Summary:

- Amid all the focus on how generative AI threatens Google’s search engine business, the investment community is missing the fact that it also raises risks for Amazon’s e-commerce business.

- Amazon’s AI opportunities are indeed bountiful across the platform.

- Some familiar issues impede Amazon’s AI-related opportunities.

HJBC

Every business on the planet is destined to be transformed by AI, and Amazon is no exception. Unlike its competitors, Amazon (NASDAQ:AMZN) has been rather slow in deploying generative AI across its suite of consumer-facing services, and there are notable reasons why it may not be rushing into speedy transformations. While generative AI offers many opportunities to Amazon, it also poses threats to its revenue growth.

In the previous article on Amazon, we covered the strengths and challenges of AWS, including how producing its own AI chips gives it an edge over Microsoft Azure, but that encouraging customers to shift away from Nvidia’s GPUs would be a challenge. Now we will be exploring the opportunities and threats from generative AI on the e-commerce business. Nexus Research maintains a ‘hold’ rating on the stock.

While the AI frenzy has re-ignited investors’ interest in the technology, note that Amazon has already been using AI in various corners of its platform like delivery and advertising. Take fast delivery as an example. On the last earnings call, Amazon’s executives proclaimed how the regionalization of its fulfilment network in different geographic regions is allowing Amazon to deliver packages faster in the US. The e-commerce giant uses machine learning (a fancier term for AI) to forecast demand for various products, and have it in stock ready for swift delivery, especially for Prime members.

That being said, Amazon will now need to prove that it can successfully deploy generative AI across its platform. On the Q2 2023 earnings call, CEO Andrew Jassy touched upon Amazon’s AI ambitions:

“On the AI question, what I would tell you, every single one of our businesses inside of Amazon, every single one has multiple generative AI initiatives going right now. And they range from things that help us be more cost effective and streamlined in how we run operations in various businesses to the absolute heart of every customer experience in which we offer. And so it’s true in our stores business. It’s true in our AWS business. It’s true in our advertising business. It’s true in all our devices, and you can just imagine what we’re working on with respect to Alexa there. It’s true in our entertainment businesses, every single one. It is going to be at the heart of what we do. It’s a significant investment and focus for us.”

The most obvious use case of generative AI on the e-commerce platform is a chatbot-based shopping assistant. Google and Microsoft have already introduced their own conversational chatbots Bard and Bing Chat, respectively. In fact, they have also enabled third-party merchants to directly integrate their services with the chatbots. For instance, Google has revealed partnerships with “Spotify, Walmart, Redfin, Uber Eats, TripAdvisor and ZipRecruiter”. These tech giants are certainly not going to stop there, as they will indeed leverage the power of generative AI to facilitate richer shopping experiences, posing a threat to Amazon’s leadership position in the e-commerce space.

Furthermore, e-commerce rival Shopify has already revealed its own AI-powered shopping assistant in its consumer-facing Shop app, hence forcing Amazon to move quickly to keep up in the AI race.

An Amazon shopping assistant that can engage in human-like conversations with shoppers can indeed open the door to greater commercial opportunities. Enabling shoppers to describe what they are looking for can offer incredible insights into their preferences and the context in which they intend to use the desired products. Moreover, the back-and-forth conversations can enable Amazon to gain a deeper understanding of consumers’ decision-making processes.

Furthermore, these advantages extend to Amazon’s AI-powered voice assistant, Alexa, which will indeed be upgraded to possess more advanced generative AI capabilities, as CEO Andrew Jassy alluded to on the last call.

With Alexa being built-into Amazon’s range of home devices like Echo and Fire TV, the e-commerce giant has various avenues of engaging with its consumers beyond desktops/ mobiles. This enables Amazon to learn more about its consumers during various daily activities through natural conversations.

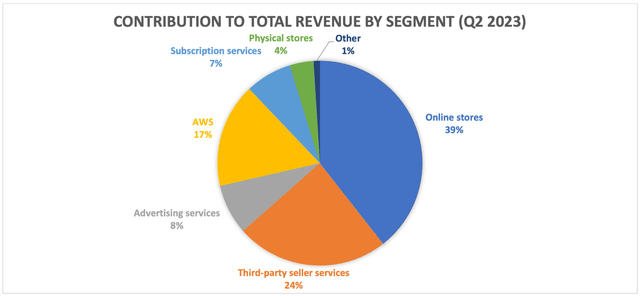

Therefore, generative AI-powered products and services can help Amazon collect a lot more data about its customers, conducive to being able to deliver increasingly more relevant products and services that better satisfy consumers. As a result, this can induce customers to stay knotted to the Amazon ecosystem in terms of both the Amazon marketplace and the suite of home devices. Consumers will become less willing to shift to alternative shopping experiences from competitors if their Amazon systems are already well-acquainted with their preferences. An increasingly loyal customer base fosters the quality and sustainability of Amazon’s e-commerce sales revenue for shareholders, which made up 63% (both ‘Online Stores’ and ‘Third-party seller services’ segments) of total revenue in Q2 2023.

