Summary:

- MSFT’s RSI is currently at 49, indicating a neutral position. This suggests stability, with the potential for a bullish reversal if the trend shifts upward.

- Strategic investments in cloud and AI, including partnerships with Palantir, drive growth. Azure’s revenue is growing 29% annually, despite some margin pressures.

- Microsoft’s gross margin slightly decreased to around 70%, impacted by the sales shift toward Azure and rising AI infrastructure costs, highlighting challenges in maintaining profitability.

- Microsoft’s AI and security markets are expanding, with 1.2 million security customers and $1 billion in Defender for Cloud revenue, reinforcing its leadership in these sectors.

wellesenterprises

Investment Thesis

Since our last bullish coverage in late June, Microsoft’s (NASDAQ:MSFT) stock has declined by 7.5%. This decline provided a more favorable risk/reward setup because of the higher margin of safety. Despite recent downward pressure, Microsoft’s long-term growth remains intact, especially considering its strategic investments in cloud computing, AI, and enterprise software.

The current price levels offer an entry point for investors seeking to realize value from Microsoft’s ongoing innovation and market leadership. While further near-term volatility may be seen, the stock is fundamentally well-positioned to rebound once macroeconomic conditions stabilize and demand for cloud and AI services ramps up. We maintain a buy rating on MSFT, considering the recent pullback an attractive opportunity for long-term investors.

MSFT’s Path to $565: Fibonacci Levels and Seasonality Point to Bullish Potential, with 35% Upside

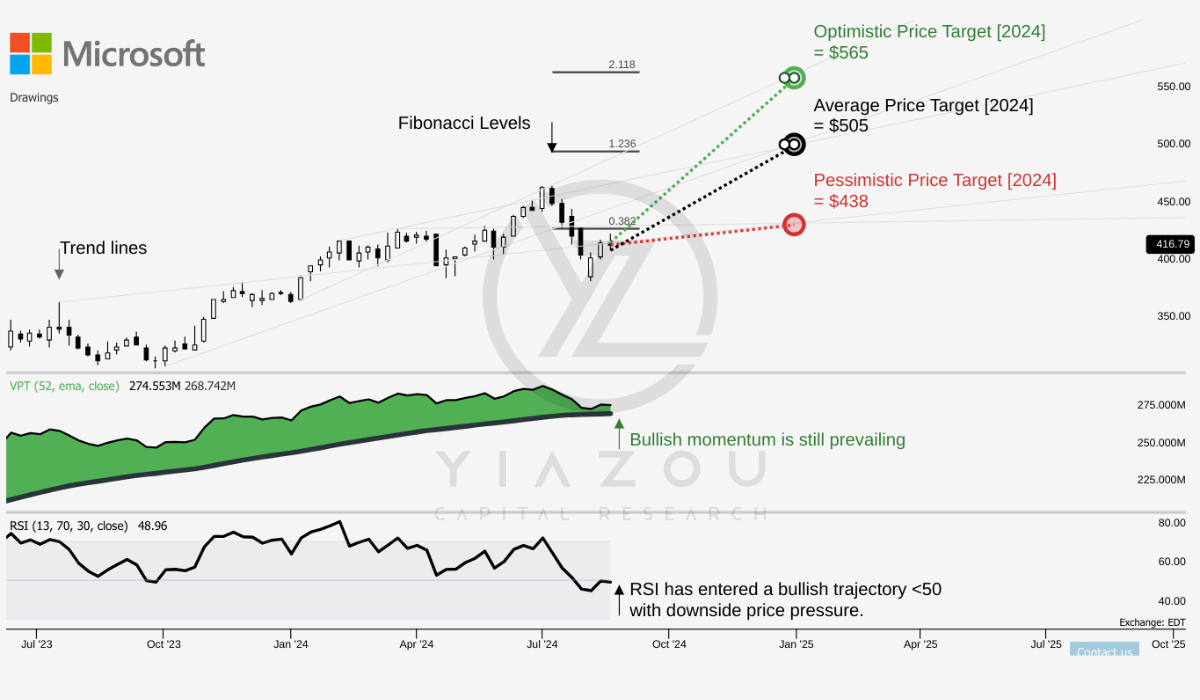

MSFT’s current price is $417, and the average price target 2024 is $505. This target aligns with the 3-point Fibonacci level of 1.236. It suggests a moderately bullish outlook, with the target within a typical retracement level.

The optimistic target of $565 aligns with the 2.118 Fibonacci extension, indicating a more aggressive, bullish scenario. This projection suggests a significant potential upside. Conversely, the pessimistic target is $438, based on the 0.382 Fibonacci level. This target implies a conservative forecast suggesting a decline but remains above the current price.

