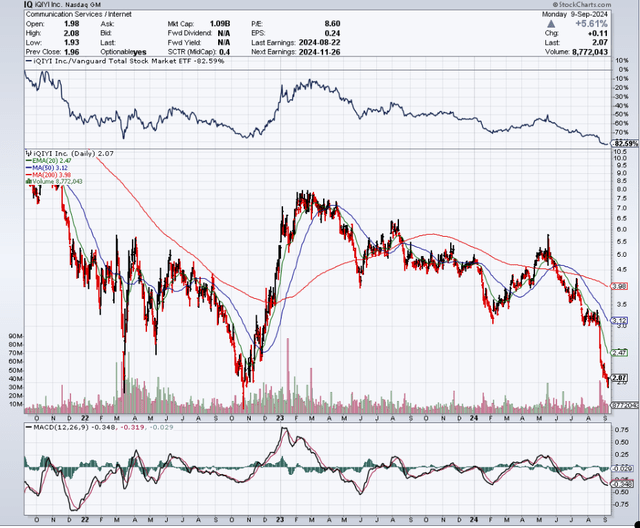

The Stock Is Trading At Multiyear Minimum Price Marks

If we do not look at the company’s financial statements, IQ’s stock price appears quite undervalued. When the IPO was executed many years ago, the stock traded at many times the current share price. We can buy shares today at not far from $2-3 per share.

I think that there are large stock buyers between $2 and $3 per share, which may explain why the stock price did not really fall below $2-$3. In my view, if the demand for the stock continues, and net income growth continues, we could see an increase in the stock price in the future.

In the last quarterly report, the company reported better than expected quarterly revenue. Besides, the EPS was not lower than expected. Goldman did cut its rating, which pushed the stock price down. However, many analysts think that the stock is a buy. The average price target is larger than the current price mark.

In My View, Artificial Intelligence Could Accelerate Net Sales Growth

The company uses AI technology for video content creation, purchase, production, tagging, distribution, monetization, and customer service. In the last annual report, IQ delivered significant information about the use of AI technology to enhance the platform. In this regard, investors could read the following lines from the last 20-F.

We have developed and put into use an integral set of technology infrastructures and tools, comprising of intelligent integrated production systems that improve digital workflow by integrating and streamlining the elements of video production; production business intelligence systems and integrated production tool sets that empower content producers with AI-powered decision-making, and other tools that support the facilitation of the content production process. Source: 20-F.

In my view, IQ will most likely learn a lot more about its customers in the coming years thanks to AI. My main thesis about the company is that the new learning from AI will most likely accelerate viewership and monetization, and will most likely bring net sales growth generation. With other companies using AI in the United States trading at high valuations, I do not think many investors did take a look at IQ.

I Think That Investments In Research And Development Could Enhance Net Income Growth

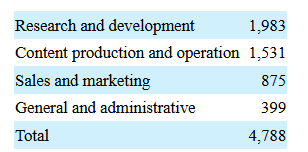

The company continues to make significant investments in research and development. These investments are expected to enhance user profiling and content recommendation. The company also uses AI Radar and Watch Me Only to support real-time recognition besides searching information from video images. As a result, clients can search content specifically from certain artists, or do better searches. In my view, these features will most likely accelerate subscribers, and bring net sales growth. The company gave the following information about R&D expenses in the last 20-F:

In the years ended December 31, 2021, 2022 and 2023, our research and development expenditures, including share-based compensation expenses for research and development staff, were RMB2,794.9 million, RMB1,899.2 million and RMB1,766.6 million (US$248.8 million), respectively, representing 9.1%,6.5% and 5.5% of our total revenues for the years ended December 31, 2021, 2022 and 2023, respectively. Source: 20-F

I reviewed the total number of employees and their activities. According to the last annual report, a significant number of employees work in research and development. There are more employees doing R&D than employees doing marketing or content production. Take a look at the following table from the annual report.

Source: 20-F

It means that the company is really betting on technological developments inside IQ. Given that the company is really making a lot of efforts to provide quality video content and technological innovations, I expect net sales growth in the future.

Baidu Controls IQ, And Accepted To Increase IQ’s User Traffic

I think that it is interesting to review the list of shareholders and the voting power. The company reports two classes of shares. Class B shares offer more voting power per share than class A shares do. In this regard, the following lines are from the last 20-F.

Each holder of our Class B ordinary shares is entitled to ten votes per Class B ordinary share. Our Class B ordinary shares are convertible at any time by the holder into Class A ordinary shares on a share-for-share basis. Source: 20-F

There is one shareholder, Baidu, which owns close to 89% of the total voting power. I am not at all concerned about this fact. Baidu is also a technological company, which means that it understands well what IQ does. In my view, it will most likely elect clever executives to the Board of Directors, and make clever decisions about the future of IQ. Baidu and IQ signed agreements with regard to future developments. Besides, Baidu agreed to increase IQ’s user traffic, which appears quite ideal. In this regard, I would read the following words.

We and Baidu agree to cross-sell our respective advertising services, and Baidu agrees to grant us priority to advertise on its platform; we and Baidu agree to leverage our respective services to increase user traffic; and we and Baidu agree to allow our respective registered users and content providers to log onto each other’s platforms. Source: 20-F

Undervalued, And 2025 EPS Expectations Stand At Close To 48% Y/Y

I do not think investors successfully reacted to the recent increase in profitability seen in the last two years. Both the net income and the free cash flow increased recently after many years of negative results. Unlevered free cash flow in the last three years stood at more than $2 billion, and appears to be accelerating. In my view, investors running financial models about the company will most likely discover that the company is substantially undervalued.

