Summary:

- Pfizer Inc. stock has taken a beating after its COVID-19 products experienced steep declines in revenue and underperformed market expectations.

- While Pfizer’s dividend looks cheap, the company continues to face a major risk.

- We discuss its growth outlook and current valuation and share our take on whether it is a Buy before it releases Q1 results.

z1b

Back in late January, I wrote an article titled “Why I’m Avoiding 6% Yielding Pfizer Stock.” In it, I outlined the fact that Pfizer Inc. (NYSE:PFE) has many things going for it, such as a strong investment grade credit rating and a stable outlook from S&P, global scale, a proven track record and significant intellectual capital in its research and development platform, an attractive current dividend yield, and a proven dividend growth track record with a 15-year streak.

Moreover, it recently closed the acquisition of Seagen, which provided a substantial leap forward in the company’s oncology pipeline, positioning it to potentially become a leader in the oncology space in the years to come. Last but not least, the CEO also emphasized at a recent healthcare conference that the company remains firmly committed to its dividend, calling it a “sacred cow,” and reaffirming its intent to continue growing the dividend, saying that its dividend growth strategy will not change.

That being said, I was cautious about the stock because its earnings were plummeting following declining demand for the company’s COVID-19 products. Consequently, its leverage had soared significantly higher due to its expensive investment in acquiring Seguin. This made the stock increasingly speculative and put an enormous amount of pressure on the company’s pipeline to deliver significant growth in the future to make it worth investing in. Despite the broader S&P 500 (SP500) rising by 5% since my last article on PFE was published, PFE has declined by 10%, validating our caution on the stock.

That being said, given the recent pullback in the stock price, I am going to take a fresh look at the stock ahead of PFE releasing its Q1 results post-market on May 1st to see if it’s worth buying on the dip.

PFE Stock’s Biggest Risk

The biggest issue with Pfizer right now is that roughly half of its 2023 revenue either came from its COVID-19-related products (~22% of 2023 revenue) or from leading products that have an upcoming loss of patent exclusivity (Eliquis made up ~12% of 2023 revenue and has an LOE in 2026, Prevnar made up ~11% of 2023 revenue and has LOEs in 2026 and 2033, and Ibrance made up 8% of 2023 revenue and has an LOE in 2027), which are likely to see sharp revenue declines in the coming years, significantly weighing on the company’s growth potential. For more on this, fellow analyst Doc on Stocks provides a nice detailed analysis of PFE’s revenue headwinds in his recent article, “Pfizer’s Doldrums, Just A Bad Case Of COVID-19?”

As a result, despite PFE investing heavily in the Seagen acquisition and also investing significant amounts in its organic development pipeline, analysts only project revenue growing at a 0.9% CAGR through 2028. Moreover, this still assumes relatively positive outcomes from its development pipeline, of which there’s no guarantee. Given that organic business is expected to see significant declines in the coming years, PFE is going to need average or better-than-average performance from its development pipeline to generate sufficient growth to offset its significant revenue headwinds.

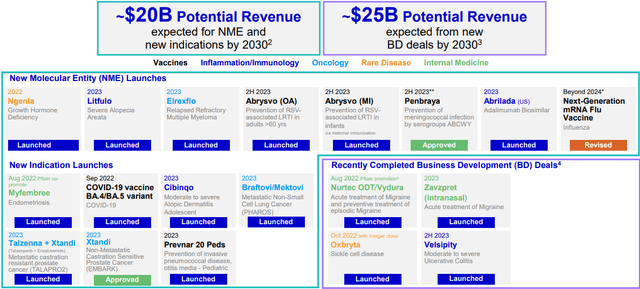

In its Q4 2023-slide deck, management tried to address these concerns by emphasizing how important its oncology pipeline is to its long-term investment thesis. They pointed out that one in three people will be diagnosed with cancer in their lifetime, making oncology one of the largest and fastest-growing therapeutic areas. They also highlighted how Seguin doubles the size of Pfizer’s oncology pipeline and late-stage development programs, and that Seguin’s inline medicines are already expected to enhance Pfizer’s top-line growth. When combined with Pfizer’s existing portfolio of drugs, it provides the opportunity for the company to lead in genitourinary and breast cancers while delivering at least eight potential blockbuster products by 2030.

PFE Pipeline (Investor Presentation)

While the company’s growth goals are quite rosy (as depicted in the graphic above), the company provided disappointing 2024 COVID-19 product guidance of just $8 billion, and it also acknowledged it is unlikely to hit its previous 6% growth rate guidance from 2020 to 2025, excluding COVID-19 product sales.

Taking a look at its valuation shows that it currently trades at a price-to-earnings ratio of 11.5 times, which is only slightly below its five-year average of 11.86 times. Meanwhile, its enterprise value to EBITDA valuation multiple is currently 10.44 times, which is actually at a premium to its five-year average of 9.73 times.

One valuation that looks quite attractive currently is the dividend yield at 6.39% compared to its five-year average of 4.05%. However, this is more a product of its dividend payout ratio starting to become fairly elevated at an unexpected 77% this year. Definitely not in the danger zone yet, but when you combine this fairly low payout ratio with the need to continue investing in its research and development pipeline to support its long-term revenue growth in the face of aforementioned headwinds, we also keep in mind its considerable debt pile of approximately $72 billion, including short-term and long-term debt.

PFE Stock Valuation

In addition to the uncertain outlook for its growth, PFE’s current valuation does not look particularly appealing, especially given how much interest rates have risen over the past five years. Its NTM P/E ratio of 12.64x is well above its five-year average of 11.92x, and its NTM EV/EBITDA ratio of 11.04x is well above its five-year average of 9.76x. While these numbers are somewhat skewed by the huge spike in EBITDA and EPS over a short period of time due to the COVID-19 windfall, expanding this average out over the past decade still leaves the valuation at a relatively unattractive level, with a 10-year average P/E ratio of 12.9x and a 10-year average EV/EBITDA ratio of 10.02x.

Moreover, while the dividend is attractive at 6.7%, and it appears that the company is committed to supporting and even growing it for the foreseeable future, if its development pipeline underperforms in the future, the dividend could very possibly be threatened, as the company will likely need to heavily prioritize debt reduction in such a scenario and doubling down on investments in trying to reignite its growth engine.

Investor Takeaway

While Pfizer is not the worst bet one can make in the healthcare space, especially if current income is a priority, and you like its structural competitive advantages and strong credit rating, I still do not see a compelling enough risk-reward profile to make me want to buy Pfizer Inc. stock before Q1 earnings.

Investors should be paying close attention to management language surrounding specific plans for deleveraging the balance sheet while supporting the dividend and, most importantly, they need to be tracking development pipeline updates to see if the company’s chances of delivering on its potential are increasing or fading, as this will ultimately determine the future of the dividend, not the current payout ratio.

Overall, I rate Pfizer Inc. stock a Hold and remain on the sidelines for now, as I am finding much more attractive opportunities at similar yields but with much more secure, long-term growth profiles.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio which has beaten the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing high yield-seeking investment service on Seeking Alpha with ~1,200 members on board and a perfect 5/5 rating from 166 reviews.

Our members are profiting from our high-yielding strategies and you can join them today at a compelling value.

With the 2-week free trial, you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!