Summary:

- Unity Software stock has experienced significant wealth destruction since its IPO, and is now trading at lifetime lows.

- The Q2 event due to be held on August 8 could be a small step in righting the wrongs, with the new CEO due to address investors for the first time.

- We touch upon the major themes that could dominate the event.

- We close with some thoughts on the technicals and the valuations and gauge if the U stock would make a good BUY now.

EvgeniyShkolenko/iStock via Getty Images

Introduction

The stock of Unity Software (NYSE:U), noted for its game development platform, has gone through a tumultuous ride since it became a publicly-listed entity in September 2020; 14 months after its debut, it peaked above the $200 levels, but since then, it has turned out to be a massive source of wealth destruction and is now trading at lifetime lows of sub $15.

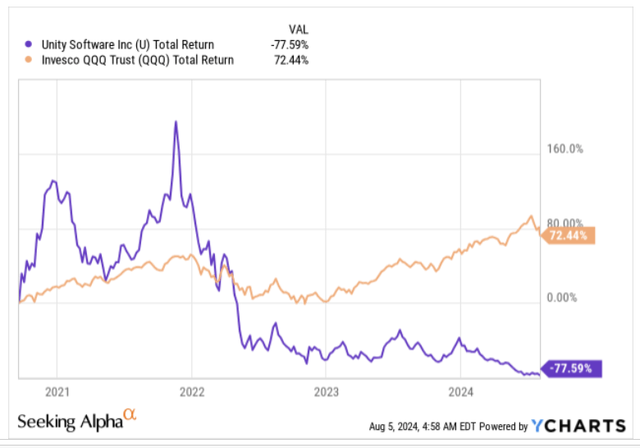

Overall, during its tenure as a publicly traded stock, U has witnessed erosion to the tune of -77%, even as the tech-heavy Nasdaq has managed solid positive returns of over 70% during the same period.

YCharts

In a few days, U will encounter a key event that could play an important role in its future direction; we’re referring to its Q2 results, which are due to be announced on August 8, post-market hours, followed by an earnings call.

The event could take on even more prominence as it will mark the debut of new CEO Matthew Bromberg (who was only appointed on May 15), and give him an opportunity to address and ameliorate some of the concerns surrounding the business.

Q2 Earnings and Beyond- What To Expect

Before we dive into the nuances of Q2, it’s worth noting that Unity Software has a near-perfect record when it comes to beating sell-side EPS estimates. Since it made its debut on the markets, it has beaten quarterly bottom-line estimates in all but one of the 17 previous instances (the exception was Q1-22).

For the upcoming Q2 event, note that expectations are not particularly strong, with an adjusted EPS figure of only $0.14 (this is around 60% lower than the Q1 EPS, and is also the lowest EPS figure over the last four quarters). For further context, also consider that over the past three months, 77% of the earnings revisions for Q2 have been to the downside, and this figure has come about after net revisions to the tune of nearly -8%. Given these developments, one would think that U doesn’t need to do an awful lot to surprise positively. However, if that $0.14 figure does come to fruition, do also note that it will represent the first time in six quarters where Unity will experience bottomline YoY decline on a Non-GAAP basis.

Seeking Alpha

Having said that, we would advise investors not to get too hung up about the headline shenanigans of beating/falling short of EPS estimates, as Q1 saw Unity trounce sell-side adjusted EPS expectations ($0.06) by a whopping 466%, but yet the stock ended up dropping by 10% post earnings.

Topline pressures are expected to linger in Q2, even though management had suggested on the Q1 call that they had successfully completed “a very large and complex cost and portfolio reset”. For the uninitiated, since last year, they have been revamping their portfolio by exiting various non-core businesses, and providing greater attention towards their Unity Engine, Monetization Solutions, and AI offerings which will be seen as strategic priorities going forward.

All in all, after coming in at $460m in Q1 (implying an -8% decline), group revenue in Q2 is expected to come in much lower, both annually (implied YoY decline of -17%) and sequentially (implied QoQ decline of -4%) with consensus looking at a figure of less than $442m.

Within this $442m figure, investors should pay careful attention to the progression of U’s strategic portfolio, which surprised quite positively in Q1. As against an expectation of $415-$420m, the eventual strategic revenue figure came in at $426m, representing growth of +2%. However, in Q2 it is difficult to envisage positive strategic revenue growth, as the expectations are only for a range of $420-$425m which would represent a 6-7% decline YoY. Basically, strategic revenue in H1 will be closer to $850m.

