Summary:

- 3M Company is one of the largest manufacturing companies in the world, headquartered in St. Paul.

- On October 24, 3M will publish its financial report for the third quarter of 2023.

- Simultaneously, 2023 is a transition year when the company’s management had to use maximum efforts to reach agreements to resolve ongoing litigation that has been going on for many years.

- Furthermore, the company’s Non-GAAP P/E [TTM] is 9.73x, 40.74% lower than the sector average and 41.85% lower than the average over the past five years.

- We initiate our coverage of 3M with an “outperform” rating for the next 12 months.

Lorado/E+ via Getty Images

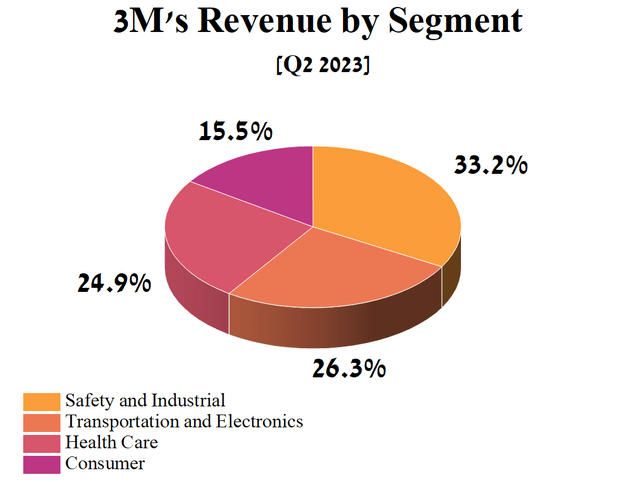

3M Company (NYSE:NYSE:MMM) is one of the largest manufacturing companies in the world, headquartered in St. Paul. The company operates through four business segments: Transportation and Electronics, Consumer, Security and Industrial, and Health Care.

Author’s elaboration, based on quarterly securities reports

3M is known worldwide for its extensive portfolio of innovative products, which include, but are not limited to, skin care products, electrical products, building materials, respiratory protection products, structural adhesives, and tapes used in various industries, including aviation.

Simultaneously, 2023 is a transition year when the company’s management had to use maximum efforts to reach agreements to resolve ongoing litigation that has been going on for many years. So, on June 22, 2023, 3M reached a $10.3 billion settlement with various U.S. public water systems to resolve thousands of lawsuits over water contamination with per- and polyfluoroalkyl substances (PFAS). However, this amount will be paid over 13 years, and given the company’s year-on-year revenue growth, we do not expect it to jeopardize its financial position.

Additionally, on August 29, 2023, the company reached an agreement to pay $6 billion between 2023 and 2029 to settle lawsuits by U.S. service members and veterans claiming they suffered hearing loss due to the use of 3M earplugs.

On the other hand, despite rising geopolitical tensions in the Middle East, which could potentially lead to significant increases in hydrocarbon prices, 3M is considered a defensive stock due to its stable cash flow even during periods of rising inflation.

However, despite the problems associated with growing inflation in the world, including due to rising hydrocarbon prices, 3M Company’s gross margin has continued to increase over the past few quarters. As a result, the company’s top five shareholders, including well-known financial organizations such as Vanguard Group, State Street, Charles Schwab Investment Management, Geode Capital Management, and Blackrock, have a combined stake of 26.56% at the end of June 2023.

Author’s elaboration, based on Yahoo Finance

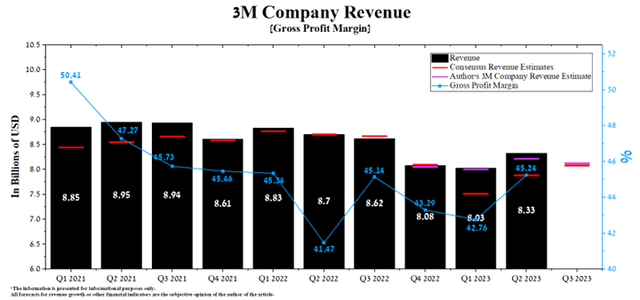

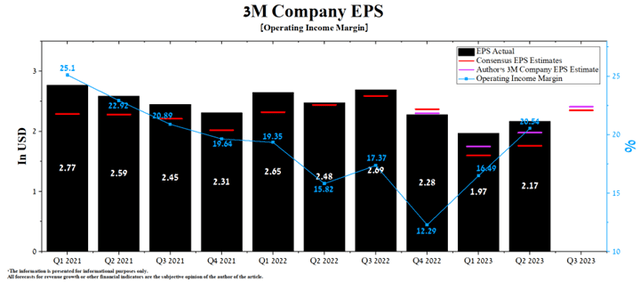

The second quarter of 2023 showed excellent results, as 3M’s revenue and EPS exceeded analysts’ expectations significantly, and its margins continued to grow year-on-year and quarter-on-quarter despite rising inflation in the United States in recent months.

