Summary:

- PFE has beaten analyst estimate both top- and bottom line. The firm has also raised its full-year guidance.

- Investors have not taken the earnings news too positively, however, because significant portion of the growth has been driven by Covid-19 related products or non-recurring items.

- Based on a single stage dividend discount model and a set of traditional price multiples, PFE appears to be undervalued.

- In our view, the current price level could be an attractive one to initiate a position.

Alexandros Michailidis

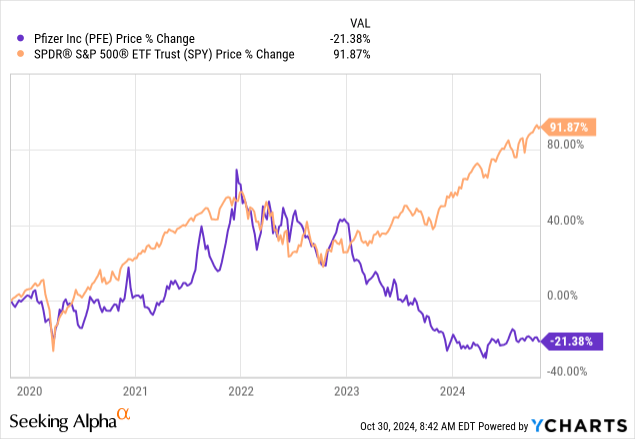

Pfizer Inc. (NYSE:PFE) discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally. The firm has been an investor favourite during the Covid-19 pandemic, as they have managed to successfully develop a vaccine for which the demand has been enormous worldwide. In the price chart of the stock, it is also clearly visible that wanted a part to be part of this success by owning PFE’s stock. After the end of the pandemic, however, PFE’s stock price has started to decline, and has been trending downwards ever since. In 2024, the stock price has somewhat normalised and has been stagnating since January.

The main question that we would like to answer in our article today is: Is it worth owning or buying PFE at the current price level, taking into account the significant revenue and earnings beat in the most recent quarter?

To answer this question, we are going to take a look at the valuation of PFE’s stock using a dividend discount model and a set of price multiples. Then, we are also going to highlight the key points from the most recent earnings release in order to support our valuation argument.

Valuation

Dividend discount model

Before we start with the valuation, we have to check, whether a dividend discount model is a valid approach to value PFE’s stock or not. There are three main criteria that must be fulfilled in order to use this model:

1.) Paying dividends.

2.) In the mature growth phase.

3.) Relatively insensitive to the business cycle.

We believe Pfizer meets all these criteria. Additionally, a strong track record of dividend growth can also give further proof that a dividend discount model may be suitable.

When we use this approach, there are two primary assumptions that have to be taken into account: dividend growth and required rate of return.

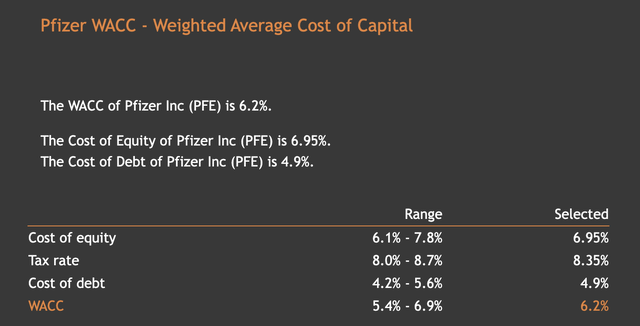

Required rate of return

To come up with a realistic required rate of return, we normally use the firm’s weighted average cost of capital (WACC). According to the latest estimates, PFE’s WACC is in the range of 5.4% to 6.9%. To stay on a more conservative side, we will be using 6.9% for our calculations.

Dividend growth

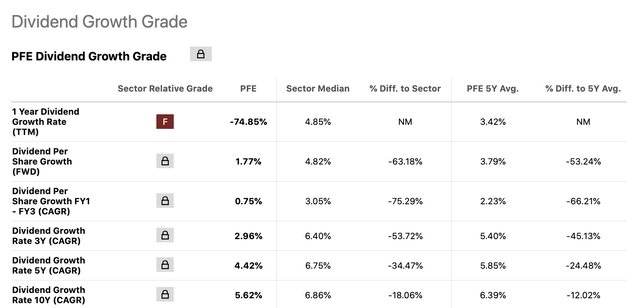

We will be using a single stage dividend discount model today, meaning that we will have one single growth figure in perpetuity. To determine what could be a realistic dividend growth in perpetuity, we are going to take a look at the firm’s historic dividend growth rate, which is summarized in the following table.

While normally we prefer the long-term averages, in this case a 5.62% growth rate in perpetuity seems too high. For this reason, we are going to use a more reasonable 1.77%.

