Summary:

- Boeing’s Q1 2024 earnings beat expectations, with revenues of $16.57 billion and core earnings per share of -$1.13.

- The Commercial Airplanes segment saw a decline in deliveries and revenues due to the Boeing 737 MAX 9 crisis.

- Boeing’s debt was reduced, but its net debt position increased, and the company is expecting significant cash usage in the second quarter.

- Boeing’s stock price has declined, but we are seeing more clarity on pacing items and a healthier approach toward airplane assembly, providing a more compelling investment case.

Wirestock

Boeing (NYSE:BA) (NEOE:BA:CA) reported first quarter earnings on April 24 before the opening bell. Results came in better than expected, and there was a lot to unpack for investors in Boeing’s Q1 2024 earnings call. In this report, I will be taking a deep dive into Boeing’s earnings, the current status of some of its commercial airplanes and dense programs, its cash and debt balances, and discuss my price target for the stock.

Boeing Q1 2024 Earnings Are Better Than Expected

Whether you’re bullish or bearish on Boeing, the company’s earnings calls are always packed with information, and especially in these challenging times for the US jet maker, that’s incredibly informative for investors to form an investment decision. I will be going through the results from company level to segment level and program level to capture as much information as possible for investors.

First quarter revenues came in at $16.57 billion, marking an 8% decline but still beating estimates by $620 million, while core earnings per share of -$1.13 beat expectations by $0.30.

Boeing Commercial Airplanes Results Drop On Boeing 737 MAX 9 Crisis

The Boeing Company

Boeing’s performance in the Commercial Airplanes segment was already not expected to be great. Following the accident involving the Boeing 737 MAX 9, the Boeing 737 MAX 9 was grounded for several weeks, and Boeing 737 MAX production was dialed back while the FAA barred Boeing to execute planned production rate increases. None of this feathers in positively in the near- and mid-term prospects for the US jet makers, but it’s evident that Boeing needed to clean house before it could plan for the future. That’s happening now and is resulting in some near-term pressure on the financial results.

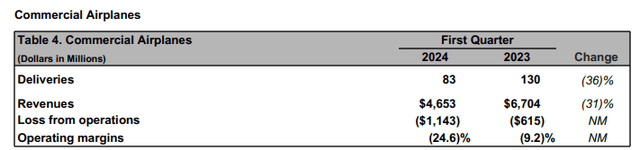

Deliveries declined by 36% while revenues declined 31% to $4.65 billion with losses expanding from $615 million to $1.1 billion. That’s nowhere near the performance investors were hoping for at the start of the year, and just by looking at the numbers we cannot determine whether, given all the pressure, the revenue and loss figures are in the range where we should be expecting them. However, I have utilized my internal modeling tool to assess this and things seem to be matching reasonably well.

Starting at the revenues, it’s important to understand that Boeing recognized a $443 million charge in connection with the MAX 9 customer considerations. Revenues were reduced by this amount, meaning that adjusted revenues are roughly $5.1 billion, signaling a 24% decline in revenues. I filled in the delivery mix for Boeing commercial airplane deliveries and this gave us a $5.102 billion revenue estimate, deviating just 0.1% from our estimate. We have modeled R&D expenses at $500 million and SG&A at $695 million for BCA, which combined with our gross margins would result in a $1.143 billion loss after subtracting abnormal costs in the amount of $80 million. So, the reported loss was exactly where we would expect it to be given the delivery profile and the several reported cost items. However, it should be noted that R&D came in $18 million higher than expected. So, while at the bottom line for BCA things are adding up, it could be that SGA was $18 million lower than expected, or gross earnings were $18 million higher than expected.

Boeing 737 MAX: Clean Fuselages and FAA Pace Production

The Boeing Company

Due to the Boeing 737 MAX 9 accident, Boeing has reduced its production rate on the Boeing 737 MAX program below the targeted 38 per month. A big change in the production flow for the Boeing 737 MAX is that Boeing is no longer allowing traveled work. In a previous report discussing the takeover of Spirit AeroSystems by Boeing, I discussed the importance of reducing traveled work and what we’re seeing now in terms of lower deliveries is a function of increased scrutiny, quality management improvements and the pipeline of fuselage deliveries.

