Summary:

- Texas Instruments’ revenue performance in Q3 was better than expected, but it is now entering a seasonally soft 6 months; meanwhile consensus estimates for Q4 have already been curtailed.

- TXN’s key end market- Industrials continues to decline, whilst its second-biggest end market- Autos is only posting better trends on account of the Chinese market.

- Despite receiving favorable ITC to the tune of $220m, TXN’s FCF margin is well short of its long-term target as CAPEX commitments towards the 300m wafer capacity remain high.

- TXN, a dividend achiever has been witnessing declining dividend growth trends and we don’t expect this to reverse given the subdued FCF outlook.

- We question if it is worth paying a premium forward P/E multiple of 33x (based on the Dec 2025 EPS), particularly given a lower threshold of EPS two years out.

manassanant pamai/iStock via Getty Images

Introduction

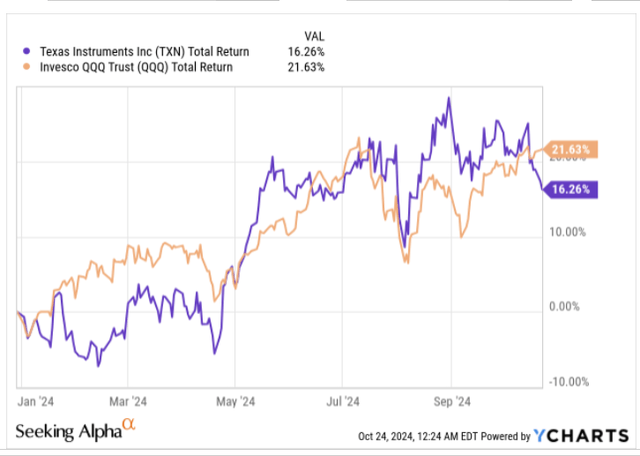

The large-cap semiconductor stock- Texas Instruments (NASDAQ:TXN), noted for its expertise in analog and embedded processing chips, appears to have gotten its mojo back this year. After a disappointing 2023, where it only generated a little over mid-single-digit returns (which represented just a tenth of the overall returns of the Nasdaq for that year), the 2024 performance so far has been quite commendable. Until mid-October, TXN had been outperforming its benchmark but lost ground before its Q3 results which came out a couple of days ago. Nonetheless, the market appears to have liked what TXN delivered in Q3, as the stock gapped, and is up by 4% since the event.

So, how do we feel about TXN after the Q3 event? Well, here’s our read on some of the important sub-plots from that event.

Q3 Earnings – Key Takeaways

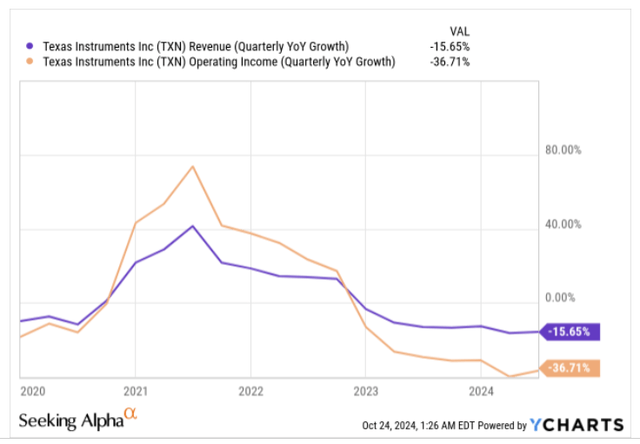

Long-standing observers of Texas Instruments would be aware that the business has been facing topline challenges for a while now, and while that has continued for yet another quarter (this trend will only likely reverse from Q1 next year), the pace of decline has abated quite significantly in Q3 with TXN posting single-digit declines (-8%) after a long time (for context, the market was expecting a decline of over -9%.)