The Relative Strength Index (RSI) value is 49, which indicates that MSFT is currently neutral. The RSI trend is sideways with no strong divergences, suggesting stability without solid momentum. The RSI signal is neutral, but the downward reversion trend hints at potential short-term weakness.

The Volume Price Trend (VPT) shows a sideways movement with an upward reversal. The VPT line is at 275 million. It is above its moving average of 269 million. This suggests positive accumulation. The long setup shows a bottom touchdown on the moving average, which may offer new entry points. This supports potential buying opportunities if the current trend continues.

Yiazou (trendspider.com)

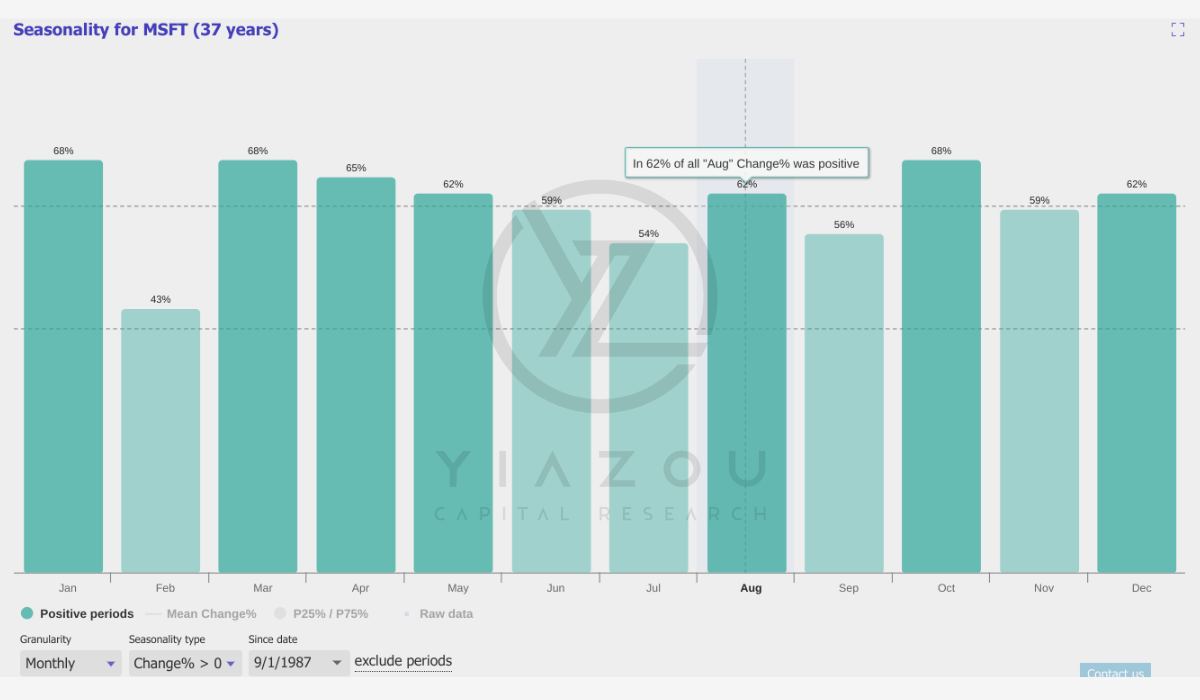

The seasonality analysis of MSFT over 37 years reveals a generally positive bias, with several months showing a strong probability of positive returns. January, March, October, and December stand out as particularly favorable, each with a 68% or higher chance of positive returns, suggesting these months are prime for investment. Conversely, February is the weakest month, with only a 43% probability, indicating a more cautious approach might be necessary. August presents a 62% likelihood of positive returns, making it a good, though not the strongest, period for investment. September and October show contrasting seasonality trends for MSFT.

September has a relatively moderate probability of positive returns at 56%, indicating a somewhat cautious outlook for investors this month. In contrast, October has a strong 68% probability of positive returns, making it one of the most favorable months for investing in MSFT. This suggests that while September may require a more careful approach, October has been a good month historically.

Yiazou (trendspider.com)

Microsoft and Palantir Forge AI Powerhouse: Boosting National Security and Sparking Revenue Growth in Cloud Analytics

Microsoft’s partnership with Palantir Technologies (PLTR) represents a key advance in AI and analytics. This collaboration enhances the capabilities of the US Defense and Intelligence Community. Microsoft’s large language models (LLMs) will be integrated through Azure OpenAI Service on Palantir’s AI Platform. Azure OpenAI Service will operate in Azure Government Secret and Top Secret clouds. With Palantir, these deployments meet high-security standards essential for national security.

