Summary:

- Abercrombie & Fitch has outperformed the S&P 500 and Russell 2000 in 2024, delivering a 62% total return, driven by strong Q1 and Q2 earnings.

- The company has improved inventory management, with five of the last seven quarters showing inventory days below the five-year average, a sign of increased efficiency.

- Abercrombie trades at a forward valuation of 13.6x next year’s earnings, with analysts revising top-line estimates upwards several times over the past year.

- Risks include changing fashion trends and macroeconomic instability, but strong management focus and favorable input costs support a positive outlook.

Robert Way

Background

Clothing retailer Abercrombie & Fitch (NYSE:ANF) is an interesting tale of riding the ups and downs of both the market and the whims of teenagers and twenty-somethings. When we last wrote about the company (you can read that article here) in January of this year, we were hesitant that the positive momentum under CEO Fran Horowitz could continue. We have been proven more or less wrong to have been skeptical:

ANF vs SPY & RTY, YTD (Koyfin)

In 2024, Abercrombie has outperformed both the S&P 500 (SPY) and the Russell 2000 (RTY) indices, delivering a 62% total return, while RTY and SPY have brought home 17% and 27%, respectively.

Admittedly, most of the ground gained came in the first half of the year on the back of strong Q1 and Q2 earnings while the back half of the year has mostly seen the stock flitting back and forth in a range. However, we think the turnaround has taken hold, and that there is likely more upside in the stock.

Under The Hood

In virtually every business it is vitally important to turn your inventory. In clothing retail, it is just about as close a matter of life and death as you can get given the fickleness of taste and fashion from season to season. In a business like this, ability to manage–and turn–inventory is key.

We are happy to see that in this regard, Abercrombie & Fitch has improved over time.

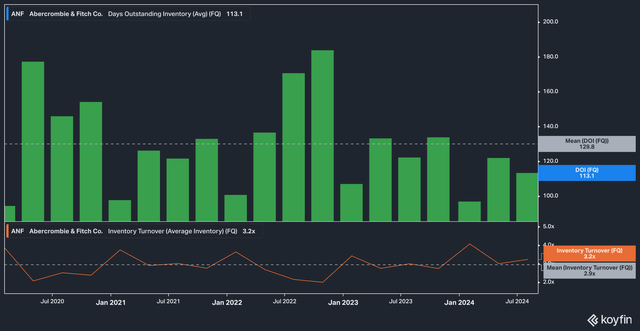

ANF DOI & Inventory Turns, 5yr (Koyfin)

Over the last five years, Abercrombie has averaged 129 days outstanding inventory, which is essentially a metric of how long inventory sits around waiting to be sold. As recently as Q3 2022, the metric jumped north of 180 days.

Five of the last seven quarters, however, have come in under the five year average, which is enough of a track record to lead us to believe that the company has improved its ability to deliver to its core customer efficiently.

What’s more, inventory turns have been on the rise (the orange line in the chart above), which is a measure of how many times the company replenishes its inventory in a given quarter. These metrics are closely related and show, to us, that the company is more efficient than it has been in the past.

Running a disciplined inventory is also clearly on the minds of management: the subject was mentioned 15 times in the latest earnings call.

Valuation & Fair Value Estimate

On the back of its recent results, Abercrombie has earned itself a premium valuation among its peers:

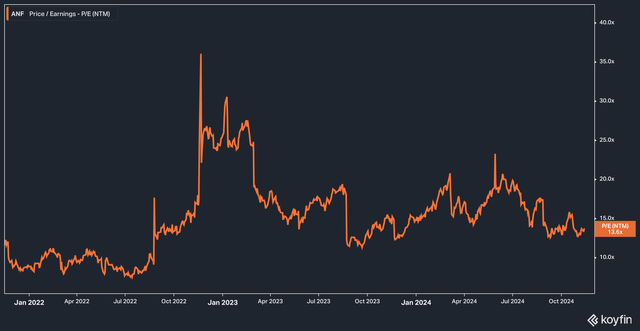

ANF Forward P/E Estimate, 3 Yr (Koyfin)

Today, the stock trades hands for 13.6x next year’s earnings estimates, while competitors American Eagle Outfitters (AEO) and GAP (GAP) trade at 10.2x and 11.6x their forward estimates, respectively.

