Summary:

- Big tech has been on a tear recently, and Apple alone makes up about 8% of the total market capitalization of the S&P 500.

- Since many own a good deal of Apple through retirement or regular account indexing, an evaluation of potential forward returns is appropriate.

- I estimate Apple will have to compound free cash flow at a rate of over 20% for the next 5 years to justify a $3 trillion valuation, which is optimistic.

- Growth has continued to stagnate in recent quarters, and Apple should be focusing on its high margin faster growing services segment to improve net income.

Justin Sullivan

Introduction

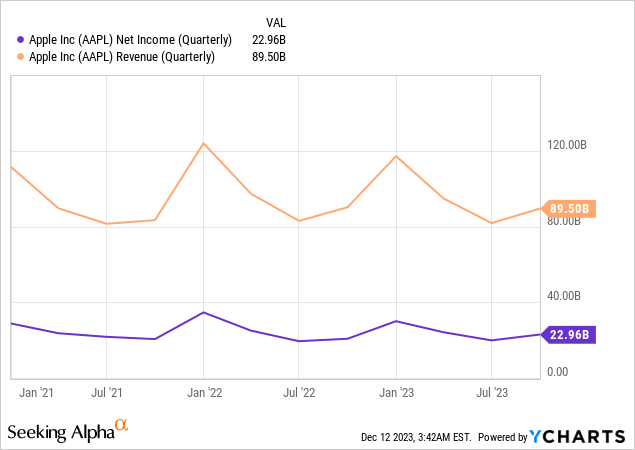

I covered Apple (NASDAQ:AAPL) in May and felt the company deserved a hold rating, as it is clearly a superior business, but was trading at multiples that were implying 15% growth while the macroeconomic backdrop became more hazy. Over the last two quarters, revenue continued to stagnate but the September quarter had a solid 10% year over year increase in net income despite reporting a FY 2023 year over year decline. The company has also increased to a valuation of approximately $3 trillion. I wanted to revisit Apple here to see if this valuation makes sense given performance.

Like many others, my future retirement income plan is based on mindlessly investing in the S&P 500, no matter what the price is. A company like Apple performing well is key for me and many others, because as of current writing it represents about $3 trillion of the $36 trillion in the S&P, or 8%. Clearly, this rally has been great for those already retiring, or soon to be retired. Will it then, be great for those of us who have to wait a few more years?

Superior Business

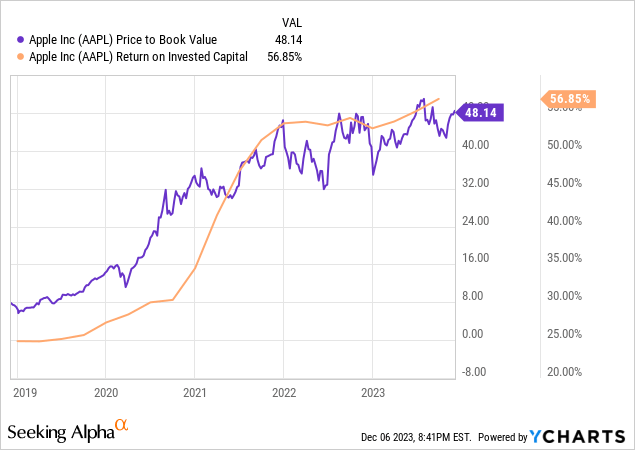

Apple is a prime example of why asset based cigar butt investing of Ben Graham could be a little more antiquated. Some of the best companies are capital light and able to pay their investors with the majority of their earnings, leading to high ROIC and price to book ratios. Apple historically has had obscene readings on these two metrics over the years, as can be seen below. This is a clear sign that Apple is probably a superior business than most with a wide moat.

