Summary:

- AbbVie investors that bought the anxiety over the loss of Humira exclusivity are sitting on massive gains.

- There are three significant reasons for optimism from here.

- However, the dividend yield is near its lowest point in six years; it may pay to wait for another dip.

jroballo/iStock via Getty Images

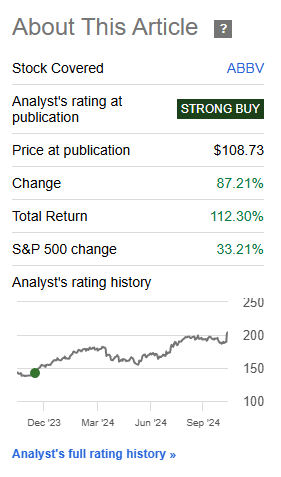

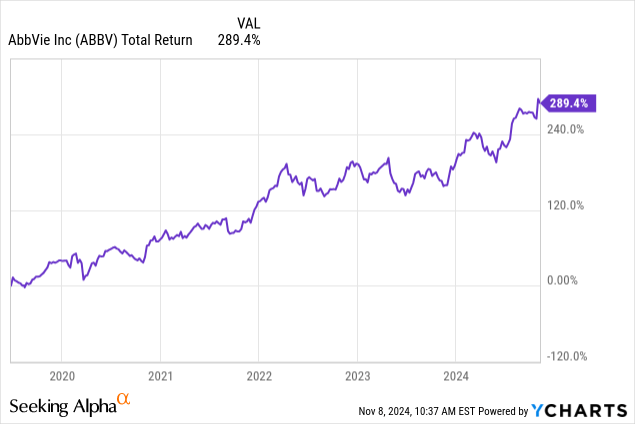

AbbVie (NYSE:ABBV) stock continues to defy gravity, shrugging off the loss of Humira exclusivity. Since 2019, management has done a fantastic job setting the company up for success post-Humira. AbbVie stock has a total return of more than three times the S&P 500 since I first covered the stock in 2021, as shown below.

Seeking Alpha

Over the past five years, AbbVie’s total return is 208% compared to the SPY (SPY) at 101% and outperformed the high-flying QQQ (QQQ), which returned 153%. Even better, AbbVie isn’t subject to crazy swings like many tech stocks and it is an excellent passive income stock.

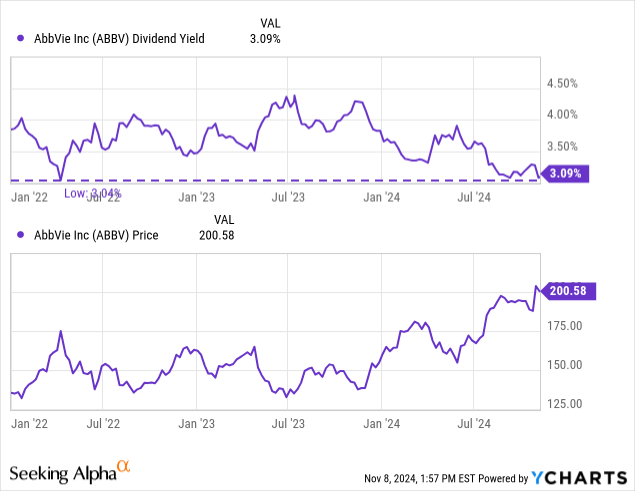

However, the dividend yield is at its lowest level in five years because of the upward march of the stock price.

Is it still a strong buy, or is it time to take profits?

Management did a masterful job.

Humira provided well over $200 billion in revenue as one of the most successful drugs of all time. It wasn’t going to be easy to replace. But, AbbVie knew that competition for Humira was inevitable. So management took bold action.

In 2019, Humira accounted for 58% of AbbVie’s sales. The company was essentially a one-trick pony. Humira sales peaked in 2022 at $21.2 billion, but this was only 37% of total sales due to the blockbuster acquisition of Allergan.

The $63 billion acquisition, a 45% premium to Allegan’s stock price, seemed like too much to pay for some on Wall Street. However, much to their credit, Seeking Alpha analysts were mostly positive – and they were right:

The total return since the announcement date is nearly 300%, and AbbVie has been a steady source of income.

Looking at AbbVie’s filings since the merger, total cumulative sales from Allergan products since 2020 eclipsed $65 billion this year, per my calculation. And obviously, there is much more to come.

What’s next?

Here are three strong reasons for optimism from here:

- Skyrizi and Rinvoq;

- ImmunoGen expansion; and

- Cerevel potential.

Newest top sellers:

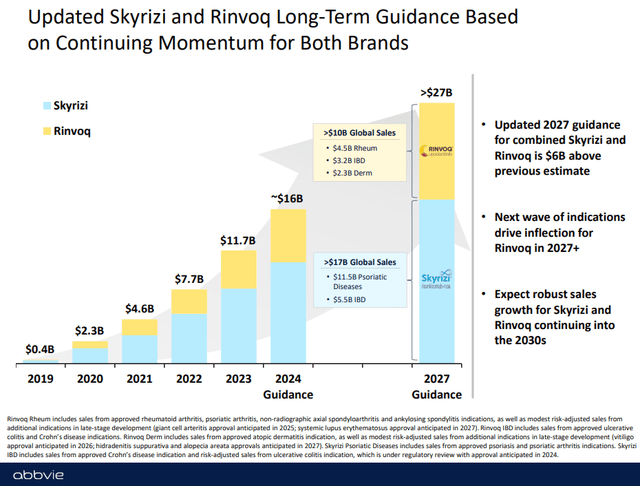

AbbVie’s newest hit drugs are forecast to exceed Humira peak sales soon, as depicted below:

2027 sales estimates represent a terrific 69% increase over this year’s forecast. Rinvoq and Skyrizi gained many new treatment approvals over the past few years and AbbVie expects more to come. This will drive revenue and cash flow well into the next decade.

ImmunoGen acquisition

AbbVie completed the $10 billion acquisition of ImmunoGen in February this year. The deal brings AbbVie the ovarian cancer drug Elahere plus a pipeline of drugs ranging from preclinical stage to phase 3 approval. Plus it brings ImmunoGen’s expertise in cancer-fighting ADCs (antibody-drug conjugates). I covered the acquisition in greater detail here.

Elahere sales grew 9% sequentially from Q2 to Q3 and is on a $550 million run rate. AbbVie expects significant label expansion and has the track record to make it happen.

Cerevel acquisition

The Cerevel acquisition was finalized in August 2024 at a price tag of $8.7 billion. They purchased Cerevel for the pipeline, which includes psychiatric medication to treat anxiety and mood disorders, Parkinson’s, Schizophrenia, and Dimentia and Alzheimer’s psychiatric issues. These are all massive markets that will only grow from here. AbbVie has sufficient resources and experience to push these over the finish line of approval and market them successfully.

Is AbbVie stock still a buy?

The secret is definitely out on AbbVie. The market panic over the loss of Humira is in the rearview mirror. The best time to accumulate shares was when others were ringing their hands, and many of us did.

My philosophy on accumulating AbbVie stock has been to buy when the dividend yield exceeds 4%. As shown below, there were several opportunities since 2022.

However, the yield is now near its lowest level since early 2018 due to the rapid gains in the stock price. This yield will get more attractive as interest rates drop, and AbbVie will hopefully be able to keep an attractive dividend growth rate as sales of Skyrizi and Rinvoq ramp up. However, now that Wall Street believes there will be success after Humira, AbbVie’s valuation isn’t nearly as attractive. I’m waiting for a dip before buying more.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.