Summary:

- Markets were stunned Monday by Intel Corporation CEO Pat Gelsinger’s sudden retirement.

- The decision was effective immediately, with the position at the helm temporarily replaced jointly by CFO David Zinsner and Intel Products CEO Michelle Johnston Holthaus.

- The sudden leadership change suggests a rift between Gelsinger, his previous IDM 2.0 turnaround plan, and the Board. And the ensuing sentiment shift could restore prospects of a foundry spin-off.

hapabapa

In the latest surprising turn of events for Intel Corporation (NASDAQ:INTC), its CEO and leader of a multi-year turnaround plan – Pat Gelsinger – retires. Gelsinger’s removal from the helm of Intel, effective immediately, comes just when we thought the Intel storm had calmed.

The stock’s largely stemmed the worst of its declines since having Gelsinger at the helm. It’s also stabilized recently following an upbeat 3Q earnings report and management’s presentation of a capital preservation plan to the Board in late September.

Gelsinger’s sudden retirement is nothing but ordinary. And it highlights Intel’s potential deviation away from the core of Gelsinger’s turnaround plan for the company – namely, to return Intel to its foundry roots, all while eyeing restored process leadership. The latest development essentially reinstates uncertainties to the fate of Intel Foundry, which garnered peak investor interest in September when the company was riddled with unsolicited takeover interest and spinoff speculations.

And a deeper dive into Intel’s press release for Gelsinger’s retirement unveils three key pieces of evidence that the reorganized tone at the top may be favoring – or at least seriously contemplating – a foundry spinoff. This could foreshadow positive implications for the stock, as a foundry spinoff would lift the significant overhang stemming from related growth uncertainties and capital intensity.

1. Gelsinger No More = Foundry No More?

Gelsinger was the leader and key advocate of Intel Foundry. And his removal from Intel’s helm casts significant uncertainties to the future of Intel Foundry and its role in the broader company’s long-term trajectory – particularly given the mixed contract manufacturing demand outlook for Intel 18A.

Gelsinger’s turnaround blueprint for Intel upon his installment as CEO in 2021 was “IDM 2.0.” And a core part of the strategy was to return Intel to its foundry roots and regain process leadership with “five nodes in four years” (“5N4Y”).

Since then, the company has introduced the Intel 7, Intel 4, Intel 3, Intel 20A and Intel 18A process nodes. However, only Intel 18A’s been earmarked for contract manufacturing with external chipmakers. The latest and most innovative node from Intel will start shipping with the launch of Intel’s very own Panther Lake client CPUs and Clearwater Forest server CPUs in 2025. And Intel 18A is not expecting significant external contract manufacturing volumes until at least 2026.

But Intel 18A’s external demand outlook remains uncertain, which makes Intel Foundry’s capability in besting rivals like TSMC (TSM) and Samsung (OTCPK:SSNLF) a significant uncertainty still.

Recall that key foundry rival, TSMC, has repeatedly noted that it maintains process leadership over Intel’s latest 18A node (1.8nm equivalent). Specifically, TSMC’s direct answer to Intel 18A – namely, the N2 process node (2nm equivalent) – is not expected to start volume production until 2H25. Meanwhile, Intel 18A was supposed to have already begun volume manufacturing with Panther Lake in 2H24, with initial shipments beginning early next year.

However, TSMC believes that its enhanced N3P process node, which builds on the existing N3 node (3nm equivalent) and enters volume production later this year, is at least on par, if not better, than Intel 18A in contract manufacturing. And the upcoming N2 node will only further outperform the N3P process and Intel 18A next year. Instead, TSMC suspects that Intel 18A may only possess process leadership when applied to its products – namely, Panther Lake and Clearwater Forest.

Intel 18A’s external demand woes are further corroborated by key prospective customer Broadcom’s (AVGO) recent claims that the process node is “not yet viable to move to high-volume production.” And despite its subsequent announcement of a multi-billion dollar foundry contract with Amazon (AMZN) in September, there’ve been no material changes to the $15 billion lifetime deal value that Intel had announced for its chip manufacturing unit since earlier this year.

In addition to demand uncertainties and inherent capital intensity, Intel Foundry has also cost Intel its product leadership in the semiconductor industry. Intel’s demise today essentially begun when repeated product delays and lacking innovation before Gelsinger’s leadership drove hefty revenue share loss in the server CPU market to rival Advanced Micro Devices (AMD) during the cloud era. And the company’s largely nominal presence in AI accelerators today essentially marks an extension of the same mishap.

