Summary:

- The third quarter of 2023 showed excellent results, which also exceeded our expectations.

- Carvykti sales were $152 million for the third quarter of 2023, an increase of 176.4% year-over-year.

- Stelara’s total sales were $2,864 million in Q3 2023, an increase of 16.9% year-over-year.

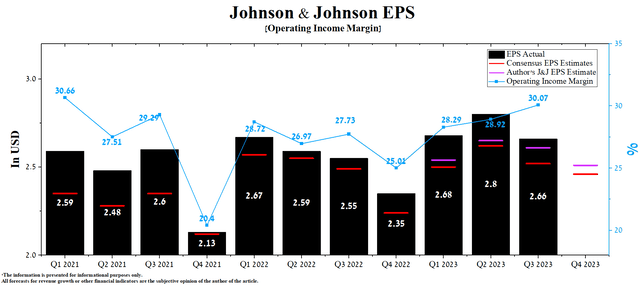

- The company’s management raised its financial guidance for full-year 2023 adjusted-diluted EPS from $10-$10.1 to $10.07-$10.13 and also increased its operating sales forecast from $83.6 billion-$84.4 billion to $84.4 billion-$84.8 billion.

- We continue our analytics coverage of Johnson & Johnson by upgrading to Outperform from Hold for the next 12 months.

KucherAV/iStock via Getty Images

Johnson & Johnson (NYSE:JNJ) is one of the largest companies in the healthcare sector, headquartered in New Brunswick.

Investment thesis

Since our last article was published in early August 2023, its share price has been under downward pressure. However, in October, it reached a price level at which we believe the risk/reward profile will be attractive. Johnson & Johnson’s financial results for the third quarter of 2023, published on October 17, 2023, were also a key reason for our upgrade to Outperform from Hold.

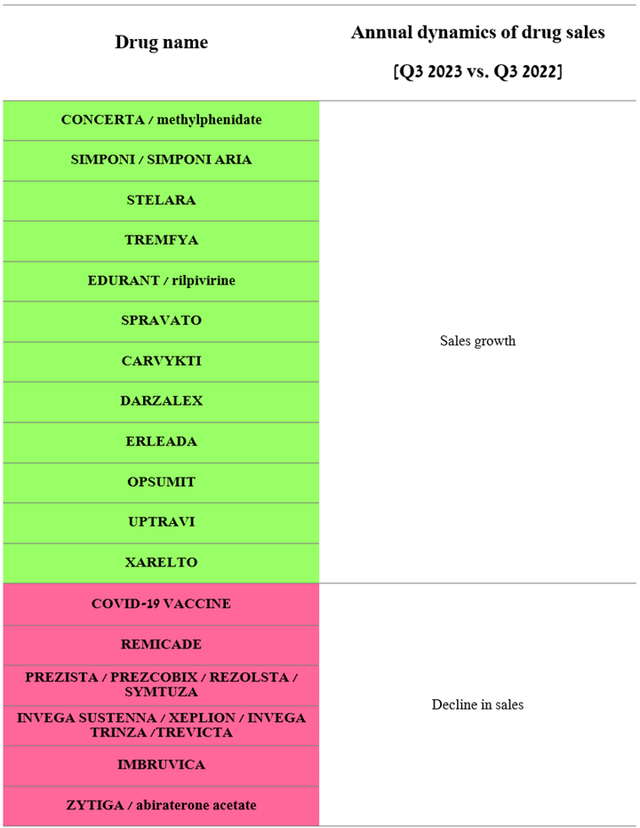

First, the company’s management raised its financial guidance for full-year 2023 adjusted-diluted EPS from $10-$10.1 to $10.07-$10.13 and also increased its operating sales forecast from $83.6 billion-$84.4 billion to $84.4 billion-$84.8 billion. We believe this was due to stronger sales of products from Johnson & Johnson’s Innovative Medicine business segment. The main contributors to the growth of this segment were innovative medicines such as Stelara, Tremfya, Spravato, Carvykti, and Darzalex.

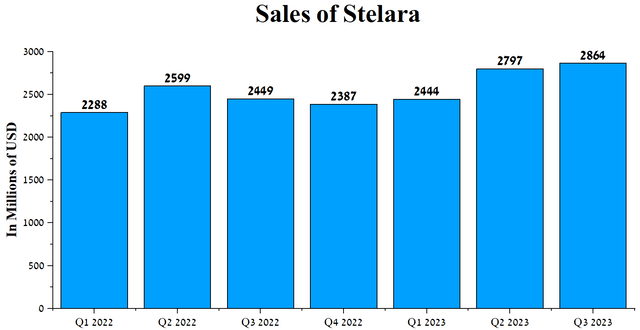

Stelara (ustekinumab) is a drug whose sales contributed approximately 13.4% of the company’s total revenue for the third quarter of 2023. Regulatory authorities have approved this medicine for the treatment of such widespread diseases as plaque psoriasis, psoriatic arthritis, Crohn’s disease, and moderate to severe ulcerative colitis. Its cumulative sales were $2,864 million in Q3 2023, an increase of 16.9% year-over-year, primarily due to its competitive advantages in the global inflammatory bowel disease drugs market.