When Boeing stopped accepting fuselages on which there was traveled work, it had fuselages in the pipeline on which new inspection processes were yet to be performed, and in case work was yet to be done it could no longer be shipped for the work to be finalized at Boeing. That change from fuselages with traveled work to clean fuselages will take 60 days to finalize and will keep production at lower levels for the time being. That’s not a bad thing, as I believe that reduction of traveled work is absolutely key for Boeing to improve quality and cycle times on the assembly lines. So, for Boeing’s ramp up effort for production, the number of clean fuselages that are coming in will determine the pace of production, which is an important change from previous routines where fuselages were shipped to keep the lines running at intended rates and any work that was left to be done because it was not done before shipping the fuselage to Boeing was done afterwards.

When it comes to reducing traveled work and increasing production, Boeing’s supplier Spirit AeroSystems plays a critical role. Boeing is in talks to acquire the challenged supplier. I initially have not been a big fan of any such acquisition, but at this time I believe there’s no other option for Boeing than to acquire Spirit AeroSystems to create cleaner flows between the fuselage supplier and Boeing and eliminate any inter-company friction. Furthermore, it should be noted that Boeing is increasingly aware that it needs to acquire Spirit AeroSystems to execute future production rate increases.

Previously, a shortage of engines was the bottleneck for Boeing 737 MAX production, but that bottleneck has now become the number of timely and clean fuselage shipments. In some way, we’re seeing similarities with 2018, when Boeing production on the Boeing 737 MAX melted down. Boeing was attempting to execute another rate increase to 52 aircraft per month, and it didn’t go smoothly. There were engine shortages and Spirit AeroSystems delivered a fuselage late for the first time in four years and the way deliveries were pacing back then showed that Spirit, and Spirit’s supply chain had issues supporting the rate increase to 52 per month. With that in mind, there’s little doubt on my side that in order to execute rate increases to 50 airplanes and beyond, Spirit AeroSystems needs to be a part of Boeing.

Boeing currently has around 205 Boeing 737 MAX airplanes in inventory. 110 of those were -8s built prior to 2023 and that was down from 140 in the previous quarter, showing a burn off rate as expected on that inventory. Furthermore, there are 35 -7s and -10s which are not yet certified and as a result cannot be delivered. Furthermore, there are 60 Boeing 737 MAX airplanes that are currently work in progress airplanes as a result of constraints in the supply chain and factories. That also indicates that Boeing does have an inventory to unwind in the remainder of the year as it gets its quality management system and practices in order. It should be noted that while the Boeing 737 MAX 10 is quite often placed in a bad light, Boeing actually completed the first phase of FAA flight testing. That’s a stark contrast with the view of a stalled or halted certification that many have adopted. Certification is delayed, but there most definitely is progress.

Boeing 787: Seats and Heat Exchangers Formerly Produced In Russia As Pacing Items

The Boeing Company

On the Boeing 787 program, Boeing had 40 airplanes that require rework which is a reduction of 10 units from the prior quarter. Driven by a shortage of heat exchangers, which were previously manufactured in Russia and for which manufacturing was moved outside of Russia, Boeing has to dial back production of the Dreamliner to below five airplanes per month. Furthermore, a shortage of seats selected by customers and operators is also causing hold-ups in production. So, Boeing has reduced production and currently there are around 20 airplanes in inventory beyond the ones that require rework. By the end of the year, Boeing hopes to increase production back to five airplanes per month as the capacity problems with the heat exchangers should be resolved.

Boeing 777: Orders for Boeing 777X And GE90 Engine Shortage

The Boeing Company

On the Boeing 777X program, there was no change in the certification timeline, but positives for the program were an order for eight Boeing 777-9s with options for 12 more for Ethiopian Airlines. Furthermore, Boeing received an order from an undisclosed customer for 20 Boeing 777X airplanes in March. On the delivery side of the Boeing 777 program things are a bit less smooth than they should be as a shortage of GE90 turbofans (GE) is holding up deliveries.

So overall, we see weaker performance in BCA but in line with our modeling tool. Furthermore, Boeing has reduced production on the Boeing 737 MAX and Boeing 787, as necessary. The reduction on the Boeing 737 MAX program reflects inspections by the FAA and clean fuselage shipments volume, while the Boeing 787 production reduction reflects supply chain constraints. Similarly, Boeing 777 freighter airplane deliveries are currently slower than anticipated due to engine shortages. So, Boeing is managing the best it can at the moment, but all of its key programs are in a challenging position.

