Summary:

- Apple’s miserly yield may fail to enthuse a few dividend-chasing investors, but we still see a lot of silver linings.

- AAPL’s desire to become more cash neutral may bring down the heightened dividend coverage levels, but the company should still have enough in the tank to maintain its dividend growth.

- The technical and valuation facets make the stock a hold.

Everyday better to do everything you love/iStock via Getty Images

What is Apple’s Current Dividend Yield?

Over the years, Apple Inc. (NASDAQ:AAPL) has attracted investors of differing characteristics and varied investment objectives. We certainly can’t speak for all AAPL enthusiasts, but generally, we’d like to think that most investors gravitate to the stock for its premium positioning, and a remarkable and consistent ability to trailblaze its way through a hyper-demanding consumeristic era.

Those are no doubt admirable strengths, but one facet of AAPL that often goes unnoticed is its dividend narrative. For the uninitiated, the company commenced quarterly dividend payments in April 1987, only to discontinue it around 8 years later. The quarterly dividends were reinstated once again in July 2012, and have been maintained ever since.

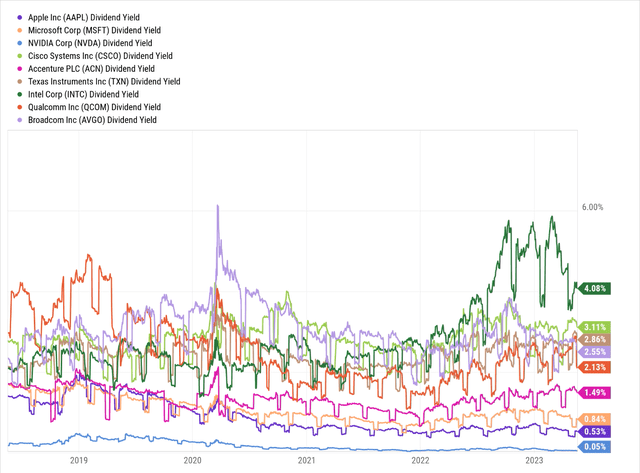

When you consider the forward yield on offer, it’s understandable why most investors may overlook the dividend angle; for context, despite the recent 4.3% hike in its quarterly dividend (to $0.24 per share), you still only get an underwhelming yield of 0.53%, which is a good 35bps lower than the 5-year average yield.

Crucially, if you juxtapose that yield against what you’d get from some of the dividend-paying tech giants of the S&P 500, you can see how poorly the AAPL stock comes off. Only NVIDIA (NVDA) offers a lower yield than Apple!

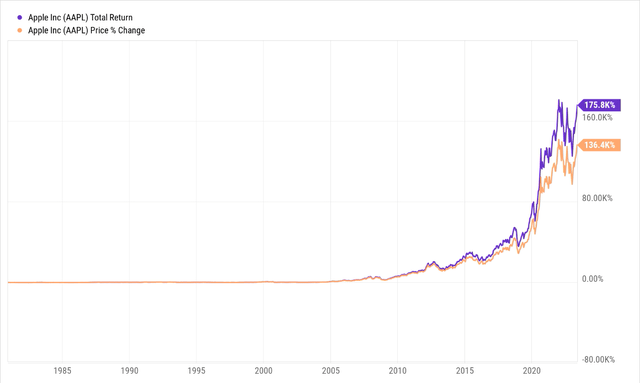

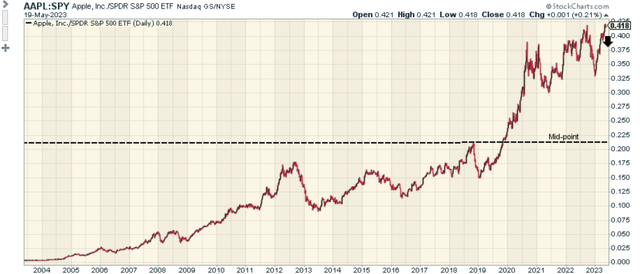

Having said all this, whilst AAPL’s yield may not be setting the world alight, investors should not underestimate the impact that the reinvested dividends can have on long-term wealth generation. The image below sheds some insight on how reinvested dividends so far have helped enhance AAPL’s total returns (since listing) by 1.29x the price returns.

Is The Dividend Safe?