Palantir’s products (Foundry, Gotham, Apollo, and AIP) will be used in these secure settings to handle large-scale data and complex analytics. With a partnership with Palantir, Microsoft targets demand for national security missions and operational needs. The impact of the partnership on security could be significant, as Microsoft’s OpenAI GPT-4 and other language models will be employed in these environments. GPT-4 excels in natural language processing and assists with various tasks, including support logistics, contracting, and prioritization. Interestingly, focusing on the offered capabilities, Azure OpenAI + Palantir analytics platforms can be considered the best match for a cloud platform.

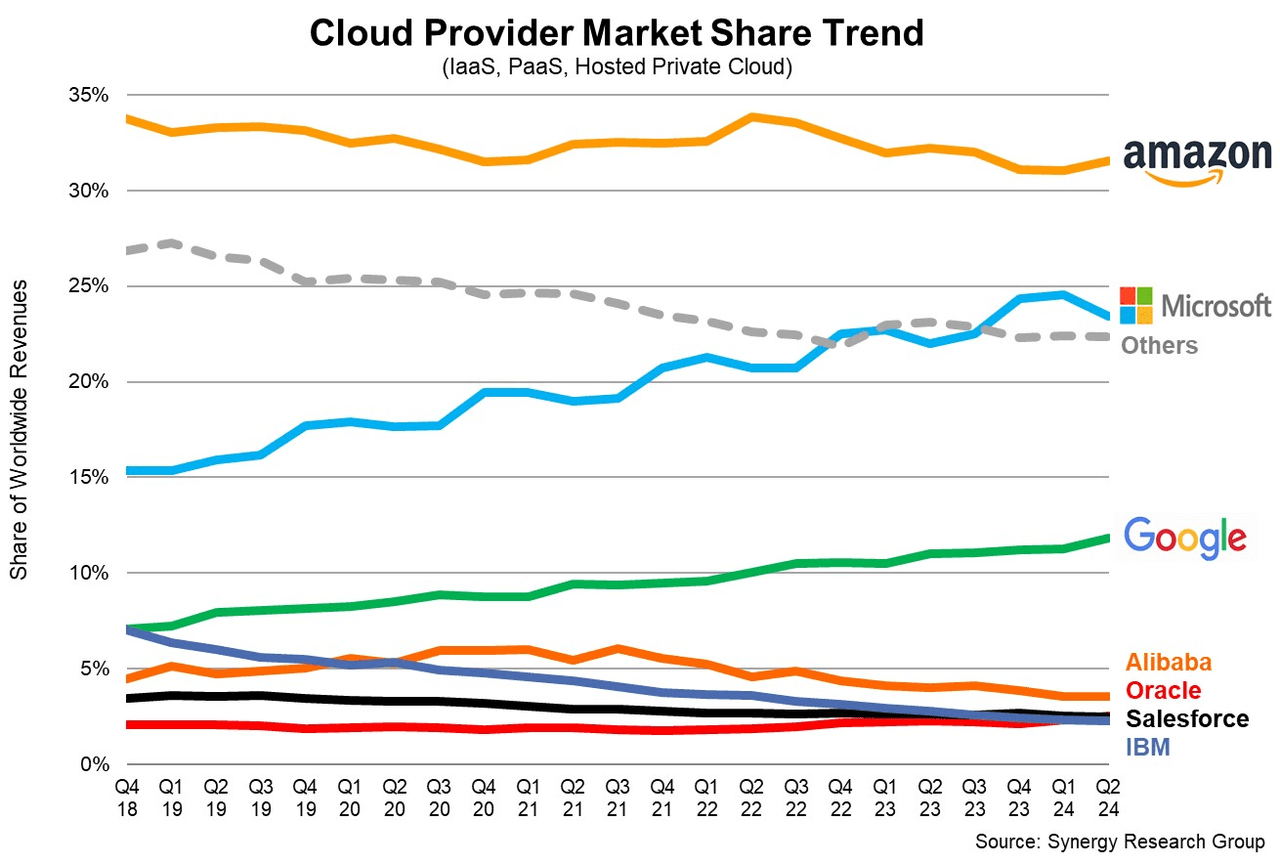

Commercially, the partnership will benefit Microsoft’s top-line with integration into government projects, showing the growth potential and edge of Microsoft’s cloud AI environment in the market. In short, the partnership and related revenue may boost Azure and related cloud revenue, which is already growing 29% annually as of Q4 fiscal 2024.

Finally, it will also prevent an inflection in Azure’s market share, which has dropped sequentially from 24% to 23% in Q2 2024. Palantir’s government revenue was at 23% annual growth in Q2, 2024, and the company holds a solid moat in the government analytics market. Therefore, if both companies extend this featured offering in the market, a real opportunity will emerge in the commercial space.