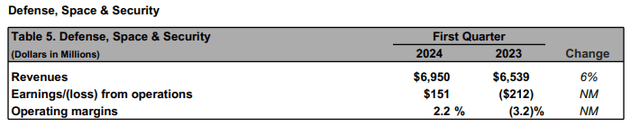

Boeing Defense, Space & Security Cost Growth Continues But Portfolio Strength Radiates

The Boeing Company

Estimating the Defense, Space & Security business has been tricky as more often than not, cost growth on fixed costs development programs are triggering charges. As a result, the undisturbed segment profit margins are closer to mid-single digits rather than low-teens as higher revenue is not translating to higher profits. Boeing beat my revenue estimates by $200 million and its operating margins were 2.2%, contrary to the 2% that I had estimated, resulting in profits that were $13 million higher than I modeled. During the quarter, Boeing continued derisking its development programs, leading to $222 million in charges. Excluding these charges, Boeing’s defense business would have seen a margin of 5.3%. $128 million was related to the tanker and $94 million related to the T-7A trainer jet. So, we do see continued cost growth, but we also see that Boeing’s portfolio excluding the fixed price development programs is performing better, paving a more promising path for the high single-digit margin target.

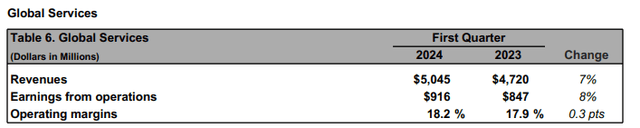

Boeing Global Services Earnings Continue To Show Strength

The Boeing Company

Boeing Global Services remains the strongest performer in Boeing’s business line with 7% growth exceeding $5 billion in revenues at 18.2% margins. Years ago, Boeing made the decision to have its Global Services as a standalone business within Boeing, which in my view emphasizes its importance to the revenue and earnings stream of the Boeing Company. We’re also seeing the positive impact that the focus on services had for Boeing, including the acquisition of KLX Aerospace in 2018 and the acquisition of Aviall back in 2006. Boeing expects continued margin strength and expansion in that segment as it aims to combine both distribution businesses this year.

Boeing Beats My Expectations

After I put all the numbers in my model, Boeing managed to beat my expectations on revenues by $191 million, driven by better than anticipated revenues in the defense segment. The core operating loss came in $63 million better than expected and on core earnings per share, Boeing beat my estimates by $0.06. This shows that our estimates are significantly tighter than that of Wall Street analysts, but Boeing managed to beat these expectations as well, driven by higher segment profits. Other income was partially offset by higher than expected interest expenses.

Boeing Debt Reduces, Net Debt Positions Increases

During the quarter, Boeing repaid $4.4 billion in debt out of a total of $5.1 billion in debt repayments scheduled for the year. After the debt repayment, the debt balance stands at $47.9 billion. Cash and marketable securities fell from $16 billion to $7.5 billion, indicating that the net debt positions got worse as it increased from $36.3 billion to $40.4 billion, fully reflecting the $3.9 billion free cash flow burn during the quarter.

Boeing has around $0.7 billion in debt to repay this year and $4.6 billion next year. With its current cash balance, it can easily pay the maturing debt. For the second quarter, Boeing is expecting another quarter of significant cash usage. The company has $10 billion in revolving credit facilities that it can use, so I do not see any immediate challenges for Boeing. But free cash flow generation in the second half of the year is key to maintaining a comfortable position to reduce debt and finance the acquisition of Spirit AeroSystems.

Boeing CEO Steps Down, Will Stephanie Pope Take The Lead?

One key item that I will monitor is Boeing’s decision to appoint the new CEO. I discussed possible candidates for Boeing’s CEO spot in a previous report. As an investor, for me, it’s key to see Boeing selecting the right candidate. To me, that candidate should have engineering sense and should not be someone with an accounting background for the simple reason that I believe things went horribly wrong at Boeing because the company’s managers and executives tried to force engineering into a financial framework without respecting the engineering and manufacturing practices.

