Summary:

- Airbnb’s business model resembles that of a financial services firm.

- It concludes that Airbnb has a business that allows to accumulate float, and can create considerable income for the company and shareholders in the very long-term.

- The article also shared some takeaways out of Q2 that shows Airbnb is in a strong position competitively in its original travel business.

Mike Windle

I am initiating a buy rating on Airbnb. I believe the company has unique set of characteristics that sets apart from other hotel chains and travel companies in general. In fact, I think Airbnb bears a closer resemblance to financial services firms than typical internet-based businesses. This article explores that resemblance and why it presents a good opportunity for long-term investors. The hope is that more value-oriented investors can see what can be appealing about this investment opportunity.

Why Airbnb is Like A Bank

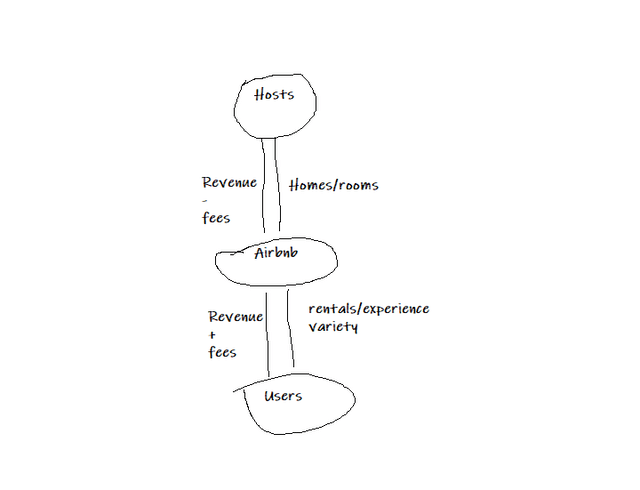

Airbnb is more like a bank (created by author)

Most companies in the technology and travel sectors adopt well-defined business models, such as retail, subscription, or advertising. However, Airbnb does not fit neatly into any of these categories. Instead, it embraces an intermediation business model, similar to that of banks. Rather than dealing with currency, Airbnb operates with houses and rooms as its commodities, effectively connecting hosts and guests. The company’s revenue, derived from the cut it takes from the Gross Booking Value, mirrors banks’ net interest margin, where they collect deposits at a cost and lend them out at a higher interest rate, capturing the spread between the two. In fact, I believe Airbnb’s model is more superior to banks.

One aspect that distinguishes Airbnb’s business model from traditional banks is the cost of its capital input. While banks must pay interest to borrow money, Airbnb enjoys a unique advantage in that it is practically paid to borrow homes on its platform from hosts. In this sense, Airbnb is more reminiscent of an asset/wealth management firm rather than a conventional bank. By capitalizing on this advantage, Airbnb’s profitability can outshine traditional banks as it leverages its vast network of accommodations without incurring significant capital costs. The company’s real advantage as a result, is the ability to acquire homes.

Airbnb, a Hedge Fund?

There’s been far, far, far more money made by people in Wall Street through salesmanship abilities than through investment abilities

This was the highlight of Warren Buffett’s epic rant against Wall Street and hedge funds. The gist of that rant is that Wall Street/hedge funds are more interested in accumulating assets (salesmanship abilities) rather than in the investment performance, given they collect a 2% fee regardless of the performance. And of course they don’t settle for that fee, they also typically participate in the action by collecting a 20% of the gains as well.

