Summary:

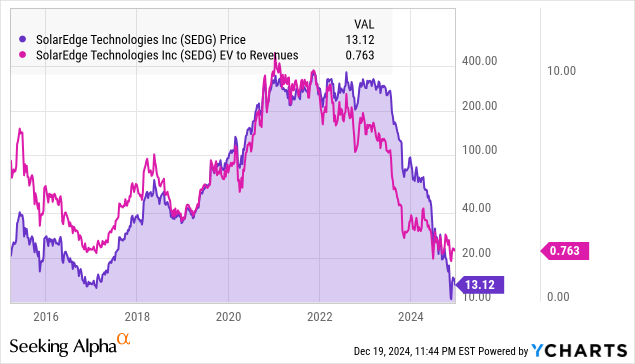

- SolarEdge (SEDG) lost all its glitter in 2023-2024. The market lost all hope for a change in the solar industry and the company’s future in particular.

- The business’s financial condition is somewhere between bad and very bad.

- There is a qualitative side of the company and several positive aspects.

- We are weighing the pros and cons of this investment and discussing what an investor should do now.

Eakarat Buanoi/iStock via Getty Images

The fall from the Olympus in 2023-2024 for SolarEdge (NASDAQ:SEDG) has been abrupt and bloody. Not if it was something new for the solar energy sector: the 2011 to 2012 period was as cruel, if not more so; 2016 and 2018 were not particularly pleasant years, but not as bad as 2023-2024, though. But, is it all over for this business as some worry? I can not answer to that. Through the following reasoning and fact-checking, I will endeavor to name all the negative and positive aspects of the company’s present state.

The Bad

Here, I will discuss unsettling issues, like a cyclicity-induced decline, developments beyond control, or harmful yet common business practices.

There is a statement in the “Security Analysis” magnum opus:

“There is a strong tendency in the stock market to value the management factor twice in its calculations. Stock prices reflect the large earnings which the good management has produced, plus substantial increment for “good management” separately.”

I am inclined to occasionally make this kind of double calculation when exceptional leadership sets an expectation of a continuation of success. But, in the case of the current state of SolarEdge the figures speak louder; the situation is bad. Even if Guy Sella (RIP) was still with the company, I doubt he could have fought off the ongoing slump; even such a great leader as Mr. Kothandaraman from Enphase (ENPH) is having trouble fighting off the cyclicity and Asian competition. Nevertheless, if the management is inclined to learn from many mistakes they made during the “fat” years, they can provide a solid recovery once the European market ramps its volume up. The North American market is recovering, as Enphase and SolarEdge’s reports saw some YTD improvement in the 2d and 3d quarters in 2024.

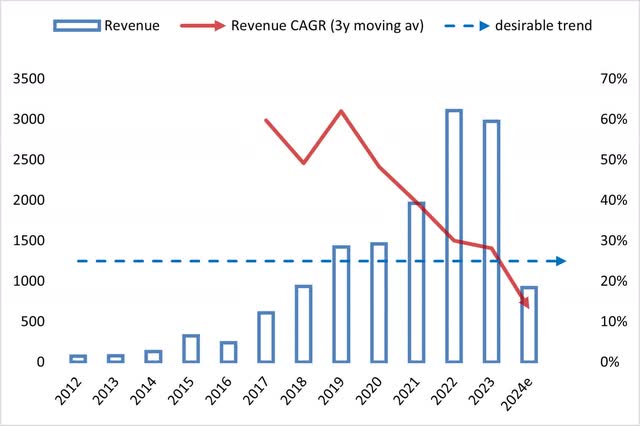

The company’s revenue fell to the level last seen in 2018, undermining 5 years of progress. The only hope is that 2024 will be the lowest point for the company.

Revenue, 3-year average moving CAGR (Financial reporting and Author’s estimates)

Having a moderately optimistic scenario in mind, namely, 2024 being the worst cyclicity-induced year in the history of SolarEdge and getting back to the 2018 revenue level, we have far massive expenses correlated with the scale of operations during 2022-2023 (staff, offices, production, branches, corporate structure, etc.). So, the cash-depleting expenses (not including write-downs) in 2024 could be around $1.8 billion, two and a half times more than in 2018. That leaves the business extremely vulnerable; they would either need to cut everything down to the bone or pray for a massive demand recovery in 2025. The following chart vividly expresses how unprecedented the collapse is; it ruins all the trends.