Author’s elaboration, based on quarterly securities reports

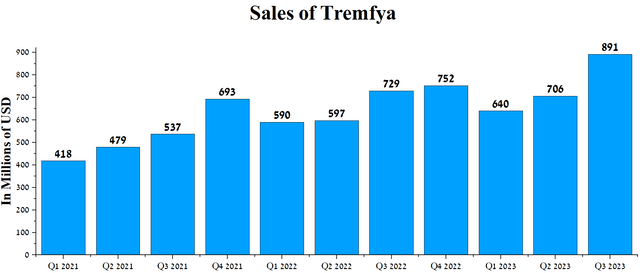

On the other hand, Stelara biosimilars may appear on the market as early as the end of 2024, which increases the degree of nervousness among some of the company’s investors. However, Johnson & Johnson has a drug that minimizes the damage from lost sales of Stelara, and it is Tremfya (guselkumab), the mechanism of action of which is based on blocking the initiation of the IL-23 pathway. Its sales were $891 million for the third quarter of 2023, an increase of 26.2% year-over-year.

Author’s elaboration, based on quarterly securities reports

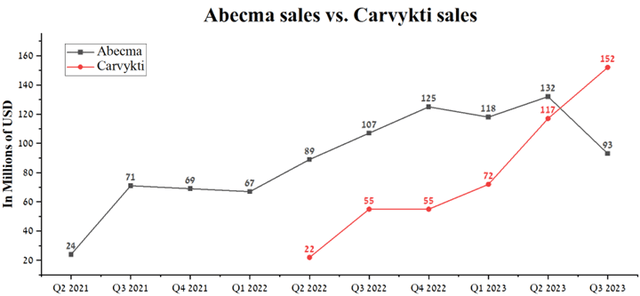

Moreover, we believe that demand for Carvykti (ciltacabtagene autoleucel), which is used to treat certain patients with relapsed and refractory multiple myeloma, will remain extremely strong not only in the fourth quarter but also in subsequent years. Its sales were $152 million for the third quarter of 2023, an increase of 176.4% year-over-year due to capacity improvement and competitive advantages in the efficacy of treating this type of cancer relative to Bristol-Myers Squibb’s Abecma (BMY).

Author’s elaboration, based on quarterly securities reports

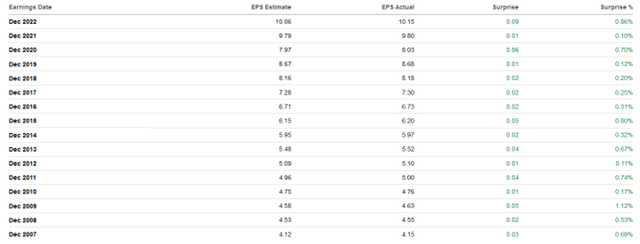

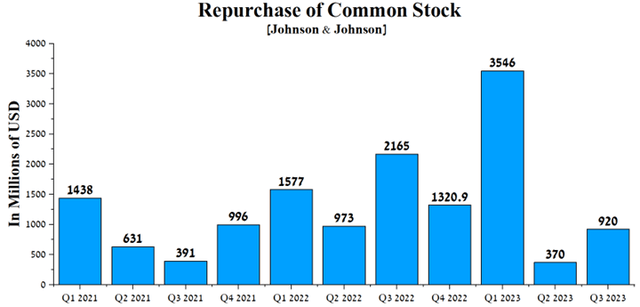

Moreover, the second investment thesis is that the company’s management has an active share repurchase program, a major contributor to beating analyst consensus estimates in recent years.

Author’s elaboration, based on Seeking Alpha

Johnson & Johnson’s free cash flow for this purpose was approximately $920 million in the third quarter of 2023, an increase of $550 million from the prior quarter.

Author’s elaboration, based on Seeking Alpha

Johnson & Johnson’s Q3 2023 financial results and outlook for the 2H 2023

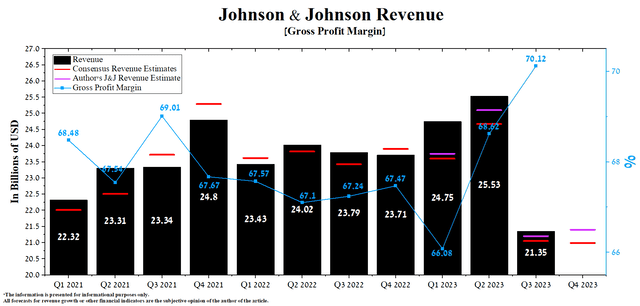

The third quarter of 2023 showed excellent results, which also exceeded our expectations. First, even after the consumer-health spinoff, Kenvue, Johnson & Johnson’s revenue and EPS increased relative to the prior year, indicating that its management’s business strategy remains extremely effective. At the same time, it should be noted that sales of most of Johnson & Johnson’s drugs continue to grow yearly despite increased competition in the global oncology and immunology market.