During the call, David Calhoun said that he has an internal candidate:

First of all, the process we have in place is a good one. Steve Mollenkopf in the Chair role, Bob Bradway in the governance role, the Board at large, they’re going to look at the market every way they can. They know I have an internal candidate that I think the world of. They will balance sort of their perspective and get to the right conclusion with my full support. I do not expect that to happen in the next month or two. So, let’s all be clear about that.

We have recently seen Stephanie Pope take key roles that put her very high on the list to become Boeing’s next CEO, and if that is Calhoun’s proposed candidate to lead Boeing, then I will be a less comfortable shareholder as Pope, besides having decades of experience at Boeing, comes from the accounting side and has been part of Boeing while the company eroded its engineering values. I also strongly believe that Calhoun, as someone who has not been able to steer Boeing in the right direction, should not be at the center of selecting Boeing’s next CEO. As a shareholder and stakeholder, it wouldn’t sit well with me that a CEO who basically received a vote of no confidence from airline executives and the aviation regulator would be part of the process of appointing his successor.

Is Boeing Stock A Buy Or A Sell?

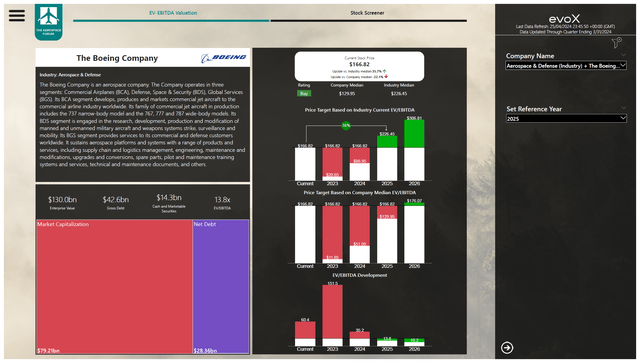

The Aerospace Forum

In a report published in April, I put a Hold rating on Boeing stock as the risk reward profile did not look extremely appealing to me for near-term investors with the many uncertainties that Boeing faces on the manufacturing level as well as its leadership. For the longer-term investor, I believe that Boeing stock continues to hold value. Some near-term positives were the better than anticipated free cash flow. And while Boeing is facing challenges on its key commercial airplane programs, I do see a much more realistic approach that could unlock future growth. Furthermore, we’re seeing more promising numbers at the Defense segment and the Services segment is performing at record levels.

For near-term investors, I continue to mark Boeing shares a hold. But I would also point out that Boeing or any aerospace stock is a stock you would want to hold for its mid to longer-term prospects. And even with the $10 billion free cash flow target in doubt, I do believe that Boeing stock remains attractive. As a result, I’m providing a $226.50 price target on Boeing stock, representing 36% upside and a Buy rating. For readers who have a tendency to criticize analysts who change ratings, it’s important to keep in mind that analysts continuously have to weigh short-term vs. long-term prospects and weigh all incoming news, and Boeing had a lot of news during its earnings call.

Right now, I’m changing from Hold to Buy based on adopting the longer-term investment horizon, positive development in the defense business where the business was profitable despite continued risk retirement and positive signs on Boeing’s reduction in traveled work with clean fuselages becoming the baseline rather than the exception. We need some further reassurance on upside to Boeing 737 MAX deliveries with respect for safety and quality practices and leadership selection, but for now, we have seen enough positive developments to be more comfortable assigning a buy rating again. Even more since Boeing stock at its median EV/EBITDA multiple is trading below 2026 valuation levels, making the entry point more compelling.

Conclusion: A Long Recovery Runway For Boeing

Earnings were not pretty, but if we take a deeper look we do see some elements to be positive about, namely the production rates pacing with bottlenecks rather than forcing airplanes down the line and the improvement in defense performance as well as the continued strong performance in the services business.

Boeing still has a long road to financial recovery and infusing a new corporate mindset. But with its focus on clean fuselages to drive production, I can already see a tangible change in the mindset. Previously, Boeing would accept fuselages that needed rework just to keep the lines running at the desired rate. The company is now ditching that practice, recognizing that having the lines run at the pace at which clean fuselages can come in results in a much cleaner workflow and better cycle times, leading to a leaner production system which can over time drive cash flow by being efficient rather than forcing volumes.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.