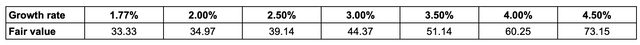

Results

Setting these figures into our dividend discount model, our fair value for PFE’s stock is estimated to be $33.3, which is about 16% above the current share price. The following table also shows a sensitivity, considering higher growth rates in perpetuity. While we believe the higher end of the table is relatively unrealistic, 2-2.5% dividend growth may be possible and reasonable as normally such growth rates are assumed for the economy as a whole in the United States.

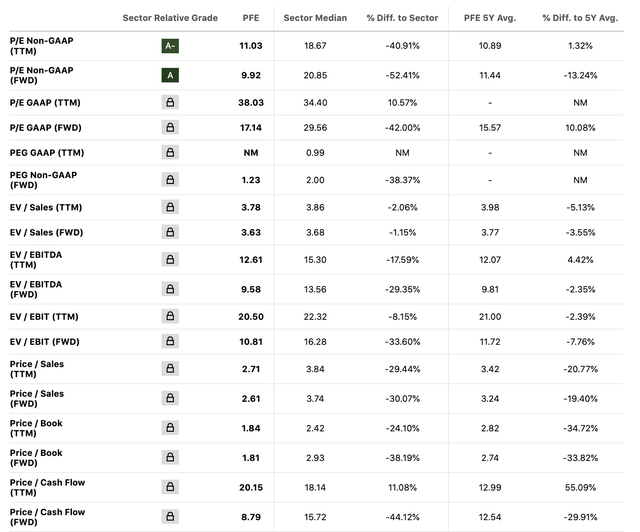

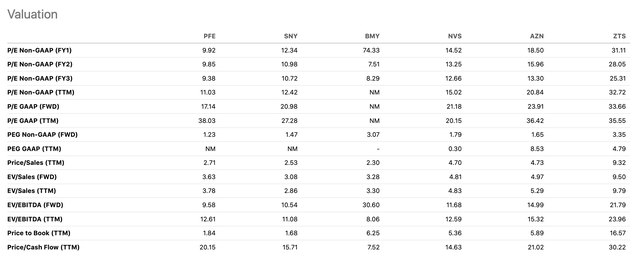

If we take a look at the valuation from a different perspective, using price multiples, we get similar results. Based on most of the following multiples, PFE’s stock appears to be undervalued both compared to the sector median, as well as compared to its own historic averages.

When narrowing the comparison to a peer group consisting of firms from the pharmaceuticals industry only, we also see that PFE appears to be undervalued.

Now, to give these figures a meaning, there are two things that we have to investigate. First: Are the dividends actually sustainable? With sustainable dividends we cannot rely on our dividend discount model results at all. Second: Why is PFE selling at a discount compared to the peers? To answer these, we will take a look at the most recent earnings results.

Earnings results

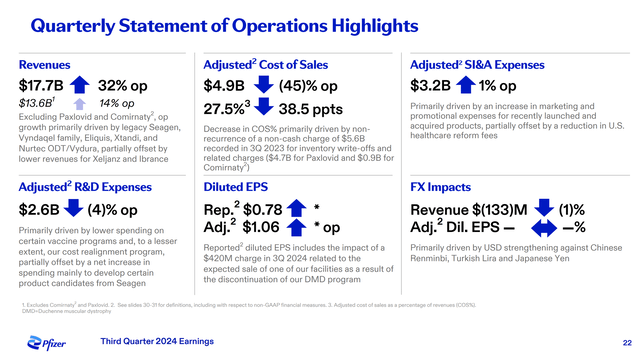

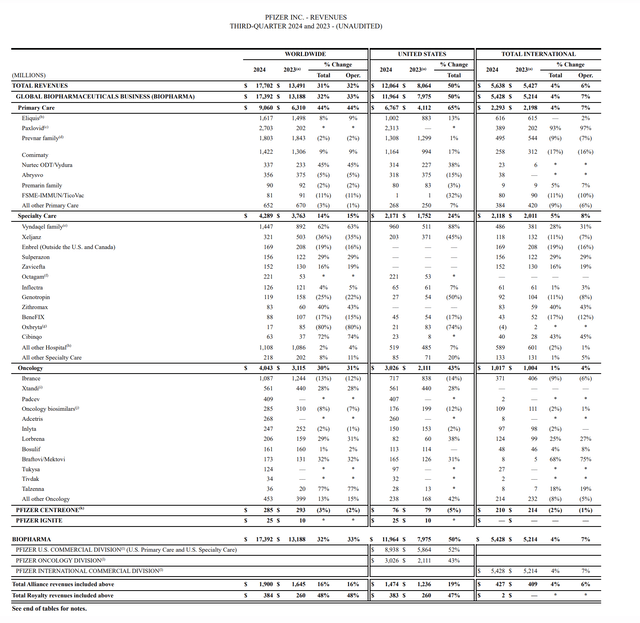

PFE has reported a strong third quarter with both revenue and EPS beating analyst estimates. The firm has also increased its full year guidance. Revenue came in at $17.7 billion, beating estimates by $2.83 billion. This is a whopping 32% Year-over-Year growth. EPS came in at $1.06 or $0.45 above analyst expectations. Operation growth has been roughly 14%, excluding Covid related products. The primary products that have been leading the growth (excluding Covid related products): Vyndaqel family, Eliquis, Xtandi and Nurtec ODT/Vydura. These were partially offset by the weaker performance of Xeljanz and Ibrance. Higher competition and price decreases have been the primary drivers of the negative growth across these product categories.