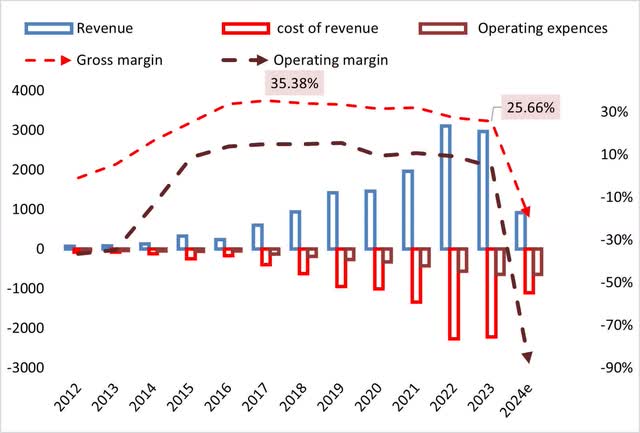

Revenue, COGS, and margins (Financial reporting, Author)

Gross and operating margins became irrelevant in 2024. We can return to a discussion about the competition between growth trends of revenue and expenses if SEDG survives. But, even before the crumble of 2023-2024, the business’s gross margin declined from 30+% to 25%, which reflected not only the ramp-up of operation but also competition. Nevertheless, at the same time, Enphase’s gross margin changed from 29.9% in 2018 to 46.2% in 2023. That says something. The company’s operating margin peaked in 2019 at 15.5% and has deteriorated since then, down to 4.4% in 2023. Again, ENPH had the opposite dynamics, from 17% in 2019 to 20% in 2023.

Interest income and expenses both got over 2%-mark compared to revenue in 2024. It could remain above 3-4% while interest rates stay high or revenue is limited to one billion dollars.

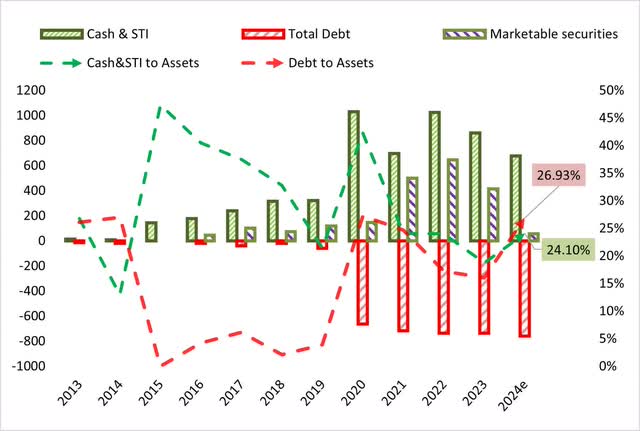

Cash, STI, and debt (Financial reporting, Author)

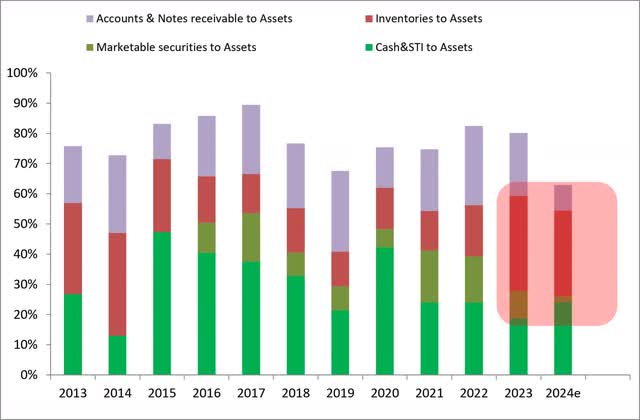

As the chart above tells, cash & STI fell from $1024 million in 2022 to $678 in 3Q 2024, which does not look so terrible, but SolarEdge also had $647of long-term marketable securities; those were literally evaporated, only $56 million remained at the end of 3Q 2024.

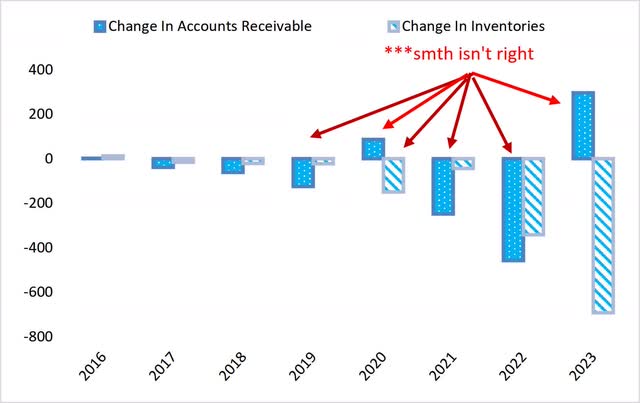

Analyzing the history of change in Accounts receivable and Inventory in the Cash flow from operations, we may come to a conclusion that the market for the company’s products has been hot till the end of 2023 and that heat caused management to be reluctant to watch over their accounts, producing every year more than they were able to sell and selling goods constantly on credit. And though that is probably true for many OEMs, SolarEdge was gradually losing control over the concept of lean business administration, which is the reason behind unnecessary inventory build-up in late 2023 and 1H 2024.

