Summary:

- The Home Depot is one of the world’s largest home improvement retailers headquartered in Atlanta.

- On November 14, Home Depot will publish its financial report for the third quarter of fiscal 2023.

- Moreover, the company’s Non-GAAP P/E [TTM] is 18.23x, which is 50.65% higher than the sector average and 14.8% lower than the average over the past five years.

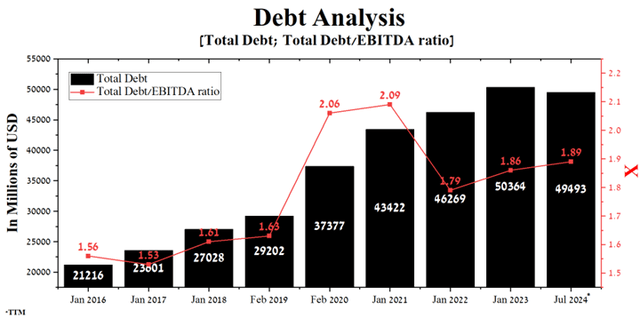

- Following the completion of the fourth quarter of fiscal 2022, the company’s total debt began to decline and stood at approximately $49.49 billion at the end of July.

- We initiate our coverage of Home Depot with a “hold” rating for the next 12 months.

skynesher/E+ via Getty Images

The Home Depot (NYSE:HD) is one of the world’s largest home improvement retailers, which plays a key role in providing a wide range of home decor products, building materials, home improvement products, power tools, furniture, plumbing fixtures, garden supplies, and more.

Home Depot’s extensive network of more than 2,300 stores in North America at the end of 2022, as well as its online platform and mobile app, offer access to its many services in addition to its diverse product offerings. This combination empowers do-it-yourself (DIY) consumers and professional contractors to undertake home improvement projects efficiently.

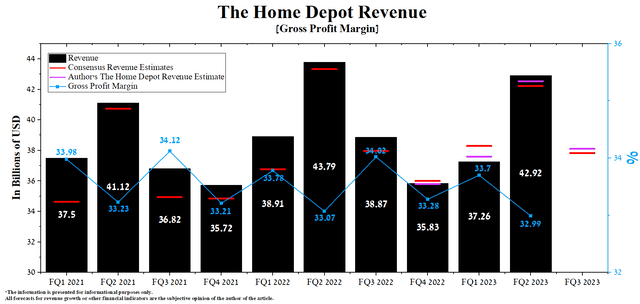

Between 2020 and 2021, the company experienced a rapid increase in revenue, primarily driven by heightened demand during the Covid pandemic. However, the situation began to change in the second half of 2022, mainly due to tightening of monetary policy by central banks.

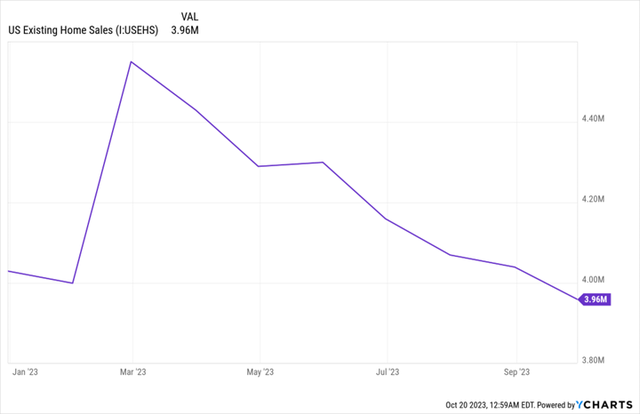

Recent months have seen a decline in demand for existing homes as high mortgage rates reduce affordability for many Americans. So, at the end of September 2023, sales of U.S. existing homes amounted to 3.96 million units, a decrease of 15.4% compared to the previous year. As a result, we expect this will not only negatively affect the demand for Home Depot’s products but also reduce interest in the company from institutional and retail investors.

