Summary:

- Tesla, Inc. has charted an underwhelming YTD performance, despite the recent rally from the April 2024 bottom, with us concurring that the stock “does not look like a Magnificent 7 stock.”

- The management believes that it is “more than just a vehicles” company and nearer to an “AI robotics company,” attributed to their FSD/ Robotaxi/ Humanoid Robot ambitions.

- While we concur with the massive opportunities in these end-markets, it is uncertain when we may see Tesla effectively monetize these capabilities – attributed to their penchant for ‘elongated timelines.’

- The stock is likely to remain volatile moving forward, attributed to the mixed signals on EV demand, multiple key events occurring in H2 ’24, and the uncertain macroeconomic outlook through 2026, if not 2027.

- We will also be highlighting a few metrics to look out for in the upcoming earnings call on July 23, 2024, with it underscoring the health of Tesla’s businesses along with near-term prospects.

PhonlamaiPhoto/iStock via Getty Images

We previously covered Tesla, Inc. (NASDAQ:TSLA)(NEOE:TSLA:CA) in April 2024, discussing the three key factors why we believed that the company might face further downgrades, as the automaker failed to leverage its first mover advantage and electric vehicle (“EV”) know-how to address the volatile market trends and sales cycle through the $25K mass-market model.

With its installed capacity under-utilized and consumer demand waning, it remained to be seen how and when a reversal in market sentiments might occur, resulting in our reiterated Hold rating then.

Since then, TSLA has retraced by -17% to retest its previous support levels of $140s, before recovering after the FQ1 ’24 earnings call and further rallying to $240s after beating FQ2 ’24 delivery estimates.

Even so, our sentiments remain pessimistic, since the beat is only attributed to drastically lowered consensus estimates, with the automaker company is likely to still report impacted automotive margins in the upcoming FQ2’24 earnings call post-market on July 23, 2024.

We will also be highlighting a few metrics to look out for in the upcoming earnings call, with them underscoring the performance of TSLA’s business segments along with near-term prospects.

TSLA’s Investment Thesis Remains Expensive – No Margin Of Safety

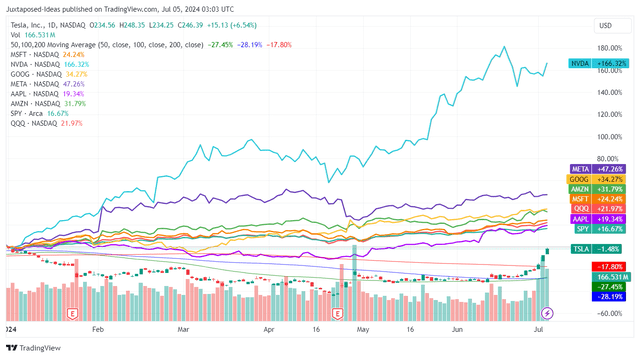

TSLA YTD Stock Price To Other Mag 7 Stocks

For now, on a YTD basis, TSLA has underperformed the wider market despite the +73% rally from the April 2024 bottom, with us concurring that the stock “does not look like a Magnificent 7 stock anymore.”

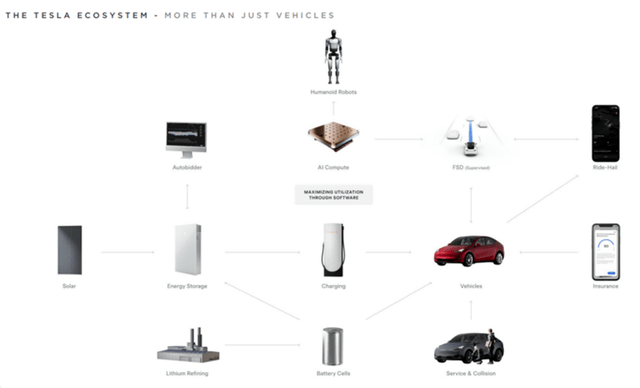

TSLA’s Grand Ambitions

In the grand scheme of things, TSLA is reportedly a “more than just vehicles” company, attributed to its well diversified offerings as listed in the chart above.

1. TSLA Remains A One-Trick Pony, For So Long As Its Side Ventures Are Not Yet Monetizable

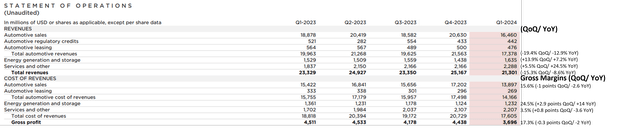

TSLA’s Statement Of Operations

Even so, we must remind readers that TSLA currently only monetizes its Automotive, Energy Generation/ Storage, and Services/ Others as of FQ1 ’24, with each segment reporting mixed QoQ/ YoY performances aside from the Energy Generation/ Storage segment.

It is apparent that the drastic price cuts have not worked out in its favor as well, as observed in the impacted automotive gross profit margins of 15.6% (-1 points QoQ/ -2.6 YoY) and overall operating margins to 5.4% (-2.8 points QoQ/ -6 YoY) in FQ1’24.