Change in inventories and receivables (Financial reporting, Author)

The last thing that has also been affecting new orders is the following risk, taken from the 10K 2023 financial report:

…since the start of the war on Hamas, we have become aware of pressure being placed on our customers not to engage in business with us due to our affiliation with Israel.

The Ugly

Here, we will discuss what has been plaguing the business till now and will probably partially continue to do so.

Tax Cuts and Jobs Act (TCJA) and Global Intangible Low-Taxed Income (GILTI) shifted the company’s tax base. The R&D expenses and foreign subsidiaries’ income increased SolarEdge’s taxes dramatically, 57.5% and 47% in 2023 and 2022 years, respectively, versus 9.64%, 14.26%, and 18.84% in 2021, 2020, and 2019, respectively. The company’s current low-to-negative income situation makes its financials insanely ineffective. That also discourages some overseas ramp-ups.

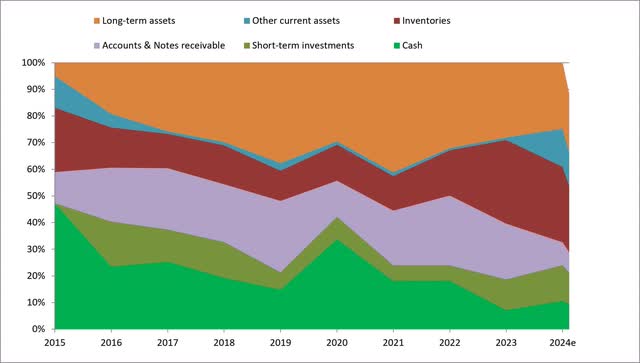

Asset structure (Financial reporting, Author)

Net fixed assets stand at $466 mln., down by $200 in the course of two years. Own manufacturing is generally good, but that is still to be seen in the case of SEDG. Some of SolarEdge’s products are produced in-house; the Sella 1 manufacturing facility in Israel is used for manufacturing power optimizers and inverters. Enphase is doing without own manufacturing, but SolarEdge has taken another path, throughout several years building up Sella 1 and Sella 2 (batteries in South Korea, which they sold in November 2024). That certainly incurred noticeable capital expenditures, which chipped away from the operating margin since 2019. It will be a real pity if the vertical integration doesn’t play out eventually

Another $100 million was written off from Goodwill ($140 in 2019 and $31 in 2022). – Nice spending, guys. Basically, SolarEdge spent $100 mln above acquired assets resulting in Goodwill and around $450 to 500 mln in unnecessary capex since 2018 for Sella 1 and Sella 2. Thus, in theory, operating profit for 2019-2023 could have been greater by approximately $550-650 million. Making mistakes is naturally a reasonable policy to learn and to improve. However, there is no evidence that SolarEdge learned anything valuable up to the present moment.

The management discontinued all businesses acquired during 2018-2019 (UPS, e-Mobility, Kokam); those were terrible decisions – they shouldn’t have gone on a shopping spree in the first place.