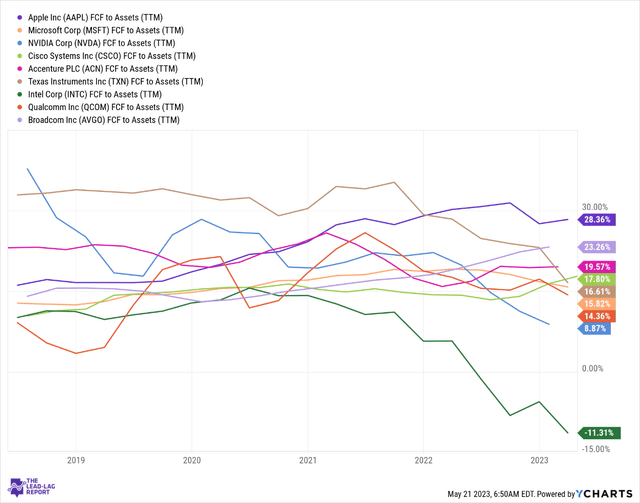

There are quite a few companies that take on additional debt to fund their capital return programs, but such is Apple’s competence in internally-generated cash flow, that its dividends feel safe and reliable. For context, note the high margin of FCF generated by Apple’s asset base. This is the best amongst all the largest dividend-paying tech companies of the S&P 500.

Then, it also helps that AAPL is becoming a bit more service-oriented (Apple Music, App Store, Payment Services, iCloud, Apple TV, etc.), which typically consumes less capital, has better margins, and helps facilitate greater flow through to the bottom line and cash flow. In the recent Q2, service revenue hit record highs of $21 billion, taking the service revenue share to 20% (around 5 years back this share was 14%). With an installed base of 2bn plus devices, Apple is well-poised to extract more value here.

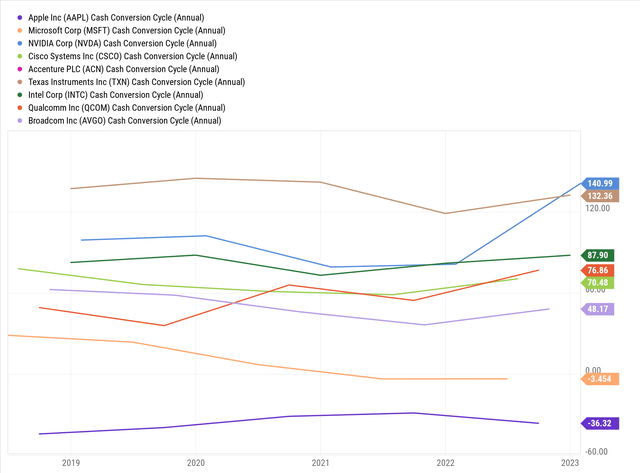

We also shouldn’t forget AAPL’s expertise in managing various facets of its working capital. In effect, this is one of the few tech mega caps whose cash conversion cycle has been negative (which becomes a source of cash) and thus provides a fillip in generating huge OCFs (operating cash flows)

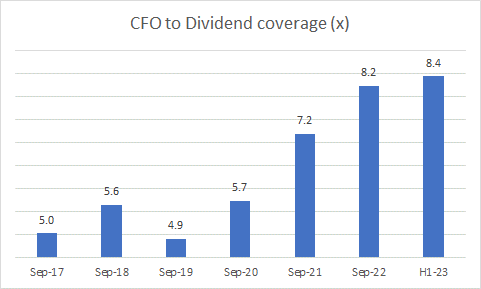

If one looks at Apple’s cash outflow towards dividends in recent years, we can see that it has been growing at a CAGR of 3% since FY17, yet note that its operating cash flows have been growing at a far greater pace of 14% during the same period. In effect, Apple’s CFO coverage over its dividends, which stood at 5x in FY17, stood at 8.23x in FY22. More recently, in H1-23, the coverage improved even further to 8.43x!

Seeking Alpha

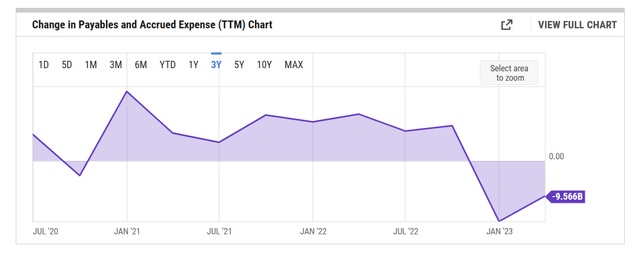

I believe there’s a good chance that Apple witnesses even better cash-gen in H2-23 as the H1 situation was unusually skewed by huge cash outflow on the payable front (-$21bn of cash outflows) which is not sustainable, if historical trends are to be believed. To reduce supply chain challenges, Apple may likely have speeded up cash outflows to suppliers in H1, but you’d think this would normalize over the year.