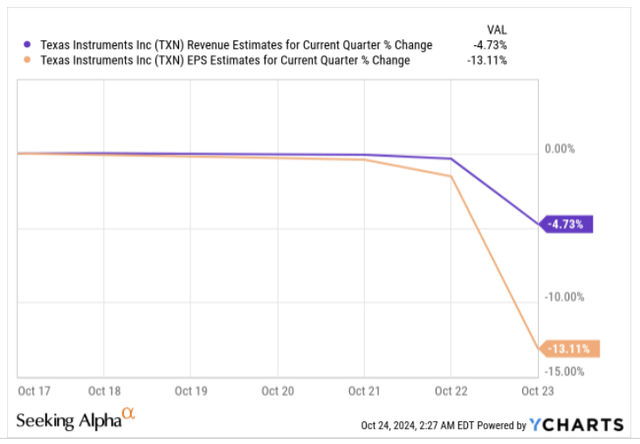

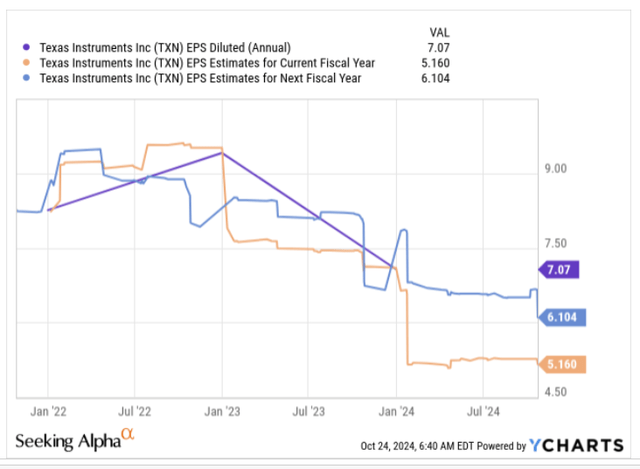

On a sequential basis, the topline was up by +9%, but we would advise investors to not jump the gun and expect further sequential progress, as traditionally, on account of seasonal factors, the December (Q4) and March (Q1) quarters usually see a decline in business momentum. Indeed, in the earnings release, management provided rather soft guidance for Q4, with an expected topline range $3.7-$4bn, and an EPS range of $1.07-$1.29. This has already prompted some sharp revisions by the sell-side community with consensus topline numbers coming off by -5% and bottom-line numbers coming off at a much greater pace of over 13%!

The significant EPS revision is due to the pronounced degree of operating deleverage that TXN continues to experience. Operating profits have been falling at a greater pace than the topline since the latter part of 2022, and in recent quarters it has been well over 2x (see image below which does not include the Q3 numbers). Nonetheless, that >2x differential persisted yet again in Q3 with an -18% decline on the operating profit front, vs an -8% decline on the topline). Pressure here will likely persist, as sales in Q4 is expected to drop both annually and sequentially, but yet, TI management expects the OPEX base to be “ flat to slightly up”.

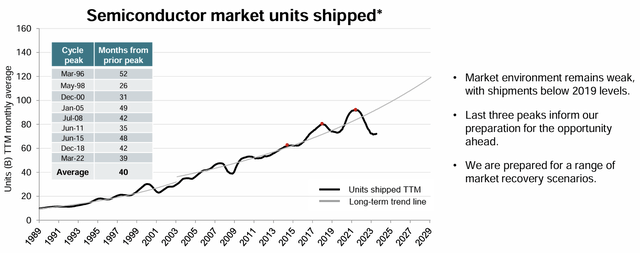

When semiconductor unit shipments are below par, Texas Instrument’s IDM (Integrated Device Manufacturer) characteristics put it at a disadvantage, relative to some of the fabless alternatives that won’t quite see the same pressure on the fixed costs front. The image below provides some context on how far below industry shipments are relative to the normal trend (currently below the 5-year lows).

Capital Management Presentation

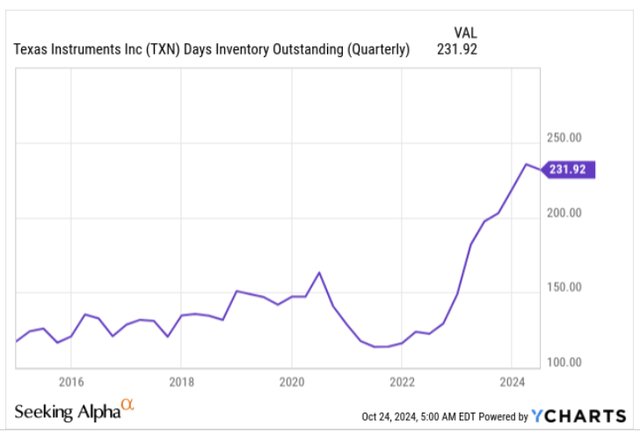

One may argue that the current slump looks overdone (relative to the long-term trend), but TXN management was not too keen to call a bottom in their largest end-market- the industrial segment (contributes 40% of group revenue), which has been falling over the last 8 quarters, and continued to decline by low-single-digits for the second successive quarter. When your largest end-market is still coping with a bloated inventory position, that reflects poorly on your own days in inventory (DIO) position which is now at decade highs.