Airbnb…A hedge fund? (Airbnb)

Drawing parallels with the salesmanship-oriented approach of hedge funds, Airbnb follows a similar playbook by accumulating assets in the form of houses and rooms. The company raises these assets from hosts, offering the promise of affluent customers in return for a standard fee, with additional charges of 11%-15% layered on top. Not only does Airbnb get to accumulate homes and rooms, it also accumulates the gross booking value and realizes interest on some of it before passing it along to hosts. For example, in Q1, the company’s net interest income reached $142 million, equivalent to 7.8% of revenue, showcasing its ability to generate significant income from its cash pile, including guest funds held for future payouts. A total of $1 billion of the funds Airbnb received from guests on behalf of hosts sat in money market funds according to the 10-Q. In Q2, that number held steady at 7.6% with net interest income of $189 million on revenue of $2.4 billion. Funds held on behalf of customers sitting in money market funds ballooned to $2.4 billion in Q2, compared to $1 billion the quarter before. That sum, as well as other cash balances and the interest they generate, is set to grow as Gross Booking Value grows and the math over very long periods of time is very compelling.

This is somewhat similar to the float dynamics at Berkshire Hathaway, and as the company grows, that portion of the business can end up being a nice surprise for long-term investors.

Here is Buffett again on the advantage of cheap float:

This collect-now, pay-later model leaves us holding large sums – money we call “float” – that will eventually go to others. Meanwhile, we get to invest this float for Berkshire’s benefit… Our float has grown from $16 million in 1967, when we entered the business, to $62 billion at the end of 2009. Moreover, we have now operated at an underwriting profit for seven consecutive years. I believe it likely that we will continue to underwrite profitably in most – though certainly not all – future years. If we do so, our float will be cost-free, much as if someone deposited $62 billion with us that we could invest for our own benefit without the payment of interest.

It might even be less risky given that the information Airbnb has about its booking allows it to match the fund to the appropriate maturity, without the catastrophe risk that could happen in the insurance business.

The Difference Between Airbnb and Uber

Many will highlight the similarity between Airbnb and Uber’s business models. They certainly are very similar given that what I described above is essentially a market place business model. There is one key difference however, which is that Airbnb has relinquished control over the pricing of stays at homes/rooms on its platform, allowing hosts to dictate rates. In contrast, Uber retains control over pricing for its service. This difference has implications for future competition; Uber faces potential threats from new entrants willing to undercut it on price, future Airbnb competitors can’t resort to that strategy because the hosts themselves might resist it and not sign up.

The State of Competition

Airbnb boasts inherent advantages in the travel industry, setting it apart not only from traditional hotels but also from online travel agencies (OTAs) like Booking and Expedia. Firstly, Airbnb’s significantly lower marginal cost provides a considerable edge over hotels, which often face the burden of constructing and maintaining physical properties. This key difference allows Airbnb to swiftly control its supply and offer customers a wider range of choices – a competitive advantage that hotels find challenging to replicate.

While OTAs like Booking and Expedia have attempted to encroach upon Airbnb’s territory by incorporating private rooms and homes into their offerings, they still fall short of replicating Airbnb’s unique advantages. However, it is important to note that travel isn’t a winner take all market and all companies in the space can thrive, including hotels. Nevertheless, Airbnb holds a distinctive edge over OTAs concerning customer acquisition. Airbnb’s direct relationship with its customers grants them an easier avenue for acquiring new users. For example Expedia’s marketing expenses accounted for a staggering 52% of its revenue in Q2 of this year, primarily driven by its reliance on Google for customer acquisition. On the other hand, Airbnb’s customer acquisition costs stood at 19.5% of their revenue during the same period.

This advantage becomes crucial as Airbnb already enjoys a first-mover advantage with a substantial number of homes and rooms listed on its platform. While Booking and Expedia may attempt to challenge Airbnb’s margins by offering better deals to hosts, gaining market share, and attempting to grow faster, they face a significant hurdle; hosts still require customers, and acquiring customers proves to be much more expensive for Booking and Expedia compared to Airbnb. As a result, Airbnb’s business model appears less attractive for Booking and Expedia, not to mention that Airbnb possesses a more substantial profit margin that it can temporarily sacrifice to emerge victorious in any competitive showdown. So even if one company catches up to Airbnb, the latter is still likely to have a bigger share of profits.

