Summary:

- AT&T Fiber Expands Opportunities for Integrated Services.

- Reducing Debt and Growing Free Cash Flow.

- Business Wireline – Lower Demand for Legacy Voice and Data Services.

- AT&T is trading at a discount of 10.58x compared to its peers forward P/E multiple of 14.62x.

RiverNorthPhotography

Background

My previous analysis “Why AT&T Might Be A Good Contrarian Bet” was published on 25th August 2023. The stock was trading at $14.11 and is now trading at $22.84 (~62% upside). My contrarian investment thesis was driven by improved ARPU, margin expansion and strong FCF. In this article, I will go through the latest earnings report and valuation multiple to understand if the stock is overpriced now.

AT&T is a provider of telecommunications, media, and technology services. The company offers wireless communications, data/broadband and internet services, local and long-distance telephone services, telecommunications equipment, managed networking, and wholesale services.

US Telecom Industry Overview

The US Telecom Industry is projected to increase from $535 billion in 2024 to $849 billion by 2031, at a CAGR of 6.8% between 2024-2032, driven by the adoption of 5G networks. The growth in 5G accelerated due to its application for IoT devices, smart cities, and autonomous vehicles. In addition, the demand for data consumption increases due to the rising mobile ecosystem. As a prominent player with the capability to utilize existing 5G networks, AT&T can grab the market share to increase revenue in the future. With AI applications and now quantum computing, I believe the company is in a strong position to improve its topline over the next decade. For AI applications through machine learning, we need humongous amounts of data to be transferred for processes like training models, examination, and deployment. AT&T’s fiber infrastructure is capable of providing the fast and reliable data transmission needed for these AI processes. Whereas quantum computing requires fast and low latency networks to transfer quantum data and align systems across locations. AT&T is well positioned through its fiber optics to support the accuracy and speed vital for quantum computing. In nutshell, AT&T’s fiber network is a key enabler of advanced technologies like quantum computing and AI.

The key competitors for AT&T in the US telecom services market include Verizon Communications (VZ), Comcast Corporation (CMCSA), and T-Mobile US (TMUS). Until FY 2022, the company was going through a challenging phase due to declining growth in revenue, increasing investment costs for network and infrastructure expenditure. As a result, the stock has underperformed compared to the market index. The wireline telecom industry in the U.S. has matured, and the projected revenue growth will be driven by 5G fiber.

Let’s analyze this situation based on the revenue growth of AT&T.

AT&T Revenue (in $Billion)

| $Billion |

TTM |

Dec-23 |

Dec-22 |

Dec-21 |

Dec-20 |

Dec-19 |

| Revenue | 122.1 | 122.4 | 120.7 | 134.0 | 143.1 | 181.2 |

| Growth Rate | 0.26% | 1.40% | -9.92% | -6.30% | -21.05% |

Data compiled by the author by using data from Seeking Alpha.

The revenue growth was negative between FY 2020 to FY 2022 due to declining wireline revenues. With the deployment of 5G fiber, the company has started reporting positive revenue growth. The management has projected positive revenue growth for FY 2024 for the wireless service and broadband revenue segments. If we consider the high street estimate for FY 2025, the revenue growth rate could be 4.23%. We have already discussed that the industry is expected to grow at a CAGR of 6.8% between 2024-2031. In summary, it seems AT&T is breaking the growth conundrum and moving slowly towards a positive growth trajectory.

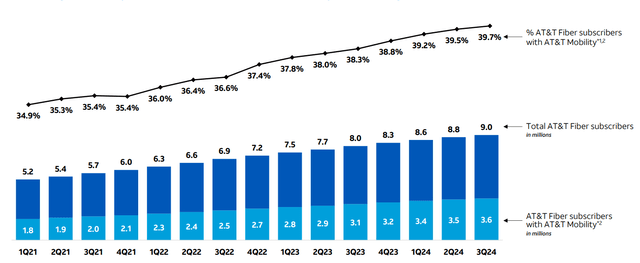

Increasing Mobility Service Revenue and AT&T Fiber Revenue

The revenue for mobility services increased by 4.0% in Q3 2024 due to positive subscriber growth and postpaid phone ARPU. The postpaid phone subscribers increased by 1.5 million and ARPU increased by $1.08. In terms of operational efficiency, the mobility EBITDA margin increased to 57.4% in 3Q 2024, an increase of 150 bps compared to Q3 2023. This margin expansion was driven by a consistent go-to-market strategy, customer growth and reduction of operating expenses. Due to this, the company has reported the highest ever mobility EBITDA in Q3 2024. According to management, the mobility EBITDA growth will be in the mid-single digits range for FY 2024. We can see a similar increasing trend for fiber revenues and their EBITDA margin as well (in the above chart).

“We delivered another strong and consistent quarter, furthering our leadership in converged 5G and fiber connectivity,” said John Stankey, AT&T CEO. “Despite severe weather and a work stoppage in the Southeast, this is our 19th straight quarter of adding more than 200,000 new AT&T Fiber customers. We continue to grow our largest business – Mobility – the right way with what we expect will be industry leading postpaid phone churn for the 13th time in 15 quarters.