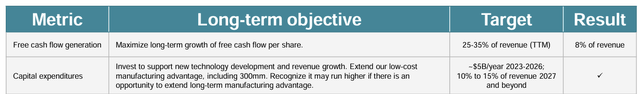

Note that after boosting their inventories on the balance sheet by $190m in Q3, TXN is still looking to spend another $100m in Q4 towards this endeavor. With inventory commitments the way they are, it is little wonder that TXN is underperforming its long-term FCF margin target of 25-35%. In Q3, FCF declined by 11% YoY (despite receiving useful investment tax credits to the tune of $220m from the US Chips and Science Act) with the FCF margin coming in only at 9.3%.

Capital Management Presentation-Feb 2024

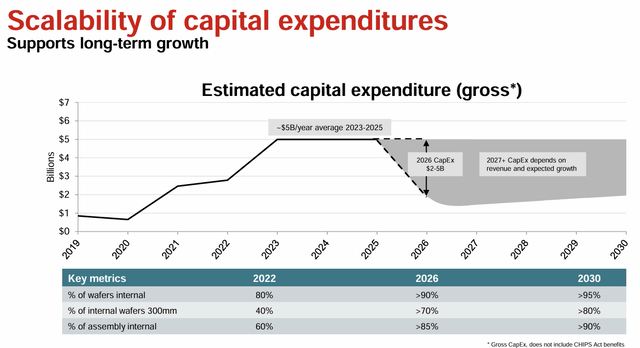

Another reason why FCF continues to be hamstrung is because TXN is neck deep in ramping up Phase 1 of their $300m wafer fab investments, which will see CAPEX at an elevated threshold of $5bn p.a. through the end of FY25.

Capital Management Presentation-Feb 2024

You won’t see the benefits of this any time soon, but in the long-run, TXN will be more competitively positioned from a cost angle, as chips built on 300mm wafers will cost around 40% less than chips built on 200mm wafers and could end up driving gross margin improvements to the tune of 800bps! Needless, to say, as things stand, TXN’s gross margins aren’t in the best shape, and as of 9M-24 stand at only 58.3% (lower by 560bps YoY). In Q3 per se, the gross margin pressure was not as pronounced as in previous quarters with only a 250bps decline (at 59.6%), but management did suggest that GM pressure will continue in Q4 as well.

Then TXN’s top market may still be in a bad way, but its second-largest market (automobiles which contribute 32% of group revenue) did see some green shoots. After declining by mid-single-digits in the first two quarters of this year, growth was finally seen in Q3 at the upper single-digit mark (one could argue this was the main trigger in TXN’s topline coming in better than expected). The key catalyst here was the Chinese part of the auto market where new records are being established. Naysayers may question whether the Chinese momentum could continue, but we’d think this still has some legs as the effect of the Chinese government’s vehicle scrappage program should still linger (Bloomberg NEF believes this scheme could result in EV sales crossing the 10m mark there by the end of this year). Having said that, we would urge investors not to get too carried away, as the Chinese component of TXN’s auto business is only 20%, and management did confirm that the rest of the business has still not bottomed out.

Closing Thoughts- Why TXN Stock Does Not Make For A Good Buy Now

To sum up the previous section, while Texas Instruments did see some green shoots in Q3, abiding weakness still persisted on quite a few metrics (particularly TXN’s largest end market). Crucially, management did not sound confident enough that a bottom was in place. Nonetheless, their cautionary stance is reflected in the Q4 guidance which has prompted the sell-side to cut both topline and bottom line estimates.