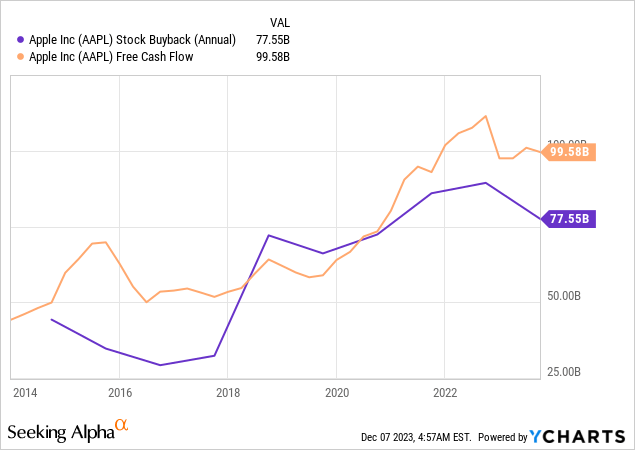

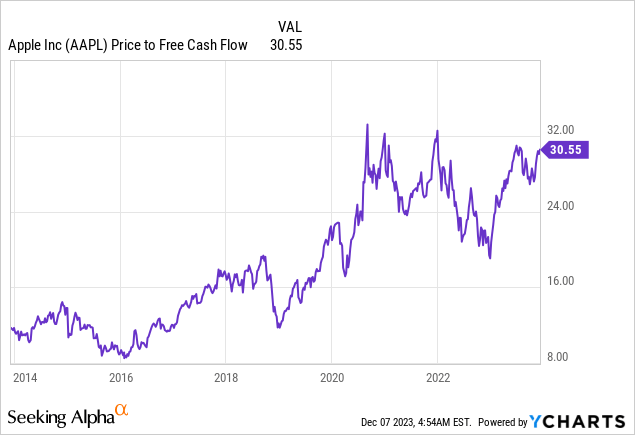

But does their capital return strategy make as much sense as it did a few years ago? To me it probably does not. As can be seen below, the company started cranking up the buybacks in 2018, and I wonder if part of this strategy had to do with Buffett involvement with the company. Since 2018, free cash flow has nearly doubled and the P/FCF ratio has also doubled in 5 years, resulting in a quadrupling of AAPL’s share price. This is fantastic capital allocation in retrospect.

Moving forward, it is difficult to make the case that the marginal buyer can be rewarded as much as buyers of the company a few years ago. It’s hard to imagine that multiple expansion for P/FCF will go much higher than a 30. Apple’s growth has also been stalling, though that may or may not be a long term problem given growth was stagnating back in 2016 when Buffett first started buying. The difference though, is Buffett was buying at a P/FCF of around 10.

Buybacks: Is There Ever Too Much of A Good Thing?

It’s pretty easy to criticize a company that is diluting a lot with stock based compensation, but can buybacks ever be a problem? If we think of stock as a financing tool like debt is, the obvious answer is yes. Financing with stock when share prices trade at high multiples is effectively like taking out debt at a very low, attractive rate. Therefore, buying back overpriced stock is akin to retiring debt trading at a low interest rate that effectively never matures. Why would you do that? Benjamin Graham, ever the skeptic of corporate shenanigans, has some idea:

“Unfortunately, in the real world, stock buybacks have come to serve a purpose that can only be described as sinister. Now that grants of stock options have become such a large part of executive compensation, many companies–especially in hightech industries–must issue hundreds of millions of shares to give to the managers who exercise those stock options”

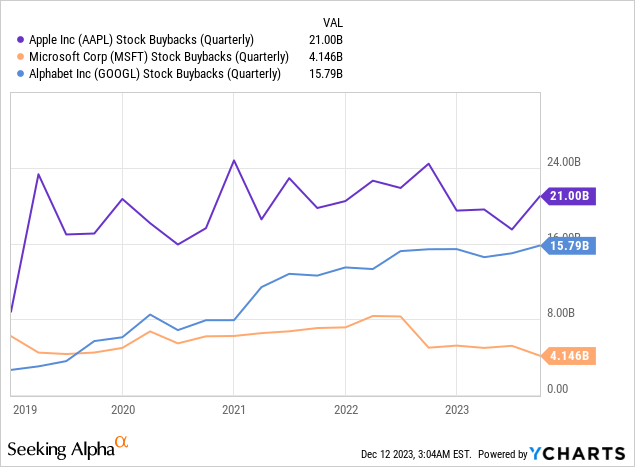

Graham ultimately recognizes that buybacks can be accretive, but often are done unintelligently at high prices and used to pad the pockets of those receiving stock based compensation. Apple perhaps is an example of this, with a forward p/e of around 30, and the highest dollar amount of stock buybacks of any big tech company. Recent quarters likely indicate more of the same moving forward.