While peers’ data center GPU sales have grown multiple folds since the advent of burgeoning interest in generative AI, Intel’s data center and AI (“DCAI”) group sales have persistently declined. And Intel’s direct answer to the transition to accelerated computing – namely, Gaudi 3 – has failed to arrest its trailing progress in capturing DCAI opportunities. Gaudi 3 volume shipments have been currently matched with slower than anticipated adoption rates. This coincides with the chip’s increasing performance inferiority when compared against next-generation accelerators like the upcoming Nvidia Blackwell (NVDA) and AMD Instinct MI325X.

2. A Sudden Shift in Tone at the Top

In addition to Gelsinger’s sudden departure from Intel, the company’s newest Board composition also drops Intel Foundry as a priority.

The newly installed interim executive chair of the Board, Frank Yeary, made sure his first remarks on Intel in the post-Gelsinger era would focus on the products business.

While we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry, we know that we have much more work to do at the company and are committed to restoring investor confidence. As a board, we know first and foremost that we must put our product group at the center of all we do.

Yeary went on to clarify that the reverted focus on Intel Products would include restoration of sustained profitable growth across the business group’s composition – namely, the client computing group (“CCG”), DCAI, and Networking Group (“NEX”).

We believe this is a step in the right direction, as Intel’s likely looking to start over (again) with a clean slate that focuses on the company’s core cash generator.

For CCG:

By refocusing on Intel Products, the company’s strategy forward will likely garner prioritization in de-risking Intel’s substantial China exposure, particularly in its core CCG operations. Specifically, Intel currently generates more than a quarter of its revenues from China, generated from sales of client processors to key Chinese PC makers like Lenovo (OTCPK:LNVGY, OTCPK:LNVGF). Meanwhile, peers like Nvidia and AMD have reduced their respective exposures by more than half since the initial run of U.S. export curbs imposed on advanced semiconductor technologies.

AI PCs will likely become Intel’s core growth strategy amid the secular transition to next-generation client workstations. Yet, its significant market share in China inherently exposes it to elevated risks of disruption amidst intensifying U.S. curtailments on exports of advanced semiconductor technologies. The first order of business in the post-Gelsinger era’s restored focus on Intel Products should entail prudent management of the business group’s core China operations.

For DCAI:

Intel’s long fallen behind on data center processors, even before the Gelsinger era. This was essentially, time and again, the outcome of stalled innovation and product delays. And it was painfully evident in Intel’s lacking presence in the cloud computing and, more recently, AI compute arms race.

At the minimum, management should continue efforts in ensuring Intel regains competitiveness in the secular transition to accelerated computing critical for AI workloads. And this would be complemented by prioritization of Intel Products, which underpins the potential resumption of critical growth investments towards product innovation.

For NEX:

Intel has shown early signs of a cyclical recovery in the high margin NEX segment during its Q3 earnings results. Following more than a year of consecutive declines, the unit restored delivery of growth – both on a y/y basis and sequentially – in Q3. The positive progress, though early, coincides with Intel’s increased focus on networking opportunities critical in increasingly complex and performance-demanding AI processors, and reshuffled edge business into CCG. The restructured unit is likely to benefit further from prioritization of the broader Intel Products group in the post-Gelsinger era, which supports an improved margin expansion trajectory.

3. The Leadership Restructure Resonates with Favoritism for Intel Products

A potential foundry spinoff’s likely still on the table for consideration, given the Board’s selection of new leadership for Intel in the post-Gelsinger era. In addition to CFO David Zinsner, the Board has also selected Michelle (“MJ”) Johnston Holthaus as interim co-CEOs for the company.

The key lies with the Board’s selection of MJ at the helm. In MJ’s 30+ years tenure with Intel, she’s held multiple key positions across the company’s core CCG segment. They include lead of global CCG sales and, more recently, executive vice president and general manager of CCG. Her experience with Intel’s core growth and profitability driver over the years is likely what drove the Board’s decision for MJ to take on the permanent role of CEO for Intel Products as well upon Gelsinger’s departure.

With the double-CEO role across corporate Intel and the Intel Products group, MJ will oversee not only the developments across CCG, DCAI and NEX, but also Mobileye and other day-to-day operational decisions such as the impending Altera divestment. This essentially foreshadows more streamlined decision-making needed to fast-track the Board’s prized Intel Products strategy going forward, and represents potential positioning for a smooth transition into a new Intel in the event of a foundry spin-off.

Ex-Foundry Implications

On a net basis, Gelsinger’s departure and the implications that the development carries (i.e., potential foundry spin-off) could be a positive for Intel.

Qualitatively, the Board and new leadership’s already made their stance on prioritizing Intel Products. And the potential spin-off of the nascent foundry business could restore management’s much-needed focus on product innovation – a key shortfall in salvaging Intel’s technology leadership, time and again, recently.

