Summary:

- Both the AT&T Inc. and Verizon Communications Inc. stocks have continued to demonstrate strong correlation to movements in long-end Treasury, with their yield differentials maintained at historical levels following Q1 results.

- Yet, coming out of the latest earnings season, both telco giants have exhibited characteristics of continued improvements in their underlying business fundamentals through 2024.

- This continues to build a case for double-dipping into competitive yields and fundamental-driven long-term upside potential for income-focused investors at AT&T and Verizon.

MARHARYTA MARKO

Since our last coverage, both AT&T Inc. (NYSE:T) and Verizon Communications Inc. (VZ) stocks have continued to demonstrate close correlation to movements in long-end Treasury yield, as expected. Specifically, both stocks have maintained a consistent yield differential of about three points on a relative basis to U.S. 10-year Treasury yield (US10Y) at current levels.

Meanwhile, from a fundamental perspective, both companies have continued to progress positively on their intended roadmaps. Despite seasonal declines in core wireless postpaid phone net additions, stabilizing churn amid recent price increases continues to demonstrate a growing value proposition from Verizon’s push for premium subscriptions. This couples with persistent momentum in broadband market share gains, led by Verizon’s fixed wireless access (“FWA”) net adds as its C-Band network expands.

Although Verizon had underperformed estimates in Q1, management remains committed to delivering progress in shoring up free cash flows critical to supporting dividends – which is key for its income-focused investor base. This is further corroborated by management’s latest reiteration of their commitment to raising dividends, while staying hyper-focused on ramping up deleveraging efforts in 2H24. We believe this has been key to preserving the Verizon stock’s outperformance to peers like AT&T this year. Specifically, the stock has swiftly restored 2%+ gains YTD despite the brief post-earnings slump.

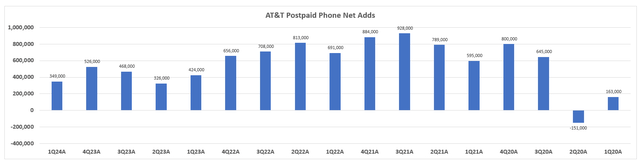

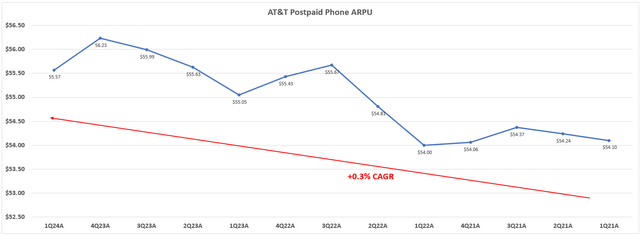

Meanwhile, AT&T is also increasing market share gains in postpaid wireless mobility and fiber. The company is also deepening its foray into accretive FWA opportunities with the introduction of “Internet Air for Business.” We believe the latest Q1 outperformance reverses some of our previous concerns that AT&T’s wireless mobility business may be nearing exhaustion after strong market share gains from Verizon over the past three years. This pairs favorably with stabilizing average revenue per user, or ARPU, and record-low churn, supporting a sustained pace of growth and, inadvertently, margin expansion at scale. The latest results continue to reinforce AT&T’s $17 billion to $18 billion FCF target for the year, which is critical to its deleveraging efforts and dividend program for shareholders.

Taken together, we believe both telco giants remain well-positioned for pent-up valuation gains, underpinned by continued fundamental improvements through 2024. However, sticky inflation and interest rate uncertainties could add pressure to both stocks’ near-term performance. Considering the increasingly structural higher for longer rate narrative, and the consistent dividend yield differential observed across AT&T and Verizon against 10-year Treasury, we believe it remains a good time to partake in both stocks’ eventual upside appreciation at current levels, given intact fundamental prospects.

Preserving Core Mobility Market Share Through Value Proposition

AT&T

AT&T grew mobility revenues by 0.1% y/y, driven by a 3.3% y/y increase in service sales during the quarter. This was largely due to robust postpaid phone net adds paired with 1% y/y growth in postpaid ARPU to $55.57 (-1.1% q/q). The company also achieved record low first-quarter postpaid phone churn at 0.72% despite the higher ARPU, highlighting progress in bolstering its value proposition to customers.