Furthermore, using the power of generative AI to enhance the value of Amazon’s services and subsequently keeping consumers entangled to the platform can also be conducive to more shoppers becoming Prime members. If shoppers find that generative AI-powered shopping assistants on Amazon marketplace and Alexa voice assistant are becoming an increasingly convenient way of shopping for all their needs, they could indeed become more inclined to subscribe to Amazon Prime for faster and cheaper delivery, along with other bundled perks like Amazon Video and Music. Hence, Amazon’s generative AI advancements could also help boost the subscription services revenue segment, which made up 7% of the tech giant’s total revenue in Q2 2023.

Amazon’s AI opportunities indeed don’t stop there, as the company is likely to imbed generative AI capabilities across other Prime services too. This includes more convenient grocery shopping with Amazon Fresh as well as Prime video for richer entertainment experiences. These advancements are likely to be conducive to long-term, sustainable subscription services revenue.

Now while the AI-related opportunities are indeed promising, Amazon also faces various risks in this new era.

How the AI revolution poses risks to Amazon

Amazon’s brands versus third-party products: It is well-known that aside from selling goods from third-party sellers on its marketplace, Amazon also sells its own private labelled goods, including ‘Everyday Essentials’. In fact, the e-commerce giant has faced anti-trust litigation over using data about how shoppers interact with third-party sellers’ products to feed into its own product development processes, and subsequently undercut third-party merchants’ prices. Such unethical practices threaten third-party merchants’ business survival.

So now amid the generative AI revolution, while AI-powered shopping assistants can indeed offer incredibly lucrative insights into shoppers’ preferences, Amazon faces a dilemma over whether to keep these insights to inform its own product innovation/development for its private labels, or also share this data with its third-party sellers to enable them to grow their businesses on the Amazon marketplace.

If third-party sellers perceive that Amazon is once again using this data to promote its own products rather than support external merchants, then these sellers could indeed be encouraged to leave the Amazon marketplace and sell through an alternative marketplace, or even set up their own web stores using services like Shopify. This would threaten the ‘Third-party seller services’ revenue segment, which contributed 24% to total revenue last quarter.

Amazon’s advertising dilemma: Amazon also has a growing advertising business, and using the power of generative AI, Amazon should be able to leverage its advanced insights into shoppers’ preferences to deliver higher-converting ads, as well as enable advertisers to produce ads more easily.

But in the era of generative AI powering conversational chatbots, it faces the same dilemma as Google over whether to show shoppers products that exactly match their queries, or prioritize sponsored ads from third-party sellers. Amazon could take a similar approach to Google’s experimental advertising strategy by showing a mix of ads and relevant products in the chat answers to shoppers’ queries. But Amazon has yet another problem that Google doesn’t have, and that is whether to prioritize their own products over those from third-party sellers when listing relevant products. If Amazon is perceived to show its own products more prominently, it could dissuade sellers from advertising on Amazon, posing a risk to Amazon’s advertising revenue. Furthermore, it could discourage sellers from listing on Amazon altogether and push them towards competitors. Therefore, Amazon will need to prudently manage its advertising strategies in this new era of AI to sustain revenue growth.

Shopify’s AI advancements: Shopify is making generative AI advancements across its platform more swiftly than Amazon. We covered earlier the conversational shopping assistant in the Shop App, which will push Amazon to launch similar assistants to stay relevant in the AI race.

Moreover, Shopify has also introduced tools like Sidekick that can assist merchants in various time-consuming tasks and run their businesses more easily. Shopify will certainly not stop there, as the rival will continue to leverage the power of generative AI to enable merchants to start and run their own web stores more seamlessly.

As per the aforementioned issues regarding how Amazon will use shopping-related data in the era of AI, if third-party sellers indeed feel disadvantaged, it could induce them to become Shopify merchants instead.