In our minds, this represents a relatively fair and appealing valuation. We also note since falling off its January 2023 highs, today’s valuation is knocking on the door of the stock’s lowest forward P/E levels in more than 18 months.

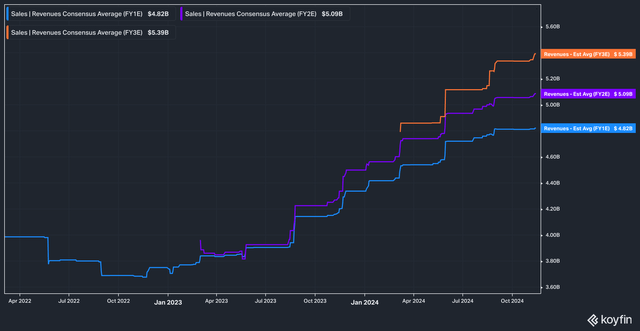

Analyst Revenue Estimates, 3yr history (Koyfin)

Now, mix in a valuation trading around recent (but firm) lows with the fact that analysts in the last 12-18 months have done nothing but revise top-line estimates upwards. At the start of January of 2024, analyst consensus top line revenue for FY2026 sat at $4.36 billion. Today, estimates for next year’s top-line revenues sit at $4.82 billion.

For a fair value, first let’s take a look at the company’s net income margin profile.

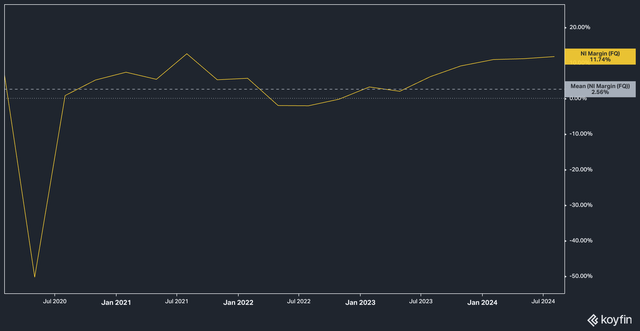

ANF Net Income Margin %, 5Yr (Koyfin)

Barring the large negative drop during COVID, Abercrombie has by and large been able to stay above water, posting a negative net margin in only three quarters since the start of 2021. In recent quarters management has executed exceptionally well, posting an 11% net profit margin in the latest quarter.

What’s driving this? Well, for one, input costs have declined. The cost of cotton (as measured by cotton futures) has declined 15% year-to-date after a brutal stretch during COVID and the supply-chain crunch that saw the material’s price jump as much as 120%. Since the first half of 2022, however, prices have returned to earth and have continued to fall, contributing to the company’s profit-generating ability.

Looking out two years, analysts consensus estimate for Abercrombie’s FY 2027 non-GAAP EPS currently sits at $11.80 per share, versus estimates for this current fiscal year of $10.40. We think that falling input prices and a high amount of focus from management on inventory give the company a decent chance to hit these numbers. Applying a 15x multiple to FY 2027’s estimates gives us a price target of $177 for the stock, which we think would represent fair value.

Risks

The principal risk with any fashion-oriented company is that, well, fashion will change and leave the company behind. For some, that’s reason enough to not invest. For everyone else, read on. We believe the biggest threat to our bull thesis on Abercrombie is macroeconomic. Should economic conditions destabilize (whether through tariffs, a cooldown in consumer spending, etc), the first place consumers will want to pinch pennies will be non-essentials–a category in which Abercrombie squarely falls.

The Bottom Line

Abercrombie & Fitch is currently doing what most investors consider to be insanely difficult, if not impossible–generate consistent positive results in the fashion retail space. And yet, through a blend of macro forces and a strong eye from management, the company has managed to do just that. With little on the horizon to suggest a downturn in the economy and a continued focus on process improvement from management, we see upside in Abercrombie from today’s levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice, and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations—buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.