Data from investors.att.com Data from investors.att.com

As competition stiffens among America’s largest telecom service providers, paired with an increasing push for premium unlimited 5G plan sales amid a mixed macroeconomic environment, value proposition is key to driving customer retention. In addition to a competitive pricing strategy and improving network capabilities, AT&T has also consistently rolled out value-add features for customers.

Following its data leak in late March, AT&T has swiftly introduced complimentary security measures for its customers. The personal data of more than 70 million AT&T customers were subject to a security breach in late March, and was subsequently leaked on the dark web. As part of its remediation efforts, AT&T is now offering “complimentary identity theft and credit monitoring services” to all customers. And to those that were directly affected by the security breach, AT&T will be offering an even wider range of complimentary security services for one year. These services include credit monitory, identity theft detection and resolution, identity theft insurance policy coverage of up to $1 million, and access to identity restoration assistance.

In addition to focusing on consumer mobility, AT&T has also beefed up its security offerings for business customers. With its launch of Dynamic Defense in Q1, AT&T is now the “first and only network with built-in security controls.” What this entails is having security capabilities – spanning threat detection and prevention – being directly embedded into the business network without the need for added equipment and/or software. The standard tier is currently offered for free to businesses on the AT&T network, while Advanced and Premium plans go for $175 and $275 per month, respectively. The value proposition of Dynamic Defense comes from its seamless integration into business networks, improving customers’ access to mission-critical cybersecurity measures in a cost-efficient way.

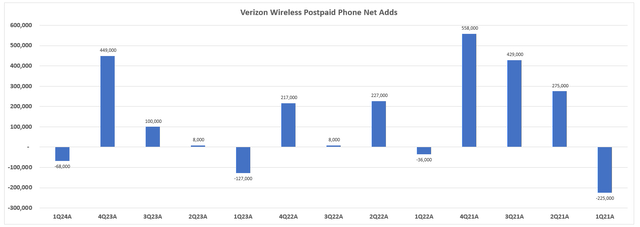

Verizon

Verizon’s latest results also corroborate improvements to its value proposition, which is critical to preserving market share amid stiffening competition. While Verizon has consistently posted Q1 postpaid phone net declines lately, the number was greatly reduced in the latest completed quarter. This was largely due to robust postpaid phone gross adds of 5% y/y, despite plan price increases of $4 per month that went into effect on January 1. Wireless postpaid phone churn was also greatly reduced to 0.89%, highlighting durability in Verizon’s retention efforts.

Management has largely attributed the results to its myPlan product, introduced in 2Q23. Specifically, the myPlan product allows Verizon’s Unlimited Plan customers to add common household subscriptions – such as Netflix (NFLX) and Max (WBD) – at a discounted price of $10 per month. This has likely encouraged stronger uptake of the higher priced unlimited plans, which paired with myPlan perk add-ons likely contributed to ARPA growth of 4.4% y/y to $135.75 in Q1. The company is also leveraging AI to better optimize myPlan bundle recommendations for customers, which will likely further reinforce its differentiated value against rising competition.

Taken together, we believe the continued ramp-up of plan price increases through the remainder of the year, alongside myPlan bundle deployments, will be key to preserving mobility growth at Verizon. This will also be key to offsetting the impact from fluctuating postpaid phone subscription volumes in recent quarters, especially as management seeks a balance in consumer volume and ARPA expansion to ensure sustained growth through 2024.

Resilient Broadband Momentum

AT&T

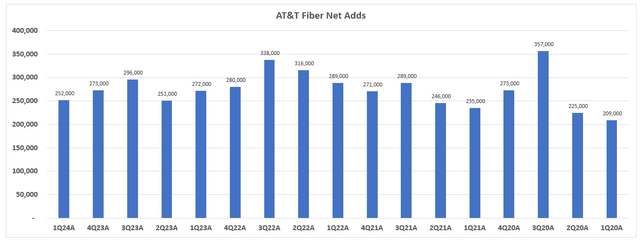

On the broadband front, AT&T continues to benefit from strong market share gains in fiber. The company posted 252,000 fiber net adds in Q1, marking its 17th consecutive quarter of 200,000+ net adds.