Digital Information World

AI-Powered Growth Drives Cloud, Productivity, and Security Leadership

Microsoft is expanding its data center footprint across four continents, reflecting its commitment to enhancing cloud computing capabilities. New AI accelerators from AMD (AMD), NVIDIA (NVDA), and Azure Maia support diverse customer needs.

Azure OpenAI Service offers access to advanced models like GPT-4o and GPT-4o mini. Over 60,000 Azure AI customers show a strong demand for AI-driven solutions. The doubling of paid Models as a Service of customers quarter-over-quarter reinforces this trend. Major companies across industries use these models, underscoring Microsoft’s leadership in AI technology.

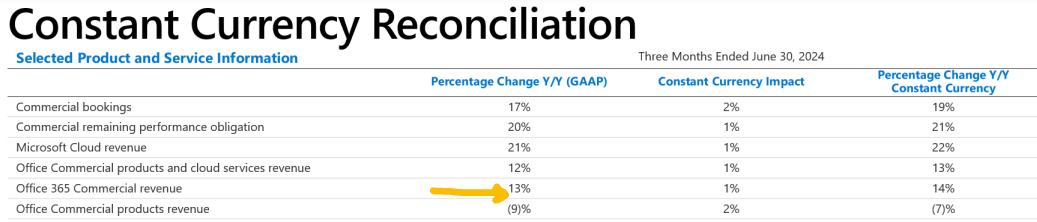

Microsoft’s investments in AI and cloud services also boost its Productivity and Business Processes segment. Office 365 commercial revenue grew by 13% year-over-year (YoY). This growth is due to higher average revenue per user (ARPU) and the adoption of Copilot for Microsoft 365. The impact of AI on productivity tools and customer engagement is evident. Microsoft’s focus on high-margin premium products and Copilot+ PCs is strategic. The increase in Windows 11 active devices by 50% YoY shows success in driving user adoption. Surprisingly, Teams Premium seats grew nearly 400% YoY, reflecting strong user engagement.

Microsoft Q4

Microsoft’s emphasis on security is also notable, with over 1.2 million security customers using its solutions. Defender for cloud contributes $1 billion in revenue. AI integration, such as Copilot for Security, strengthens Microsoft’s position in the security market. Similarly, the growth of Microsoft Fabric, with over 14,000 paid customers, and increased usage of Azure’s data and analytics tools demonstrate its data solutions capabilities. There is nearly 50% YoY growth in data and analytics tool usage, driving value for customers across various industries.

Microsoft Faces Margin Pressure as $19B Cloud and AI Investments Strain Financial Resources Amid Rising Costs

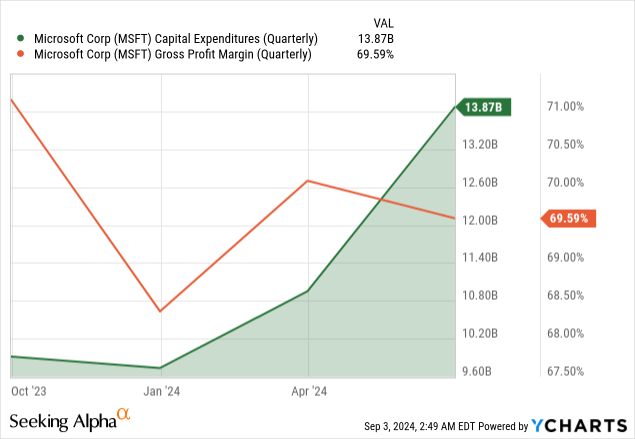

In Q4, 2024, Microsoft reported $19 billion in capital expenditures ($13.9 billion excluding finance leases). The primary investments were in cloud and AI services. Significant spending went into data centers and infrastructure. These investments aim to support anticipated demand growth. However, they also represent a considerable financial burden. The company expects higher capital expenditures in FY2025, putting a financial strain on Microsoft. Extensive capital spending to expand cloud and AI services may strain financial resources. If growth projections fall short, the strain could worsen.

Moreover, margin compression is a key concern for Microsoft. The company’s gross margin percentage slightly decreased to 69.6%. This decrease is due to the sales mix shifting toward Azure. Costs associated with scaling AI infrastructure contributed to the decline. Similarly, Cloud’s gross margin dropped to 69%. Maintaining profitability amid rising expenditures is challenging. The decline in gross margin and rising costs suggest potential profitability issues.

Takeaway

Despite short-term pressures, the company’s strategic investments in AI and cloud services continue to drive growth, mainly through partnerships with Palantir. While margin compression and rising costs pose challenges, the demand for cloud and AI services supports a positive outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.