In fact, even if Amazon uses the data to support third-party sellers on its marketplace, it may not stop merchants from exploring running their own web stores through Shopify, or other e-commerce website builders. This is thanks to Amazon’s ‘Buy with Prime’ program, which enables external e-commerce businesses that run their own independent web stores to sell to Amazon’s loyal Prime members using Amazon’s fulfilment network for fast delivery, as well as other Amazon e-commerce solutions like Amazon Pay. Essentially, it enables independent merchants to sell to Amazon Prime shoppers without being Amazon marketplace sellers, while it allows Amazon to monetize external independent merchants.

Consider that ‘Buy with Prime’ could actually encourage Amazon sellers to build own web stores using services like Shopify, as they would still be able to access Amazon Prime shoppers through the ‘Buy with Prime’ program, while taking advantage of increasingly easy-to-use generative AI tools.

Amazon’s Financials & Valuation

The ‘Online Stores’ and ‘Third-party seller services’ segments remain Amazon’s largest sources of revenue, together making up 63% of total revenue in Q2 2023.

As per Amazon’s latest quarterly earnings release, Online Stores “includes product sales and digital media content where we record revenue gross”. In other words, it is the sales revenue derived from selling Amazon-branded goods and services.

The third-party seller services segment “includes commissions and any related fulfilment and shipping fees, and other third-party seller services”.

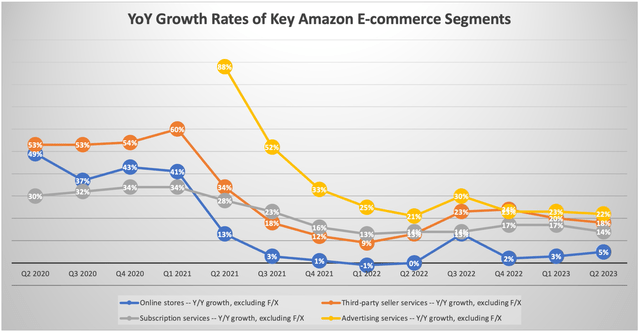

While ‘Online Stores’ is the largest segment, ‘Third-party seller services’ continues to grow faster than ‘Online Stores’, growing 18% versus 5%, respectively in Q2 2023. Hence, third-party seller services remain a key source of top-line revenue growth through attracting more merchants to the platform and enabling them to sell more goods.

As Amazon embarks on transforming its e-commerce platform for the era of generative AI, it opens up the opportunity for further sales growth through more intricately serving shoppers’ specific preferences. However, the company will need to prudently navigate through the issue of how it uses the resulting insightful shopping data. Hoarding the data to boost its own private label product sales, subsequently growing ‘Online Stores’ revenue, would come at the expense of ‘Third-party seller services’ revenue, particularly as alternative e-commerce avenues arise thanks to new generative AI services.

In terms of other key sources of revenue, the ‘Subscription services’ segment, which made up 7% of total revenue last quarter, could also see revenue growth amid generative AI advancements. Particularly as Amazon’s machine learning technology becomes increasingly better at serving customers’ unique preferences to enable more seamless shopping experiences. This could be conducive to greater consumer-loyalty to the platform, which would manifest in the form of greater Amazon Prime subscription revenue.

That being said, keep in mind that competitors like Google and Shopify are already leveraging generative AI to facilitate e-commerce activity. Google for instance will undoubtedly use consumer data from across its wide range of services, including YouTube and Google Maps, to serve shoppers more intricately with relevant recommendations. Hence, competitors’ advancements may undermine Amazon’s ability to induce consumer-loyalty to drive Subscription services revenue growth.

Amazon’s advertising business remains one of its fastest-growing segments, as its marketplace is one of the most lucrative avenues for reaching high-intent shoppers. Though as Amazon’s powerful search engine inevitably transforms towards, or is supplemented by, more conversational chatbots amid competitive pressures, the e-commerce giant will need to reconsider its advertising solutions to strike the right balance between promoting its own products and those of third-party sellers.

Therefore, while the generative AI revolution presents great opportunities for Amazon, the tech giant will also need to navigate various risks to sustain its sources of e-commerce revenue, and ultimately bottom-line profitability.

Amazon stock currently trades at over 63x forward earnings, which is a steep price to pay given the uncertainties around how generative AI will be deployed across its e-commerce platform. While competitors like Google also face its own share of uncertainties, Amazon’s dilemmas are complicated by the need to simultaneously drive sales growth for both its ‘Online Stores’ and ‘Third-party seller services’ segments, collectively making up majority of its revenue. Nexus Research maintains a ‘hold’ rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.