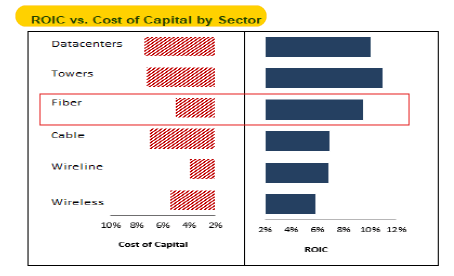

Much of the momentum continues to come from AT&T’s competitive pricing strategy, alongside continued improvements to its network coverage and performance. We believe fiber remains a key growth driver and margin accretive factor to the overall business, despite it being a smaller contributor to consolidated revenue. This is consistent with recent industry data showing how the fiber business – out of others in the broader telecom and communications infrastructure sector – boasts one of the widest costs of capital vs. ROIC spreads.

RBC Capital Markets

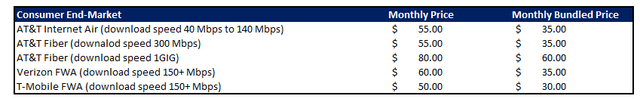

In addition to fiber, AT&T is also deepening its foray in FWA, where it has a smaller presence compared to rivals Verizon and T-Mobile (TMUS). Following its launch of “Internet Air” in late 2023 to consumer end-markets, AT&T has recently rolled out Internet Air for Business to further penetrate commercial opportunities. Similar to Internet Air for consumer end-markets, AT&T’s recent launch of Internet Air for Business also follows an aggressive pricing roadmap when compared to rival offerings.

Data from verizon.com and att.com Data from verizon.com and att.com

For the standard tier, AT&T charges AT&T Internet Air for Business customers $60 per month – or $30 per month if the subscriber is also an eligible wireless customer. Meanwhile, for the premium tier, AT&T charges $100 per month – or $70 per month with an eligible wireless bundle – and offers a “higher level of priority” on speed for the first 250GB of data usage. As mentioned in our previous coverage, industry estimates AT&T Internet Air to be offering average download speeds between 40 Mbps and 140 Mbps, which with unlimited use could be an economical choice.

AT&T’s recent roll-out of Internet Air and Internet Air for Business could also potentially benefit from changes to T-Mobile’s FWA offering as well. Specifically, T-Mobile currently charges $60 per month for its 5G fixed wireless home internet product, or as low as $40 with an eligible wireless plan subscription. For business customers, T-Mobile charges $60 per month – or $40 with an eligible wireless bundle. In the latest development, T-Mobile has limited the speeds for customers using more than 1.2TB of data per month. Although 1.2TB is a significant threshold, the implemented speed changes could potentially impact the value proposition to some customers and drive new demand for AT&T Internet Air.

Although Internet Air’s share of the FWA market remains nominal, we believe the product remains accretive to AT&T’s broadband business. Not only does it allow AT&T to partake in an expanded broadband addressable market with access to prospective FWA customers, but it also allows the company to upsell existing fiber customers – particularly in the commercial setting – who are looking for network diversity. Specifically, Internet Air, with deeper penetration into business opportunities starting Q1, is expected to drive additive scale to AT&T’s 5G investment returns and further reinforce its FCF growth trajectory.

Verizon

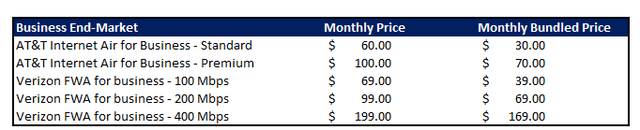

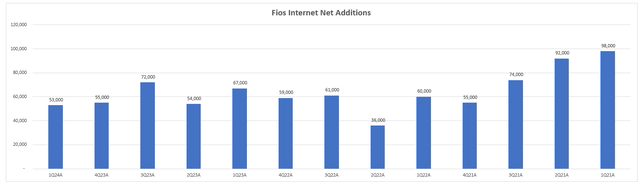

Meanwhile, Verizon has maintained robust momentum in its core FWA broadband offering. The company had 354,000 FWA net additions, complementing 53,000 Fios fiber net additions in the quarter. This has contributed to FWA revenue of $452 million in Q1 (+77.3% y/y) on more than 3.4 million total subscribers, while Fios revenue of $3.2 billion was relatively stable at 0.3% y/y growth.

