Summary:

- Nvidia Corporation stock has increased by 61.33% since my previous article in August, outperforming the S&P 500.

- I own Nvidia stock in three out of five portfolios and highlight its dividend history and total return.

- Nvidia has delivered strong earnings growth and outperformed the S&P 500, earning an A+ performance grade. Valuation is high, but future expectations suggest further upside.

da-kuk

My last article on Nvidia Corporation (NASDAQ:NVDA) published 8/29/24 was titled “Nvidia Remains The Best Stock in The Market Now.” That was a bold statement, but I made it with strong conviction. At the time, the performance and valuation numbers backed it up. I also put my money where my mouth was, as it was also my largest position at that time. The stock is up 61.33% since then, while the S&P 500 (SP500) is up 12.91%.

You all are seeking alpha, and my article delivered.

I manage five portfolios at my firm, and Nvidia is in three of them. These portfolios, along with my live trades, are also available to my premium subscribers. I own Nvidia in my Premier Growth, Ultra Growth, and Dividend & Growth portfolios. I do not own it in my Emerging Growth or Best Bonds Now portfolios.

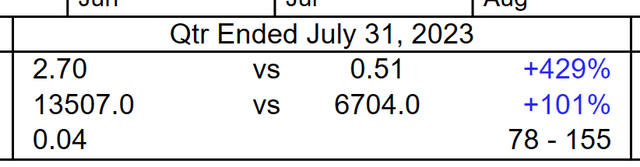

These portfolios usually have about 20 stocks in them (when fully invested) and yes, Nvidia is a dividend payer. Therefore, it qualifies for my Dividend portfolio. Here is what their dividend history looks like:

Dividend history (Yahoo Finance)

You are not going to retire off Nvidia’s dividends, but along with the capital appreciation, the total return has been phenomenal. I have found that in most cases, the companies that pay the fat dividend returns do not deliver much in the way of capital appreciation. Therefore, the total return is usually mediocre.

Now that Nvidia has delivered another blowout quarter, its third one in a row, is it still the best stock in the market now? What did this latest quarter due to its performance numbers, and most importantly, what does its valuation now look like going forward? I require at least 75% upside potential over the next five years to consider a stock for purchase.

In my last article, Nvidia had just delivered its Q2 2023 earnings report. I began by stating that its earnings report was the one that was heard around the world. I compared it to Bobby Thompson’s famous “home run shot” heard around the world back in 1951.

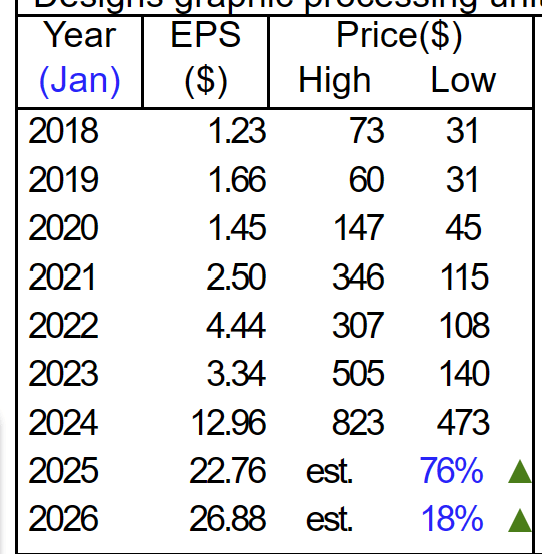

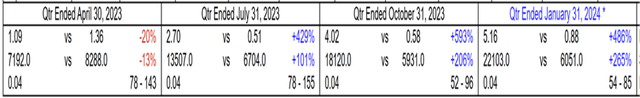

Here is what that home run shot by CEO Jensen Huang’s Nvidia looked like:

Sales were up 101% and earnings were up 429% vs. the same quarter the previous year (2022). In addition to this, the company guided much higher for their next quarter and announced a stock buyback. It does not get any better than that.

It was one of the best “beat and raise” quarters that I have ever witnessed during my almost 25 years as a professional money manager. Anyone who has studied William O’Neill’s “CANSLIM” momentum method of stock selection knows that the “C” stands for current earnings and the “A” stands for annual earnings.

O’Neill was looking for stocks with huge current (quarterly) earnings growth and huge annual earnings growth. Nvidia has now reported two more quarters of earnings and sales growth since my last article. We will look at these in a bit, but let’s first look at what their current annual earnings growth looks like.