With new cash accumulating, the company gradually reduced its total amount of debt, so net debt appears quite under control right now. As shown in the last quarterly report, in August 2024 the company repurchased its convertible senior notes due 2026.

In August 2024, the Company completed the repurchase right offer for its 4% convertible senior notes due 2026 (the “Notes”). An aggregate principal amount of US$395.5 million of the Notes were validly surrendered and repurchased with an aggregate repurchase price (including the aggregate principal amount of the Notes plus accrued and unpaid interest) of US$397.5 million. Source: Quarterly Report

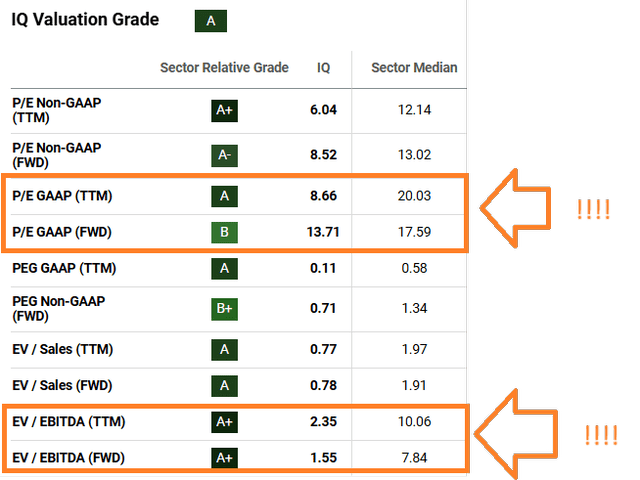

It is also worth noting that the total amount of equity also increased in the last three years. The book value per share is currently not far from the current share price. Companies in the United States running artificial technology never trade close to the book value per share.

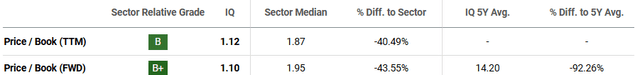

Currently, the company’s PE GAAP FWD ratio is close to 13x, and the PE GAAP TTM stands at 8x. Besides, the company’s EV/ FWD EBITDA appears to be close to 1x-2x. In sum, there are many variables indicating that the company is quite undervalued.

In my view, as soon as more analysts take a look at the EPS expectations for 2025, 2026, and 2027 the stock price could trend north. I obtained the following figures from Seeking Alpha:

Source: Seeking Alpha

There Are Some Risks

The company signs agreements with advertising agencies from China. These agencies receive rebates based on the volume of business that they bring to IQ. According to the last annual report, IQ noted that the number of advertising agencies in China decreased as a result of a consolidation phase. In my opinion, lower advertising budgets, lower demand, or work from advertising agencies could lower the amount of money that IQ collects. If advertising revenue declines, IQ could deliver lower EPS growth and FCF growth. In the worst-case scenario, we could see a decline in the stock price.

The company’s business model mainly depends on the ability to produce good content. In this regard, it is necessary to have qualified personnel. In the last decade, IQ hired a significant number of employees, and the number of subscribers increased. In sum, I think that IQ’s talent acquisition abilities are beneficial. With that being said, in the future, the company may not be able to provide high-quality original content offerings for many reasons. Artists may decide not to work for IQ, or other platforms could pay more than IQ. As a result, the number of subscribers and visitors could lower. In the worst-case scenario, net income growth could be lower.

The company’s business is subject to new regulations with regard to information security, privacy, and data protection. If new laws in China damage the company’s freedom to sell, transmit, and exploit information from millions of clients, I think that the company’s net income growth could be lower. If a sufficient number of analysts write detrimental reviews about the company, and expectations about future EPS decline, the stock price could be lower.

Among the new laws, which could damage the company’s revenue line, there is the PRC Cybersecurity Law. The law requires that network operators collect and use personal information. If the company fails to respect such new regulations, the fines could affect the company’s net income. IQ offered substantial information about these matters in the last annual report.

The PRC Cybersecurity Law, which took effect in June 2017, created China’s first national-level data protection framework for “network operators.” It is relatively new and subject to interpretations by the regulator. It requires, among other things, that network operators take security measures to protect the network from unauthorized interference, damage, and unauthorized access, and prevent data from being divulged, stolen, or tampered with. Source: 20-F

The company may also suffer substantially if the ADSs cannot be sold in the United States because of the Holding Foreign Companies Accountable Act. As a result, I think that the total amount of cash received from international investors could be lower, which may lead to lower cash per share and book value per share. Besides, IQ may not be able to invest in research and development, and future net sales growth expectations could be lower.

My Opinion

IQ is currently trading at multiyear lows after delivering positive unlevered free cash flow for some years. Besides, the company continues to invest substantially in research and development, and artificial intelligence technologies continue to enhance video content and search capabilities. The fact that Baidu controls IQ and appears to help the company increase its user traffic. I do not see what could go wrong in terms of traffic generation and user growth. Baidu is like Google in China. In my opinion, if free cash flow growth continues, and a sufficient number of investors study the company’s financials, the stock price could trend back up. The recent reduction in the total amount of debt, recent equity growth, and the price/book value per share indicate that IQ appears to be significantly undervalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.