In summary, the company is growing its subscriber base, ARPU and operating margin. Although the stock has changed 66% compared to my previous buy rating, we can still have upside potential. Investors should watch trends in this segment closely in subsequent earnings reports.

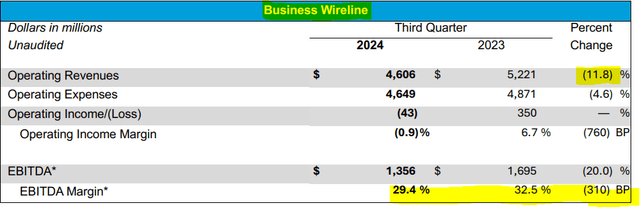

Lower Demand for Legacy Voice and Data Services

The business wireline segment revenue and operating profit declined in Q3 2024 due to the downturn of legacy voice and data services. However, the decline has been partially offset by growth in fiber services. The EBITDA margin is down by 310 bps, and management expects EBITDA to further decline in the high-teens range for FY 2024. Based on this, we can say that the performance of fiber connectivity is crucial for the company to offset the negative impact of declining business segments.

Convergence Opportunity

In the above analysis, we can see that the total subscribers have been increasing since Q1 2021. In Q3 2024, the number of subscribers reached 9 million and out of these, 39.7% of fiber subscribers have mobility. In every quarter, the percentage of fiber subscriptions with mobility has increased, showing converged service adoption. The company’s continuous investment over the decade in fiber optics is now benefiting the company in capturing broadband market share.

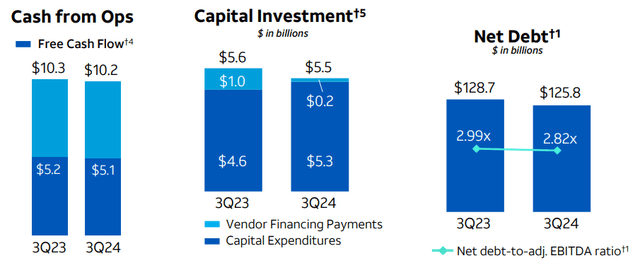

Reducing Debt and Growing Free Cash Flow

AT&T has been investing in fiber optics for years with the aim of capturing broadband market share. The company is still continuing with the same strategy as projected to have $22 billion in capital investment for FY 2024. For investors, the crucial indicator is improvement in FCF in spite of capital investment. FCF for Q3 2024 is $5.1 billion, which is almost flat compared to Q3 2023. However, year to date FCF is $12.8 billion, which is $2.4 billion higher compared to the same period of the previous year. One of the factors for better FCF is operational efficiency attained by the company, which helped it to navigate the difficult phase. In terms of net debt, it has been reduced to $125.8 billion in Q3 2024 with an improvement in the net debt to an adjusted EBITDA ratio of 2.82x (2.99x in Q3 2023). In conclusion, the company is in a strong position with increasing FCF and declining debt. This situation will impact the credit rating as well for better performance.

Trading At Discount

| Peers | Price | Forward EPS | P/E Multiple |

| AT&T (NYSE:T) | $23.42 | $2.22 | 10.58x |

| Verizon (VZ) | $42.08 | $4.60 | 9.12x |

| T-Mobile US (TMUS) | $233.31 | $9.54 | 24.56x |

| Comcast (CMCSA) | $40.17 | $4.22 | 9.41 x |

| Deutsche Telekom (OTCQX:DTEGY) | $31.36 | $1.89 | 16.58x |

| Swisscom (OTCPK:SCMWY) | $56.72 | $3.61 | 15.79x |

| BCE Inc (BCE) | $25.81 | $2.11 | 12.28X |

| Average | 14.62x |

Data compiled by the author by using data from Seeking Alpha.

Based on the above analysis, the 2025 forward P/E multiple of AT&T is lower compared to its peers. The multiple is slightly higher than the 5-year average multiple of 8.19x. Given its market-leading position in the telecom industry and solid business, I believe AT&T should trade at a higher multiple compared to its peer’s average. However, presently it looks underpriced compared to peers and the sector median of 13.77x. I believe new investors may want to wait for the PE multiple to normalize around 8.19x, which is the 5-year average, to buy this stock. This level provides a better margin of safety.

Why The Story Isn’t Over Yet

In the long term, I believe AT&T will match or even outperform the industry average multiple of 14.62x, driven by the implementation of 5G technology and its impact through cost-cutting. Also, with the wider application of advanced technologies, the requirement for 5G fiber will increase. AT&T is also aiming to reduce its debt, and that will impact the valuation for potential upside.

At the industry average multiple, I can see the stock price moving towards $30 in the short term (EPS – $2.22 * Industry Average P/E Multiple 14.62x = $32 per share). The average target price between Goldman Sachs, JP Morgan, and Citigroup is $28. However, the company could have much greater possibilities provided it continues to manage its cost structure, generate FCF and manage debt. For investors aiming for regular income, the company has an impressive dividend yield (forward) of 4.86%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.