Author’s elaboration, based on quarterly securities reports

Johnson & Johnson is expected to release its financial report for the fourth quarter of 2023 on January 23, 2024. According to Seeking Alpha, Johnson & Johnson’s revenue for the quarter is expected to be $20.19-$21.25 billion, down 0.3% from analysts’ expectations for the previous quarter.

On the other hand, according to our model, the company’s revenue will be slightly above this range and amount to $21.4 billion. The company’s quarterly revenue growth will be driven by continued growth in sales of its immunology and oncology products, which partially mitigates the impact of lower demand for its Vision and Surgery franchises.

Author’s elaboration, based on Seeking Alpha

In light of the separation of Kenvue and stronger growth in demand for Johnson & Johnson’s oncology drugs, we expect its operating income margin to reach 30.5% for 2023. At the same time, this financial metric will increase to 31.8%, mainly due to the expansion of the company’s product portfolio, an increase in prices for its medicines, a decrease in the cost of raw materials necessary for their production and the weakening of the US dollar relative to the euro, the Japanese yen and the British pound sterling.

According to Seeking Alpha, Johnson & Johnson’s fourth-quarter EPS is expected to be $2.4-$2.52, down 2.4% from the consensus estimate for the third quarter of 2023. On the other hand, according to our model, the company’s EPS will be in this range and will be $2.51.

Moreover, the company’s Non-GAAP P/E [TTM] is 13.88x, which is 15.05% lower than the sector average. Meanwhile, the Non-GAAP P/E [FWD] is 14.44x, which is 13.78% lower than the average over the past five years, indicating that financial market participants remain conservative about Johnson & Johnson’s future.

Author’s elaboration, based on Seeking Alpha

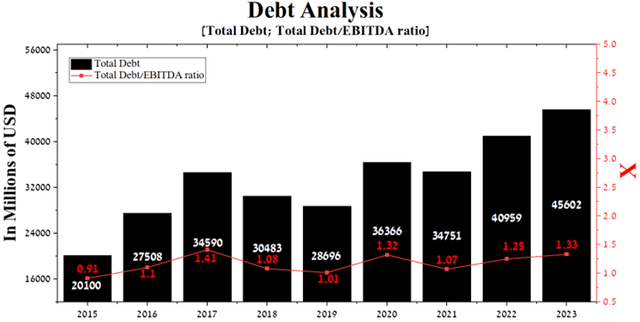

Despite the increase in financial guidance for FY 2023, the factor that unpleasantly surprised us is the increase in its total debt from year to year. As of October 1, 2023, Johnson & Johnson’s total debt was about $45.6 billion, an increase of $10.85 billion from 2021. On the other hand, the company’s EBITDA continues to increase year on year, which contributes to the slower growth rate of its total debt/EBITDA ratio, which stands at 1.33x.

Author’s elaboration, based on Seeking Alpha

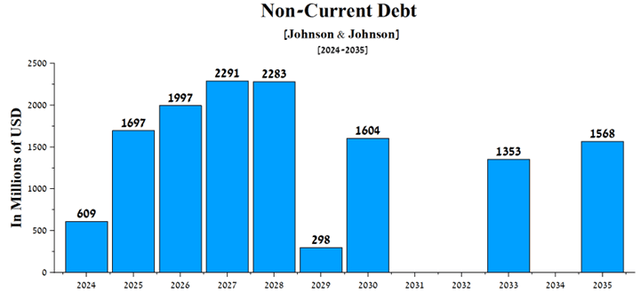

However, with the company’s expanding portfolio of medicines, growing cash flow, and its total cash and short-term investments exceeding $23.5 billion, we do not expect Johnson & Johnson to have significant difficulty repaying the senior notes and debentures maturing between 2024 and 2035.

Author’s elaboration, based on quarterly securities reports

Conclusion

Johnson & Johnson is one of the largest companies in the healthcare sector, headquartered in New Brunswick.

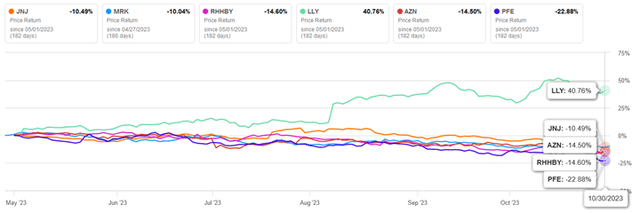

Key financial risks such as President Biden’s Inflation Reduction Act, failure to resolve thousands of lawsuits related to its talc products, and slowing sales growth in its MedTech segment are weighing on J&J’s share price, which is down more than 10% over the past six months.

Author’s elaboration, based on Seeking Alpha

On the other hand, the growth of dividend payments year-on-year, the high rate of expansion of the company’s portfolio of product candidates, and the continued growing demand for medicines such as Tremfya, Spravato, Carvykti, and Darzalex are key investment theses that make J&J an attractive asset for long-term investors.

We continue our analytics coverage of Johnson & Johnson by upgrading to Outperform from Hold for the next 12 months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSVT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.