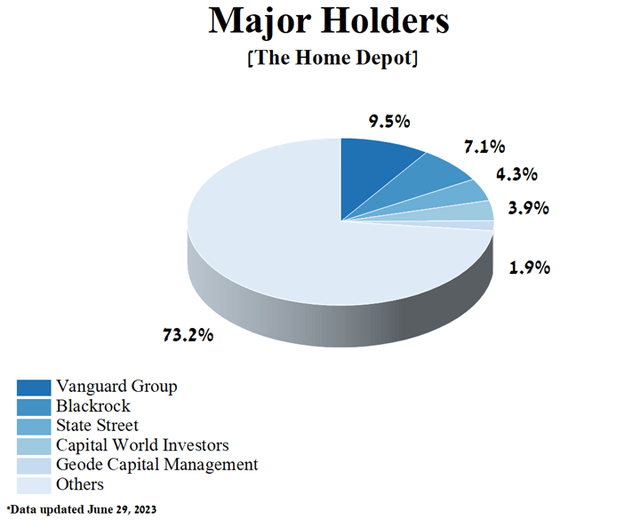

Despite the growing competition in the global home improvement market, Home Depot’s five main shareholders are such well-known financial organizations as Vanguard Group, State Street, Capital World Investors, BlackRock, and Geode Capital Management, owning 26.78% of the company’s shares at the end of June 2023.

Author’s elaboration, based on Yahoo Finance

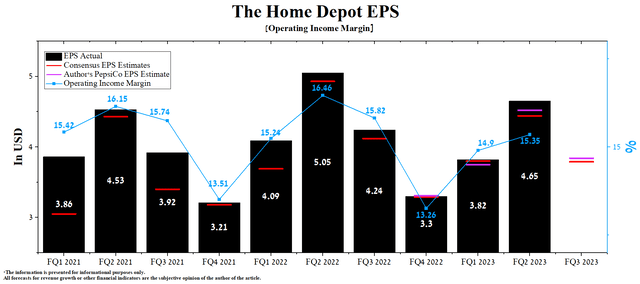

At the same time, the second quarter of fiscal 2023 showed mixed results since, on the one hand, Home Depot’s revenue and EPS exceeded analysts’ expectations, but at the same time, these two crucial financial metrics decreased relative to the previous year. As a result, this contributes to growing uncertainty among investors in the ability of the company’s management to find new ideas for additional sources of revenue in the current difficult macroeconomic situation.

On November 14, Home Depot will publish its financial report for the third quarter of fiscal 2023. According to Seeking Alpha, Home Depot’s revenue for the third quarter is expected to be $37 billion to $38.51 billion, down 0.4% year-over-year and 10.4% below analyst expectations for the prior quarter. At the same time, under our model, the company’s total revenue will be within this range, amounting to $38.1 billion.

Author’s elaboration, based on Seeking Alpha

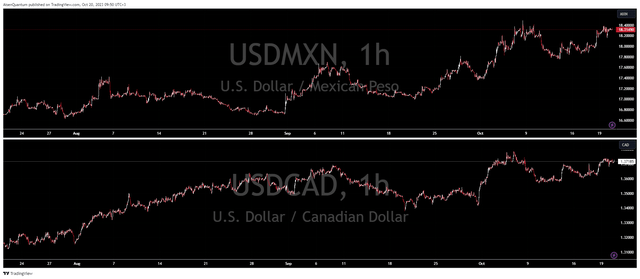

The year-over-year decline in the company’s total sales will be primarily due to the strengthening of the US dollar against the Canadian dollar and the Mexican peso, falling demand for US existing homes, and lower demand for its building materials.

Simultaneously, we expect Home Depot’s operating income margin to reach 14.5% for 2023. Furthermore, in 2024, this financial metric will increase to 15.1%, thanks to the expansion of the company’s product range, optimization of labor costs, and our expectation of the Fed cutting interest rates, which will contribute to the growth of US consumer spending.

According to Seeking Alpha, Home Depot’s Q3 EPS is expected to be $3.48-$4.02, down 14.6% from the consensus estimate for the second quarter of fiscal 2023. Besides, according to our model, Home Depot’s EPS will be above the median of this range and reach $3.84.