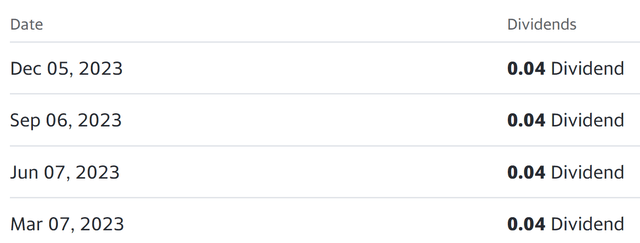

NVDA Annual EPS (Marketsmith.com)

As you can see from the table above, the company has had astonishing annual earnings growth since 2018. You can also see the relationship between growing earnings and stock price appreciation. Stock prices and indexes follow earnings. At the end of the day, it is a very simple mathematical equation that is updated regularly.

Now let’s look at Nvidia’s current (quarterly) earnings growth:

NVDA last 4 quarters (Marketsmith.com)

Nvidia’s last three quarters in a row are the best that I have ever seen for a company this size. This is a perfect example of the “C” in CANSLIM. Stocks like this do not come along very often.

But, past earnings tell us where a company has been, and future earnings estimates help to tell us where a company could go in the future. This is also true of indexes. More on Nvidia’s earnings outlook going forward in a moment.

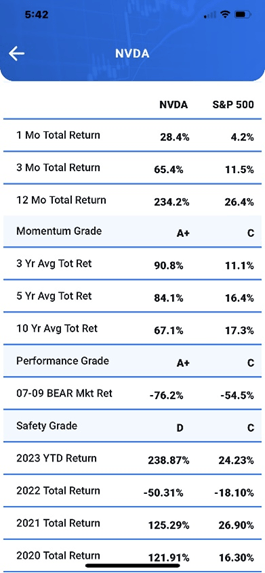

Let’s now take a look at what Nvidia’s current performance numbers look like against the S&P 500.

Valuation Numbers (Best Stocks Now Database)

You can see from the results above Nvidia’s astonishing annual earnings growth. The stock has vastly outperformed the S&P 500 in the short term (one year or less) and currently has a momentum grade of A+ when compared with 5,369 other stocks and ETFs in my database.

When I compare Nvidia’s three, five, and ten-year performance against the others in my database, the stock gets an A+ overall performance grade. As you can see from the list below, Celsius Holdings (CELH) is the only stock that has a better ten-year performance than Nvidia.

Top ten year performance (Best Stocks Now Databas)

My Best Stocks Now methodology gives performance (momentum) and valuation equal weighting, while most quant systems only consider performance. Suffice it to say that Nvidia still easily meets my performance criteria. There are only a handful of stocks in my database that have a better performance record right now.

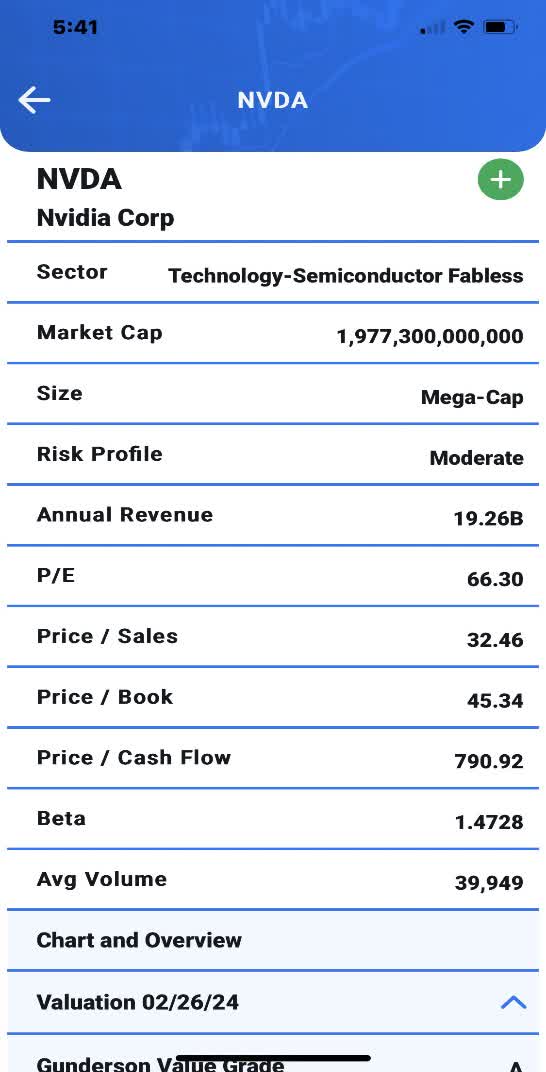

Now we need to examine the other half of the equation, which is valuation. I do five-year valuations that tie in with the company’s expected 5-year growth rate.