Having said that, investors can afford to be more optimistic about developments in H2, as the FY guidance for strategic revenue stands at $1760m-$1800m, which would imply a higher runrate of $910-$950m in H2.

U’s platform consists of two separate sets of solutions (Create Solutions and Grow Solutions), which are likely to see even more integration under Bromberg’s stewardship who has a wealth of experience in both game development and monetization (overall 20 years of experience in Zynga and Electronic Arts). Within U’s overall portfolio, we would pay closer attention towards Grow Solutions, which is focused on enabling U’s customers to better monetize their content (even if the content was not created on the Unity platform), and accounts for the lion’s share of group revenue (61% of FY23 revenue). Management is likely to provide further granularity on how well both Unity Ads and ironSource Ads have been doing on AdMob Mediation. The Grow Solutions side will also start seeing the benefits of greater confluence from the data garnered by the data teams of ironSource.

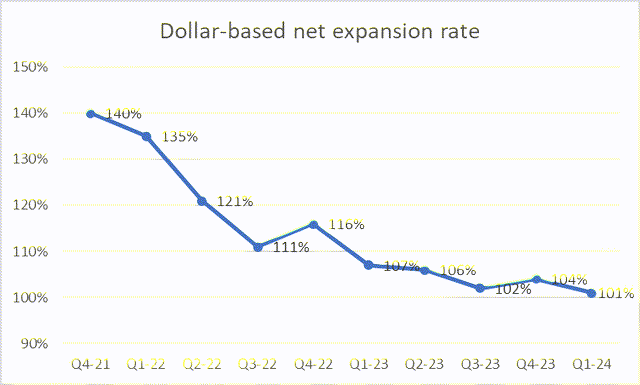

Another reason why H2 YoY growth, particularly Q3-24, could look good is because back in Q3-23, management had made some unfavorable pricing changes on the Create side of the portfolio, which resulted in a slowdown in new contracts and renewals. Even for the U business as a whole, it’s worth seeing if the dollar-based net expansion rate can make a rebound. For the uninitiated, this metric is a function of renewals, expansion, contraction, and churn by U’s existing customers. A few years back, it was at 140%, lately it has been hovering closer to the 100% levels. If Bromberg can get it up and trending again, that will be taken positively by the markets as an indicator of better customer stickiness.

10K and 10Q

Management will also likely bring to light some of the customer feedback for Unity 6 which will launch later in the year, but which they’ve already released a preview in early May. Unity 6 promises to be a very competitive offering as the onus this time has been on driving performance optimization which could abet accelerated production across varied platforms. Mobile developers too will take a greater fancy to this, as the Render Graph feature will provide lower memory bandwidth and energy consumption.

On the cash flow front, note that after three straight quarters of operating cash inflows, U once again saw operating cash outflows in Q1, but even; otherwise we remain wary of the quality of operating cash flow that this business generates, as it is heavily driven by stock-based compensation (SBC). For context, last year SBC accounted for a mammoth 276% of the total operating cash flow!

Closing Thoughts- Is Unity Software A Good Buy Now?

As implied in the previous section, the headlines from Unity’s Q2 event are unlikely to set the world alight but don’t rule out the prospect of new CEO Bromberg providing some encouraging forward-looking guidance (particularly on the health of the strategic portfolio, customer behavior & engagement, etc.) that may help arrest some of the ongoing adverse sentiment towards the stock.

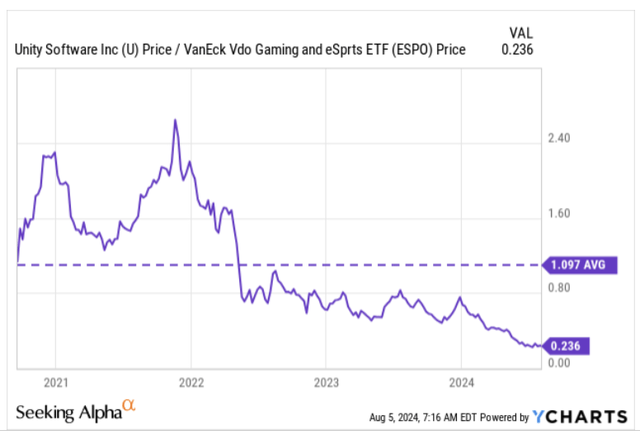

Prima facie, the relative strength charts suggest that U’s stock could serve as an ideal mean-reversion candidate for those looking for beaten-down opportunities in the terrain of video game development. U’s relative strength ratio versus other alternatives is currently at record lows and only around a fifth of its long-term average.