Risks

The biggest risk in my opinion is Airbnb expanding into other verticals of travel that wouldn’t be as advantaged as the one they currently have, eating away at the advantage they have in terms of accumulating float.

Another big risk is a major accident in an Airbnb listing that alters the perception of users regarding the brand and the safety of staying in alternative accommodation. This is one of those risks that should probably keep investors and management up at night even though they can’t do much about it.

Price Target and Tactical Vs. Strategic Risk Management

The factors I normally consider in valuing any business are its return on equity (ROE), its market structure and competitive advantages that would help it maintain or improve its ROE, it’s price to book multiple, and its potential to grow book value.

Airbnb’s ROE is 45% at the TTM for Q2 of 2023. This is much higher than the average S&P 500 company which has an 18% ROE.

The company’s competitive advantages have been discussed earlier in the article, they are mainly a first-mover advantage and network effects that will be hard to replicate at a decent margin for entrants. As a result, I believe that the stock is trading at an appropriate premium to the average S&P 500 company (18x compared to 4x for the average S&P 500 company).

Airbnb is growing its book value by $3.58 a share on a TTM basis as of Q2 2023. I’m of the opinion that the company will be able to grow its book value by much more than $3.58 a share in the future. But even at that rate, Airbnb would double its book value in less than 2 years. If its P/B multiple holds, that means the stock could trade $280 a share by Q3 of 2025.

Of course the argument for many is that the multiple is way too high to be sustainable. I’d refer readers to my first article on Netflix, back then the stock was trading 5x book value, compared to 3.9x for the average S&P 500. The assumptions I made in the article concluded that the stock could go to ” $320 (almost 15% CAGR in nominal terms based on June 6 closing price).” by 2026. It’s a bit more than a year later, the assumptions I made about book value growth were almost dead on, and the stock is trading more than $100 north of my four-year target in a quarter of the time.

The point is spotting a high-multiple stock is easy, but timing its multiple contraction is very tricky. Investors could have bought Nvidia in February of 2014 at a valuation of 792x earnings and still realized compounded returns of 15% a year to today ($103 a share on $0.13 a share of earnings in the year ending January 2014).

It also brings me to my second point about tactical vs. strategic management of risk. Much of the use of valuation and market commentary in general seems to revolve around risk. For example, stock x has a nosebleed valuation, hence I will avoid it (due to the risk it poses). Or Jerome Powell will raise interest rates or that a recession is coming so I will average in a stock or wait until its below the 200-day moving average.

All these methods and this general attitude is simply a tactical management of risk. Investors could adopt a more strategic approach to managing risk. Like Munger’s buy and forget approach. Because I really don’t think investors should shun a fantastic business because it has an extreme valuation based on the past. If an investor is sure a multiple contraction is coming, they can simply buy a put option along with the shares of the high-quality business. The investor could even structure his allocation to obtain his or her desired risk profile (assuming no decline in implied volatility for the period. But this topic goes way beyond the scope of this article).

Should the stock decline, the proceeds can go towards buying more shares of that quality business and trusting that compounding works in the long-term, rather than avoiding the quality business all together in favor of a much worse company whose current over-earning makes it look cheap.

My point is, I’m assuming Airbnb will maintain its multiple and will double in two years, and I am happy to hold it or buy a put that I roll methodically every set period of time. And I’d rather do that to manage the risk of high valuation, rather than avoid the business all together because of its current valuation.

Conclusion

Airbnb’s unique business model, combining elements of a financial services company and a travel marketplace, makes it a standout player in the global travel and hospitality sector. Airbnb is exhibiting extraordinary ability to generate net interest income thanks to its healthy balance sheet, ability to attract hosts, and its policies on bookings and payments. These advantages makes Airbnb akin to financial services companies . This unique characteristic, along with its ability to withstand price competition in the travel business, solidifies Airbnb’s position as a formidable force in the industry, making it an intriguing prospect for long-term investors seeking growth and stability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.