Data from verizon.com Data from verizon.com

With FWA representing the largest and fastest-growing opportunity for Verizon, this makes a favorable driver of returns on the company’s massive 5G investments. We believe the latest quarter of robust FWA net additions – the seventh consecutive quarter with 300,000+ net adds – for Verizon continues to corroborate market share gains from industry leader T-Mobile. This remains accretive to Verizon’s close to 40% share of the total U.S. broadband market, especially as it continues to capture additional opportunities in tandem with the full deployment of its C-Band spectrum licenses this year. To date, Verizon has already surpassed its 250 million points of presence (“PoPs”) target, about a year ahead of its previous plans. And the expanded network coverage is likely to further reinforce market share gains in the long-run.

Valuation Considerations

Taken together, we believe both companies continue to exhibit consistent positive progress on fundamental improvements. This accordingly bodes well with the elevated capital cost environment today. Specifically, as both companies enter the ramp and scale phase of 5G deployments, the ensuing impact on margin expansion alongside their reduced capex exposure will continue to benefit FCF growth.

This is consistent with Verizon’s expectations for further FCF build through the remainder of 2024. Despite exiting Q1 at $2.7 billion, which is shy of consensus estimates of $3.7 billion, management remains committed to maintaining the balance between profitable growth and FCF expansion. This is further corroborated by their reiterated guidance for annual dividend growth, while also focusing on ongoing deleveraging efforts.

Meanwhile, at AT&T, its $3.1 billion FCF generated in Q1 continues to track favorably towards management’s reaffirmed guidance of $17 billion to $18 billion for full year 2024. With the peak 5G investment cycle now behind AT&T, the company remains focused on strengthening its network capabilities to ensure sustained long-term growth and market share gains amid stiffening competition. This is consistent with AT&T’s recent efforts undertaken to bolster its value proposition to customers, spanning broadband TAM expansion with Internet Air and complimentary value-add features in wireless mobility.

The favorable FCF outlook continues to reinforce AT&T’s current quarterly dividend of $0.2775, which represents a 6.8% yield at the stock’s price of about $16 (April 24). The company also pays a quarterly dividend on its preferred shares, which also show strong correlation to Treasury yield with capital returns reinforced by AT&T’s improving FCF outlook:

- 5.000% Perpetual Preferred Stock, Series A (T.PR.A): $312.50 per preferred share or $0.3125 per depositary share, which represents a 5.8% yield

- 4.750% Preferred Stock, Series C (T.PR.C): $296.875 per preferred share or $0.296875 per depositary share, which represents 5.9% yield

- Fixed Rate Reset Perpetual Preferred Stock, Series B: €2,875 per preferred share

With reduced capital intensify and continued value accretion from premium 5G product deployments, both AT&T and Verizon remain well-positioned for further FCF tailwinds ahead. This would also be favorable to their respective deleveraging efforts and capital returns program, critical to the income-focused investor base.

However, both stocks continue to show strong correlation to 10-year Treasury. Specifically, their yield differentials have maintained at similar levels to historical trends at about 3 percentage points. Hence, the near-term macroeconomic implications cannot be overlooked when gauging both AT&T and Verizon’s valuation prospects.

Both AT&T or Verizon Are Competitive Dividend Stocks

Admittedly, both of AT&T and Verizon’s fundamental improvements continue to support pent-up valuation gains. However, sticky inflation and increasingly structural prospects of a higher for longer rate environment could risk keeping both stocks range bound and counter the potential for a near-term upsurge in both stocks. The paradox between improving fundamentals and macro-driven downside risks could present as an opportunity, though, in our opinion. Specifically, the stocks’ correlation to elevated Treasury yields offers an opportunity for income-focused investors to partake in both pent-up valuation gains underpinned by consistent fundamental improvements in the long-run, and immediately favorable capital returns.

We believe AT&T presents a reinforced outlook coming out of the latest earnings season. Specifically, AT&T has kicked off the year with a better start by delivering better than expected results. Management’s reaffirmed FCF guidance for full year 2024, alongside the reduction of AT&T’s yield differential versus Treasury this year back towards historical levels following YTD declines, present as a compelling opportunity. This potentially reflects AT&T’s prospects of generating a better return profile spanning dividend yields and fundamental-driven valuation upside potential in the longer-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!