YCharts

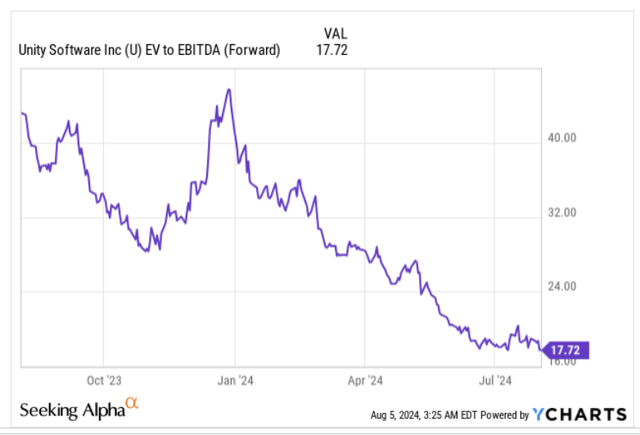

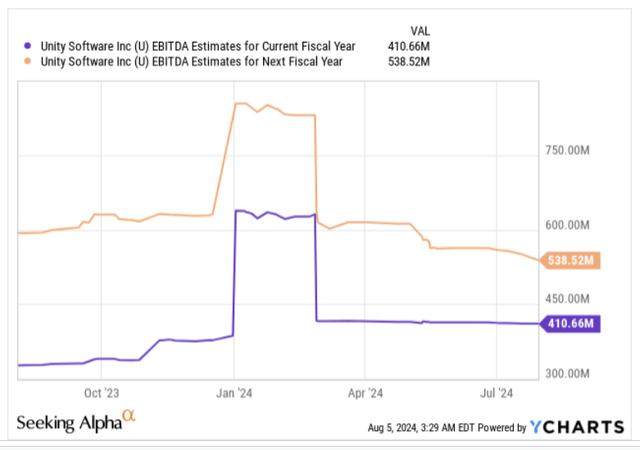

Having said that, investors may also want to note that U is still not a particular cheap stock to own, especially in the light of its near-term EBITDA growth outlook. Currently, the stock is priced at a forward EV/EBITDA of over 17x, and for a double-digit multiple like that, you’d want to see EBITDA growth in line with that multiple.

YCharts

However, note that after delivering EBITDA of $448m last year, consensus estimates actually point to negative EBITDA growth for the current year (-8%). Some investors may point to U exiting certain non-core businesses (non-core revenue contribution was $34m in Q1 and expected to drop to single digits by year end), but do note that these businesses didn’t generate any positive EBITDA in the first place. Then, even if U does grow YoY from a low base next year, on a two-year CAGR basis you’re still only getting 10% EBITDA growth from the FY23 levels.

YCharts

Switching over to U’s weekly price imprints, it looked like from December 2022 to April 2024, this was more of a trading play, as the stock chopped around within the $25-$50 range (the green highlighted area). However, that came to an end in mid-April, until we saw some selling till June. Even before the breakdown from support, note that the stock had been losing ground in the shape of a tight descending channel that had been in play since December last year.

From June till the end of last month, it looked like the stock was showing some signs of bottom formation with six weeks of relatively flat price action, but yet again last week, we saw another breakdown with the stock dropping to record lows. Until we see further stabilization, we don’t think it would be a good idea to jump in.

Investing

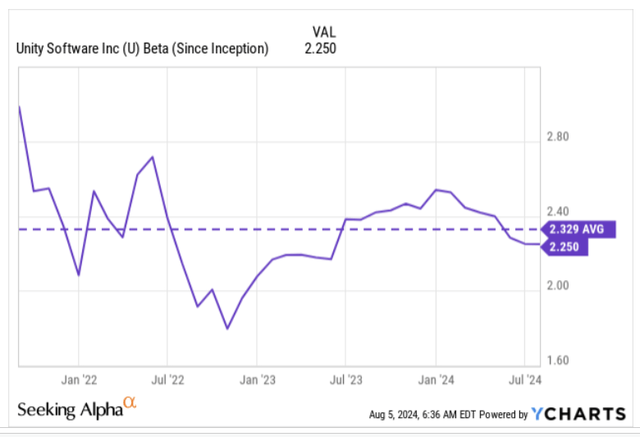

Also, given the risk aversion that has enveloped global markets over the last few days, we don’t believe it would make a great deal of sense to load up on U now, more so as its sensitivity relative to the benchmark is inordinately high, with an average beta of 2.33x.

YCharts

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.