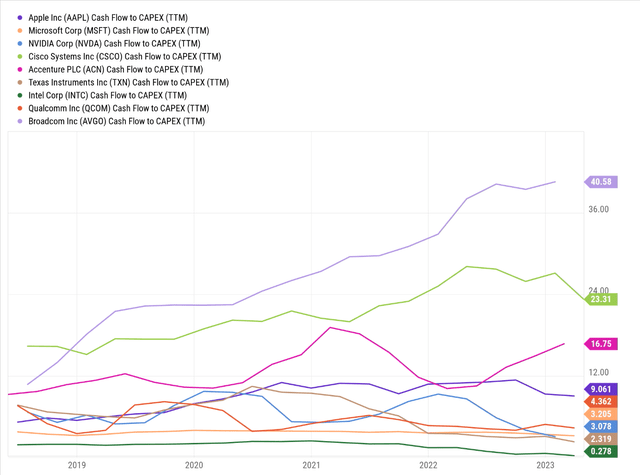

When AAPL’s OCF generation is in order, investors don’t need to fret over its CAPEX commitments as its OCF coverage of CAPEX is best-in-class, at over 40x, comfortably ahead of other peers.

Then, if you look at Apple’s H1-23 asset base, you’d also note that this is dominated by one line item – marketable securities (both short and long-term) which account for 43% of the total asset base. These marketable securities primarily consist of high-rated corporate debt that can always be easily liquidated if the company ever incurs a cash crunch. Apple also has around $25bn of idle cash, which account for 8% of the total asset base. Basically, all these tools only bolster the dividend coverage even more.

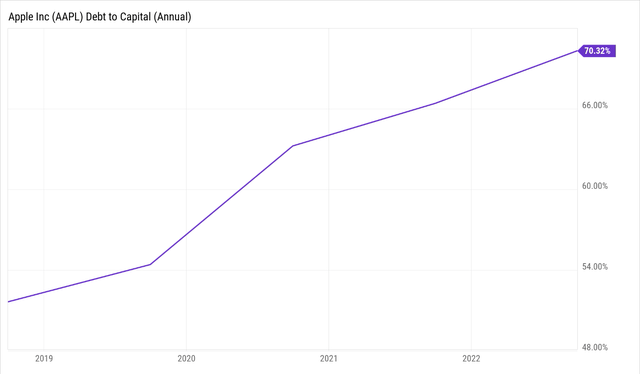

So clearly, AAPL has a lot of tools to service its dividends comfortably, but going forward, investors may also need to get used to the notion that the heightened dividend coverage levels may come down. I say this because the company has been gradually increasing the level of debt in its capital structure (it is now at 70%), and recent reports suggest it is likely to tap the debt markets in a five-part offering to help it get closer to cash neutrality (as of H1-23, AAPL had a net cash position of +57bn).

Needless to say, some of the excess cash-gen will likely be diverted to servicing potentially higher debt, but it should still leave Apple with enough elbow room to meet its dividend bill.

Closing Thoughts – Is AAPL Stock A Buy, Sell, Or Hold?

Clearly, Apple has the right foundation to keep its dividend going, but we have concerns over the risk-reward on offer for those contemplating a long position at current levels.

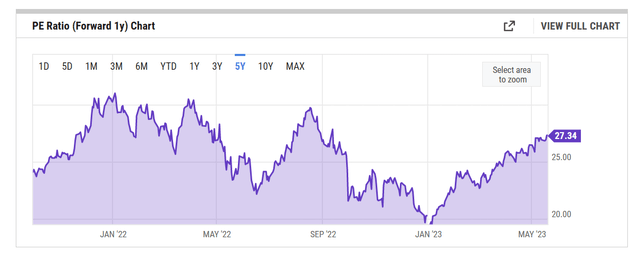

Firstly, if you consider sell-side EPS estimates for FY24 ($6.4), forward P/E valuations don’t look cheap (a $6.4 EPS figure would represent decent YoY earnings growth of +9%, but also note the salutary effects of a weak base, where earnings for Sep 2023 look poised to decline by -4% YoY). For context, the AAPL stock currently trades at 27.3x, higher than the rolling forward P/E average of 25.6x.

Then compared to the other tech offerings from the S&P 500, we’ve seen a pullback in the relative strength ratio (previously it was trading closer to the upper boundary of the ascending channel) but it is still yet to hit the mid-point of this channel and is also a long way from the mid-point of its 20-year range (for more conservative investors).

Spread the net to include the entire S&P 500 and AAPL’s overbought nature gets amplified even more (see chart below), with the relative strength ratio at record highs.

Finally, as noted previously, one tends to witness an additional supply of the AAPL stock when it crosses the $176 price point, which usually prevents further upside. Once again, we’re almost at that point. Besides, since the turn of the year, the stock has been trending up in the shape of a strong ascending channel, and the most recent leg of AAPL’s uptrend (which has lasted for 10 weeks now) looks rather steep. We remain wary of further outsizes gains at this price point, and we think the stock could do with a pause, and a pullback.

To conclude, despite the unappealing yield, we still see merit in Apple’s dividend profile. However, the technical and valuation narratives are not too supportive of a long position at this juncture, and thus we rate the stock as a HOLD.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.