At the same time, we may see TSLA’s automotive segment face more headwinds, with the EU already announcing new tariffs for Chinese-made BEVs (unspecified) and US tariffs jumping drastically from 25% to 100%.

While there has been no confirmation if the US-based company may eventually be exempted, the long-term implications are undeniable indeed, since the Shanghai Gigafactory exported 347K EVs globally in 2023 (no breakdown reported for the US), comprising 19% of its overall deliveries.

Furthermore, driver appetite for EVs has also waned in China and the US, as they turn to PHEVs, also known as Hybrids.

For example, Ford (F), the leading automotive brand in the US in 2023 based on volumes sold, has reported growing volumes for Hybrid sales at +49.6% YoY in H1 ’24, compared to +6.1% YoY in H1’23.

The same has been reported by BYD (OTCPK:BYDDF), with it delivering 556.71K Hybrids (+71.6% QoQ) compared to 426.03K EVs in FQ2 ’24 (+41.9% QoQ), building upon the accelerating QoQ trend observed over the past few quarters.

Combined with the robust Hybrid demand in the EU, we believe that TSLA’s one-trick EV pony may have temporarily lost its edge in an intensely competitive automotive market as consumers’ tastes suddenly change.

Combined with the overly niche Cybertruck market and minimal lineup refresh, compared to the well diversified offerings from other legacy/ start up automotive peers, we believe that TSLA’s recent performance has left us wanting, yet again.

This is especially since the FQ2’24 production of 410.83K (-5.2% QoQ/ -14.3% YoY) and deliveries of 443.95K (+14.7% QoQ/ -4.7% YoY) remain underwhelming on a QoQ/ YoY basis, with the QoQ jump in deliveries only attributed to the lower deliveries during Chinese New Year festivities in FQ1 ’24 and constant price cuts thus far.

Compared to TSLA’s installed capacity of up to 2.35M and the implied ~30% in redundant capacity, we believe that the upcoming FQ2’24 earnings call may bring forth more pain to its automotive gross margins indeed.

2. FSD/ Robotaxi Monetization Remains Uncertain

While TSLA slated to hold its Robotaxi event in August 2024, it is uncertain how the management expects to launch and monetize this segment, with multiple Big Tech/ legacy players, such as Alphabet’s Waymo (GOOG) and General Motor’s Cruise (GM), still burning cash while failing to scale domestically, let alone globally.

In our previous Uber (UBER) coverage here, we had reckoned that TSLA might be using their excess inventories as the Robotaxi fleets while partnering with the former’s ride-share platform as a go-to-market strategy, allowing the automotive company to rapidly monetize the segment.

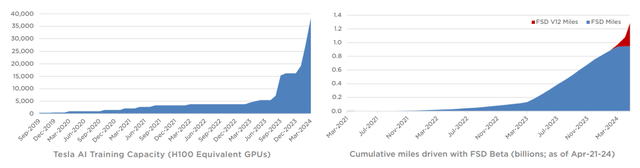

Growing FSD Miles Driven & AI training Capacity

Combined with the growing FSD miles driven and AI training capacity, it appears that TSLA’s ambitions of achieving vehicle autonomy and a ride-hailing service are not too ambitious indeed.

At the same time, we must highlight it has cleared multiple FSD hurdles in China, with the company potentially test launching its Robotaxi capabilities there first, especially given the country’s booming market and the progressive regulations.

On the other hand, readers must note that the TSLA CEO has had a penchant for ‘elongated timelines,’ as observed in the multiple FSD, Robotaxi, and EV claims made over the past few years, with the “show me the money” event yet to take place.

Therefore, while we concur that there are massive opportunities in this new end-market, it remains to be seen when we may see those claims substantiated.

We also concur with JPMorgan (JPM), in which “we do not expect material revenue generation likely for years to come,” with the segment potentially being a bottom-line drag, underscoring why investors need to temper their intermediate term expectations.

3. Humanoid Robots

The Evolution Of TSLA’s Robots

TSLA continues to tout it being an “AI robotics company,” while introducing Optimus – Gen 2 robots by the end of 2023 and guiding the sale of its robots “as soon as the end of next year” (2025).

However, we believe that these claims remain rather ambitious, especially since the CEO expects to build the robots “at a volume for about $10,000 a unit and sell them for $20,000, resulting in a $1 trillion profit.”

For reference, TSLA’s US-based robotic competitor, Boston Dynamic, had previously commercially launched an entry level four-legged robot at $75K in 2021 (without a self-charging dock while being more limited in its autonomous capabilities), compared to other full autonomous four-legged robots at $150K then.

While a growing manufacturing scale may eventually lower ASPs, readers must note that TSLA has yet to achieve its low cost $25K EVs thus far, with it remaining to be seen if the 2025 robotics launch may come at the advertised sticker price of $20K.