On October 24, 3M will publish its financial report for the third quarter of 2023. According to Seeking Alpha, 3M’s revenue for the third quarter of 2023 is expected to be $7.94-$8.37 billion, down 7.2% year-over-year and up 2.1% from analysts’ expectations for the previous quarter. At the same time, per our model, the company’s total revenue will be within this range and amount to $8.12 billion.

3M’s year-on-year decline in revenue will be due to the strengthening of the US dollar against other major currencies and a decrease in demand for the company’s products in Canada, Japan, and China due to raised household debt, which, among other things, leads to a decrease in consumer spending.

Author’s elaboration, based on Seeking Alpha

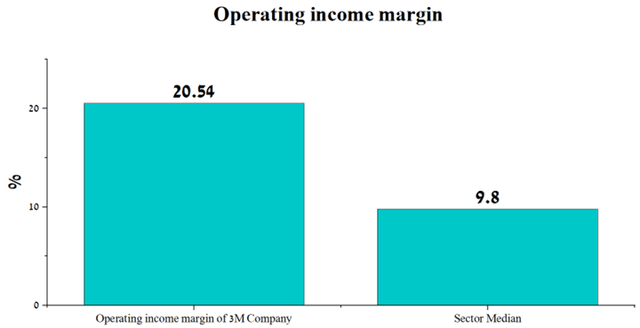

On the other hand, 3M’s operating income margin in Q2 2023 was about 20.5%, an increase of 4.72% relative to Q2 2022, but more importantly, it is significantly higher relative to the industrial goods sector.

Author’s elaboration, based on Seeking Alpha

At the same time, we predict that 3M’s operating profit margin will reach 18.5% by 2023. On the other hand, in 2024, this financial metric will increase to 19.1%, thanks to lower prices for raw materials and electricity needed to produce the company’s products, an increase in total sales year-on-year, higher consumer spending as central banks lower interest rates and a weakening US dollar relative to other foreign currencies.

According to Seeking Alpha, 3M’s Q3 EPS is expected to be $2.25-$2.39, up 33.5% from the Q2 2023 consensus estimate. At the same time, according to our model, 3M’s EPS will be above this range and amount to $2.41.

Furthermore, the company’s Non-GAAP P/E [TTM] is 9.73x, 40.74% lower than the sector average and 41.85% lower than the average over the past five years. Nonetheless, 3M’s Non-GAAP P/E [FWD] is 9.99x, which is one of the factors indicating its significant undervaluation by financial market participants during the new war in the Middle East.

Author’s elaboration, based on Seeking Alpha

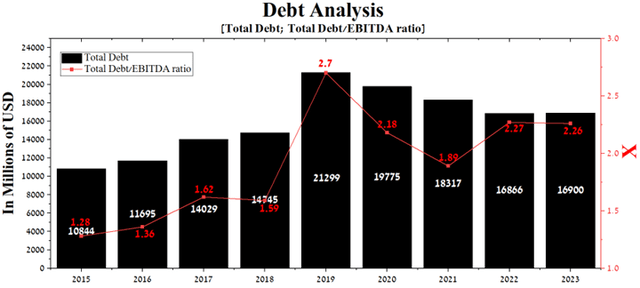

Even as 3M continues to settle numerous lawsuits brought against it by tens of thousands of people, the company’s debt continues to decline yearly. At the end of the second quarter of 2023, 3M’s total debt was about $16.9 billion, down 7.7% from 2021. Moreover, in recent quarters, there has been an increase in the company’s EBITDA, which is reflected in the stabilization of its total debt/EBITDA ratio of about 2.25x.

Author’s elaboration, based on Seeking Alpha

Conclusion

3M Company is one of the largest manufacturing companies in the world, headquartered in St. Paul. Moreover, the company is known worldwide for its extensive portfolio of innovative products, which include, but are not limited to, skin care products, electrical products, building materials, respiratory protection products, structural adhesives, and tapes used in various industries, including aviation.

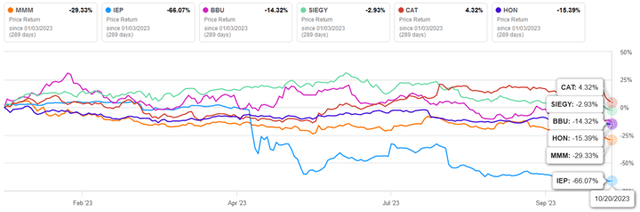

Simultaneously, 2023 is a transition year when the company’s management had to use maximum efforts to reach agreements to resolve ongoing litigation that has been going on for many years. As a result, the company’s share price has declined by more than 39% since the start of 2023, underperforming key competitors in the industrial sector such as Caterpillar (CAT) and Honeywell International (HON).

Author’s elaboration, based on Seeking Alpha

Meanwhile, for 64 years, 3M has maintained a policy of increasing dividend payments year after year, which is one of the crucial investment theses that helps attract the interest of long-term investors.

We initiate our coverage of 3M with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.