Best Stocks Now Database

As you can see from the graphic above, Nvidia’s P/E, Price to Sales, Price to Book Value, and Price to Cash Flow numbers are all very high right now. That does not mean that Nvidia cannot grow into those numbers, however.

We need to take a look at Nvidia’s current expectations going forward to calculate a current 5-year target price. When I wrote my last article on this stock back on August 29th of last year, my five-year target price was $871.58. The stock was trading at $487.84 at the time. That gave the stock 89.6% upside potential at that time, which many commenters found to be an outrageous number.

The stock is now trading at $787.01.

NVDA valuation (Marketsmith.com)

I first take the EPS estimate for next year and extrapolate it out over the next five years at my expected annual average growth rate of 18% per year (the Street is at 36.1% per year), and multiply the result by a multiple that I think that is appropriate for this stock, I get a 5-year target price of $1,563.43.

This gives the stock a 97.8% upside potential from here based on Nvidia’s current forecasts.

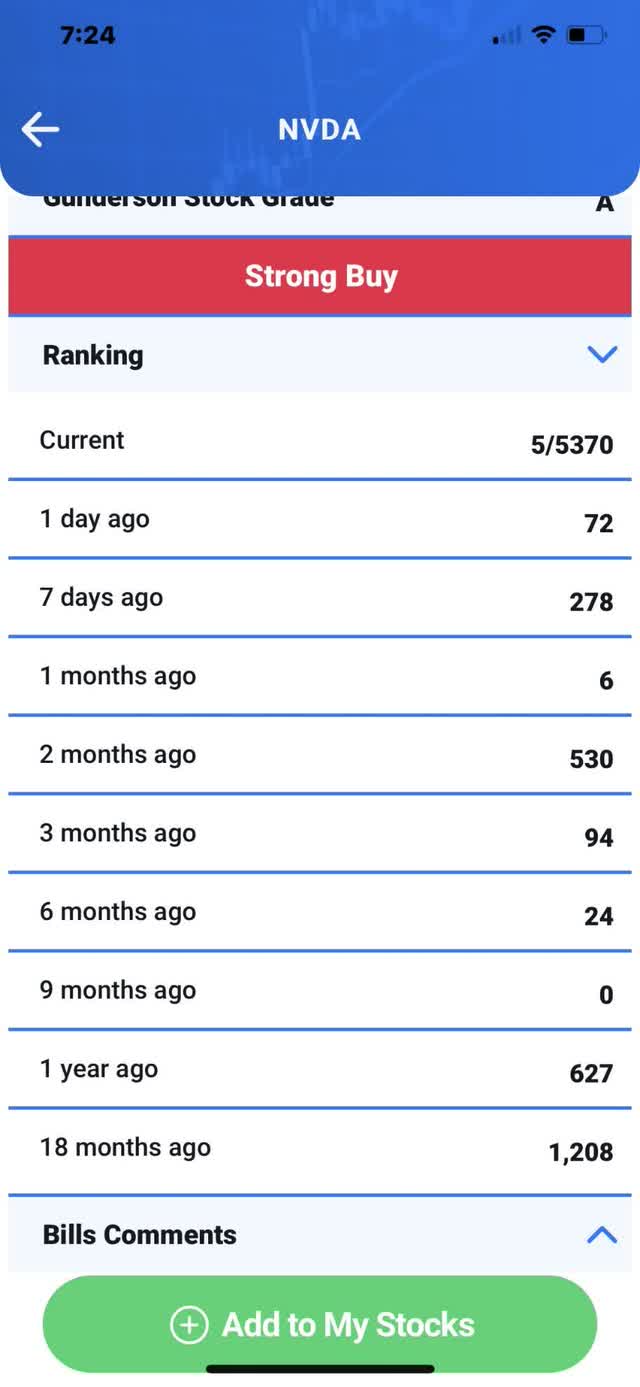

With a combination of powerful performance and good upside potential, Nvidia Corporation stock is currently ranked at #5 in my database of 5,370, and I currently rank it as a strong buy.

NVDA rank (Best Stocks Now Database)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 24 years of experience.

You get Bill’s daily “live” buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, Dividend & Growth, and Best Bonds Now. These portfolios have done very well since their 1/1/2019 inception.

Both our Premier and Ultra-Growth Portfolio were up over 30% in 2023.

JOIN NOW to get daily “live” buys and sells, and weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on almost 6,000 securities, a daily chat room (mon-fri), and a daily live radio show (mon-fri.)!