For now, it appears that TSLA has been making great progress in reducing costs, with Optimus – Gen 2 mostly made of a lightweight material, Polyether Ether Ketone, with the plastic material naturally being cheaper than those made of metal.

At the same time, another Chinese humanoid robot company, Unitree, has already announced a relatively promising entry-level price point of $16K for Unitree G1, naturally benefiting from the country’s lower cost of labor.

Even so, with TSLA only reporting two robots working in factory floors as of H1 ’24 and volume manufacturing still a distance away, we believe that it may be better to take the CEO’s words with a (large) grain of salt.

This is especially given the intensifying robotics market competition in China, potentially triggering more headwinds to its near-term prospects.

TSLA Is Even More Expensive Here – Offering A Minimal Margin Of Safety

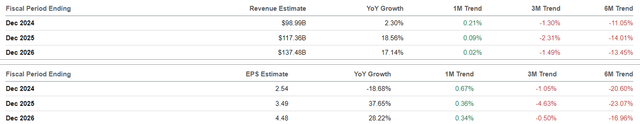

The Consensus Forward Estimates

As a result of its impacted EV prospects and uncertain FSD/ Robotaxi/ Humanoid Robot monetization, it is unsurprising that the consensus has further lowered their estimates, with TSLA expected to chart a lower top/ bottom-line growth at a CAGR of +12.4%/ +12.7% through FY2026.

This is compared to the original estimates of +20.8%/ +28.9% (at the start of the year) and the historical growth at +40.9%/ +290.1% between FY2019 and FY2023, respectively, implying its maturing business profile barring the emergence of a new top/ bottom-line driver in the near-term.

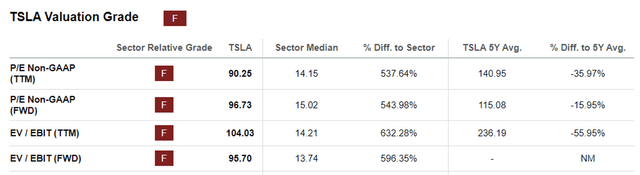

TSLA Valuations

Combined with the overly optimistic stock rally over the past two weeks, it is undeniable that the TSLA stock is overly expensive at FWD P/E valuations of 96.73x, compared to the previous article at 57.68x, 1Y mean of 65.29x, and the sector median of 15.06x.

For so long that its side ventures have yet to show signs of successful monetization, we believe that TSLA needs to be temporarily valued as an automotive/ energy storage/ solar company.

Even then, TSLA’s energy storage capabilities are partly attributed to battery cells made by CATL and BYD Company (OTCPK:BYDDF), with the former responsible for the end assembly into complete systems for different applications.

Due to the minimal margin of safety, we believe that TSLA does not offer a compelling investment thesis at these inflated levels.

So, Is TSLA Stock A Buy, Sell, or Hold?

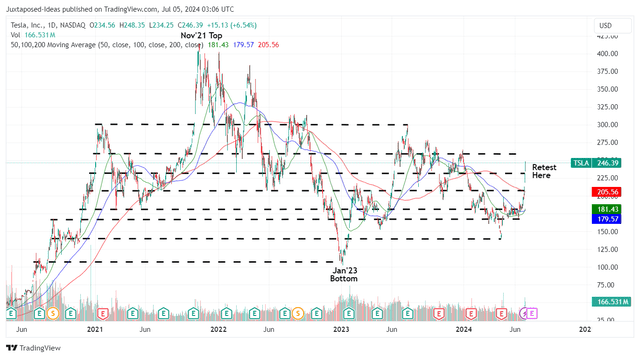

TSLA 4Y Stock Price

For now, TSLA has charted an eye-watering vertical rally after the FQ2 ’24 delivery update, as the market overreacts to the supposed beat, the ratified CEO pay package, and supposedly lower EU tariffs.

The upward ride has been very optimistic indeed, with the stock well exceeding our previous fair value estimates of $207.60 offered in January 2024, based on the 1Y P/E mean valuation of 65.29x and the consensus FY2023 adj EPS estimates of $3.18.

This also means that there is now a minimal margin of safety to our long-term price target of $292.40, based on the same 1Y P/E mean and the consensus FY2026 adj EPS estimates of $4.48.

At the same time, we maintain our previous conclusion that TSLA is likely to be rather volatile moving forward, attributed to the mixed signals on EV demand, multiple key events occurring in H2’24, and the uncertain macroeconomic outlook through 2026, if not 2027.

While we concur that TSLA now looks a lot more interesting, thanks to the numerous advancements in its Robotaxi and Humanoid Robot developments, it remains uncertain it these may eventually be top-line accretive with the bottom-line drag almost a certainty.

While we have most certainly missed the recent rally, we are uncertain if there is any more upside ahead, with most likely baked-in already.

Readers may be better off waiting for more clarity from the upcoming FQ2 ’24 earnings call on July 23, 2024, before chasing this rally, resulting in our reiterated Hold rating for the TSLA stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.