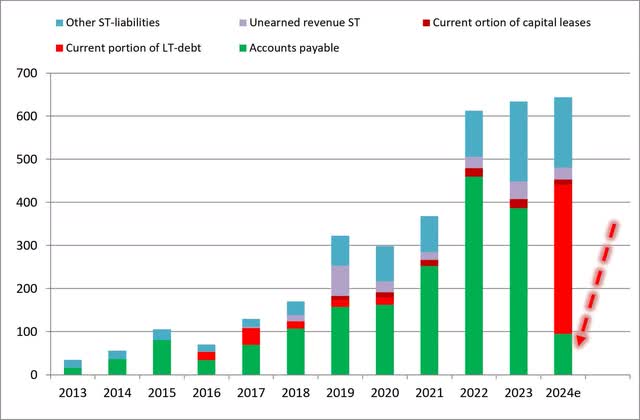

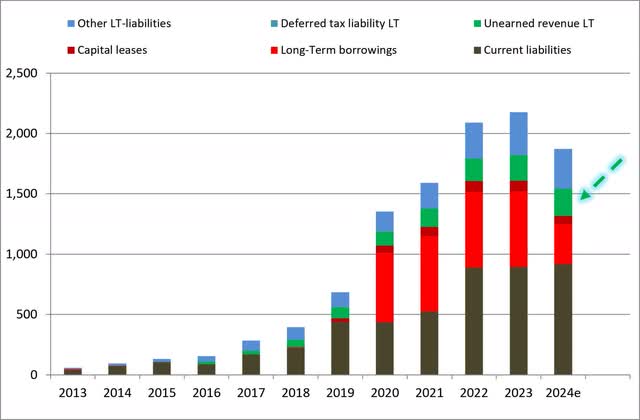

Short-term liabilities (Financial reporting, Author)

The chart above reports that accounts payable fell to an unseen since 2017 level of only $94 million at the end of 3Q 2024, signaling a pessimistic state of operations.

The debt-to-assets ratio, in light of the development of the last couple of years, grew from 16% to 27%, which I dislike. SolarEdge has always been a PV-inverter company with a lower debt-to-assets ratio than Enphase. That changed for the worse.

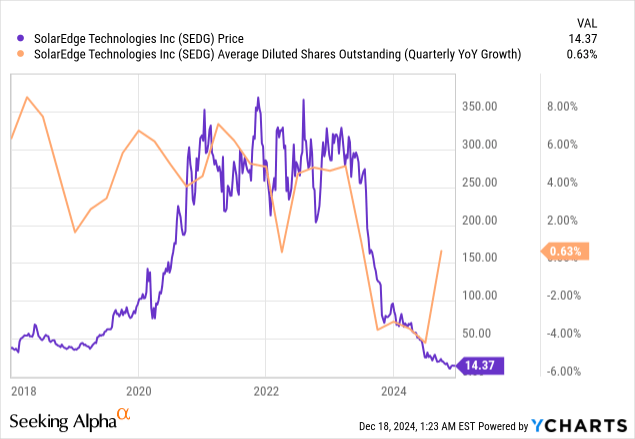

The company has diluted its current investors all the way down to 2023, usually by 5-6% a year (provided in the next chart), which is almost twice as high as the value investing principles suggest. The stock awards in 2023 were unreasonable ($149 mln in the Cash flows statement). The company was reluctant to face the fact of the ongoing crisis and take preventive measures – handsomely reducing any kind of incentives, including the stock-based ones. The business had a ratio of 100 to 1, CEO vs median employee in 2023. It is 3-times better than Enphase, but that doesn’t help SEDG for now.

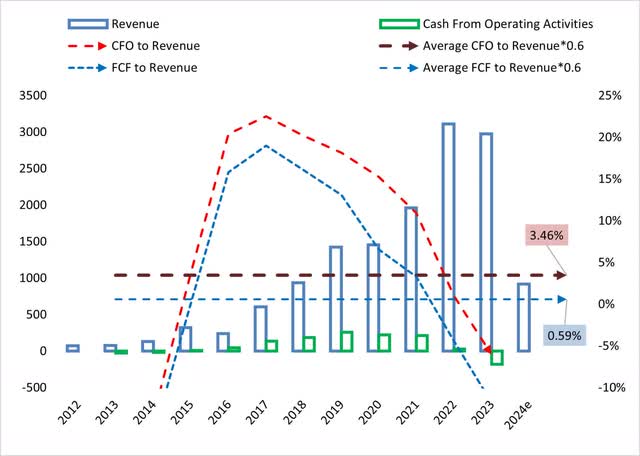

Let’s discuss cash flows by looking at the following chart. Average CFO to Revenue *0.6 stands at 3.46%, and in 2022, the actual figure was 1.01%, and in 2023 -6.05%. What is happening!? Though paper-expense, stock-based expenses were $102.59, $145.54, and $149.95 million for 2021, 2022, and 2023. That is an ominous policy. In terms of being a cash-profitable business, SolarEdge gave this up in 2020-2021, in my opinion, having chosen to develop other products in-house and spending a lot on them.

Cash flows (Financial reporting, Author)

The Good

In this section, I will do my best to admit the positive sides of this investment.

Current assets (Financial reporting, Author)

The management has written off half of the inventories in 3Q 2024; they stood at $1,505 million at the end of June 2024. Facing reality is all but comfortable, but it is good that they did it. The question is, why have they limited the write-off, for a good reason or simply not to get ahead of themselves?