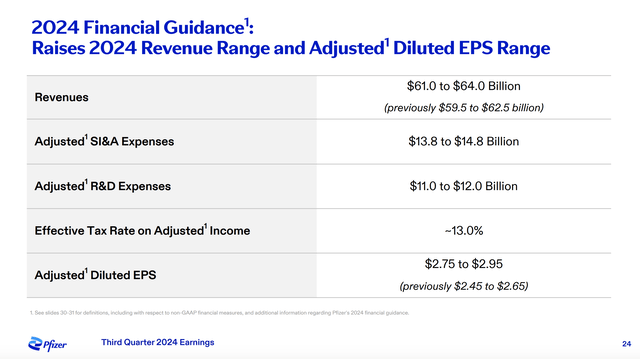

The guidance for the full year has been also substantially boosted:

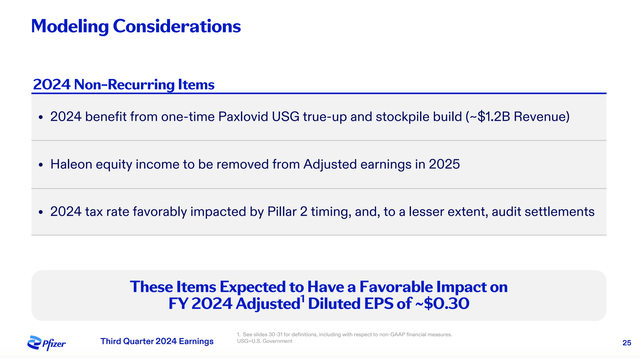

So then why the stock has not been soaring on this news? Well the answer is relatively simple: non-recurring items have contributed significantly to the growth numbers. The firm does not expect this favorable impact to continue into next year and therefore investors appear to be more cautious.

To put these figures into perspective, the following table summarizes PFE’s revenues by product and by geography. Paxlovid made up roughly 20% of total revenue in the United States, while it has accounted for approximately 15% of the total global revenue in the third quarter.

Looking forward, it will be important to monitor, whether the Vyndaqel family can keep its strong double digit (63%) growth, which has been primarily demand driven. We also need to keep an eye out on how the loss of patent-based exclusivity on Eliquis will impact revenues in the coming quarters. Xeljanz, for example, has experienced a significant decline in demand in the previous quarter, which has been driven by both lower prescription volume as well as by the impact of regulatory exclusivity expiry in Canada.

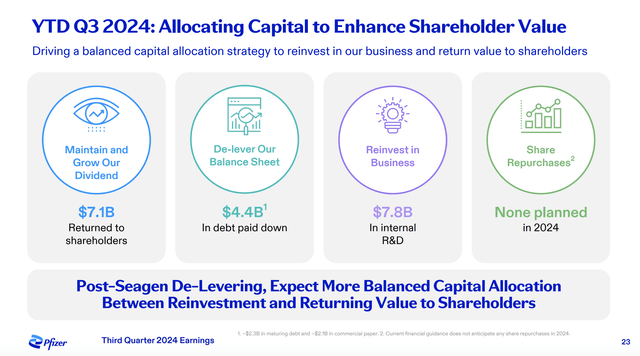

On the dividend sustainability side the firm has affirmed investors that it will keep putting significant emphasis on shareholder returns, primarily in the form of dividends as share repurchases are not planned. Dividend growth has been also envisioned.

Further, the firm’s initiatives on reducing costs are also on track, meaning that the sustainability of the dividend is likely to improve gradually.

On Track to Deliver Net Cost Savings of At Least $5.5 Billion from Previously Announced Cost Reduction Initiatives […] At Least $4 Billion Anticipated by End of 2024 from Cost Realignment Program […] Approximately $1.5 Billion Expected by End of 2027 from First Phase of Manufacturing Optimization Program

All in all, we believe that the PFE’s earnings results are strong, despite the significant favorable impact due to non-recurring items. We believe that the current valuation, based on both dividends and price multiples, are justified based on the firm’s fundamentals.

Key takeaways

PFE has delivered strong quarterly results, beating estimates both top- and bottom line. The guidance has been also raised. Investors, however, did not react positively to these news, due to significant amount of non-recurring items and significant reliance on Covid-19 related products.

The firm appears to be attractively valued based on a set of traditional price multiples and also based on our single stage dividend discount model.

We believe that based on the fundamentals and the firm’s continued commitment to pay dividends, PFE’s stock could be an attractive buy at the current price levels.

For these reasons, we rate PFE as buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.