The Growth Problem Is Still Here

Apple reported FY 2023 results in November, and it demonstrates the company has been having issues with year over year declines in both revenue and net income. The story here is that perhaps the much larger products segment is maturing, and Apple will need to find new avenues for growth. This could involve growing more aggressively its small but higher margin services segment, which increased revenue approximately 10% year over year to $85 billion.

This segment has approximately 70% gross margins compared to 36% gross margins for the products business. And unlike products, services should HAVE mostly fixed costs and very little variable costs. So scaling this business could be very accretive. But even though revenue has increased in this segment since last year, gross margins for the segment are actually slightly lower. So this theory has not been realized in practice so far.

Additionally, how much growth in such a small segment would be needed to even make a dent in overall earnings? Let’s assume the segment can grow 20% next year. This would make revenue about $102 billion for the segment, and add about $70 billion to gross income or a year over year increase of about $10 billion. If this can go to the bottom line, that is a 10% increase in net income all else equal. Clearly, this segment is key to future earnings growth, and we will have to see if Apple can execute here.

Valuation

In May, I used a 15% growth rate for our forecast period combined with a 4% terminal growth rate to value Apple at around $2 trillion. I think these were optimistic assumptions, and as shown above, Apple has not yet demonstrated a return to growth in the most recent quarters. With that in mind, and consensus analyst estimates of EPS growth being significantly lower than 15%, I think a reworking of the model is warranted. Optimistically, I used a 12% growth rate in free cash flow net of SBC. To be conservative, I used a 10% discount rate as this is likely the minimum return equity holders should expect and the company is capitalized minimally with debt. I again used a 4% terminal growth rate, as Apple is a superior business with a wide moat. This gives us a conservative valuation of about $1.5 trillion, as can be shown below.

This Writer, estimates

To justify its current valuation of $3 trillion using my model, Apple would have to compound FCF at over 20% per year in our forecast period. Based on these data, I don’t believe the current share price offers a good margin of safety, and Apple should also consider this valuation as they shovel their free cash flow into buybacks.

Inverting The Thesis

Apple May Change Its Capital Allocation Strategy

Apple may decide to stop performing mindless buybacks at these valuations and could instead invest in organic growth or make accretive acquisitions. At the very least they could try to time the buys to be sure they are occurring at good prices.

Interest Rates

If treasury yields go down to levels they were at a few years ago (in 2021, you could expect a 1-1.5% return on the US 10 year), a P/FCF of 30 on a superior growing business may not seem as bad, and multiple expansion could continue once again.

Wide Moat Business

Apple is definitely a wide moat business, given its strong consumer brand and ecosystem. With its pricing power, perhaps growth could continue at a more moderate rate but a longer time period than my forecasting period, which could mean the shares are undervalued.

Conclusion

My updated analysis of Apple has not really assuaged my fears that the current price is of questionable forward return, and therefore could have a distinctively negative impact on the long-term performance of an indexing strategy. That being said, I will leave my retirement capital already invested in the index alone, but I have been contributing a bit less lately. To justify its current valuation, I believe Apple will have to grow free cash flow over 20% a year for the next 5 years.

Since this exceeds the previous 5-year performance and future consensus growth predictions, and Apple’s growth in both revenue and net income has stagnated recently, I believe a sell rating is warranted. I would not short a superior company such as this, but it may be worth considering if there are better investments available. Apple and the rest of big tech have had a fantastic year coming out of a trough, but it’s questionable if this outperformance can continue at current prices. Additionally, the persistent use of buybacks at historically high prices has me questioning capital allocation. To feel safe investing in Apple, I would want a 50% lower share price, and a better capital allocation strategy. Apple’s high margin services business will be key to future earnings growth, and we will see if management can execute here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.