Refinancing SolarEdge’s debt was unavoidable, so 2.25% wasn’t bad for an interest rate. Taken from 10Q from the 3rd quarter 2024:

On June 28, 2024, we sold an aggregate principal amount of $300 million of 2.25% convertible senior notes due 2029 in a transaction exempt from registration pursuant to Rule 144A and Regulation S under the Securities Act. The net proceeds from the offering of the Notes 2029 were approximately $293.2 million, after deducting fees and estimated expenses.

They won time till 2029, once they repay $345 million in 2025. However, if they get better in the future, the dilutive effect of Convertible notes should be stomached by investors. Thus, they can get by with $734 million of Cash & STI plus the rest of long-term marketable securities minus $345 million.

As the following chart suggests, at least Unearned revenue is still at the level of 2022-2023, indicating that the long-term order intake can still be healthy. The sales team has replaced finished works with new orders in 9m of 2024.

Long-term liabilities (Financial reporting, Author)

Since 2023, the company has had a 60% concentration on commercial customers over residential. I deem it a positive change because SolarEdge and Enphase should separate their primary objectives. SEDG’s products are better suited for larger-scale solar energy production (commercial and utility segment), and ENPH’s solutions are better suited for residential-PV. The management should deepen this characteristic to capture ever-growing opportunities in big-scale PV-projects.

Another noticeable change is that in 2023 and 2024, the company stopped employing two co-founders and leaders, Mr. Galin and Mr. Adest, VP of R&D and CPO, respectively. It could be for the better since the single seed investor of SolarEdge, Mr. More, is still there and serving as the Chairman of the Board, but founders-led businesses are usually faring better. In November 2024, Mr. More purchased around $2 million worth of SEDG. That’s a promising sign, along with Goldman Sachs’s recent improvement of the view on the company’s prospects.

Given the situation, I find it impossible to come up with a more or less reliable financial analysis based on the foundation of past financial results. Because the collapse we witnessed in 2023-2024 has been unprecedented for SolarEdge, only comparable to the 2011-2012 solar crisis, where 1 out 3-4 companies that I followed back then eventually faced acquisition/bankruptcy/delisting. There is no knowing how bad/good things can turn out in 2025-2026 for the company. However, there should be a recovery simply based on the Clean-energy megatrend, the magnitude of figures companies and people spend on substituting fossil fuels with alternative energy. That’s not the topic of this article, but anyone can google/chat-GPT “renewable energy capacity investments historical data.” Therefore, SolarEdge can be an eventual benefactor of the recovery if the qualitative part of its business still looks appealing to customers. That is where product quality and rankings come in handy.

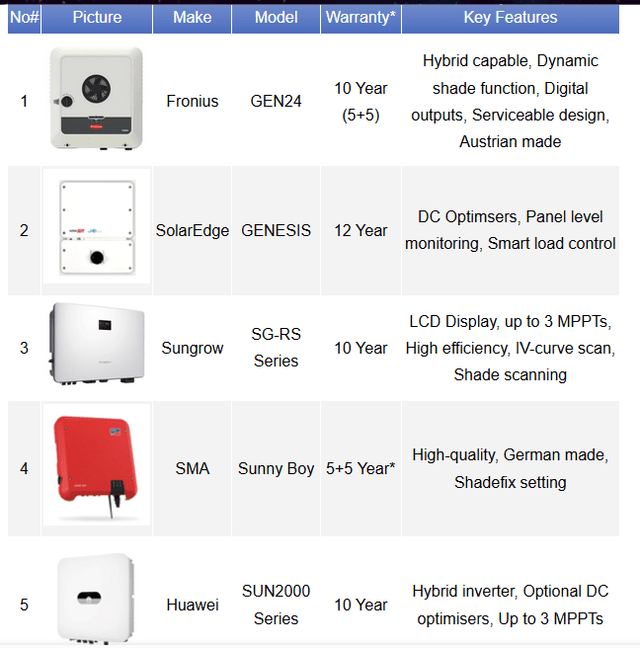

Thus, according to Cleanenergyreviews.info, in 2024, one of SolarEdge’s products is among the top 3 PV-inverters in the world.