Author’s elaboration, based on Seeking Alpha

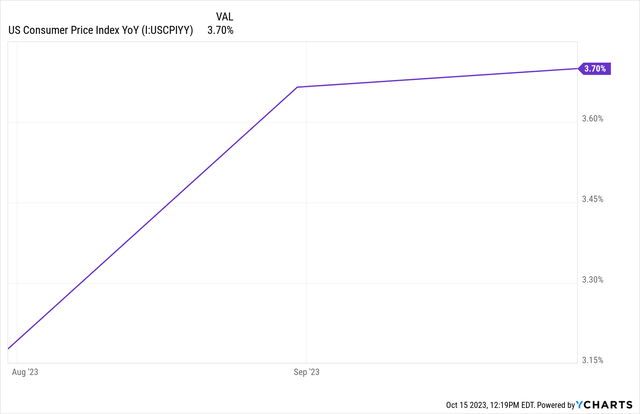

Moreover, the company’s Non-GAAP P/E [TTM] is 18.23x, which is 50.65% higher than the sector average and 14.8% lower than the average over the past five years. Nevertheless, Home Depot’s Non-GAAP P/E [FWD] is 19.16x, which is one of the factors indicating its slight overestimation by Mr. Market during the current period of rising inflation in the United States.

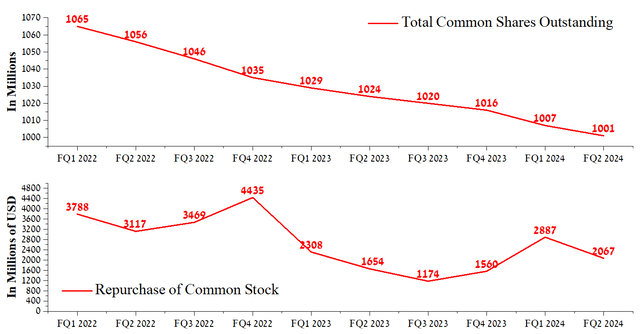

On the other hand, in the three months ended July 30, 2023, Home Depot repurchased about $2,067 million of its shares. On August 15, 2023, the company pleased investors with an announcement that its board of directors approved a $15 billion share repurchase program, which we estimate will help minimize the impact of short sellers on its share price if inflation continues to rise in North America.

Author’s elaboration, based on Seeking Alpha

Following the completion of the fourth quarter of fiscal 2022, the company’s total debt began to decline and stood at approximately $49.49 billion at the end of July. Simultaneously, thanks to Home Depot’s EBITDA growth in recent quarters, its total debt/EBITDA ratio remains stable and does not exceed 2x.

Author’s elaboration, based on Seeking Alpha

Thanks to its stable cash flow and effective business strategies implemented by its management, including those aimed at preventing Home Depot’s gross profit from declining in recent quarters, we believe the company will not have significant difficulty repaying its senior notes.

Conclusion

The Home Depot is one of the world’s largest home improvement retailers, playing a key role in providing a wide range of home decor products, building materials, home improvement products, power tools, furniture, plumbing fixtures, garden supplies, and more.

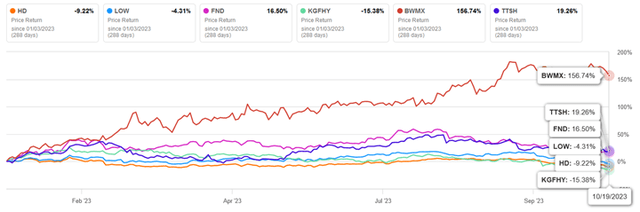

Home Depot’s year-on-year and quarter-on-quarter decline in revenue, coupled with rising mortgage rates, which are dampening real estate market activity, has led to a more than 9% drop in its share price since the start of 2023.

Author’s elaboration, based on Seeking Alpha

Despite all the difficulties that Home Depot has encountered in recent months, its management continues to increase dividend payments year after year. As a result, the company’s dividend yield is about 2.88%. In addition, the share repurchase program’s implementation makes it possible to partially mitigate the negative impact of short sales on the price of Home Depot shares.

We initiate our coverage of Home Depot with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.