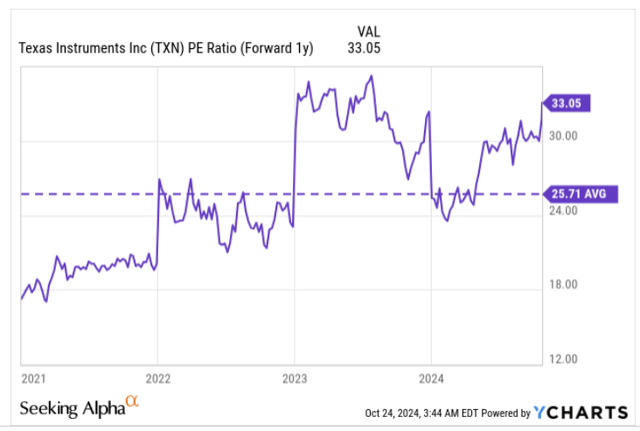

In light of this backdrop, we question whether it would be prudent to shed out a premium valuation multiple to own the TXN stock. For context, based on next year’s EPS ($6.1), the stock is now priced at an elevated forward P/E of 33x, which translates to a 28% premium over the stock’s long-term average.

The rationale of paying a P/E premium deserves even further scrutiny when one notes that even two fiscals from now, TXN’s EPS will still be lower than what was seen in FY23.

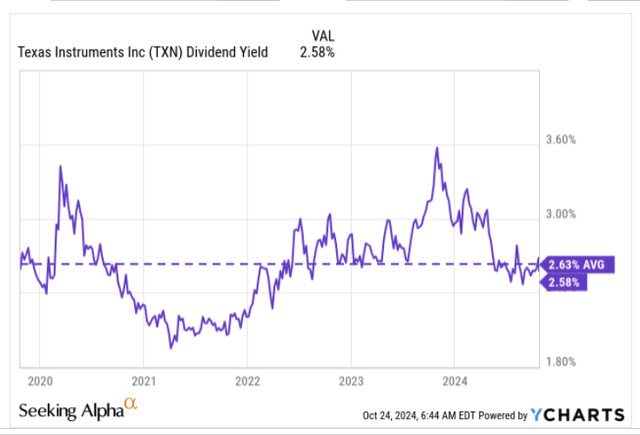

Then, we acknowledge that a substantial part of TXN’s shareholder base pursues it for its distribution prowess, but as we’ve noted previously, the pace of dividend hikes appears to be slowing in recent years, and the most recent hike has only been around 4.6%. Now, given the share price appreciation seen this year, the yield too is not very compelling, coming in below its 5-year average of 2.63%.

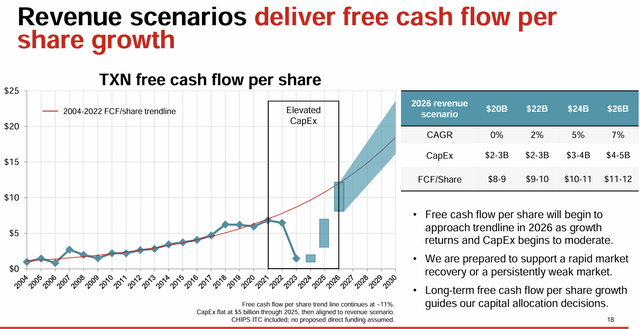

We also don’t think investors should brace for the dividend growth trends to start trending higher any time soon, as this is just a corollary of FCF generation (TXN’s target is to distribute 40-80% of FCF as dividends) Note that, TXN’s FCF generation is expected to stay subdued through 2026 (FCF/share will only catch up with its long-term trend once CAPEX begins to moderate in 2026).

Capital Management Presentation-Feb 2024

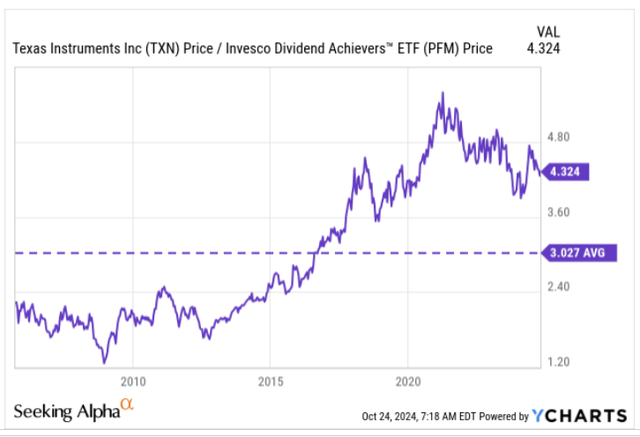

With a relatively unappealing “current” dividend profile (which is of course transitory), we also question why TXN’s relative strength versus other dividend achievers is still on the higher side (43% above its long-term average) and believe it could be vulnerable to further normalization.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.