Top 10 Solar Inverters 2024 (cleanenergyreviews.info)

- Quality & Reliability – 8/10

- Service & Support – 7.5/10

- Monitoring – 8.5/10

- Warranty – 9/10

- Features – 8/10

SolarEdge has one of the best smartphone apps for remote system monitoring. The MySolarEdge App is a free cloud-based system monitoring portal that provides solar generation and consumption monitoring (with an additional energy meter).

In addition to the individual panel-level monitoring and power optimisation, SolarEdge optimisers offer a great safety advantage by reducing the DC cable voltage to 1 volt per panel if a grid or inverter shuts down. Strings of solar panels can be dangerous (during the daylight) as the DC voltages are usually 300-600 Volts, which can be hazardous in the event of a fire or an emergency.

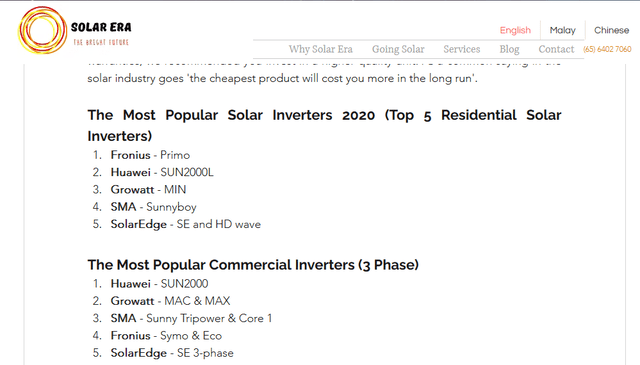

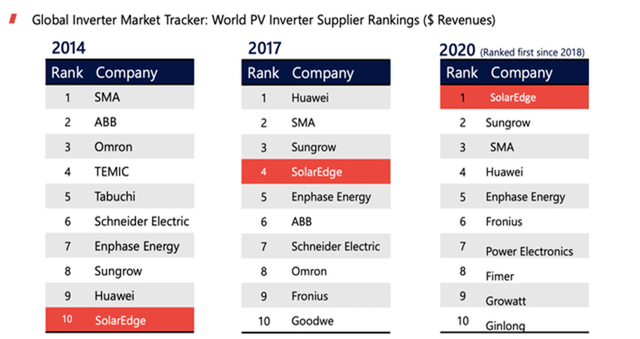

SolarEdge, Enphase, SMA Solar (OTCPK:SMTGF), and Fronius have been at the top for years. That is not a surprise. The following pictures are from 2020.

The Most Popular Solar Inverters 2020 (thesolarera.com)

Global inverter market (SolarEdge presentations)

Here is another fresh article about the same topic: Best Solar Inverters: The Top Inverters for Your Solar Array. So, having a trustworthy name in the industry for product quality is a valuable asset for SEDG, without a doubt, which could help them recover.

How to approach the stock

My personal story with the company: I discovered it in 2017 and had ridden it from $15 to $30 up to $380, cashing out along the way at $38, $50, $60, $86, and $273; Still leaving 15% of the total personal portfolio at the start of 2023. That investment changed my career and financial story. However, when things turned ugly for the business I sat still and started adding from $179 down to $28. That did not end well. The investment is worth around 1% of the total portfolio now. That has also impacted my life and career. Yet, I still wanted to pay this company its dues, producing a deep review you just read.

The financial statements said that the company had efficiency problems before sales collapsed in 2H 2023; it spent a lot of cash on R&D but still had to cancel ancillary operations; the sales growth is the only big bright spot the business had. They must properly insert themselves into the expected recovery; otherwise, the company will sink into oblivion.

This business is worth a go, given that an investor would limit his/her exposure below 4% of the total portfolio. These people are famous for learning from their mistakes, and the business has a qualitative edge of having good products. In two years, the company would either triple from now or go under. I would risk it, but I already have significant exposure. An investor should try accumulating this 4% from below $15 to $10, maybe less, because the volatility is insane.

Discussing the results of recent quarters, the SEDG’s management said:

…we experienced substantial unexpected cancellations and pushouts of existing backlog from our European distributors.

My idea is that as abruptly the demand evaporated in the 2d half of 2023, as abruptly it can return. All the experts in the world will not tell you what is going to happen, as they weren’t able to do so even in early 2023. The megatrend for clean energy is a multi-decade play, and no force could change it because the math is simply there.

Risk factors

1) No financially viable footing to project future business results because the ongoing dumping crisis in solar energy leaves everyone with less sales and income;2) The stock lost 95% of its price in the course of 1.5 years; it can continue to do so in 2025. This is a dangerous and speculative investment presently.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SEDG, ENPH, SMTGF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.