Meanwhile, a potential foundry spin-off could also make more sense on the quantitative front. Intel Foundry is currently an inherently capital-intensive and significant loss-generating unit for Intel. In management’s latest update, Intel Foundry isn’t expected to see pronounced margin improvements until 2026. That’s when contract manufacturing volumes on 18A are expected to ramp up, and planned outsourcing of certain Intel processors to rival TSMC start to make their way back to Intel Foundry.

By spinning off Intel Foundry, Intel could potentially mitigate its exposure to the impact of the unit’s widening losses as utilization ramps up alongside looming demand uncertainties. The emerging execution risks are corroborated by increasing contradictions of Intel Foundry’s anticipated synergies with Intel Products and the broader company’s recent cost-savings efforts.

Specifically, Intel’s recently decided to skip in-house manufacturing of the Arrow Lake client CPUs on the 20A process node, and outsource them to rival TSMC instead. Management expects the decision to generate $500 million in cost-savings, while we view it as counterintuitive to 5N4Y’s originally intended synergies. Recall that Intel’s 5N4Y ambitions under Gelsinger’s IDM 2.0 comeback plan had earmarked up to $10 billion in annualized savings exiting 2025. Much of it was expected to be realized through full internationalization of Intel chip manufacturing on in-house developed nodes. But by eradicating Intel 20A for an extra $500 million in savings, Intel’s essentially drawing questions to the feasibility of its foundry ambitions and raising expectations that a spin-off of the money-bleeding unit might actually be the fix.

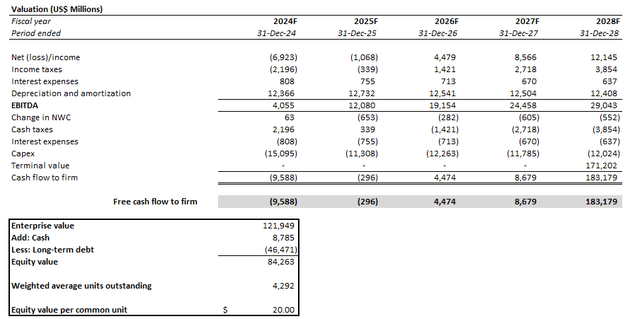

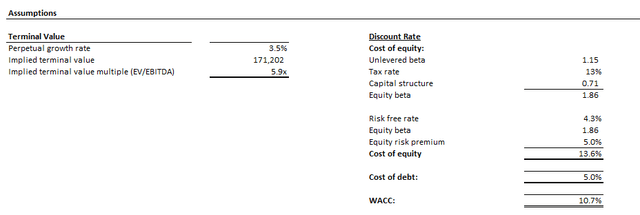

Fundamentally, we believe the combination of Intel Products and Intel Foundry to be worth $20 apiece in the base case scenario. The estimated intrinsic value is computed under the discounted cash flow approach, which considers a 10.7% WACC and 3.5% estimated perpetual growth rate in line with Intel’s capital structure, risk profile and expansion prospects. Cash flow projections considered reflect anticipated revenue expansion at a five-year CAGR of 9%. We consider the assumption a fair representation of Intel’s inherently elevated exposure to China risks and impending demand uncertainties at its foundry unit. The cash flow projections considered also reflects the inherent capital intensity and margin-dilutive nature of Intel Foundry.

However, under an ex-foundry composition, Intel could unlock incremental resources towards product innovation. This would be critical for unleashing pent-up profitable growth prospects in Intel Products and facilitate cash flow growth underpinning its valuation prospect. The upside potential ex-foundry is further corroborated by higher multiples typically observed in Intel’s higher-growth and more profitable fabless semiconductor peers like AMD and Nvidia. The cohort of fabless chipmakers currently trades at an average of 10x NTM sales, while Intel currently trades at about 2x.

Conclusion

Admittedly, uncertainties remain on Intel’s significant management reorganization following Gelsinger’s sudden retirement. This is corroborated by the market’s mixed response. The stock surged as much as 6% following the announcement of Gelsinger’s departure, before it shed all gains and closed in the red during Monday’s session (December 2).

But with the prospects of a foundry spin-off back on the table, the Intel stock faces improved prospects of near-term respite. By prioritizing product innovation on a standalone basis, Intel could do away with the qualitative and quantitative headwinds of an uncertain and capital-intensive foundry business.

While it’s not to be confused with a conclusion of guaranteed upside from here on out, the removal of Gelsinger could symbolize a positive inflection for Intel, nonetheless. The development essentially paves way for a potential foundry spin-off. And this would represent the removal of a substantial barrier to progress lately and restart Intel’s potential pathway to a restored trajectory of long-term profitable growth as a fabless chipmaker.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.